Space, aerospace, defence, nuclear energy are some of the sunrise sectors in the Indian economy witnessing rapid growth and a BIG PUSH from the Government. I wrote about various companies catering to these sectors and it is worth a re-look as to how their businesses are shaping up.

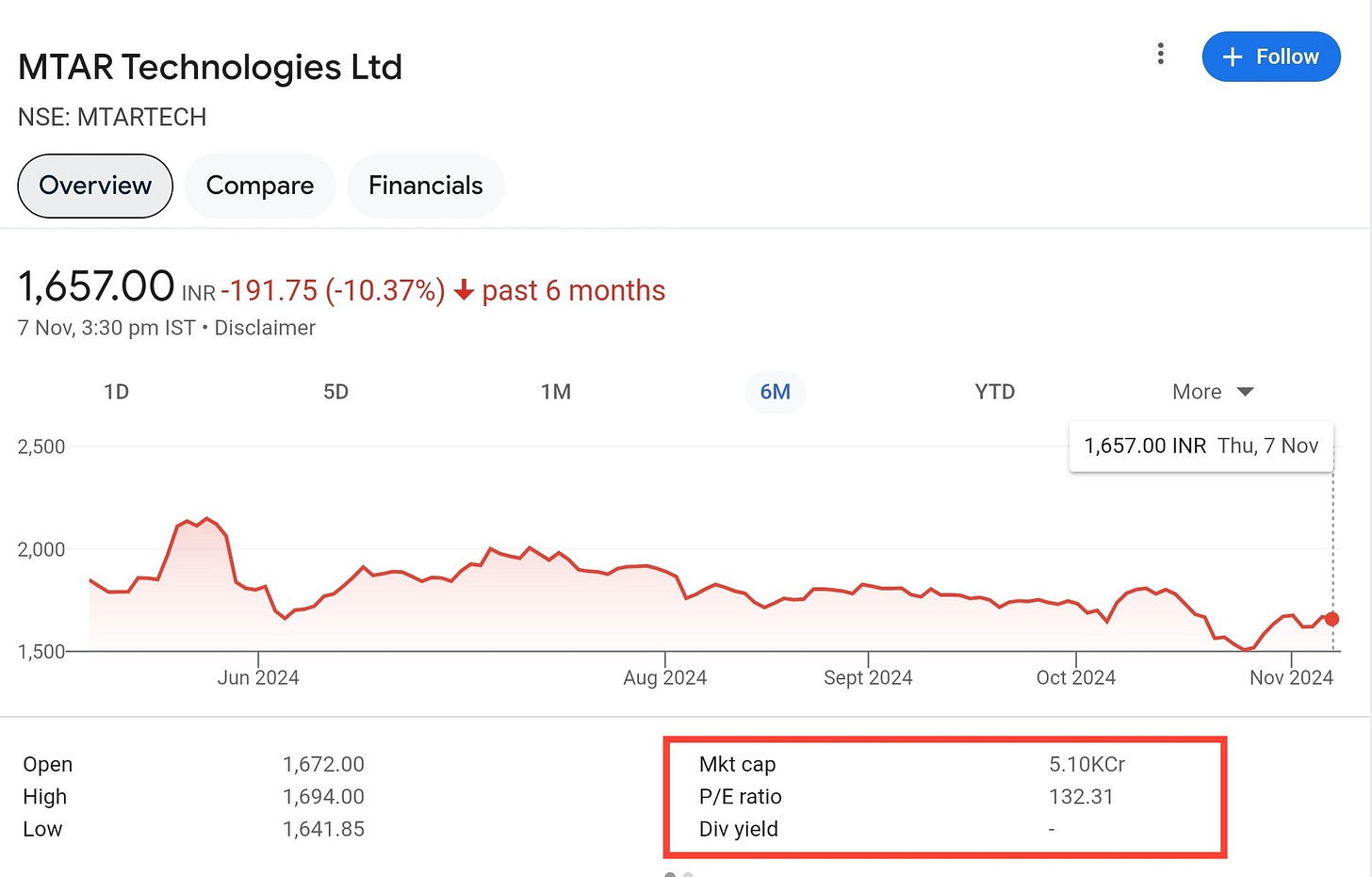

#1 MTAR Technologies

MTAR is an engineering company that makes machine equipments, assemblies, sub-assemblies and caters to various industries like clean energy, nuclear energy, space, defence, aero-space etc.

All of these sectors are high growth sectors, which is why MTAR makes the cut into my watchlist — and it makes sense to track the quarterly results to see how the business is performing.

Despite a flat 6 month performance, the stock still looks expensive [PE of 132 times] which means that investors are betting MTAR will significantly capitalize on future growth.

Q1 Biz update:

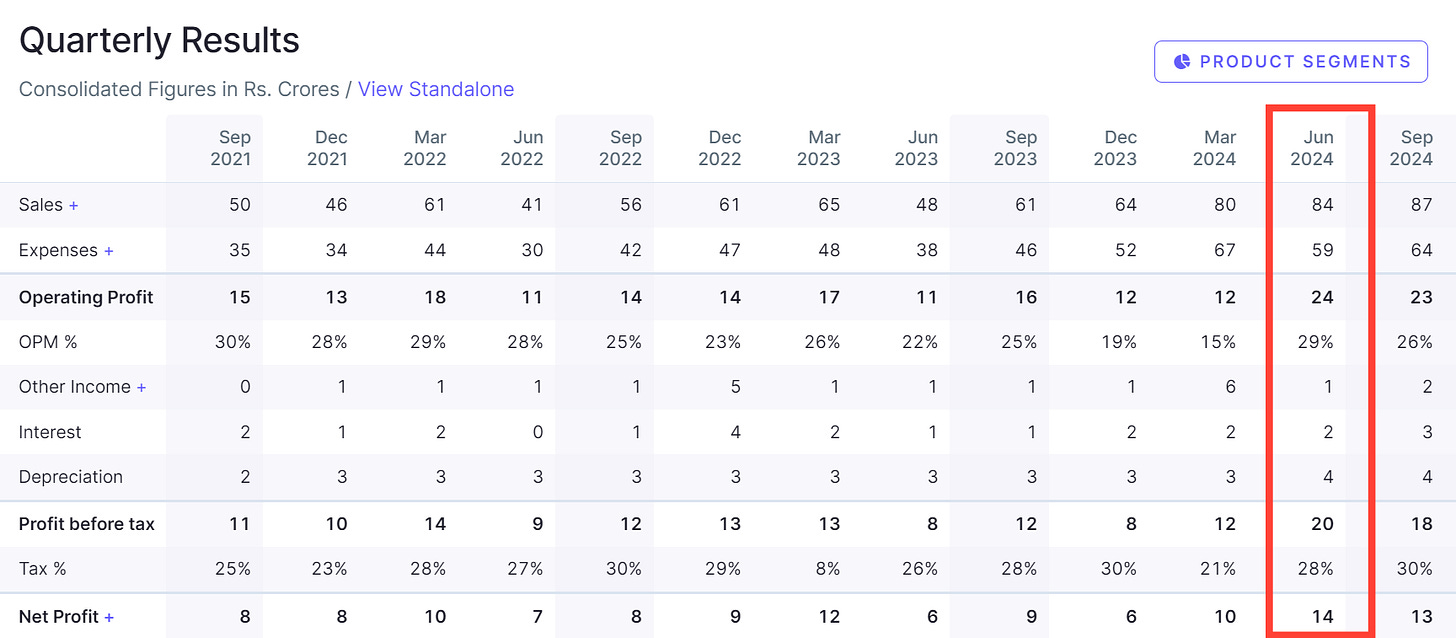

Financial performance — Q1 was not a great quarter for MTAR, with all metrics down. The management is still guiding for a revenue growth of 30-35% for FY25 and an EBITDA margin of 22% (+/- 1%)

For Q2FY25 — the management has estimated it’s highest ever quarterly revenue of INR 200 Cr.

Order book — at the end of Q1, the order book stands at INR 894 Cr and the management is expecting to close FY25 with an order book of INR 1,500 Cr, with major orders coming from nuclear, aerospace, defence and new verticals (oil & gas)

The company has achieved a revenue of INR 190 Cr based on actual results for Q2FY25 — so it is not very far off from what the company estimated.

Clean Energy — major revenue comes from this segment. In Q1, this segment contributed INR 86 Cr to the topline. The company dispatched 814 units of hot boxes + 22 units of electrolyzers.

Expecting dispatch of 3,300 units of hot boxes for FY25. 990 hot boxes expected to be delivered in Q2.

Revenues of Bloom Energy — the company’s highest revenue generating customer — are projected to grow by 18% p.a. on average for the next 3Y. That should translate to more orders for MTAR.

Nuclear Power — delivered first articles in Q1, resulting in marginal sales of INR 1.3 Cr. Expecting sales of INR 16 Cr in Q2 and INR 62 Cr for FY25.

The management is estimating BIG GROWTH in this sector with orders worth INR 600 Cr from Kaiga 5 / 6 coming in H2FY25 + orders for refurbishment of reactors.

Major revenue from this segment is expected to flow from FY26 onwards — since execution timelines for nuclear projects are long [5-10 years]

A lot of private companies are looking at setting up small nuclear reactors for their energy requirements. MTAR, with it’s expertise in this segment could be a significant beneficiary.

Space & Aerospace — generated INR 8.5 Cr in sales from this segment. Expecting 3X growth in revenues compared to FY24.

In Q2, management estimates delivery of INR 12 Cr worth of orders to ISRO + INR 20-25 Cr of orders to MNC aerospace customers.

For FY25 — estimating execution of INR 120-130 Cr of orders of which INR 50 Cr will be to ISRO [which includes the Semi-cryo engine] and balance of INR 70-80 Cr will come from MNC aerospace customers.

Partnerships — the company entered into a long term agreement with IAI, Thales and will be signing a contract with GKN Aerospace soon.

Manufacturing facility — new aerospace facility in Hyderabad will be commissioned by Sep’24 [operational by Dec’24]. INR 20-25 Cr of CAPEX expected out of which certain expenditure is already incurred.

Other segments / New product development — Revenue from defence for Q1 was INR 4 Cr. Expecting annual revenue from defence of INR 30 Cr. R&D team is working on various new products for defence & space segments.

Management is expecting to get clients in the oil & gas field segment. Estimating CAPEX of INR 35-40 Cr for additional machinery / facilities. Expecting revenues of INR 150 Cr coming from this sector from FY26.

The company is expecting to receive certifications from the defence department for it’s roller screws. Going forward, the government wouldn’t need to import these screws from Rollvis Sweden and it can procure it directly from MTAR.

#2 Paras Defence

Paras Defence is in the business of manufacturing defence electronics, defence & space optics and high precision mechanical systems.

I dissected the business model of Paras Defence here.

The 6 month performance of Paras has been pretty good, up 46%. At a PE of 88 times the stock looks expensive. However, at a market capitalization of INR 4,000 Cr there’s a lot of room to grow.

Q1 Biz update:

Financial performance — Q1 was pretty impressive. Revenue was up 73% YoY. Net profits more than doubled. The management expects to grow topline at a steady pace of 25-30% p.a. with baseline profit margin between 15-18%.

Defence electronics — this segment posted revenues of INR 45 Cr in Q1FY25, compared to INR 29 Cr in Q1FY24.

Defence optics — revenue from this segment surged 100% YoY to INR 38 Cr compared to 19 Cr in Q1FY24. This segment has potential for high scalability + profitability as compared to defence electronics [which is highly competitive]

The management is very bullish on the anti-drone business and it’s prospects going forward.

Order book — current order book [as at 30 June 2024] stood at INR 600 Cr, which is expected to grow to INR 2,500 Cr by FY28. The company has orders worth INR 1,500 Cr in the pipeline.

An associate entity of Paras Defence won a INR 305 Cr order from L&T — involving supply of 244 units of ‘Sight 25 HD Electro Optics system’.

Received an order worth INR 42 Cr from Opto Electronics Factory for supply of 5 types of electronic control sub-systems which will be used in thermal imaging fire control systems [by IAF].

Electromagnetics has a good amount of opportunity with a funnel of >500 Cr. These orders are not yet won officially, only in the early discussions stage.

#3 Hindustan Aeronautics Limited

Hindustan Aeronautics Limited [HAL] is a one stop shop for India’s defence aviation needs. It specializes in design, manufacture, repair & maintenance of aircrafts, helicopters and their engines — making it a critical supplier for the country’s defence program.

You can read more about HAL in my article here.

The stock has delivered a decent return of 15% in the past 6 months and has mostly been range bound.

Q1 Biz update:

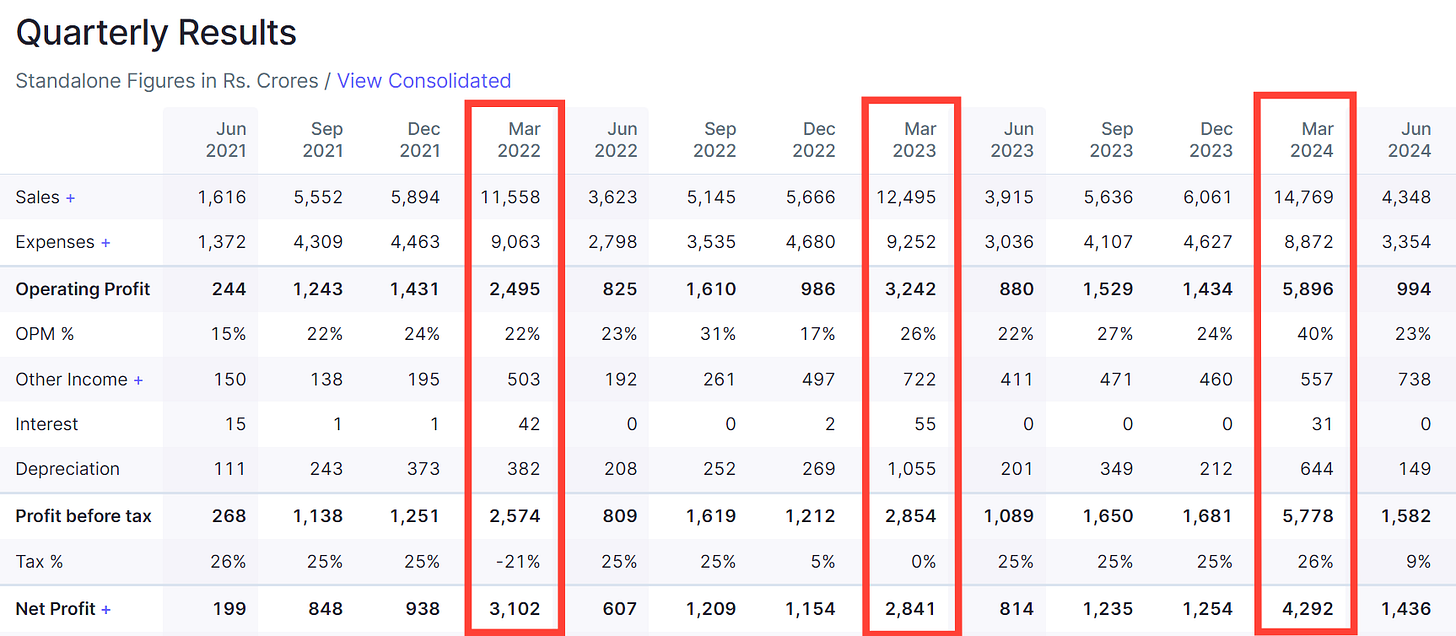

Financial performance & delivery schedule — YoY performance was impressive, however QoQ all metrics were down because a lot of revenue booking happens in Q4. [see chart below]

Near term financials may be a little volatile on account of delay in execution of Tejas MK1A orders due to supply issues of GE 404 engines from GE Aerospace which may persist for a large part of FY25.

Management expects FY25 revenue to grow at 13% YoY. However analysts expect FY25 revenue to grow at mid single digits due to delay in delivery of MK1A aircrafts.

Delivery of engines for the SU-30 MKI aircrafts would start from FY26 and will be completed over a period of 8 years. These engines would be manufactured at HAL’s Koraput division and will have 54% indigenous content.

Partnerships — the company entered into a MoU with GE Aerospace to produce fighter jet engines in India. It is also working on a JV with Safran to co-develop turboshaft engines in India for Indian Multi-Role Helicopters (IMRH) and Deck based Multi-Role Helicopters (DBMRH).

Order book — the current order book stands at 94,000 Cr which is expected to significantly increase in the next few years.

Cabinet Committe on Security cleared procurement of 240 aero engines worth INR 26,000Cr to be used in SU-30 MK1 aircrafts — delivery of which should begin from FY26. This will increase the order book to 1.2L Cr.

It has an order pipeline [orders not yet won] of INR 48,000 Cr for SU-30 engines, RD-33 engines, Advanced Light Helicopters (ALH), Light Utility Helicopter (LUH) — expected to materialize in the near term.

Orders worth INR 18,000 Cr are expected to materialize with respect to Repairs & Overhaul (RoH).

Long term order pipeline remains robust with business opportunity of INR 4.5L Cr over the next decade with projects like Tejas MK II, AMCA, TEDBF, IMRH & ALH.

Sectors like space, defence, aerospace, nuclear energy and clean energy are witnessing exponential growth and I will keep tabs on companies that could be major beneficiaries in India as a result of such growth.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]