Q2FY26: Arkade Developers

trading at a P/E of 20 times, makes it a compelling investment opportunity.

Original Post | Q3FY25 | Q4FY25

One of the reasons I have been frequently covering updates on Arkade Developers — is because it showcases an anomaly not observed in the real estate sector — it delivers projects on time.

Which is kind of a big deal in a sector which is capital intensive and ridden with delays. And the metrics are there to back it up.

Arkade has one of the best return ratios and margins in the industry. It boasts a 5Y ROCE of 35% coupled with an operating margin ranging between 27-30%. This is a sign of fiscal prudence. Of good capital allocation.

Obviously, it is nowhere near the scale of DLF, Lodha, Prestige, Godrej or Oberoi — the big boys of Indian real estate. Maintaining margins and ROIs at scale is a challenge, and it would be interesting to see how the margin profile of Arkade changes as it scales from here.

The YTD stock performance has been muted, but at a market capitalization of INR 3,000 Cr with a P/E of 20 times — I think Arkade is a VERY compelling investment at this point. They’ve started making bold moves, venturing into bigger projects and into the ultra premium luxury market with an increasing Order Book.

Business Updates

The company’s stock price has corrected in the past few months — the reasoning is simple. Margins have taken a hit. Pre-sales & collections are flat. Revenue, however witnessed robust YoY growth of 30%.

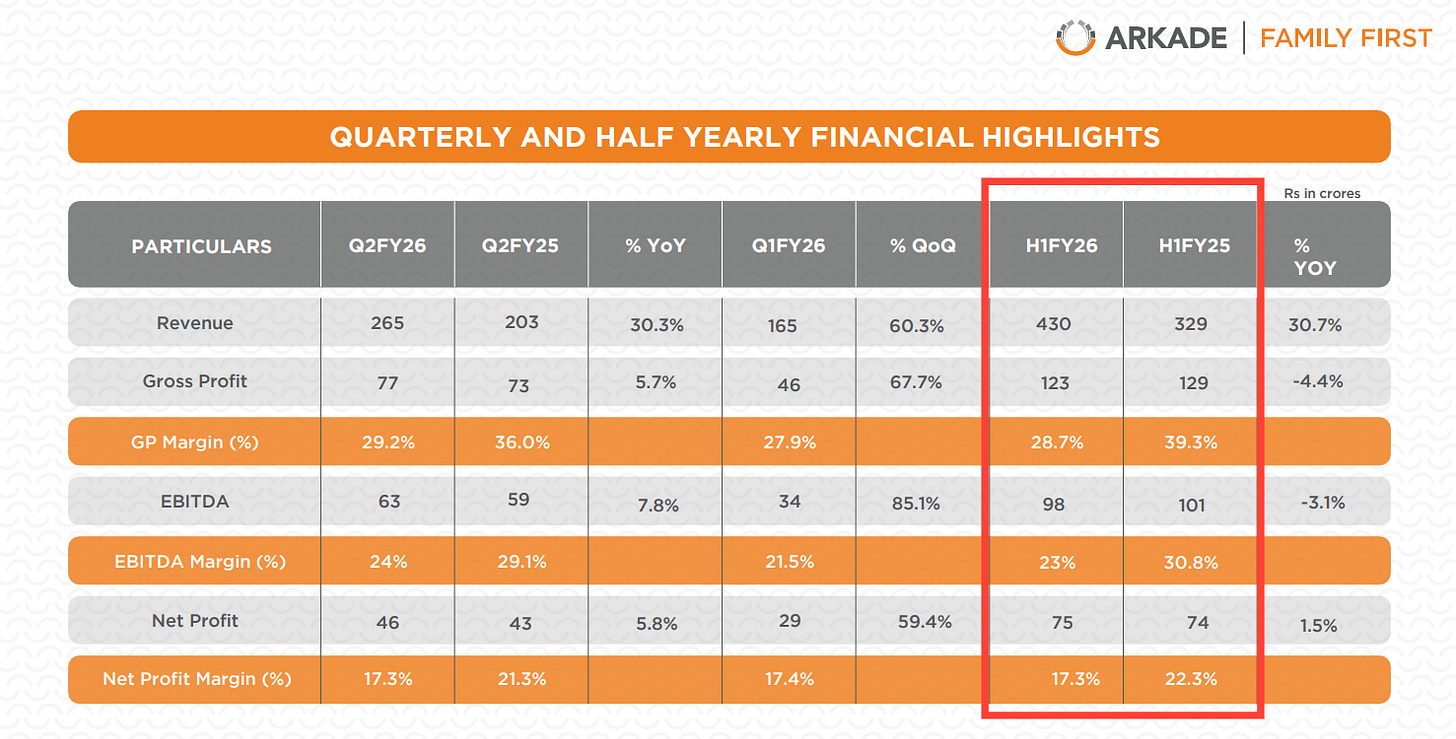

If you see the chart above, you’d notice that:

Gross Profit margins have reduced by 11% in H1FY26. EBITDA margins are down by 8% in the same period. Net profit margins are down 5%.

The reason for decline in margins is two-fold as explained by the management:

Increase in competition in the redevelopment market has caused acquisition costs to increase for real estate players, however there has been no increase in selling price per sq.ft, therefore squeezing margins. Its a case of increase in cost of acquisition of redevelopment projects.

The management mentioned that margins typically go down as real estate companies scale i.e. increase in volumes = decrease in margins.

Management however, maintains an EBITDA margin guidance of 30% for FY26 and expects margins in H2FY26 to be much better. Something that investors should closely watch out to see if Arkade can maintain margins as it scales.

Acquisitions & Projects

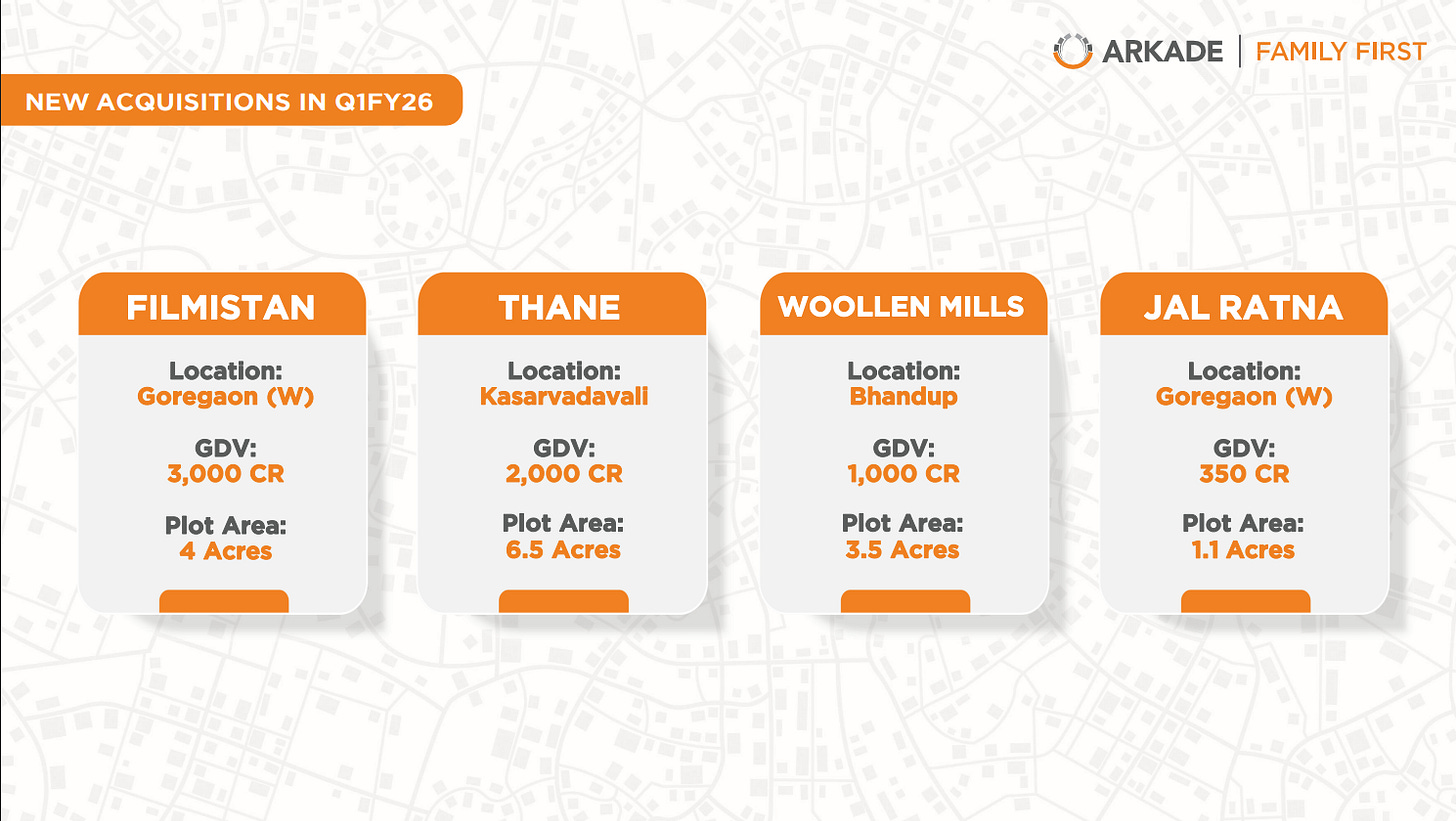

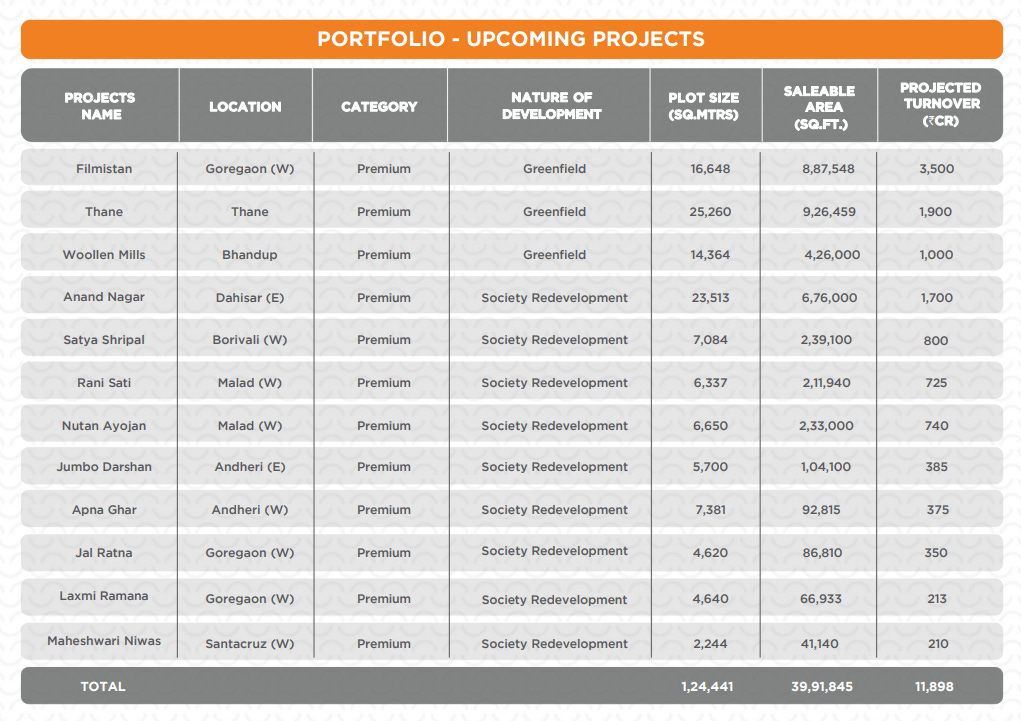

The management has started making bolder bets in Mumbai, with greenfield acquisitions in Goregaon (W), Thane, Bhandup. All these projects have a GDV of > 1,000 Cr.

The management is expecting significant revenues to kick in from FY27 — this is when revenues from Filmistan + Thane projects will start to flow. These two projects will take 5 years to be fully completed.

With the Filmistan acquisition — the company plans to foray into the Uber luxury segment offering 3 / 4 / 5 BHK residences and penthouses tailored for Mumbai’s growing HNI customer base. Mumbai, is really the city of extremes.

No new launches planned for this year — focus on completion of ongoing projects.

Order Book

As at 30th September 2025, Arkade has an Order Book of INR 13,500 Cr — an increase from INR 8,790 Cr in Q4FY26.

What’s interesting is that for the Filmistan project, the company had initially estimated a GDV of INR 2,000 Cr which is now increased to a GDV of INR 3,500 Cr — which is a 75% increase in value. I think the management is unsure of how much money they can make from this project and this is an evolving situation.

For the Dahisar redevelopment project — which is the company’s largest redevelopment project — timelines are not yet clear, due to certain restrictions and technical issues. Need to keep a close watch on this, to see if the GDV takes a hit due to delays in approval.

An interesting question asked during the Q1 concall was on what the company was doing to enable it to complete projects on time — was it faster construction?

The management replied that they use aluminium homework shuttering for the RCC work which reduces the slab cycle compared to conventional shuttering system.

The company mentioned that it has a stellar team which enables it to execute projects on time, with faster construction being one of the factors.

ChatGPT: Slab cycle is the time taken to complete the construction of one floor of a building. A conventional slab cycle might take 8 to 15 days or more, while aluminium form-work can often achieve a cycle of 4 to 7 days per floor.

Maiden Interim Dividend

Arkade declared it’s first ever interim dividend — and the promoter (Mr. Amit Jain) and whole-time directors (Mr. Sandeep Jain + Mr. Arpit Jain) are forgoing their dividends to enhance shareholder value.

This can be interpreted in two ways.

For me, I think this is a great gesture from the management — I don’t remember the last time promoters gave away their dividends. It shows ethics and putting minority shareholders’ first. Quite rare.

Another way to look at it is — does Arkade really need to pay dividends? The business is generating ROCE of >30% which is higher than what most investors can generate. Plus, this cash would yield more if it was re-invested in the company.

Conclusion

Despite a decrease in margins in the past 2Qs — revenues have been robust. Order book has significantly increased with high value greenfield acquisitions. Management believes FY27 will be a turning point for the company. They are definitely making bigger [and bolder] bets. The Filmistan project will mark it’s entry into the ultra luxury market. Lots of things to be excited about.

Disclosure — I have invested in Arkade sometime back and will increase my position if the stock further corrects from here.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]