One of the best ways to learn about a business is to track the quarterly earnings released by a company + read the earnings call transcripts where the management gives a brief summary about the health of the business and the future initiatives to grow the topline / bottom line of the company.

In this quarterly update, I will cover the Q4 results of Zomato and some of the key points to note.

ALSO READ: A detailed article on Zomato’s business model and an article covering Zomato’s Q3 results

Q4 Performance

Zomato had a decent quarter with all metrics on the rise.

In the earnings call, most questions were centered around Blinkit (Quick Commerce) which is where the investors see a LOT of growth coming from in the future. And this has helped pump up the stock price.

Let’s look at the segment wise results of Zomato.

A. Food Delivery

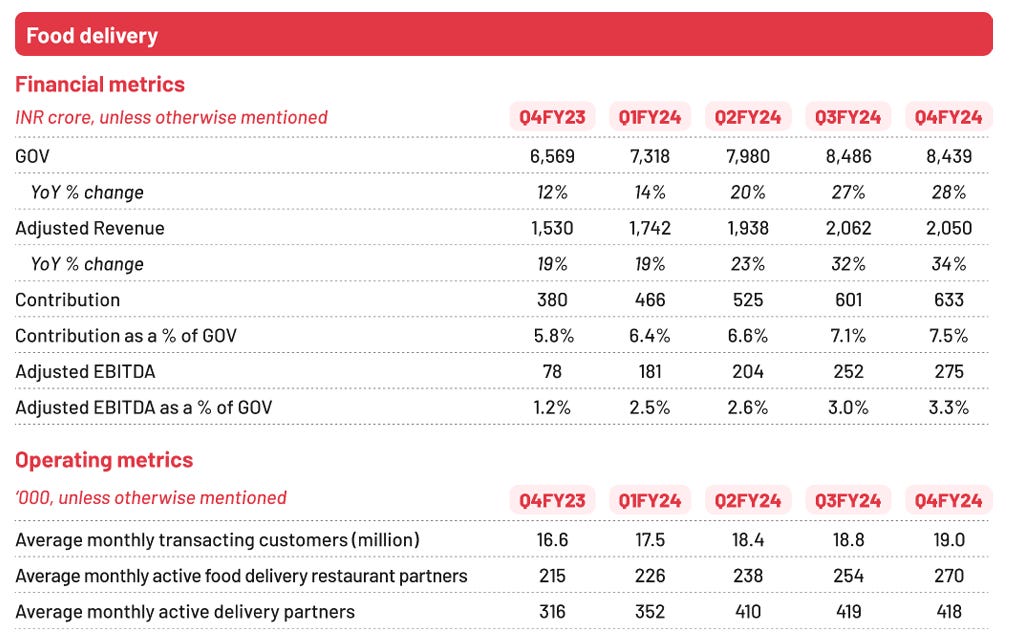

Food delivery is now a mature business with reasonable growth rates — not much was discussed about this segment in the earnings call. However, this is the most important segment contributing close to 60% of total revenue and is the ONLY segment which is profitable at the EBITDA level.

Key insights on the food delivery biz:

Revenue / EBITDA growth was flat QoQ (as you can see from the chart above). However, there was further expansion in margins — which is a key metric to look for.

Average MTC was slightly up, with Annual Transacting Customers (ATC) of around 66 million.

Zomato launched a new service called ‘large order fleet’ to handle substantial orders for gatherings, parties and events.

This fleet consists exclusively of electric vehicles.

Scaling up ‘Zomato Everyday’ — a service to provide fresh home cooked meals made by home chefs at affordable prices (to compete with Swiggy’s daily service). This service is live in Gurugram and at a few locations in Bengaluru, with more ramp up expected in the coming quarters.

B. Quick Commerce (Blinkit)

As per management’s report — the quick commerce segment turned Adjusted EBITDA positive in the month of March 2024. Not Q4. But specifically the month of March — which has been a cause of much celebration.

Key insights on the quick commerce biz:

As you can see from the chart above, all metrics were UP significantly. What concerns us most is EBITDA (not adjusted EBITDA) and Blinkit is slowly and gradually getting towards EBITDA positivity.

Store Count — as at 31 March 2024, Blinkit had 526 stores with a net addition of 75 stores in Q4.

The management’s strategy is to grow as fast as possible in this segment while maintaining EBITDA neutrality.

The plan is to reach 1000 stores by March 2025 — almost doubling the store count in the next 12 months. They expect to add 100+ stores in Q1FY25.

In terms of geographical mix, Blinkit has presence in 26 cities — Delhi NCR having the highest store count + highest GOV.

The management expects to 4X the GOV in non-NCR metro cities with a long term plan of having 400 / 500 dark stores in each metro.

Margins in the quick commerce biz has increased which is a function of increase in product margin, ad income & delivery charges.

Almost all orders have a delivery charge with an average delivery fee of INR 20 per order. Blinkit has been able to charge an elevated delivery fee despite competition providing discounted delivery.

Management believes they will NOT be required to reduce delivery fee — since the focus is to provide valuable services to customers. In the month of March’24, average delivery time was just 12.5 minutes! [which is INSANELY quick]

Ad revenue from Blinkit could rise further — but there was no clear guidance from the management on the quantum of increase in ad revenue.

Management expects Blinkit’s MTU (monthly transaction users) to be > Zomato’s MTU in the foreseeable future.

C. Others

HyperPure — the B2B supplies business — should witness normalization in growth rates due to a higher base effect. The strategy is to focus on growth & not primarily on profitability [at the moment] since they believe there is more room to scale in this business.

Going Out segment — witnessed a decline in Adjusted EBITDA in Q4. Would be interesting to see if this segment can meaningfully contribute to the bottom-line in the next few years.

Causes of concern

Some of the things that investors should keep in mind while evaluating Zomato as an investment opportunity are:

Zomato is probably losing money on the Gold program — there’s been no update on how the company plans to better monetize the Gold program + whether there would be any change in Gold pricing.

Cannibalization of Food Delivery — a rise in volumes of quick commerce means that lesser people would order food online. You can order groceries and make food at home. This could lead to cannibalizing some revenues in the Food delivery business.

ESOP Pool — the management has proposed to create an additional ESOP pool of 2% of outstanding share capital towards the Blinkit Leadership Team + Senior employees — which will lead to increase in ESOP costs in the future. And hence could reduce overall profits.

Concluding thoughts?

I think Deepinder Goyal & Team are very well equipped to scale this business. They have managed to make ‘food delivery as a service’ profitable. They acquired Blinkit (and faced a lot of backlash) and have managed to turn that business around.

HyperPure is getting built in silence. Going Out should start contributing meaningfully in a couple of years. They’ve got their hands full at the moment and they’re knee deep into execution territory.

Plus, they have INR 12,000+ CRORE in cash waiting to be deployed. So, that signals a strong balance sheet.

With no fault of Zomato’s management, the valuation of the company is such where it wouldn’t make a lot of sense to enter the stock. With a P/E of 450 times, I just don’t see a lot of UPSIDE — unless they can expand margins significantly, which looks highly unlikely at this point.

If you liked this article, you can support me by subscribing to this blog or sharing it in your network OR you could donate a small token to contribute to my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]