In my last article, I explored the Q3FY24 performance of Olectra Greentech — a company which manufactures e-buses. During the research phase, an interesting statistic popped out to me which motivated me to widen my research into e-buses and e-trucks.

Over the next 6 years, the Government of India wants to convert 8 LAKH diesel buses into electric buses. With an average selling price of INR 1 Cr+ per bus, this is a 8 LAKH CRORE opportunity.

So the natural next question was — who could be the potential winners in this space? Who are leading the e-bus segment? What are the legacy brands in this sector that will be making sizable investments?

Whenever I picture a bus, an instant picture forms in my mind. It’s a green AC bus. Low flooring. Diesel powered. Gigantic in size. Extremely difficult to overtake. Black fumes being released into the air. A complete nightmare if you’re driving a bike behind it. It’s an Ashok Leyland bus.

So I thought, Ashok Leyland must be a pretty big bus manufacturing company. It had left a deep imprint on my mind. Can it be a BIG beneficiary of this transition to clean mobility? And so to answer that question, the deep dive began.

As you can see from the chart above, the stock has delivered a 2X return in the last 5 years — not very impressive if you compare it with other stocks that have zoomed UP in the last 2 years itself. But, if it can capture a significant portion of the e-bus / e-LCV / e-truck market — it could be a different story in the future.

The market is valuing AL as a traditional commercial vehicle player and probably not as a potential dominator of clean mobility in India.

The Business

Ashok Leyland is in the business of manufacture & sale of commercial vehicles. Buses. Trucks. Heavy big ass trucks (a.k.a tractor trailers). AL makes all of these.

Incorporated in 1948, the company is part of the Hinduja Group. It is the world’s #4th largest manufacturer of buses. India’s #2nd largest M&HCV manufacturer and the largest mobility solutions supplier to Indian Defence. It has 9 manufacturing plants.

I. M&HCV Trucks + Buses

M&HCV stands for medium and heavy commercial vehicles. This is the main revenue generator of Ashok Leyland. The company has been able to increase it’s market share from 22% in 2013 to 30% last year in this segment with the #1 player being Tata Motors.

This segment contributed 75% of total turnover in FY23 out of which:

Trucks (which includes tractor trailers, tippers etc) contributed 67.2% of the total turnover.

Buses contributed 8.6% of the total turnover.

II. LCV Segment

LCV stands for Light Commercial Vehicles. The LCV business was started in early 2010s and has been quite successful. Dost and Bada Dost are the flagship LCV products of the company.

This segment contributes 12% to the company’s total revenue. More importantly, this segment enjoys higher operating margins than the M&HCV business.

AL’s market share of the domestic LCV market stood at 19.6% (as at 31 March 2023) recording sales of 66K+ units of LCVs and is on track to launch 3 new products in FY24.

III. Others

Apart from the two main segments above, AL also has the following revenue streams:

Power Solution business — where the company sells Generators, Engines and Gensets.

Defence business — manufactures various defence vehicles for the Indian army. It supplies not only Logistics related vehicles but also Armored, high mobility & tactical bullet proof vehicles under this segment.

Aftermarket — where the company sells various automotive spare parts. Again, this segment enjoys high margins and has been growing steadily — albeit on a lower base.

Vehicle Financing — AL has a material subsidiary Hinduja Leyland Finance Limited (HLFL), which extends loans to M&HCV customers of AL. It also caters to 2 wheeler / 4 wheeler buyers, however 50% of the loan book consists of M&HCV loans.

Fun fact: The commercial vehicle market is heavily dependent on financing activities, since CVs are quite expensive and most people in the industry obtain financing to make CV purchases. Any slowdown in credit activity therefore, would have a direct impact on the CV industry as whole.

What about EVs?

So, we’ve understood that Ashok Leyland is capable of making GIGANTIC vehicles — but what we’re interested in is the EV opportunity. What is AL doing here?

Enter Switch Mobility

800+ operational e-buses on Indian roads. Launched India’s sole double decker e-bus. Order book of 1,300+ e-buses.

Going to launch an e-LCV very soon — and has already bagged pre-booking of 13,000 units — from various e-commerce platforms and FMCG players.

The e-bus market is already dominated by players like PMI Electro Mobility and Olectra Greentech. However, the e-LCV market is untapped and ripe for disruption. And as investors — it would be prudent to keep an eye out on how quickly AL moves to capture market share in the e-LCV market.

As Ashok Leyland celebrated 75 years of operations last year, the company invited Nitin Gadkari — Minister of Road Transport and Highways — to unveil its electric LCV under the IeV series:

The Switch IeV series claims a range of upto 300KMs in a day + boasts a payload capacity of upto 1.7 tons.

Equipped with a 330V high voltage EV architecture. Spacious cargo body extending upto 9.7 feet.

Switch plans to produce 3K units per year of it’s IeV series which will be manufactured at Ashok Leyland’s Hosur manufacturing site — which can be easily scaled up if required.

IeV series will target categories such as cargo, containers, garbage vans, refrigerated vans etc.

Ashok Leyland has committed an equity infusion of INR 1,200 CRORE in Optare Plc (which is the holding company of Switch Mobility). During Q3FY24 — AL had already undertaken an infusion of INR 662 CRORE into Optare and will infuse the balance equity in several tranches over the next few months.

Goes on to show that AL is quite serious about pursuing the EV opportunity and is willing to spend the money that is required since Switch Mobility is not profitable at the moment.

Other updates in the EV segment:

Entered the ‘e-Mobility as a service’ space through it’s step down subsidiary OHM Mobility.

Ashok Leyland is also getting ready to make ELECTRIC TRUCKS — and sold it’s first ever electric truck [Boss 14T] at the Bharat Mobility Global Expo. The company is also nearing market trials of it’s fully electric 55 tonne AVTR tractor trailer for long haul transport.

The manufacture of electric trucks will be by Ashok Leyland and NOT Switch Mobility. Switch — will be manufacturing only e-buses and eLCVs.

The next few Qs will be quite important to see if the management can execute on delivery of e-buses / eLCVs / e-trucks.

What are the tailwinds?

Now that we have a firm grasp on the business and what AL is trying to achieve in the EV market — let’s take a look at some broad tailwinds that could build long term value for it’s shareholders:

Infrastructure Boom — India is going BIG on infrastructural spending. Airports. Ports. Roads. Renewable Energy. To build anything, you need a lot of steel and cement. And you need to MOVE a lot of steel and cement over long distances for which you need trucks, tractor trailers etc.

The Government of India has earmarked a substantial amount of it’s Union Budget towards infrastructural spending and that will have a direct benefit for the commercial vehicle industry.

The Government wants to convert 8 lakh diesel buses into e-buses — that’s a BIG opportunity. Through the PM e-bus Sewa programme — the GOI wants to provide incentives for electrification of 10,000 buses.

Skilled Management — Ashok Leyland is part of the Hinduja Group — which is a high pedigree conglomerate and known to generally be good allocators of capital.

Going through the earnings call — one thing became very clear — that the management of Ashok Leyland will NOT compromise on quality + margins to gain market share. The focus was to retain margins and building high quality products to grow market share and not enter into pricing wars with peers.

Over the last 10 years — AL has transformed itself from being a south centric player to a pan-India player with strong market share in most regions that it operates in.

Back in September 2021 — AL had a market share of 22% in the M&HCV segment and was losing market share because it didn’t have a CNG model available in the ICV business (i.e. bigger buses and trucks). The management was quick to adapt to market conditions, rolled out CNG models by March’22 and was able to claw back market share — taking it to 30% by September’22

In the e-bus segment as well, AL has been steadily gaining market share. With eLCVs + e-trucks — it will be interesting to see how things play out over the next few quarters / years.

The management has shown that it can adapt to dynamic situations and take sensible decisions to create shareholder value.

High barrier to entry — starting a new commercial vehicle company isn’t easy. Sizeable investments are required to set up capacity. M&HCV market is more concentrated than the LCV market. Break even in operations takes significant time — so you need deep pockets.

No major entrants are expected in the domestic CV market in the foreseeable future — however over the medium term entry of mass mobility companies could threaten traditional CV companies.

Future Growth Drivers — During Q3FY24, AL added several new models + variants in it’s product portfolio. Let’s look at some of the growth drivers for AL going forward.

M&HCV Business — this is the main business of Ashok Leyland and one which investors should keenly follow. This includes sales of buses, tractor trailers, tippers etc.

The management believes that the industry is moving towards higher tonnage tractor trailers which has a higher selling price + higher margins. Globally, penetration of high tonnage tractor trailers is very heavy and in India it is ONLY around 20%.

With better roads, the penetration of high tonnage tractor trailers should increase which will directly benefit AL and result in better margins.

Margin expansion = More profits = Better valuations = Increased shareholder wealth.

This is the golden formula.

Out of the mining projects going on in the country — the management expects some amount of privatization happening of the mines — which should drive UP the demand for tippers.

Talking about buses — the management has received a large # of orders and believes a LOT of steam is left in the bus segment. The existing orders should get executed over the next 8-9 months. [FYI - these are not e-buses but normal buses]

LCV business — for a business that was started in the early 2010s, AL commands a significant market share of the domestic LCV market.

LCV business enjoys higher margins than M&HCV segment so any increase in LCV sales should help AL to expand it’s overall gross margins.

LCV business is LESS CYCLICAL than M&HCV — and this should help AL de-volatize the business to certain extent.

The current product portfolio of LCVs addresses only 40-45% of the market, which means there is still more room to grow through introduction of new LCV variants.

Investing in new technologies — apart from EVs, the company is also investing in technologies of the future like hydrogen fuel cells, hydrogen ICE etc.

AL received an order to deliver 10 hydrogen fuel cell buses to NTPC.

Other segments like — after market sales of spare parts, defence business and power solutions business is also growing at a good clip. These are not big enough to move the needle at the moment though.

What are the causes of concern?

Cyclical industry — the transport business is dependent on economic activity, GDP growth, mining, construction, roads & highways and is highly cyclical. In case of a slowdown, or a black swan event like COVID-19 — this industry would be hit pretty bad.

AL is trying to de-volatize the business by amping up LCV sales. And in general, the infrastructural opportunity in India in the next 10 years is going to be monumental.

High competition — there are not many players in this segment due to high barriers to entry, however the players that do operate are all marquee business names. Tata Motors, Eicher Motors, Mahindra & Mahindra, Bharat Benz — these are players with deep pockets. Therefore, AL has to be spot on with its future strategy into M&HCV, LCVs, EVs.

Tata Motors is the #1 player by market share in the M&HCV market.

Reliance on commodity prices — raw material costs are > 70% of direct costs, with the primary raw material being steel. Although management has been able to pass on increase in commodity prices to the end customer — in a highly competitive scenario this might not always be possible.

High Debt — net debt as at 31 December 2023 was INR 1,747 crore — higher than the previous quarter by INR 608 crore. This is primarily because of it’s financing business (where the business model is to borrow money at low cost and lend money at high cost). However, investors should watch this number closely to ensure that it doesn’t balloon out of control to unsustainable levels.

No FY25 guidance — in the earnings call for Q3FY24, no mention was made of the FY25 revenue / EBITDA number that the management is targeting.

Promoter pledging — certain shares of the promoters are pledged, which is not a good sign in scenarios where the stock price goes down.

When shares are pledged with banks / FIs, and the stock price falls — it can trigger a sell order where such banks / FIs sell the pledged shares further pulling down the stock price.

Conclusion

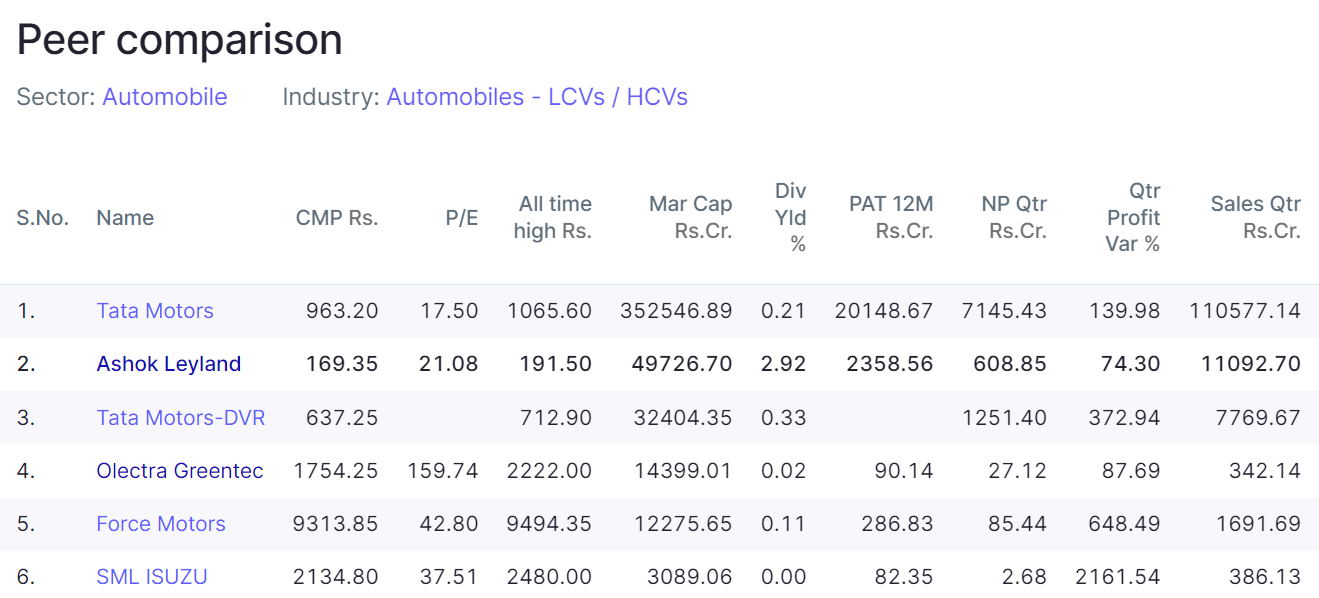

Ashok Leyland is trading at a market capitalization of close to 50,000 CRORE at a TTM P/E of 20.88 — significantly lower than the industry PE.

They had a decent performance — with 9MFY24 revenue of 27,100 crore, sales volume of 1,38,416 CVs. EBITDA margins between 10-12%, with margin expansion happening QoQ from 10% in Q1 to 12% in Q3. EBITDA was helped by cost reduction measures + declining commodity prices.

Ashok Leyland is one of the largest manufacturers of trucks and buses and would benefit from the growth in infrastructural development in India.

It’s making some good inroads in the EV sector through it’s subsidiary Switch Mobility. Getting into electric trucks / tractor trailers. Investing in hydrogen fuel cells, hydrogen ICEs.

The management is very clear that it will not sacrifice margins to gain market share but focus on building high quality products to differentiate itself and decrease the total cost of ownership (TCO) for it’s customers.

The LCV segment shows potential which is less volatile. Commands higher margins than M&HCVs. In M&HCVs, demand for tractor trailers are increasing which have better realizations and would benefit AL.

It has high debt on its book because of it’s financing subsidiary — HLFL. Promoter shares being pledged is a red flag to look out for. Plus, no forecast has been provided by the management for FY25 (yet). The industry is cyclical and characterized by high competition putting pressure on selling price.

AL — I think is being valued as a traditional commercial vehicle company. They have the potential to capture [and disrupt] the e-bus / e-LCV / e-truck market and we’ve seen that they are serious operators. If it can execute the EV strategy flawlessly, I think there’s a lot of value to be unlocked.

Definitely worth a place on your watchlist!

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could donate a small token to contribute to my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Very Informative in depth analysis. Keep up the good work