The stock of Zomato — a listed food delivery platform — popped up by 10% in a single day on Friday (04 August 2023) when it reported a NET PROFIT of INR 2 crore for Q1FY24. Investors were buzzing to see Zomato churn out a net profit, especially since a lot of people [including me] had written off the food delivery business.

Food delivery platforms burnt a lot of money to acquire customers. Endless discount coupons. Razor quick deliveries translating into high delivery costs. Wafer thin margins. Questionable customer loyalty. Customers who would game the system to take unnecessary refunds [yes, we’ve all done that!]. It isn’t an easy business by any means.

So when Zomato reported a net profit for Q1FY24, I was really curious. How did Zomato turn this ship around? What sort of revenue levers was Zomato tapping into? Were the customer & order metrics steadily increasing?

Most importantly - should I consider Zomato as a potential investment opportunity now?

The Business of Delivery

Zomato started off in 2008 as a restaurant listing platform. You could check new restaurants, their menus, the ambience and a whole bunch of other stuff. Fast forward to today — Zomato has built various lines of business.

Revenue Source #1: Food Delivery + Fine Dining

Zomato is primarily a food delivery platform — which is also its main revenue driver — where customers interact with restaurants. Zomato helps a customer discover new restaurants, new cuisines, order food online, make reservations etc.

On the other hand, it helps drive more business for restaurants/cloud kitchens. Zomato takes care of marketing, deliveries, payments, returns, customer support.

So, how does Zomato make money delivering food to customers?

Restaurant Listings/Advertisements: If you open a new restaurant today, it is a certainty that you’d list it on online delivery platforms like Zomato/Swiggy. Once you do that, customers can directly place orders through Zomato. You get more orders. More visibility. And the money is rolling in even if your restaurant is empty throughout the day.

Zomato basks in your success. And then, they send you an invoice charging a listing fee for including your restaurant on the platform and an advertising fee for making the restaurant more visible + more accessible to customers. Zomato earns the listing fees and the advertisement fees irrespective of how your restaurant performs.

Commissions: Now, if the restaurant was extremely successful via Zomato and it only had to pay listing fees and some ad fees, it wouldn’t be a very good deal for Zomato isn’t it? So, Zomato started charging a commission on every order that a restaurant fulfilled through the platform. Zomato typically charges a commission of 15-22% per order. And this is how Zomato makes most of its money in the food delivery biz.

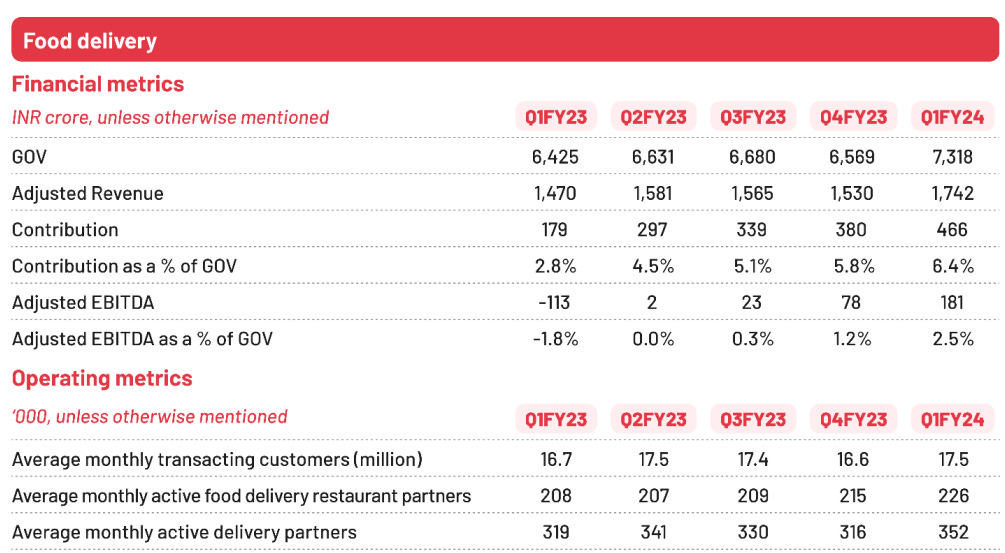

Refer to the table below. If you calculate the ratio of Adjusted Revenue to Gross Order Value (GOV), it is more or less around 23-24%.

Subscriptions: Customers subscribe to Zomato Gold (erstwhile Zomato Pro) to get exclusive discounts, non-levy of delivery charges on online orders, discounts on fine-dining restaurants etc. Restaurants also buy subscriptions to avail various offers at Zomato. This is a recurring revenue business.

Revenue Source #2: Hyperpure

From the table above, you can see that Zomato currently has around 226,000 [active] food delivery restaurant partners. That’s a vast network of restaurants.

Hypothetical conversation in a Zomato Board Meeting

Board Member 1: We’ve got a lot of restaurants in our network. Are we doing something to leverage it? Can we build something to cater to these restaurants?

Board Member 2: Agreed, these restaurants buy a lot of ingredients/food supplies on a daily basis. And this sector is highly unorganized. They have to deal with multiple vendors. Plus, they have to keep inventory of such ingredients. And, quality can be an issue a lot of times. I see business potential here.

Board Member 1: Hmmm…we’ve already aggregated food delivery. What if, and this is me thinking out loud — what if we also aggregated delivery of food supplies to restaurants. We partner with local farmers. We build an inventory of food supplies & packing materials. Restaurants can get everything they want for operations from us. Chance for us to build an entire ecosystem around restaurants. What do you think?

CEO: Aligned, lets start building something around this.

And that’s how Hyperpure was born. To cater to restaurants. Build a supply chain of food supplies, packing materials and other essentials to become a one stop shop for restaurants. The business is growing quite well, which is visible from the revenue growth QoQ.

Revenue Source #3: Quick Commerce [Blinkit]

Zomato acquired Blinkit sometime last year to venture into the business of online grocery & quick commerce. Its like a D-Mart on steroids. You don’t have to go to a local kirana store or a grocery shop anymore — you can get everything you want on Blinkit. And the motto is, before you blink your order will be delivered.

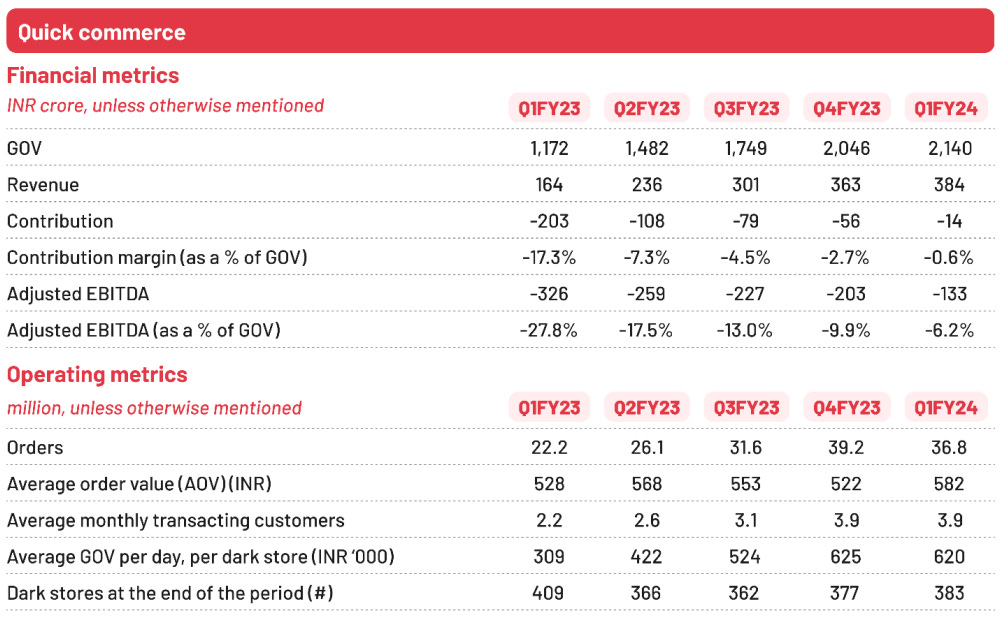

Blinkit partners with a local kirana stores/dark stores and charges a commission (15-18%) on every order that is processed through the platform. This line of business is still burning a lot of cash, however management expects this segment to become EBITDA positive by next year.

Sustainable Profitability on the cards?

If you read the Q1FY24 results, you’ll see that everything is adjusted. Adjusted revenues. Adjusted EBITDA. I don’t believe in adjustments, so let’s see how Zomato performed without it.

Here’s the summary of the unadjusted results:

Q1FY24 was a good quarter across the board. 11% growth in Gross Order Value. 17% revenue growth QoQ. EBITDA of INR 133 crore. PAT of INR 2 crore. You can see that slowly but steadily Zomato is moving towards sustainable profitability (even without adjustments). The sexiest thing in the Q1 report was the fact that Zomato generated positive free cash flows from the business!

Management is expecting 25-30% growth in food delivery business GOV for Q3FY24

Zomato has started charging platform fees of INR 3-4 per order — in line with it’s competitors. Almost 100% of orders will have platform fees.

Contribution margin for the food delivery business increased by 20bps from 6.4% to 6.6% in Q2FY24

Ad revenue increased due to more advertisers / restaurants doing more ads. Driven by increase in volume of ads.

CASH CHEST OF INR 11,761 CRORE at the end of Q2FY24!

Hyperpure + Blinkit continue to be making losses operationally, however the quantum of losses are declining with the management optimistic about these segments turning EBITDA positive in the next few quarters.

Blinkit started selling iPhones and other high end electronics. These products have high turn around time, but command high margins and should help the business turn profitable quicker. [iPhones are excluded from the GoV]

Blinkit turned contribution margin positive in Q2FY24 to 1.3% and should be able to achieve EBITDA breakeven by Q1FY25 as per management’s recent commentary.

Expecting high growth in Q3 on the back of festivals. 480 dark stores expected by the end of FY24. Blinkit’s GOV [Gross Order Value] could be > GOV of the Food delivery business in the foreseeable future.

Talking about key metrics to track the business — Monthly Average Users (MAU) was up slightly. The number of restaurant & delivery partners added on the platform increased QoQ.

Key metrics to track Zomato’s performance Management is aiming to improve profitability further to increase the EBITDA margin % — however they acknowledge that this will be a challenge given the extremely competitive landscape (Swiggy/Zepto)

Zomato Live — its events and ticketing business is growing at a fast pace and could very well become a separate revenue vertical very soon. This is a vertical to watch out for since it seems to be a high margin business and could significantly contribute to profitability in the foreseeable future.

Should I buy Zomato?

The stock is trading at INR 95.40/share1 with a market capitalization of INR 82,086 crore. What this means, is that the market believes — if you discount ALL the profits that Zomato will generate in the future, it should be equal to approx. INR 82,000 crore.

I think that’s very optimistic. Extremely optimistic. The stock is trading at a P/E of 681.43 — which signals that it is extremely expensive at this price point. Either the stock needs to significantly correct OR Zomato needs to make a MASSIVE profit over the next few years for this valuation to be justified.

Zomato is turning this ship around. But there are still some risks:

The elephant in the room is ONDC which threatens to derail the growth of food delivery platforms. Its cheaper for customers, because it is also cheaper for restaurants. ONDC charges 2-4% commission from restaurants as against a 18-24% charge by Zomato/Swiggy. Growth in the adoption of ONDC will chip away market share from Zomato and it might find it difficult to grow the GOV without lowering the commission it charges from restaurants.

Lower commissions = Lower profits = Lower valuation.

The National Restaurant Association of India (NRAI) hasn’t been very happy with the duopoly that exists in the food delivery business. They’ve been quite vocal about the high commissions that Zomato/Swiggy charge which leaves little on the table for restaurants. In many cases, restaurants have to inflate the prices of their menu, making it more expensive for customers. NRAI has already filed a compliant against these players once in the past with the Competition Commission of India voicing it’s concerns on how these platforms are using unfair trade practices. Any development on this front could negatively impact Zomato.

Zomato bought Blinkit last year and they paid more than what Blinkit was worth. As a result, there is a Goodwill of INR 4717 crore that’s sitting on Zomato’s balance sheet. Not something that any investor wants to see. On a frequent basis, Zomato will have to assess whether this Goodwill is impaired and if it is, then they might have to take a BIG hit in the P&L.

Zomato Gold is a drag on margins. Gold members contributed around 40% of the GOV in the food delivery business. Pace of gold memberships might slow down going forward. The cost per gold member is higher due to:

Higher delivery cost owing to longer average delivery distance (on account of free delivery within a 10 KM radius)

Priority service to Gold members during peak hours

Cost on account of the ‘no-delay’ guarantee benefit available to Gold members.

Metrics for Zomato Gold

HyperPure didn’t see any positive movement in EBITDA in Q2FY24. No commentary from the management on this business segment.

Bottomline: I believe Zomato is on the right path and could be a long term bet, however it looks quite expensive at this valuation.

Margins are difficult to increase in this business and profits would be driven by growth in volumes. Currently, only 30% of the Annual Transacting Users transact on a monthly basis. Increase in this number would mean more business for Zomato. Blinkit GOV should increase with the introduction of electronic sales.

Zomato has a market capitalization of INR 1.18 LAKH CRORE and reported a Q2 profit of INR 36 CRORE. You can see how big the gap is between earnings and valuations. At a P/E of 142 times, I don’t see a LOT of upside in the stock.

It would be prudent to watch the next few quarters, wait for the euphoria to die down and see if it can consistently churn out profits and improve EBITDA margins further.

If you liked this article, you can support me by subscribing to this blog or sharing it in your network OR you could donate a small token to contribute to my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Edit history:

Original post written on 06 August 2023.

First edit on 26 January 2024 incorporating the Q2FY24 results]

as at 06 August 2023