Why is the market discounting Arkade Developers?

and why I believe it could be a multi-bagger from current levels.

I generally do not like real estate businesses. They involve high capex + prudent capital allocation + stellar execution — not everyone’s cup of tea.

Making a real estate project successful requires a lot of things.

First, you need to buy land parcels in pristine locations — not an easy feat in metro cities. You need a skilled team that can design + build the structures, the layouts, facilities etc. You need regulatory & legal clearances. You need to keep politicians & local activists happy.

Projects can get delayed — a common phenomenon in India — which means your money is blocked. If your money is blocked in an un-constructed building, you’d not be able to sell it. You’d not be able to invest in other more lucrative projects. You’d not be able to repay loans on time.

Success of your business, depends on how quickly you’re able to rotate money that’s available with you.

It’s a possibility that you’ve taken an advance [pre-sales] from some of your customers, and the pressure is mounting on you to complete the project.

Worst case scenario, you are unable to complete the project. Your clients come after you and you find yourself neck-deep in legal cases. Your reputation goes for a toss. No one is selling land to you again, you’re out of business.

Obviously, this is an extreme scenario.

But, what I am trying to do is paint a picture for you — of what it takes to build a successful real estate company in India.

Enter Arkade Developers.

A real estate company established in 1986 — with a primary focus of delivering projects on time [within 3 years] in the Mumbai Metropolitan Region (MMR). Their track record is amazing, where in some cases they have delivered projects before time.

I have written extensively on this company, in case you’re interested to read more on their business model.

Original Post | Q3FY25 | Q4FY25 | Q2FY26

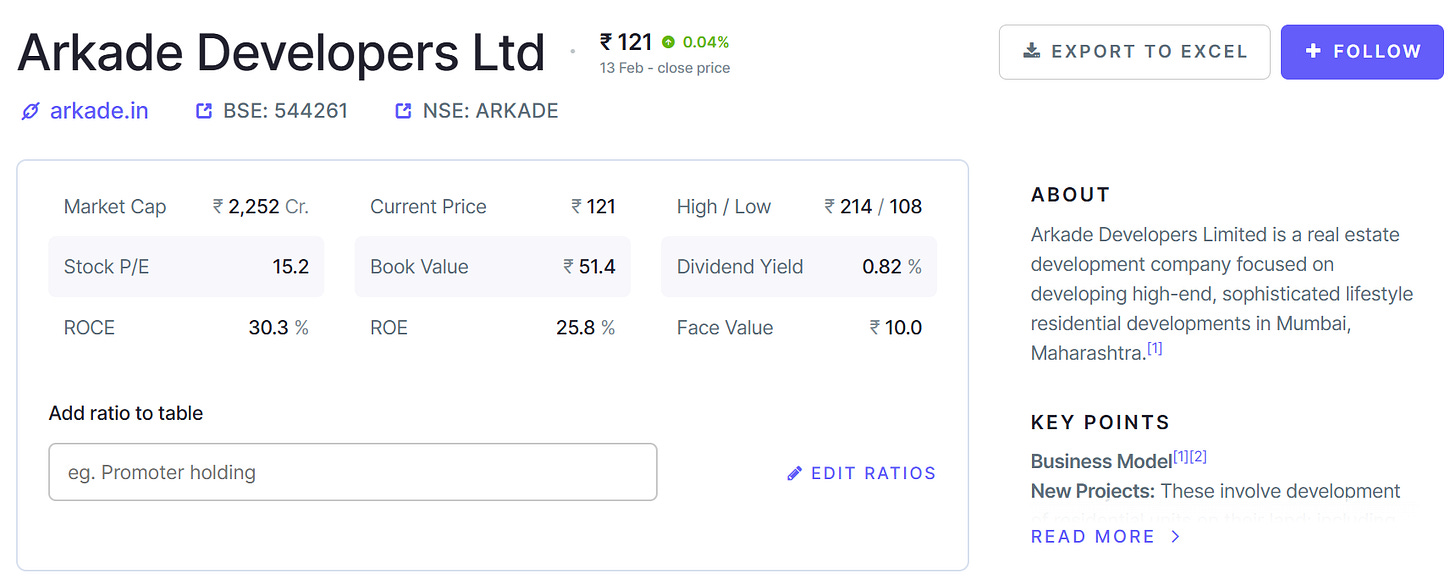

It has got minimal debt. Average 5 year ROCE of >35%. A mix of re-development & greenfield projects, which keeps it’s business asset light.

The company has still not fully utilized it’s IPO proceeds! One can say that the management is being conservative, but frugality is a lost art these days.

Why am I baffled?

You can see from the stock card above that Arkade is trading at a P/E of 15 times, with a market capitalization of INR 2,252 Cr. The stock is down 16% YoY, in a period of time where it’s order book has expanded.

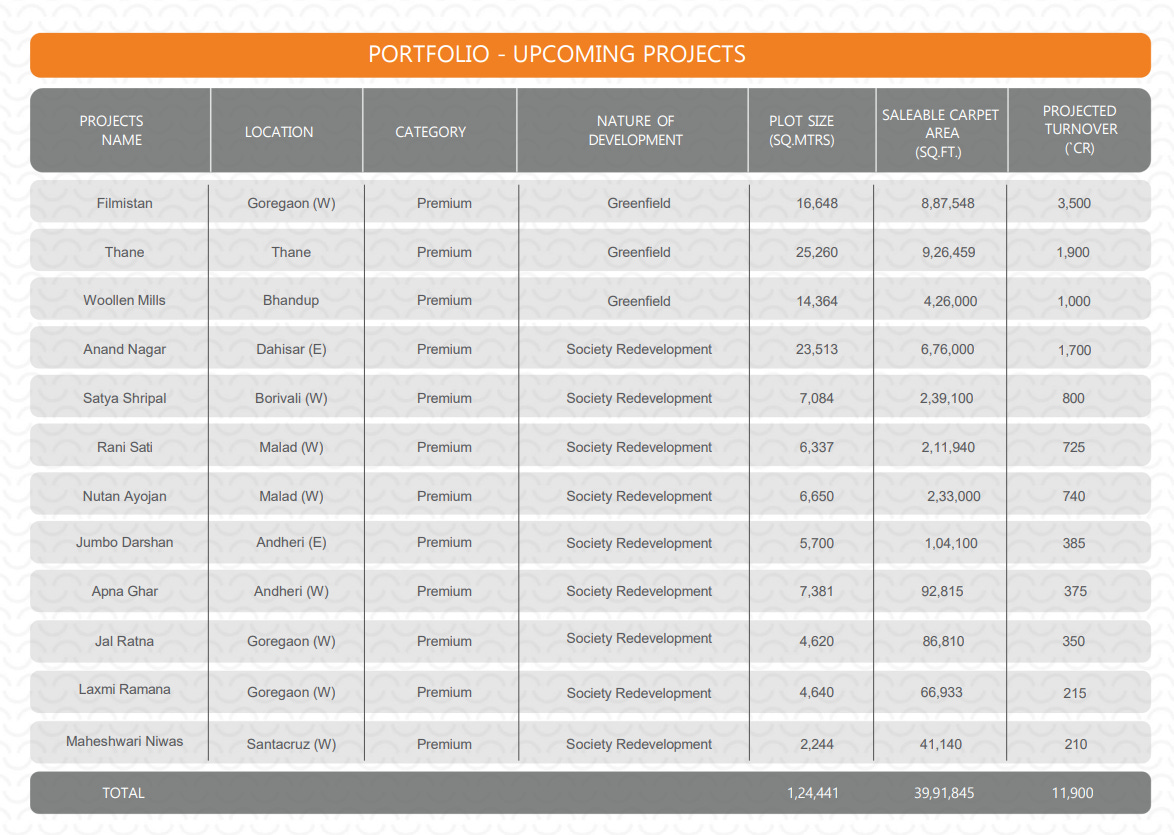

As at 31st December 2025, the company has a Gross Development Value (GDV) of INR 13,349 CRORE. GDV = Order book = Future revenues.

It has acquired key projects in Goregaon West (Filmistan), Thane & Bhandup and has multiple redevelopment projects lined up.

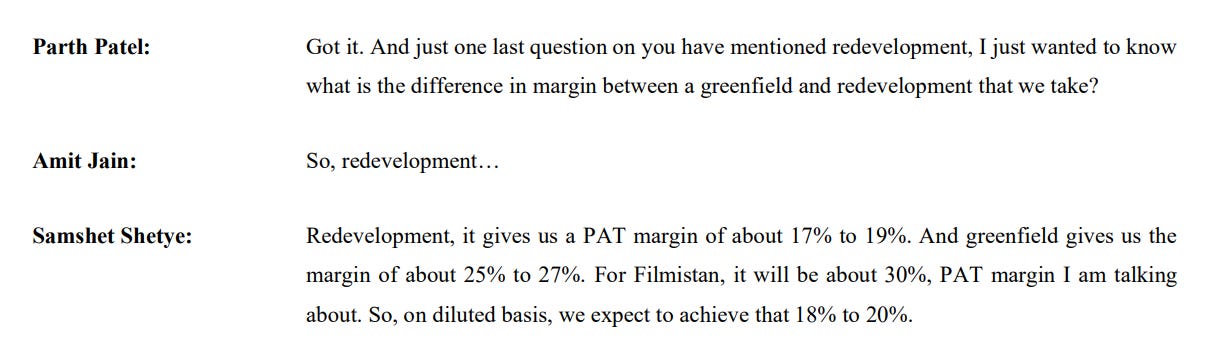

The management has guided that they’re estimating INR 10,000 Cr of cumulative revenues upto FY30. With a PAT margin of 20% (average), we’re looking at cumulative profits of INR 2,000 Cr upto FY30, which is equal to it’s current market capitalization.

With the Filmistan project alone, the company is projecting a PAT of INR 900-1,000 Cr.

Surely, this calls for a re-rating in valuations? The company’s peers are trading at P/E multiples of 30+, and the stock should at-least double from here?

The market has a different opinion. In trying to understand why the market is not assigning a premium to Arkade, I could conjure up a few things:

Execution jitters with Filmistan project? — the management at Arkade has started making bolder bets, with acquisition of land at Filmistan (Goregaon West). This will mark Arkade’s foray into the ultra-luxury segment with 3 / 4 / 5 BHK + Penthouses planned at Filmistan. The market is probably thinking that Arkade doesn’t have the appetite to execute projects at this scale. It could be right. We’d get more answers in FY27.

Corporate governance issues at Arkade? — maybe the markets think that there is some shady business going on within Arkade. It’s not an uncommon thing in the real estate business. I’ve been researching this company for more than a year now, and I haven’t found any major red flags yet. Promoter shareholding has increased QoQ. Plus, the company declared it’s maiden dividend this year — and the promoters relinquished their dividends to enhance shareholder value. Maybe, the markets know something that retail investors don’t?

Flying under the radar? — Or maybe, a very unlikely scenario — the markets are completely unaware of Arkade’s execution capabilities & future projects. Unlikely but possible, since very few DIIs / FIIs own this stock, which means they don’t have an agenda of pushing this stock into the stratosphere.

Either ways, I am very bullish on this stock. I believe that FY27 is the year we would find out whether the management has what it takes to become an ultra-luxury real estate player, in a hyper-competitive market like Mumbai. At the same time, can they maintain margins + keep an asset light biz + maintain minimal debt + continuously grow the GDV?

I believe current valuations protect investors from any significant downside, and the upside potential is HUGE. Make your moves while the opportunity exists ;)

Disclaimer: Arkade forms around 5% of my total portfolio. I’ve added more to my position during the recent correction.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

They do cash transactions. One major reason markets not participating