Micro-caps are difficult to analyse because of the lack of information available on public domains. Only a handful of people really know what’s going on and they are mostly the promoters / employees of that company.

As an investor — it is like shooting arrows in the dark. You might completely miss the target. But, in a rare few instances — you might hit the 🎯. If you do, you generate a BIG payout.

This is why it is so important to invest in micro-caps & small caps. You have to take the shot while you can.

If you don’t take risks, you will always work for someone who does ~ Warren Buffett

With that in mind, we embark on the exploration of another micro-cap — 20 Microns Limited. (at the time of writing, the company’s MCap isn’t < 1,000 Cr anymore 😷)

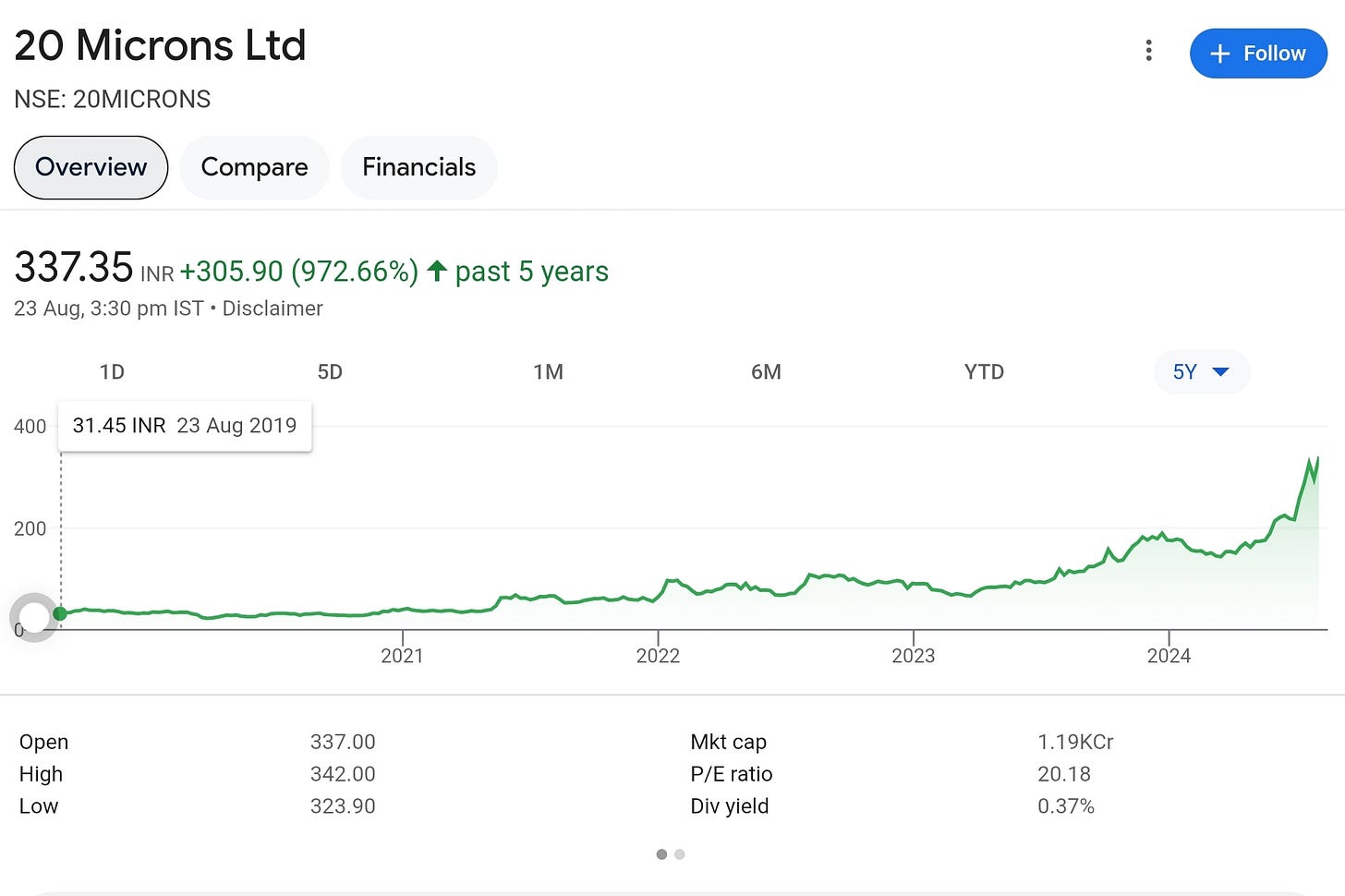

You can see from the chart above, that the stock has already delivered multi-bagger returns (10X returns 🚀) over the past 5 years going from a market capitalization of INR 100+ Cr to INR 1,000+ Cr. Not bad at all.

What we as investors are concerned about is — can the stock go another 10X from here? Can it keep winning? What needs to happen to unlock the next phase of growth?

For that, we first need to understand the business of 20 Microns.

The Business

20 Microns Limited was incorporated in 1987 and is part of the 20 Microns Group. It is in the business of production of industrial micronized minerals (hence the name) + specialty chemicals + is India’s largest producer & supplier of ultrafine industrial minerals & specialty chemicals.

The business model is simple — the company sources raw materials from mines which are then converted into industrial use micronized minerals and specialty chemicals which have applications in various industries like paints, rubber, plastic, paper, construction and many more.

In essence, it is a commodity business.

Some interesting statistics:

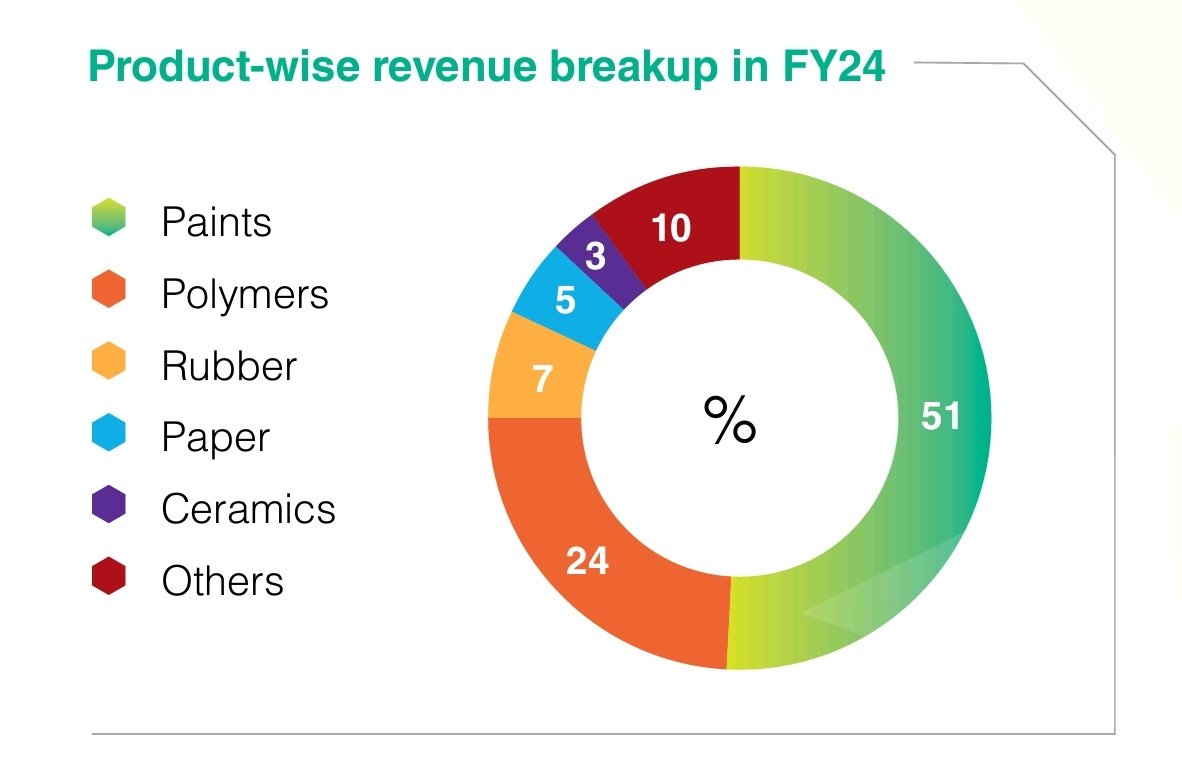

The company has two broad business segments — with 80% of revenue coming from Industrial Minerals and 20% of revenue coming from Functional Additives (Specialty chemicals).

From a product portfolio standpoint, 50% of revenue comes from Calcium Carbonate and 20% of revenue comes from Kaolin.

The company has also ventured into new segments like construction & agricultural chemicals, the revenue from which is pretty miniscule at the moment.

Business Segment I — Paints and Coatings

This segment contributes >50% of the topline. The company serves as a Level 1 supplier to major paint and coating manufacturing companies.

Various industrial minerals are supplied across various particle sizes (coarse > fine > ultrafine). Core minerals are — Calcium Carbonate (CC), Kaolin, Talc, Mica, Silica, Opacifiers etc.

A couple of new products were launched in this segment to strengthen market share in this segment.

Business Segment II — Polymers, Paper & Rubber

This segment contributes around 36% to the topline, with core minerals like CC, Talc, Silica, Dessicants, Mica, Wax & wax additives, Kaolins etc.

These minerals are used in polymers, cosmetics, rubber production & paper. Various innovative and value added products were introduced and the company expanded into new geographies + increased the base of OEM clients.

Business Segment III — Allied Division (Ceramics, Construction Chemicals, MINFERT)

The rest of the revenue is contributed by this segment which caters to Ceramics, Adhesives, Agrochemicals, Construction chemicals, Oil & gas, foundry and other verticals.

20 Microns has built long standing relationship with clients like Asian Paints, Nerolac, Pidilite, ITC, Berger, Finolex, Kajaria among others.

The Tailwinds

One of the things I really liked about 20 ML, is the amount of information that they’ve made available to their investors. It shows good intent from the management.

Another thing that I like — is that despite being a commodity business — 20 ML has been able to maintain Operating Profit Margins (OPM%) in the range of 11-15%.

However compared to peers, it is lagging far behind. But in all fairness, it’s peers are giants with massive operating leverage.

With that, let’s take a look at some of the tailwinds for the company.

Manufacturing facilities / Captive mines — in a commodity business, it is of prime importance to have easy access to raw materials. In the minerals production business, having state of the art facilities and captive mines is a BIG advantage.

20 ML has 9 manufacturing facilities + 8 captive mines (out of which 2 are leased) + 2 R&D testing centres.

It has a manufacturing capacity of > 4,50,000 metric tons per annum. Additional capex of INR 60 Cr (funded through internal accruals) is planned to expand capacity in existing locations & new locations and to acquire more mines.

50% of raw material requirement is met through captive mines and the balance 50% is sourced from outside. Acquisition of new mines should reduce external dependency and increase OPM%.

Expansion into newer geographies — 20 ML started supplying in new markets like Poland, Italy and Russia in FY24 and derives approx. 15% of revenue from the export market.

The management is focusing more towards the Middle East, South Asian & Latin American (LATAM) markets instead of US / Europe.

Emergence of new players in the paints industry presents a significant opportunity for the company given their established reputation in the paints biz.

China + 1 strategy — The company believes that it could benefit greatly from the shift in supply chains as the world looks to de-risk from their dependency on China.

For eg. there’s a huge amount of Titanium dioxide which comes from China where the company is pitching their replacement product to customers to grab some of the market share from China.

There are various other products in the company’s portfolio which it produces which are similar to those that are produced in China. There is a lot of room for export revenues to grow from here.

New Developments

20 ML added 10+ product offerings in FY24 and expanded into new territories.

Entered into a JV with Sievert (a German company) with expertise in construction chemicals and building related materials. This is a segment they want to build in the future.

Started supplying to Grasim (part of the Aditya Birla Group) — which is a recent entrant in the paints business. As Grasim grows, the order book for 20 ML should grow as well.

The company is working on development of new products:

In the EV segment — for EV battery and the semi-conductor industry. However this is under process, and the management doesn’t have a timeline by when this product will be developed.

Creating various offering in the construction chemicals + agrochemicals space (bio-stimulants, bio-pesticides & plant growth stimulators).

Points of Concern

Every business has risks, and it is extremely important as an investor to understand those risks before investing in any company. I see the following risk factors for 20 ML:

Commodity prices — raw material prices constitute more than 50% of revenue. Prices of key raw materials could fluctuate due to supply chain issues / geopolitical tensions which would directly impact 20 ML’s margins since it doesn’t source ALL of it’s raw materials from captive mines.

Regulations — since the company is in the business of mining raw materials & producing various industrial minerals & specialty chemicals — it is subject to various environmental regulations. Any regulation curbing their mining / production activity could have an adverse effect on the business.

Chinese products getting dumped into Asian markets — due to anti-dumping duties on Chinese products in the USA / Europe, it could get dumped in Asian markets. This would lead to Chinese players selling their products at lower prices, effecting other players like 20 ML.

Non-disclosure of market share — on the question of sharing the market share of 20 ML domestically, the management’s response was that the market is quite broad and that the company doesn’t compete in a very commoditized space. However, without market share — an investor doesn’t know how much room there is for the company to grow.

Plus, there’s no mention of the existing order book anywhere in the Annual Report / Company PPT.

Moderate Sales Growth — the management has guided for a 10-15% growth in topline for FY25 with EBITDA margins stabilizing in the same range between 12-13%.

The paints industry is witnessing a slowdown in growth which could adversely affect the company. Management believes this is a temporary phase and the volumes will be back in the foreseeable future.

Over the last 10 years, revenue has grown at a CAGR of 9% which isn’t spectacular. New product developments are going to take time to contribute in a significant way to the topline. With a moderate earnings growth, this is not a stock that will generate supernatural returns in the short term.

Conclusion

I think 20 ML is a well run company. I like the fact that they’ve disclosed a LOT of information for investors to understand what they do. It’s a stable business. Revenue is growing at a steady pace. Margins are in the range of 13-15% + expected to improve slightly over the years.

As an investor, it would make sense to keep a track of the following:

Growth in the paints industry — since it is the highest contributor to revenue. Any slowdown in this industry & the business takes a hit.

Traction on new products like construction chemicals + agro-chemicals (MINFERT).

Update on acquisition of new mines — since this gives the company more control over it’s raw materials and keeps price volatility in check.

How the China +1 strategy plays out. Export revenue is only 15% of topline and should increase if it can expand into newer territories.

This is not a company that will post triple digit sales growth and generate exponential profits. But, I get the feel that the management wants to grow this company organically. In a more sustainable way.

The stock has run up quite a bit in the last few months and it is not exactly cheap for a commodity business — trading at a P/E of 19 times.

It is worth a place in your watchlist though. I think there’s a lot of room for the company to grow from here over the next decade. It is a long term story & I don’t think you’d be able to make a lot of short term profits with this one.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Im also researching on the same one, allover great information, totally helpful 👍🏽