Gautam Adani.

Asia’s richest man. The 4th richest man on the planet with a wealth of $125B1. In the last two years, stocks of companies in the Adani Group have been on a tear adding > $100 BILLION to Adani’s personal wealth.

If you’ve been a shareholder of any of the seven listed Adani companies, you can’t complain. Investors who bought at the right time (i.e. the beginning of the pandemic), are sitting on multi-bagger returns.

However, if you take a deep breath and look at the valuations that some of the companies in the Adani Group are currently trading at, you would be right to wonder:

Can Adani really sustain this massive increase in wealth & keep acquiring his way to growth in a rising rate environment?

We will get to that, but first…

How did Adani become so rich?

The story of Adani is the story of India.

1.4 BILLION people. BIG divide between the rich & the poor. An overburdened healthcare system. Lack of connectivity between urban & rural areas. Several incomplete infra projects. Lots of villages without electricity & internet access.

When Modi came into power in 2014, one of the themes of his campaign was to increase investments into India’s infrastructure.

India needs massive investments in energy, healthcare, telecom, internet & transportation (roads, national highways, railways, ports, airports etc.)

Adani understood that. Since 2014, he has been buying his way into several sectors. That’s when the political connections come handy. And lets just say that Adani has a powerful network.

Adani Group has made around 30 acquisitions since 2014 into sectors like Cement, Ports, Airports & Energy assets.

Adani Group:

Is the 2nd largest cement player in India.

Is the largest commercial port operator in India.

Owns a majority stake in Mumbai Airport & has won bids to operate Airports in 6 other cities for 50 years.

Owns the largest renewable energy portfolio in India & has committed to invest another $70B in clean energy.

Is gearing up for investments in data centers, power transmission, defense, telecom, real estate etc.

Adani wants to own every piece of infrastructure in the country & capture the growth story of India.

When you invest in Adani, you’re betting on the future of India. That’s the story that Gautam Adani is selling. And the markets bought into it, pushing the stock prices of companies in the Adani Group to the roof - in turn making Gautam Adani, the richest man in Asia.

Are the stock prices sustainable?

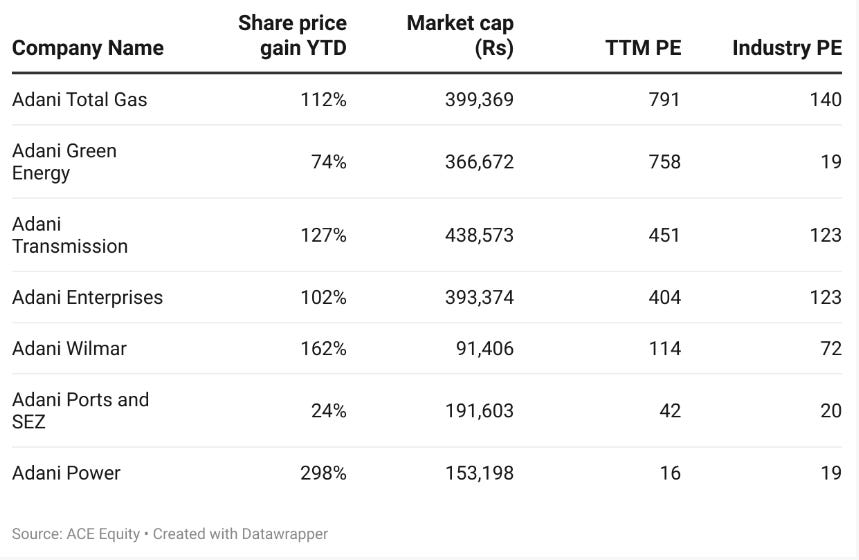

The price to equity ratio tells you a different story. If you’re a shareholder in Adani Group companies, it should scare you.

If you analyze the table below, you would notice that ONLY Adani Power is trading at a discount to its Industry PE. The rest, are flying into space.

Adani has got another problem. A huge chunk of debt.

To fund this spectacular acquisition spree, Adani Group has been raising money (mostly debt), so much so that as at 31 March 2022 it has > 2 TRILLION rupees in debt. Debt can act as a thorn to Adani’s growth in a rising interest rate environment OR in case we see a downturn in the economy.

Will the rest of 2022 be dominated by a further increase in Adani’s wealth? Or will the valuations stop making sense to the market?

I would love to see a massive correction & the return of valuations to a saner level, but Gautam Adani - as he has proved in the last 2 years - is not a man you want to bet against.

(Disclaimer: The author of this article is not an investment advisor or a certified wealth manager. The readers are advised to do their own research before deploying their capital into financial securities.)

As of 09 October 2022