A lot of people travel by trains in India. It is one of the most cost effective ways to travel over long distances. With the penetration of internet, a LOT of people prefer booking tickets online instead of going to a train station and buying tickets from the physical counter.

If you want to buy tickets online, you have only one option — visit irctc.co.in — which is the ONLY entity authorized by Indian Railways to offer online tickets. If you’re buying through an agent — that agent is buying tickets online through IRCTC. There’s no other way.

IRCTC is owned by the Government of India and it operates a monopoly business which has been granted to it by the Government.

ALSO READ: A detailed article on the business model of IRCTC - here

As you can see from the chart above, the stock of IRCTC has run up in the last 1Y delivering returns of >50% — significantly beating the NIFTY benchmark.

Have the earnings caught up to the stock price? Let’s find out.

Q4 Performance

It was decent performance in terms of topline, with Q4 revenue of INR 1,155 CRORE (19.7% YoY growth) and FY24 revenue of INR 4,270 CRORE (20% YoY growth).

However, EBITDA margins declined YoY due to increase in contribution from the catering segment, which is a relatively low margins business.

Let’s look at the segment wise performance.

I. Internet Ticketing

Revenue of INR 342.4 crore + EBIT margins of 80.3% for Q4.

Out of this, INR 224 crore pertains to convenience fee and the balance INR 118 crore pertains to non-convenience fees.

There was a decline in margins from 83% (in Q3FY24) to 80.3% in Q4FY24 due to increase in transactions via UPI where the convenience fees charged is 33% less. 39% of all tickets were booked through UPI in Q4.

Management expects EBIT margins to be in the range of 80-83% going forward, with margin expansion coming from non-convenience fee related avenues (marketing & ad income, payments income, loyalty programs etc.)

Average daily tickets of 12.91 lakh / day were booked — taking the total tickets booked for Q4 to 11.74 CRORE.

II. Catering business

Revenue for the quarter was INR 530.8 crore with EBIT margin of 8.7%. EBIT margins were in the range of 15-17% in the past few quarters which has come down to 8.7% in Q4 due to:

Additional allocation of administrative costs to catering biz of INR 11 CRORE.

5% GST on mobile catering services — however this is a pass through cost, I’m not sure how this impacts profitability.

Depreciated cost of 9 departmental kitchens (which will be discontinued) of INR 2 CRORE.

However, the math doesn’t add up. There must be some other reasons as well to contribute to the decrease in EBIT margins as an INR 13 CRORE decline doesn’t justify such a steep drop in margins.

Key developments: IRCTC entered into an MoU with Central Armed Police Forces for the catering business. 1400 ABSS (Amrit Bharat) stations are being upgraded — where additional food plazas can be built.

Currently operating 1,265 mobile catering units — 120 prepaid trains, 443 express trains, 702 TSV (train side vending).

Prepaid trains have better margin than other trains since the catering fees is charged at the time of ticket booking itself.

EBIT margins for catering biz to hover around 15% for FY25 as per management estimates.

Partnership with Zomato / Swiggy is progressing well. Crossed the milestone of 1lakh+ bookings per day, with a value of 1.5 crore / day. Flat margins of 15% on order value being charged by IRCTC. Currently this service is extended to 407 stations.

III. Others

Tourism — reported revenues of INR 201.7 Cr for Q4 with EBIT margins of 5.9%. Decrease in margins due to one time haulage charges levied on Tejas Express (which was levied retrospectively).

Sustainable levels of margins in this segment are around 8-9% as per management estimates.

Rail Neer — reported revenues of INR 83 Cr for Q4 with EBIT margins of 12.8%. Current capacity of 12 LAKH bottles per day.

Causes of Concern

Limited growth — IRCTC has a >80% penetration in online ticketing, so there’s not much room to grow. In the medium term, addition of around 475 Vande Bharat trains could add more inventory for internet ticketing, catering & Rail Neer. Increase in UPI usage might reduce internet ticketing margins further.

Regulated environment — IRCTC cannot increase the convenience fee when it wishes to, this is regulated by the Ministry. It has to share 40% of all catering profits + 15% of all Rail Neer profits with the Indian Railways. So, even though IRCTC operates a monopoly, it doesn’t have a lot of pricing power.

Management looks a little rusty — This is just an observation while reading the earnings call for the past few quarters — the management in some instances has not been able to give answers with complete clarity to the investors. I just get the feeling that they’re not very agile in execution.

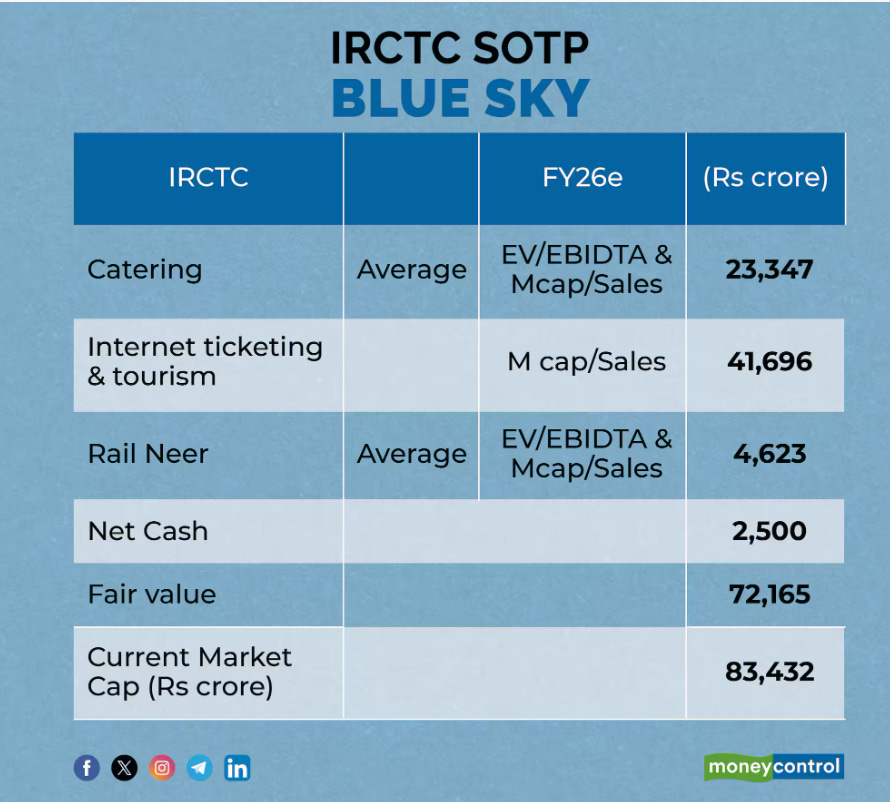

Conclusion — IRCTC is a long term play on the growth in Indian Railways, but earnings expansion looks slow and is dependent on addition of new trains. At a P/E of 70 times, the stock looks quite expensive at this moment in time.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR could contribute to my work by donating a small token!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

I am holding IRCTC since its listing(small quantity though)

Useful information on IRCTC. Keep up good work.