Olectra Greentech is in the business of manufacturing electric buses and trucks. It also has a small line of business coming from polymer insulators. But what has generated investor interest — is the potential in the e-bus segment in India.

India is going big on clean mobility. FAME II subsidies. PLI schemes. The Government of India has an aggressive target of converting 8 LAKH diesel buses into electric buses by the end of 2030.

If you do that math — that’s 6 years. 8 lakh buses. > 1 lakh e-buses required every year. Let’s say that Olectra can capture a 20% market share of the e-bus segment. That’s like 20K buses every year.

A single bus sells for somewhere between INR 1.2 crore to INR 2 crore. BOOM! That’s an annual business of >20,000 CRORE. For FY23, Olectra’s topline was around INR 1,100 crore. So — there’s a potential to grow the topline by 20X in the next few years.

Obviously, to sell 20K buses — Olectra will need to ramp up it’s production capacity. High CAPEX will be required. And it takes time to build manufacturing facilities.

But, the potential is there. And investors are willing to pay a premium for the company.

I went through the Q3 earnings call transcript and the investor PPT and below are the key takeaways.

Q3 Performance

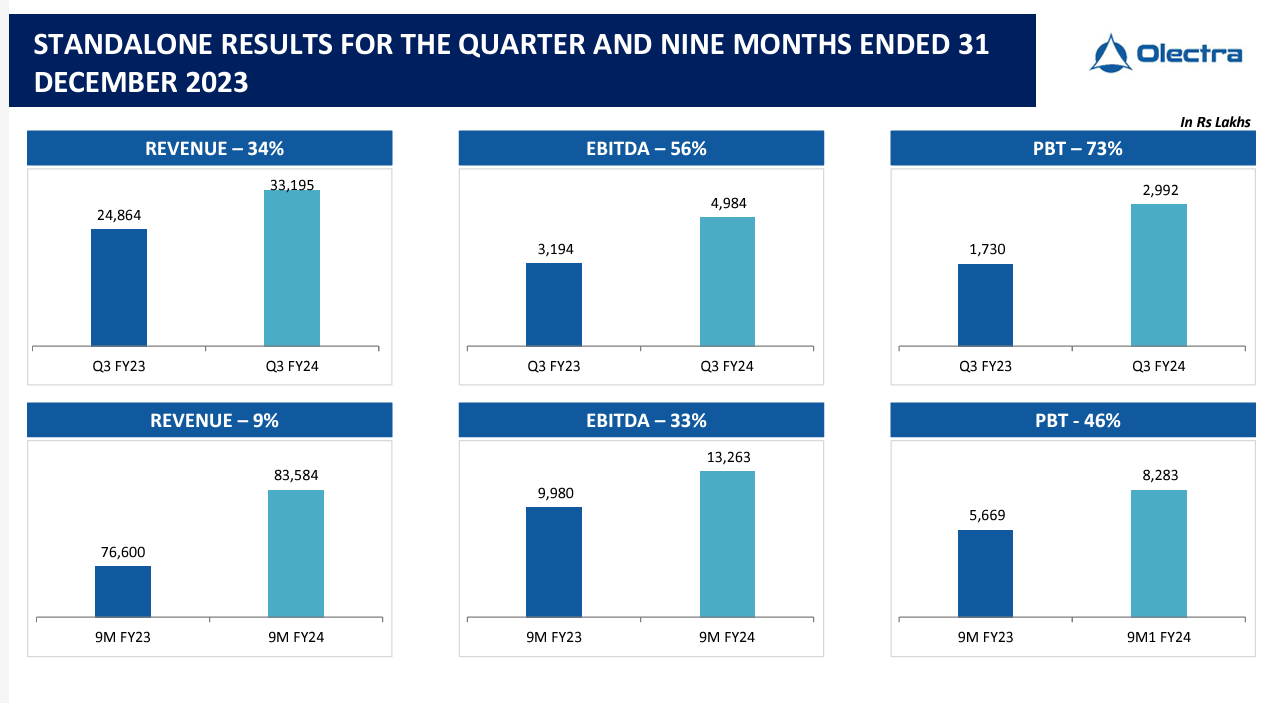

Q3 was a decent quarter for Olectra. All key metrics were UP. Revenue was up 34% YoY. EBITDA was up 56% YoY. However, investors should note that the revenue base of the company is still low so any increase looks quite impressive in percentage terms.

Key highlights

e-Bus deliveries — for 9MFY24, Olectra sold 376 e-buses (which includes 18 e-tippers).

From the graph above, it is evident that Olectra sold LESS BUSES in 9MFY24. However the increase in sales was because of sales of higher value e-buses + e-tippers.

Average selling price per bus is in the range of INR 1.2 - 2 crore depending on the size of the bus. 9 meter buses are lower in cost compared to 12 meter buses.

Average selling price for the e-tipper (a.k.a electric trucks) is around INR 1.3 crore. No subsidies are availed on this, with demand expected to come from private players. As per the management, this being a high margin product — could help in margin expansion for Olectra.

Olectra has only recently started selling electric trucks, and the company has sold ONLY 51 e-tippers till date since inception. All these e-tippers have been sold to MEIL (a group company) which is the second largest infra company in India.

Can Olectra capture the private market? Investors should keep a close watch to see if e-tipper sales is rising to private players. This could potentially result in higher margins.

Higher margins = Higher profits = Higher valuations = Higher returns.

Robust Order book — Olectra has a strong order book of > 8K electric buses as of date.

The company plans to deliver the MSRTC order [of 5,150 e-buses] over the next two FYs.

BEST order of 3,000 e-buses + PMC order of 300 e-buses are under the first level of negotiations. BEST has a total fleet of 4.5K buses that it wants to convert into e-buses.

A bus order of 2,100 e-buses which was in High Court has been ruled in favor of the Company. Out of this, more than 100 e-buses have already been delivered.

The company will submit a bid to win orders pertaining to PM Bus Sewa — a government initiative to promote clean mobility. The tender is not open yet. We should get more clarity on how much business Olectra can win in the next few quarters.

FreshBus has partnered with Olectra for their private e-bus segment. Olectra is expecting more order inflow from private players in the near future.

Manufacturing Ramp up — construction work of the new state of the art plant at Sitarampur is in full swing. Pilot production from the facility has started from the 2nd of February — with capacity expansion expected to happen in phases.

The plant is expected to operate at full capacity [i.e. 5,000 e-buses per annum] from June / July 2024 and the capacity is fungible between e-buses and tippers.

Funding for this new facility will be from internal accruals (INR 250 crore) + debt (INR 500 crore). INR 100 crore is already spent on the facility from internal accruals.

Original facility (with capacity of 1,500 e-buses per annum] will be shut down and everything will be moved to this new facility gradually.

Others

Olectra sources battery cells / technology from BYD and assembles it into battery packs in India. The GoI has announced various PLI schemes to incentivize production of battery cells in India — which would take around 3 to 4 years to ramp up. Olectra believes that it will continue to have a strong partnership with BYD in the foreseeable future.

Olectra also has a service income business where it does annual maintenance of e-buses. AMC of e-buses is required for around 12 to 14 years. With more e-buses on road, this should lead to higher recurring revenue.

How big of an impact this would make to the overall topline? Management didn’t speak about that in the earnings call.

Few points of concern

One of the biggest things to look for in an earnings call — is management estimate misses. This happens when the management (at the start of the year) commits something, but is unable to achieve it. This tells you how strong is the estimation prowess of the management and how much you should discount future projections.

In the case of Olectra — the management had estimated to sell between 1,000 to 1,200 e-buses in FY24, but upto now has sold only 376 e-buses and expected to sell 650 - 750 e-buses for the full year.

This means that they would sell close to 300 - 350 e-buses in Q4. Looks unlikely if you ask me. And this is a BIG miss.

The management has guided that the Company would sell 2,500 e-buses in FY25 — however looking at how FY24 has turned out, I would say investors should take this # with a pinch of salt.

The management has been saying for quite some time now that they would attract private interest in e-tippers — which is a high margins product. Till date, it has sold these e-tippers only to the Group Company (MEIL). If the company is unable to generate private interest in the next few Qs, something is probably wrong with the product.

GoI is looking to convert 8,00,000 diesel buses into e-buses across India in the next 5-6 years. Olectra has a current capacity of 1,500 buses p.a. New greenfield project should add a capacity of 5K p.a. scalable to 10K p.a. However, if Olectra needs to be a top 5 player, it needs to have atleast 40K p.a. capacity which will require major CAPEX.

Olectra operates at a cost plus model — which means that decrease in battery prices are passed on to the end customer. With this model, expanding gross margins would be extremely difficult — which means the only way to make more profits is to SELL MORE e-buses.

Conclusion

There’s a lot of potential to grow in the e-bus segment with major Government push towards clean mobility. What will define Olectra, is it’s ability to move fast and capture market share.

Competition is ramping up in this space from players like Tata Motors, Switch Mobility etc. Tata Motors already has experience in commercial vehicles.

Questions for Olectra’s investors to think about

Can it build capacity fast enough? Can it execute it’s order book fast enough? Can it win more orders for the e-tipper? Can it build a hydrogen powered bus in partnership with Reliance?

The company is valued at INR 14,600 crore (as at 23 March 2024) trading at a P/E of 160 times — very expensive if you look at the P/E ratio.

But, and this is a BIG BUT — if Olectra can capture even a 20% market share of the Indian e-bus market, there is a potential to grow it’s revenues by 20X and in that case looking at the P/E ratio will not be of much help.

So, we will track this stock closely over the next few quarters to see if Olectra will be able to realize it’s full potential.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Nice post. Do you have study on who is winning in e-bus tenders ? and Any statement from Olectra why they could archive planed 1000 bus sale in FY23?