I’ve written about a few micro-caps now and I am slowly understanding that finding multi-baggers isn’t an easy task. You need to develop the ability to see the future, with a limited amount of information.

What keeps me excited is not so much as finding a multi-bagger, but learning about new businesses. Researching new business models. You need to be curious if you’re going to read a TON of stuff.

With that, let’s get going. The microcap I’ll be covering in this piece is — Nitta Gelatin India Limited.

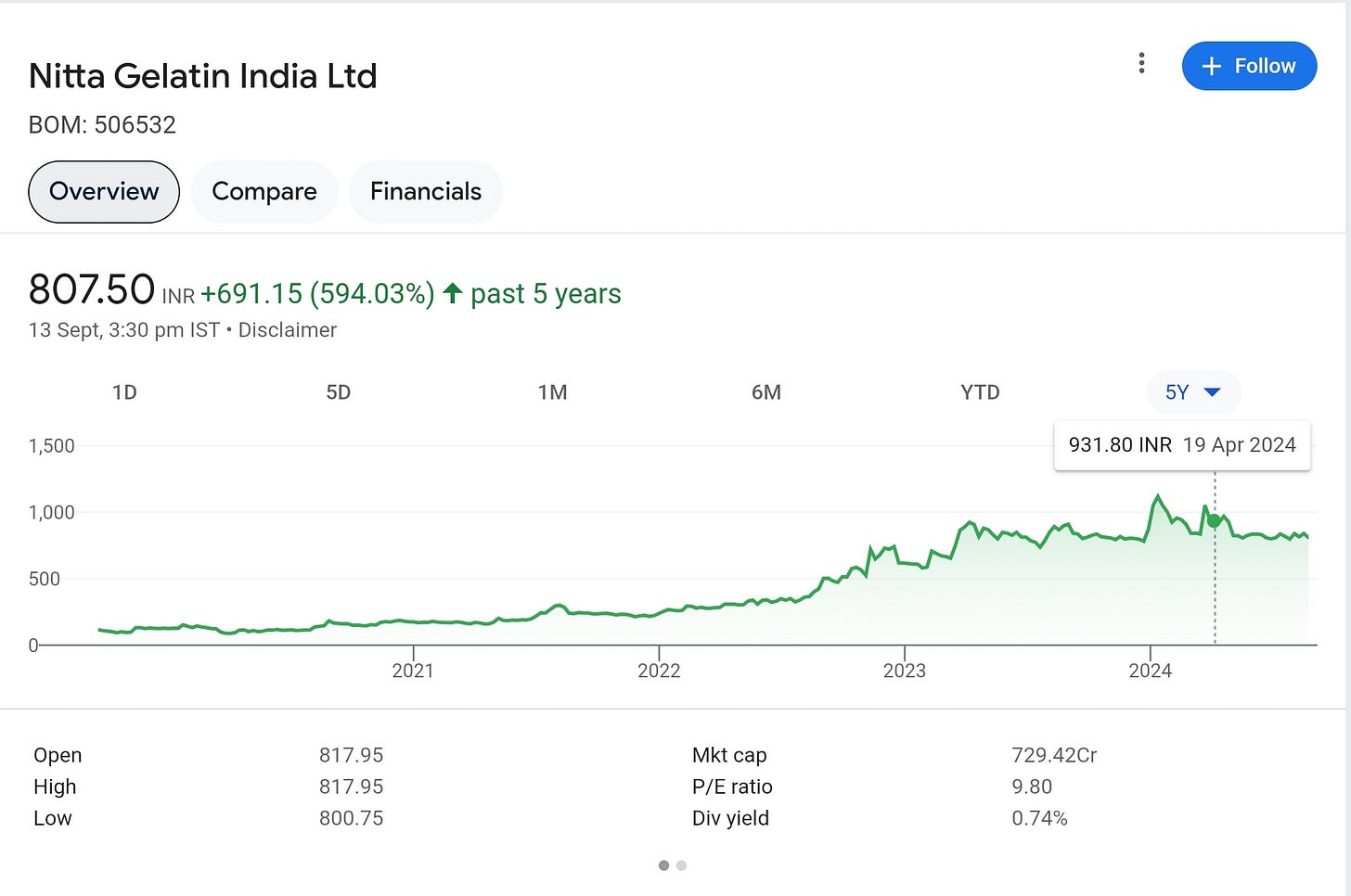

On a brief reading of the chart above, you can see that the company has delivered 6X returns over the past 5 years. However, it hasn’t moved much in the last 2 years. Is there potential for the stock to move upwards from here?

That’s the question that we’re interested in isn’t it? For this, we need to understand how Nitta Gelatin makes money and the growth drivers for the future.

The Business

Incorporated in 1975, Nitta Gelatin India Limited (NGIL) is a JV between Nitta Gelatin Inc and Kerala State Industrial Development Corporation (KSIDC). Nitta Gelatin Inc [the holding company], founded 100+ years ago in Osaka, Japan — is among the largest gelatin producers in the world.

As the name suggests, the Company is in the business of manufacturing Gelatin. It also makes Collagen peptide, Ossein, Di-calcium phosphate and other ingredients.

Products + Applications

Gelatin (67% of revenue) — used in pharmaceutical & food applications.

Di-calcium phosphate (15% of revenue) — used as a poultry feed ingredient.

Collagen Peptide (10% of revenue) — used in nutraceuticals, food & beverages and cosmetics.

Ossein (7% of revenue) — used in agricultural and industrial applications.

Gelatin is commonly used as coating for tablets / capsules helping to improve their appearance, stability and swallow-ability. They can mask unpleasant taste + odor of drugs. It is also used in production of soft-gel capsules — which are used for delivering liquid / semi-solid medications.

Gelatin’s versitality makes it the ultimate food ingredient finding use in confectionary items, desserts, beverages, dairy and meat products.

The company operates 3 manufacturing facilities and is undertaking capacity expansion for it’s Collagen Peptide product (in the existing Kakkanad facility in Kochi) as the management foresees significant growth in sales of Collagen Peptide in the future.

NGIL’s products are exported to >35 countries including Japan, USA, Canada & the EU.

The Tailwinds

One of the biggest advantages the company has is a strong parentage and benefits from the established market presence of it’s parent company (Nitta Gelatin Inc.). Some of the other tailwinds are:

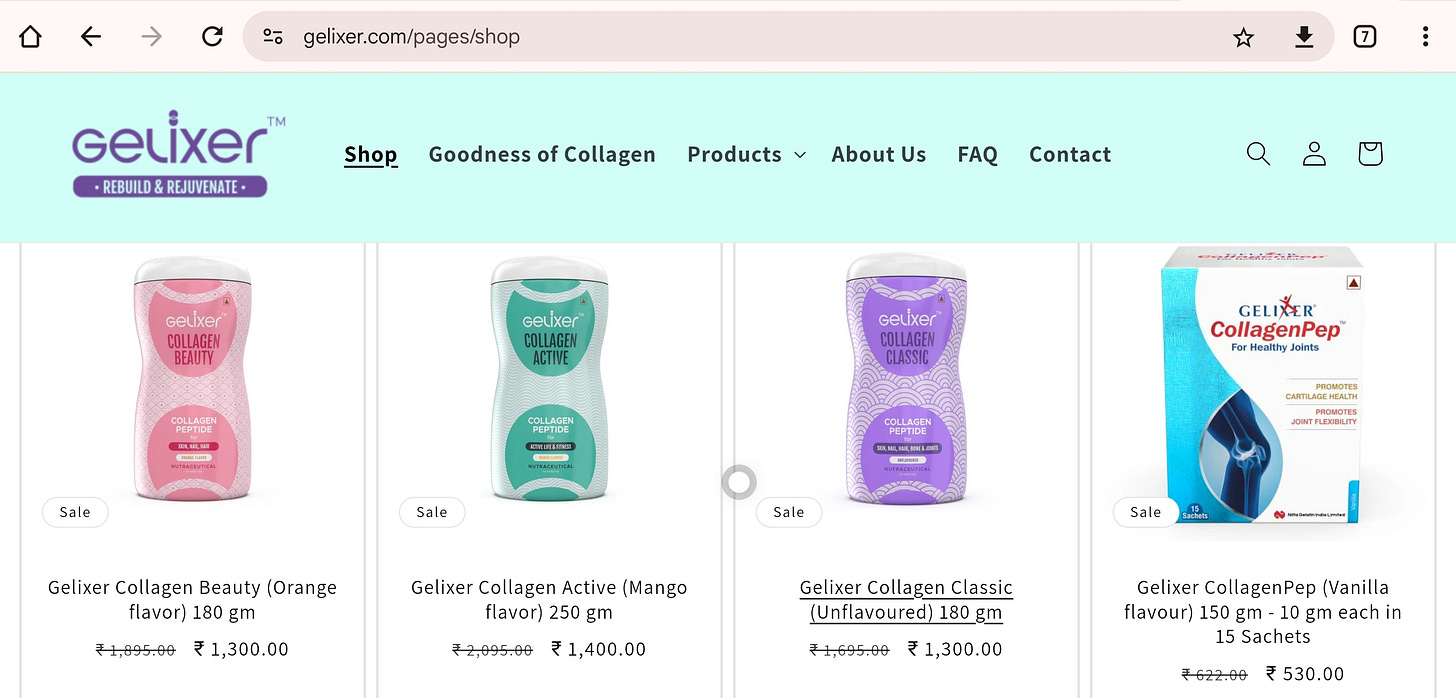

Betting on Collagen Peptide — unlike Gelatin, Collagen is a B2C product which is sold at pharmacies. Currently, the company derives close to 10-15% of revenue from Collagen — but the management believes there could be significant growth in this segment going forward.

NGIL is expanding it’s Collagen Peptide capacity from 450 MT to 1,000 MT. The Nitta Group plans to incur Capex of INR 250+ Cr over FY25 / FY26 to expand capacity in Collagen & Gelatin units.

The global Collagen market was $10B in 2023 — expected to increase to $16.9B by 2032 growing at a CAGR of 5.8%. The rapid growth in the nutraceutical industry in India will help increase the demand for Collagen Peptide.

It is the hottest ingredient in newly developed products for women’s health, fitness, nutrition and healthy aging. Nitta Gelatin sells various Collagen products through it’s brand Gelixer.

Barriers to entry — although the company hasn’t revealed any data with respect to it’s market share, I am assuming the company wouldn’t have too many competitors because:

Setting up a Gelatin / Collagen Peptide manufacturing facility is quite capital intensive. You need production equipment. Processing facilties. Incur a lot of money on R&D. The pharma industry is highly regulated. It takes time to establish + build a supply chain, since the raw materials are primarily derived from animal sources.

Less competition = less price wars = stable margins

Growth drivers — the company expects to unlock growth through the following:

Growth in the pharmaceuticals market in India — intake of medicines is on the rise due to lifestyle changes (unfortunately). Pharmacy business is booming, and that translates to more gelatin required for coating of capsules, tablets and making soft-gel capsules.

Shifting consumer preferences — Nutraceuticals & dietary supplements are fast growing segments. Gelatin is a popular choice of packaging these products (tablets etc). Indian nutraceutical market is expected to reach $18B by 2025 + Indian dietary supplements market is expected to reach $10B by 2026.

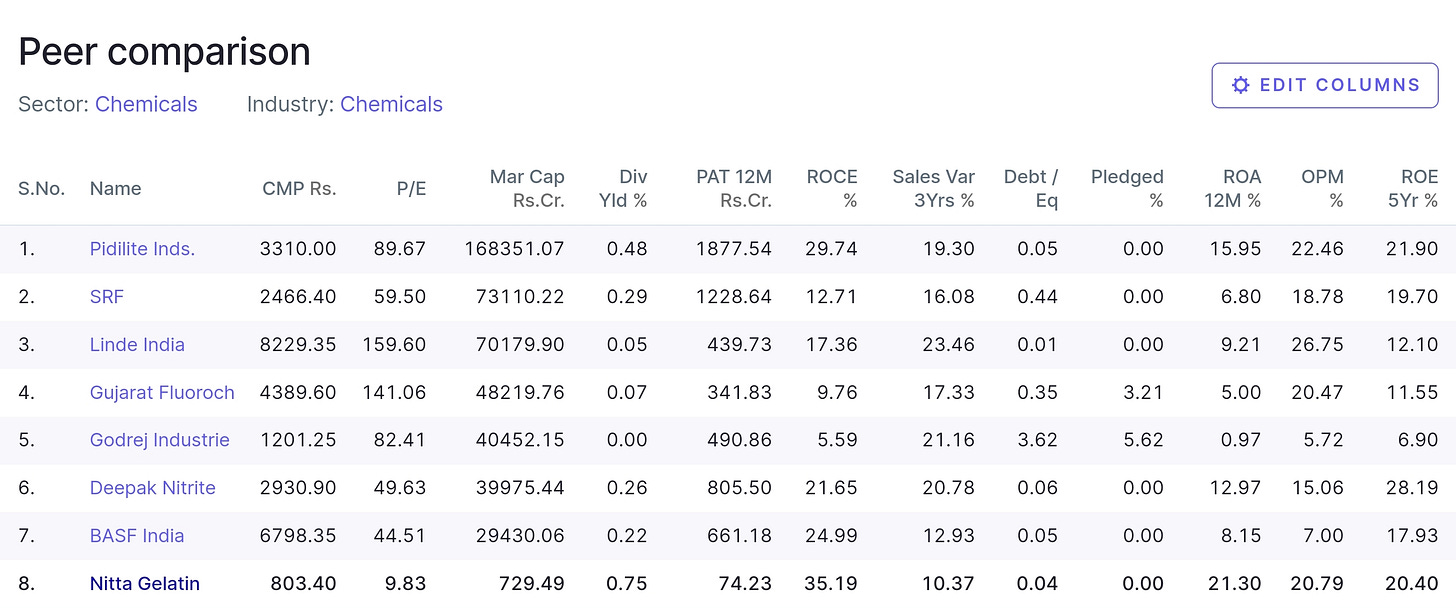

I like the fact that the company has an OPM (Operating Profit Margin) of 20% + 5Y ROE of 20% — which indicates that the Company has been able to generate pretty decent returns on their capital.

Points of Concern

One of the things about the Gelatin business — is that it involves the slaughter of animals. Gelatin is extracted from Collagen, which is a natural protein found in the skin, bones and connective tissues of animals — typically cows / pigs.

The business indirectly promotes animal cruelty, which is kind of a deal breaker for me.

Let’s look at some of the other points to note as a potential investor:

Sourcing of raw materials — the major raw material of the Company is Crushed Bones (CB), the availability of which keeps fluctuating during the year based on slaughtering activity.

with the current Government, there is a clampdown on unauthorized slaughterhouses leading to a reduction in supply of CB. In the EU as well, the cost of running pig farms has gone up, increasing raw material prices — making imports expensive.

Prices of other raw materials like fish collagen peptide and hydrated lime was stable. However, increase in acid prices increased the cost of production — causing OPM to reduce in Q4FY24.

The company is exploring possibilities to import cost competitive Gelbone in the future — which is an alternative to crushed bones.

Manufacturing plant issues — setting up a factory is a costly affair, you need to shell out a lot of money. Once a factory is built, you want to operate it at full capacity, so that you can produce more and sell more.

The company was not able to operate the Collagen Peptide, Ossein and Di-calcium phosphate unit at full capacity due to drop in demand. The production of Gelatin took a hit due to an accident which resulted in the Gelatin unit being shut in the month of September.

Maharashtra Pollution Control Board (MPCB) ordered to stop the operations of a factory of Bamni Proteins Limited (BPL) — which is a subsidiary company. The management has permanently closed the factory and consequently also decided to close the operations of the subsidiary.

The Statutory auditors of the company have qualified their audit report to this effect — which is a BIG DEAL. You don’t ever want to see a qualified opinion in an audit report.

Rise of cruelty free products — consumers are increasingly opting for products which have no trace of animal cruelty, which could hit traditional companies like Nitta Gelatin. However the management believes this to be of little danger due to:

Animal based gelatin being more nutritional than vegetable derived gelatin. Vegetable sources are low in vitamins and essential nutrients

Vegetable derived gelatin is 3x more costly than animal derived gelatin.

Some contradictory statements to note

If you see #2 above, you’ll notice that the company is not operating at full capacity. In that case, why would the management want to spend more money to expand capacity?

The company mentioned that power costs have increased due to increase in tariffs + increase in production. But, production has gone down. Sales has gone down. You’re not running the factories at full capacity, how have the power costs increased?

Further, I don’t like the fact that the Government is a major stakeholder in the organization — bringing politics into play. Plus, Gelatin is a commodity product at the end of the day, so there’s not a lot of pricing power. However the company is branching into D2C (with it’s Gelixer brand)

Conclusion

One of the reasons the stock appeared on my screener is because it has a ROCE of 35% which is very impressive. Operating profit margins in the range of 15-20% which is decent for a commodity business. Dividend yield of 0.75%. 5Y ROE of 20%. Negligible debt. And most importantly, a P/E of 9.83 times. On paper, this looks really good.

However, here are some things that investors should track:

Sourcing raw materials is a big issue for the company. Investors should keep a note of fluctuations in prices of Crushed Bones — any increase in price would adversely affect the company. Can the management find sustainable cheap alternatives to CB? That’s something to watch out for.

The management had to shut operations of it’s subsidiary (Bamni Proteins) — and a qualified opinion has been issued by the auditors to this affect. Investors should watch this closely to see if this leads to any other ripple effects (impairment of assets etc., loss of revenue, loss of goodwill in the market.)

The management is expanding Collagen Peptide capacity, despite not being able to fully operate existing capacity. Investors should watch revenue from this segment to see if the management is able to grow this segment as they’ve envisioned. This will give an insight into how good the management is in predicting the future.

I’d watch the next few quarters to understand what the sustainable level of margins are for the company and whether it is able to grow revenue. The company has potential, since it caters to the pharmaceutical / nutraceutical space — which are growing at a decent pace. And the valuation does look good.

We’ll keep a close watch on how things play out in the future.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Previous article on 20 Microns Limited 👇