A few months back, I wrote about automobile companies that were leading India’s transition to electric buses. The idea was to see who could be the biggest beneficiary and what each company was doing to gain a stronghold in this growing market.

With this article, I want to take a look at the Q1FY25 quarterly results of some companies and see how their business is shaping up.

The Q2FY25 results are out as well, however I will cover those results at a later date.

1. Olectra Greentech

Olectra has two businesses — manufacturing electric buses + manufacturing of silicon rubber insulators.

I have written a detailed article covering the business model of Olectra which you can read here

In terms of price movement, the stock has remained flat in the last 6 months — indicating sub-par performance and an overbought position.

Q1 business update:

Electric bus deliveries — the company has delivered 1,851 e-buses + 51 e-tippers cumulatively upto 30th June 2024.

Delivered 156 e-buses in Q1FY25. No tipper was delivered in this quarter.

Targeting delivery of 1,500 to 2,000 e-buses in FY25, with 1,000+ deliveries scheduled in H2. For FY26 — management plans to sell 5,000 e-buses.

I’d take this # with a pinch of salt, since the management has a track record of overcommitting & under-delivering. This is a red flag 🚩

Private e-buses are slowly taking traction — delivered 19 buses to private players, out of which 5 were delivered to Microsoft.

Order book — the net order book stands at 10,818 e-buses. Olectra plans to exhaust this order book by FY27.

Expecting tenders for 10K more e-buses in the future, for which Olectra will bid.

The company might not be able to deliver e-buses for new tenders for the next 2Y — which could be a risk for the company in winning new tenders.

41 e-tippers in the existing order book which should get delivered in H2FY25. Olectra is not going after double decker e-buses, since the opportunity is too small.

New facility — construction work of the new plant at Seetharampur is in full swing. Company has vacated the leased plant and shifted to the new plant (owned) from Q1FY25 — which has a current capacity of 2,500 e-buses per annum.

The company is targeting to increase capacity to 5,000 e-buses per annum by the end of FY25. And by the end of FY27, to 10,000 e-buses per annum.

Deployed INR 200 Cr on new plant + obtained sanction of INR 500 Cr as term loan for capex. The term loan is repayable in 5Y.

New product development — management explicitly stated that it is NOT thinking of getting in LCVs [Light Commercial Vehicles] and will be concentrating only on HCVs + e-buses. The company was earlier doing R&D on hydrogen buses [with Reliance], however that project is not being pursued anymore.

Insulator business — this is a cash cow for the company. Expected topline of INR 200 Cr for FY25 with a market share of 45-50% + operating margins of 15%. The management has no plans to sell this biz.

Financial performance — it was a good quarter for Olectra with all counters up.

EBITDA margins (or operating margins) are expected to be in the range of 10-12%. So, profit growth will be driven by increase in sales volumes.

Finance cost have increased in Q1 due to upfront fees / processing fees on term loans / working capital facilities.

Penalty of INR 2.2 Cr was levied on the company due to non delivery of e-buses. The company is in the process of getting it waived off — however, this raises a question on future penalties due to non deliveries as per schedule.

Bus maintenance revenue is around 6% of topline. Expected to hit 10% in a couple of years. [this is a high margins business segment]

2. Ashok Leyland

Ashok Leyland (AL) is one of the largest players in the commercial vehicles space. Think of buses. Big trucks. Tractor trailers. Pickup trucks (LCVs). And recently AL has taken exposure to electric buses + e-LCVs through it’s subsidiary — Switch Mobility.

You can read my comprehensive coverage of AL’s business model here.

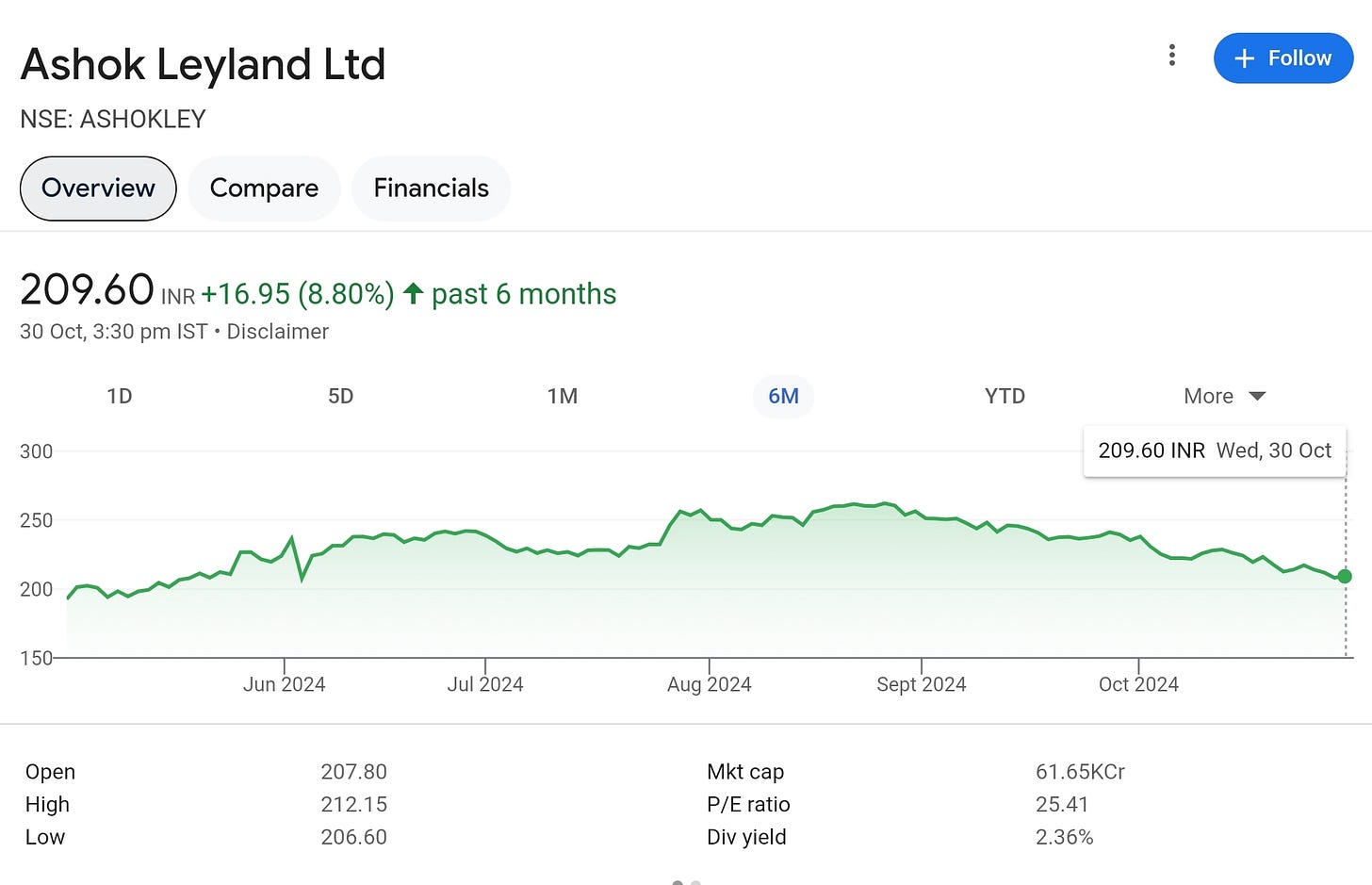

The stock has remained range bound, however the low PE ratio compared to peers indicates that investors are valuing AL as a traditional CV player — leaving some room for growth.

Q1 business update:

Core business — MHCV [Medium & Heavy Commercial Vehicles] industry volumes grew by 10% in Q1FY25. AL’s MHCV volumes grew in line with the market, resulting in retention of market share of 31%.

AL is confident of increasing market share in trucks + buses. Host of new product launches are lined up in FY25, which will beef up market share & price position.

LCV volumes [domestic] increased by 4% in Q1 to 15,345 units. LCV variants cover only 50% of the market at this point — intention is to launch new products to increase coverage to 80% of the market. 6 new LCV launches are lined up in FY25, out of which 2 new LCV variants have been launched in Q1.

Note: this is not AL’s market share in the LCV segment. 80% refers to the ‘addressable market’.

In the ICV segment — new launches are expected in the school bus + staff bus segment. Market coverage is <20% at the moment and AL wants to expand this.

CV export volumes grew by 5% in Q1. Middle east continues to see strong demand. AL is getting strong traction in Africa. The company is looking at new markets to expand.

Tractor trailer penetration in India is <20% whereas globally it is close to 60-70%. AL is expecting good growth in this segment.

There is huge replacement demand building up in the MHCV segment due to an aging fleet. >37L commercial vehicles are there on Indian roads out of which only 27% are BS VI complaint. Sooner or later, the aging fleet has to be replaced which should lead to a bump in sales for AL.

Electric portfolio — AL sells e-buses and e-LCVs through it’s subsidiary Switch Mobility. Electric trucks are sold directly by Ashok Leyland.

Slow transition to eLCVs is underway. Switch started delivering it’s first eLCV [called IeV 4] in the market which received a good response. A few days back, another variant ‘IeV 3’ was also launched.

The # of e-buses delivered were not mentioned in the earnings call, but Switch has an order book of 1,300 e-buses. If you’re in Mumbai, you can regularly see their double decker e-bus.

Capex of INR 500 - INR 700 expected in Switch Mobility + to build EV capabilities / setting up centre of excellence in software, electric drive unit (EDU) and battery packs.

Other biz segments — pertains to defence, spare parts & other business segments.

Sales of defence vehicles have crossed >1,000 vehicles in Q1. Revenue has increased by 3X compared to the previous FY. Intention is to further double the defence business in the next 2-2.5 years.

The management did not give a concrete sales # for the defence business though.

In the spare parts business, revenue increased by 10% overall YoY.

Power solutions volumes were lower than last year by around 20% owing to a very high base in Q1 of last year due to emission change announcements.

Financial performance — Q1 performance was decent. Revenue was up 5% YoY. EBITDA up 11%. PBT was up 13%. EBITDA margins were stable at 10.6%.

Other expenses shot up due to one time expenses incurred towards development of Centre of Excellence for battery packs, electric drive units and EV related software.

Material costs were at 72.2% of topline, lower by 1.5% compared to Q1 of last year. Steel prices remained soft, and cost saving efforts helped AL reduce material costs.

3. JBM Auto

The primary business of JBM Auto is making auto components, assemblies & tooling equipments. However, in the past 10 years — it has been growing it’s OEM business under which it sells buses [including electric buses].

For a detailed read, check out my article talking about JBM’s pivot to EVs

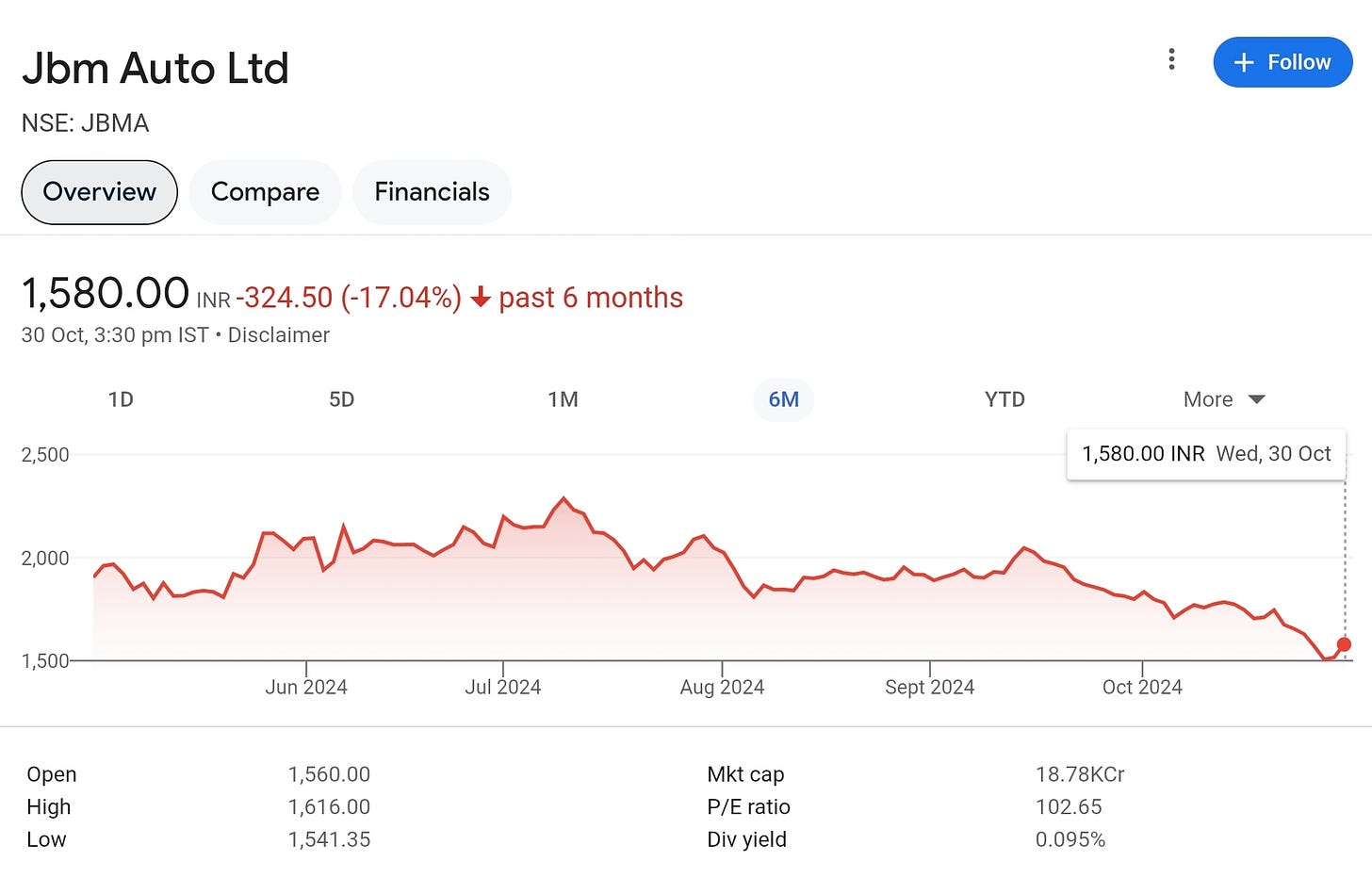

The stock has crashed by 17% in the past 6 months, indicating weakness. Despite the fall, the stock still trades at a premium valuation.

Q1 business update:

OEM / EV business — JBM is operating 1,200 e-buses across multiple cities including Mumbai, Delhi, Ahmedabad etc. The company deployed India’s first 9 meter low floor AC e-bus in Delhi. 🚎

2,500 e-buses scheduled to be delivered in FY25. 3,000 e-buses estimated to be delivered in FY26.

Established an electric bus manufacturing facility in the Delhi-NCR region which will have a capacity to produce upto 20,000 e-buses and SPVs.

Delivered 50 e-buses to Telangana as part of a larger order of 500 buses.

Order Book — JBM has an order book of >5,000 e-buses. It secured a contract from CESL under the PM e-Bus Sewa scheme to operate 1,390 e-buses at a cost of INR 7,500 Cr.

The company entered into an agreement with MUON India, a Macquarie Group company — to deploy >2,000 e-buses over the next 2 years.

JBM signed a strategic agreement with LeafyBus for supply of 200 ultra modern electric luxury buses — to be delivered within 24 months. The price per bus will be around INR 1.8 Cr.

This shows that JBM has been able to get a good share of the private market, before Olectra / Ashok Leyland.

JBM also secured funding of $100 million from Asian Development Bank (ADB) and Asian Infrastructure Investment Bank (AIIB) to boost supply of e-buses in India. The fund will be used to introduce 650+ e-buses across multiple states in a phased manner.

Performance — Revenue was up 21% YoY. EBITDA grew 25% YoY.

OEM division reported a 91.35% increase YoY with EBITDA increasing by 68%. JBM is guiding for a topline of INR 6,500 Cr for FY25, a significant increase from INR 5,000 Cr reported in FY24.

The EV business was bringing around INR 550 Cr in FY23, which increased to INR 1,750 Cr in FY24. Management expects EV biz to contribute around 3,000 Cr in FY25.

Overall EBITDA margin for the business (OEM + Auto components + Tooling) is expected to exceed 12% for FY25.

Electric Buses — an industry overview

At present, around 4,000 electric buses are operational in India. JBM Auto projects the demand for electric buses from STUs (State Transport Utilities) to reach 1,50,000 units in 7 years. The GoI wants to convert 8 LAKH diesel buses into e-buses. 🚌

From a costing point of view, the total cost of ownership of an electric bus is 15-20% lower than their ICE counter-parts. However, the upfront investment is high in buying EVs — that’s what is discouraging customers / fleet owners to go ALL OUT on EVs.

The Government has launched various schemes to facilitate a smooth transition towards clean mobility.

The Union Cabinet recently approved the PM e-Bus Sewa scheme with a total outlay of INR 3,400+ Cr aimed at supporting procurement of e-buses by STUs. More than 38,000 e-buses are expected to deployed in the next 5 years under the scheme.

The Union Cabinet also approved the PM E-Drive scheme [which succeeds the FAME program] with total allocation of INR 10,900 Cr over 2 years. The scheme is designed to promote adoption of e-2Ws, e-3Ws, e-ambulances, e-trucks & e-buses. Electric cars + hybrids are NOT covered under this scheme.

It will be interesting to see who turns out to be a major beneficiary as India transitions to an electric future. There can be multiple winners. We’ll keep tabs on ^ 3 companies + other players [like Tata Motors] who are making significant investments into EVs. 🚗

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]