One of the most important things while analyzing companies — is to track it’s quarterly results. It gives a quick update to the investors on what’s happening with the company + a brief glimpse into management’s guidance / estimates for the next few quarters or year(s) + new initiatives being undertaken by the Company to grow.

It also serves as a hygiene check on the performance of the management — have they really achieved what they had committed? That’s an extremely important metric to track, because as investors you are relying on the capabilities of the management of a company to steer it into a bright future.

I’m starting a series (based on several feedbacks received from a few subscribers of the blog) where I will cover the quarterly updates of several companies for which I have already done a DEEP DIVE!

First up, is Zomato.

ALSO READ: Detailed breakdown of Zomato’s business in this article

Q3 Performance

Zomato witnessed another profitable quarter, with growth across business segments. Revenue, EBITDA, GOV were all up. Monthly Transacting Users (MTUs) — the most critical metric to track growth in the business — stood at 18.8 MILLION USERS at the end of Q3.

Let’s dissect the performance of the major revenue segments of the company.

I. Food Delivery

This segment posted a decent Q3 performance. All metrics were healthy. Revenue from food delivery was up 29% YoY. GOV was up 27% YoY. Margins improved incrementally.

Key insights from the management on the food delivery business:

Food delivery revenue growth was contributed by increase in commission fees, platform fees and advertisement revenue.

Platform fees on food delivery is being charged in the range of INR 3-5 per order. This might remain stable and marginally increase going forward. Platform fees is charged on Gold members too.

Monthly transacting users grew by 8% YoY — the management expects MTUs to drive growth growing forward.

Since there’s only a limit upto which commission % which Zomato charges from it’s partner restaurants on each order can be increased.

Zomato Gold members contributed >40% to the Gross Order Value. Margins on Gold orders is generally low since no delivery fee is charged from Gold members.

Expecting growth in new restaurants added on the platform at 20% YoY. Most of the new restaurants onboarded onto the platform were cloud kitchens [on which Zomato generally earns better margins]

Management has guided EBITDA expansion from current 3% of GOV to 4-5% of GOV in the near future.

II. Quick Commerce (Blinkit)

Quick Commerce, has seen rapid growth in the past few quarters. Now you can also get an iPhone delivered through Blinkit in less than an hour if not within 10 minutes. This segment registered 103% YoY growth in GOV. 114% YoY growth in topline.

Quick commerce as a segment is still not profitable, but has turned contribution margin positive.

Key insights from the management on the quick commerce business:

New Blinkit dark stores are achieving contribution break-even in 2 months. 40 net new stores added in Q3, with launch in two new cities — Goa and Agra.

A store typically achieves contribution breakeven at 1000 orders. In Q3, 70% of dark stores were contribution positive with 20% of stores operating a >5% contribution margin.

Ad revenue from Blinkit has grown by 220% YoY and looks promising for the foreseeable future where partners are seeing direct benefit of advertisements resulting in more sales.

Metrics pertaining to Ad revenue from Blinkit Blinkit operates a negative working capital model, where money is received from customers upfront and payment to partners is made later. The only exception being ad revenue, where money is not received upfront.

Management expects majority of the new dark store additions to be in the existing 8 cities.

Key metric to track here is AOV (Average Order Value) + Monthly Transacting Customers — both metrics have been on the rise, with rise in AOV being contributed by introduction of electronics and other high value items on Blinkit.

III. Others

Other segments are Hyperpure (B2B Supplies) and Going Out (which includes Dine-Out and Zomato Live).

Key insights from the management on these segments:

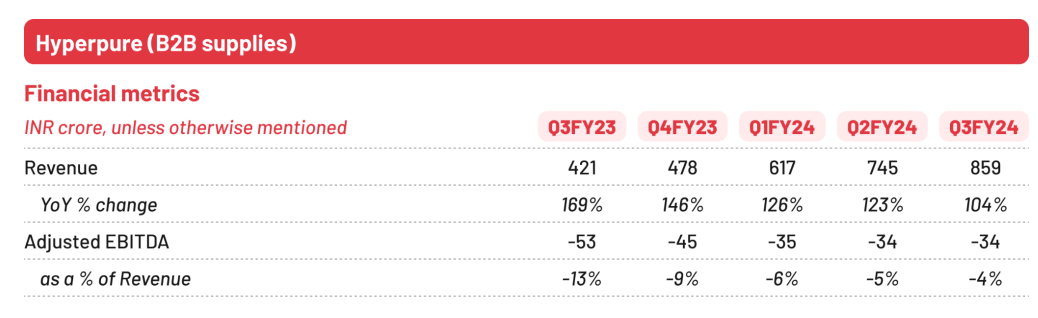

Hyperpure revenue grew 104% YoY. To address the growing need of restaurant partners — Zomato is setting up a plant for processing value added food supplies which include sauces, spreads, pre-cut / semi finished perishable products. Over the long term, this could expand margins + drive higher engagement with restaurant partners.

QoQ performance of Hyperpure On the Going-Out business, Zomato launched it’s events ticketing platform in 9 cities in India. There is a separate ‘Events’ tab on the Zomato app.

QoQ performance of Going-Out segment

Few cautionary messages

If you’ve been reading the blog, you know that covering the risks in a business is of PRIME importance and that is what I look for when I am reading the quarterly reports or earnings call transcripts of companies.

A few things to note going forward:

Zomato’s Q3 revenue was high on the back of a festive season in India and the Cricket World Cup, leading to higher sales and food ordering. Q4 is expected to be lower / flattish compared to Q3.

Fixed costs in the food delivery business increased due to server / tech infra — which will continue to be incurred going forward as well.

Going-Out business is in the build out phase resulting in increase in employee costs. It will take some time before such expenses will bear fruit.

Platform fees is unable to cover the cost of acquiring a Zomato Gold member. Pricing of Gold membership has been fluctuating which is a tactical decision to acquire / reacquire customers when membership renewal comes into the picture. The company is yet to reach a sustainable pricing model for it’s Gold membership.

No comment by the management on the risk of ONDC biting into margins / business share. ONDC volumes have been steadily growing QoQ.

Concluding thoughts?

Q3 was a good quarter overall for Zomato. All metrics were up. MTU growth looks good. The management expects revenue growth of >40% YoY.

The company is sitting on a cash balance of INR 12,015 crore. Blinkit is approaching breakeven at an EBITDA level soon. Dark stores are taking less time to achieve contribution margin break even.

The problem with Zomato lies in it’s valuation. It’s trading at a market capitalization of INR 1.4 LAKH CRORE. And generated a profit after tax of INR 138 crore for the quarter, trading at a P/E of 123 times [as at 22 February 2024].

Food delivery is not a high margins business. The competition is intense. The company is not making a lot of money on Zomato Gold. Blinkit will still take some time to become EBITDA positive. Hyperpure and Going-Out segments do not have a significant contribution to profits yet.

I like what Zomato is doing, however at the current valuation — it just doesn’t make sense to enter the stock at this point. But, there’s no harm in keeping it in your watchlist.

I’ll sure be bringing quarterly updates to your notice!

If you liked this article, you can support me by subscribing to this blog or sharing it in your network OR you could donate a small token to contribute to my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]