Clean Energy. Space. Defence. Aerospace. Nuclear Power. These are industries of the future. And MTAR Technologies is catering to all the above sectors.

Established in 1970 — the company is in the business of manufacturing various machine equipments, assemblies, sub-assemblies, and spare parts.

If you look at the stock movement, it’s sort of been all over the place in the last 3 years and hasn’t really stabilized at any level. Obviously, in this blog the idea is to play the long term game — so price movement is not something that I pay a lot of attention to. But, it’s definitely important when you want to enter into a stock.

ALSO READ: Detailed analysis of the business of MTAR Technologies in this article

How did the business perform in Q3? More importantly, was the management able to deliver on the guidance that it gave in Q2? Let’s take a look!

Q3 Performance

It was a bad quarter for MTAR with decrease across all counters.

Certain concern points that I want to highlight before I move on to the key highlights:

Revenue decreased by 26.1% YoY due to supply chain stabilization issues at Bloom Energy which disrupted sales for MTAR. Margins got a significant beating as is evident from the chart above.

Revenue guidance for FY24 has been constantly decreasing. This doesn’t help build investor confidence in the estimation capabilities of the management.

In Q1, management estimated FY24 revenue of INR 860 crore.

In Q2, that got reduced to INR 700 crore.

In Q3, guidance for FY24 revenue stood at INR 610 crore.

EBITDA % took a hit, since the company has certain fixed costs (like employee costs) which are bound to be incurred irrespective of the revenue performance of the company. A lower revenue would result in lower EBITDA margins.

Overall EBITDA guidance for FY24 was further reduced from 26% in the previous quarter to 24%. Again, not something you like to see as an investor

A certain part of its order book comprises of orders which might not get executed.

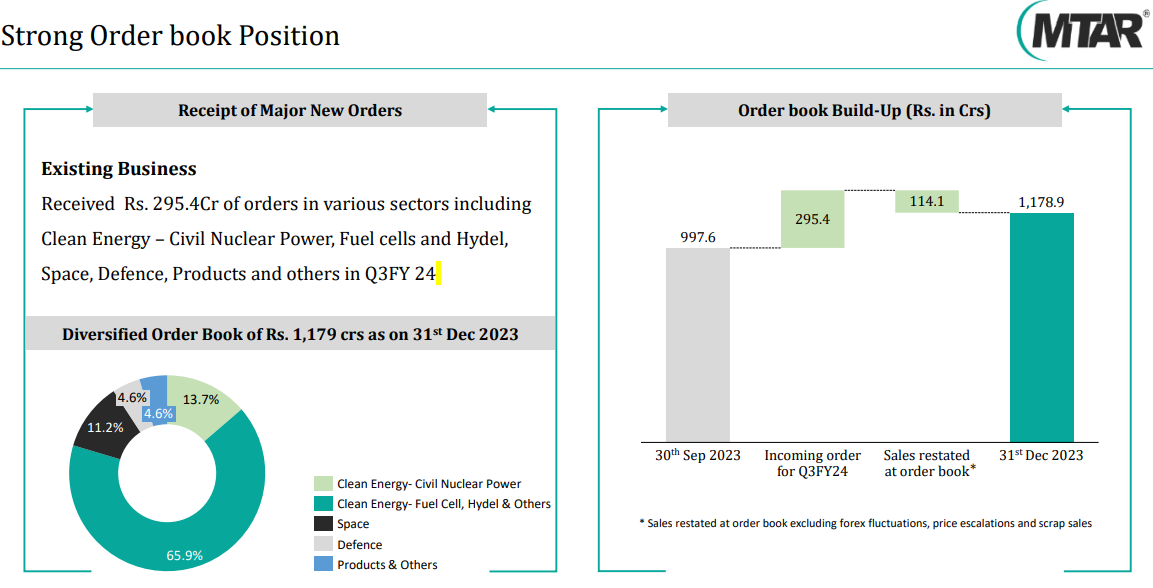

Order book position as at the end of Q3 Bloom Energy — MTAR’s most important client — is shifting it’s product line from ‘Yuma’ to ‘Santa Cruz Block 2’. As of date, there are orders worth INR 185 crore pertaining to the Yuma product line. This order either needs to be discarded OR converted into Santa Cruz Block 2. A decision on this will be taken in Q4.

Keeylocko — another product line of Bloom Energy — has orders worth INR 218 crore, the execution of which is not known at this point.

The total order book as at 31 December 2023 stood at 1,179 crore, and the management is expecting order book to close at INR 1,400 crore for FY24.

Key highlights

With the management missing expectations by a significant delta (approx. 250 crore of topline delta between Q1 estimates and Q3 estimates) — I wasn’t very buoyant about management’s guidance for the next year but here’s a summary of the key highlights discussed during the Q3 earnings call:

Revenue for Q4 is expected to be in the range of INR 170 crore. Revenue guidance for FY25 of INR 900 crore which translates into a 45-50% revenue growth YoY. EBITDA margin guidance of 26% for FY25, with expectation of margin expansion to reach 28-29% in FY26.

For the clean energy business:

Received orders of INR 264 crores in Q3 mainly pertaining to Santa Cruz hot boxes. Expecting orders of 300 units from Fluence Energy in FY25, which could increase to 1K units in FY26 and 3K units in FY27.

500+ hot boxes delivered to Santa Cruz Block 2. 664 hot boxes expected to be delivered in Q4. Management estimates delivery of 3,500 hot boxes to Santa Cruz in FY25.

Realization per hot box has increased from INR 7.5 lacs per box (Yuma) to INR 9 lacs per hot box (Santa Cruz). This should help increase margins to some extent going forward.

Delivered 44 electrolyzers in Q3 with another 60 expected to be delivered in Q4. These electrolyzers are being made specifically for Bloom Energy at the moment. Management expects this to be a BIG OPPORTUNITY, however it has not included sale from electrolyzers in it’s FY25 estimate to be conservative.

Clean Energy will contribute around INR 400-425 crore for FY25, with the hot box division (Bloom Energy) contributing to around INR 300 crore.

With this, the management expects to de-risk themselves from excessive dependency on Bloom Energy. Need to see how this ultimately plays out.

For the Nuclear Energy business:

Revenue for FY24 expected to be in the range of INR 60 crore. Management estimates INR 65 crore in revenues in this segment for FY25.

Expecting orders worth INR 500 crore from Kaiga 5 & 6 reactors from NPCIL. The pricing bid for this order is expected to close in Q4. Order execution for this project would range from 4-5 years.

For the Space / Aerospace business:

Executed INR 23 crore worth of orders pertaining to this segment for 9MFY24. Expecting FY24 revenue to close at INR 45 crore.

An on-going project [Semi-cryo engine project] is expected to be executed in H1FY25. The company is expecting sizable orders from various MNCs with respect to aerospace projects.

Space / Aerospace should contribute INR 150 crore to the topline for FY25.

MTAR made significant progress in development of SSLV launch vehicle. The SSLV project is a 4 year developmental activity — with engine related subsystem designs in progress. MTAR is in the 2nd year of the development cycle.

For defence / other products:

Recorded INR 15.4 crore of orders in the Defence segment. MTAR has received the defence license and it’s R&D team is working on several products. No commentary was given on how & when new products for defence will be launched.

Other products like electromechanical actuators (EMAs), ball screws, roller screws, sheet metal etc. are expected to contribute INR 130 crore in FY25, up from INR 18-20 crore in FY24 (estimated). As per management, some of these products are import substitutes and command high margins.

There was improvement in cash flows from operating activities + reduction in net debt by INR 48 crores.

Conclusion

My general analysis reading the earnings concall was that the management doesn’t shy away from giving details on it’s core business. I’ve read other earnings call transcripts where the CEO / MD blatantly say that they will not provide certain information due to confidentiality issues.

The biggest problem — is the delta in revenue estimates. Back in June 2023, the management had guided a full year FY24 revenue of INR 860 crore. Fast forward to January 2024, the full year revenue guidance for FY24 is INR 610 crore. THAT’S A BIG GAP IN ESTIMATION!

The management has assured that the worst is over and things should stabilize going forward. We’ll see how the numbers shape up for Q4.

If they can achieve a topline of INR 610 crore or more for FY24, plus achieve INR 900 crore in FY25 — I would be willing to give the management the benefit of the doubt. But, for now — it doesn’t instill confidence in me about their forecasting / execution capabilities.

I’d also like to see them reduce their dependency on Bloom Energy. Build new products for the defence segment (since they’ve obtained the defence license). Execute more projects in space / aerospace. If that happens, I see a lot of potential!

But, not at the current valuation. At a P/E of 76 times — the stock is very expensive. Given the fact that it’s margins have contracted YoY, it might not be the best entry point to enter the stock right now.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]