I love journeys that involve train travel. It’s such a unique experience, especially if you choose not to sit in your allotted seat but stand near the exit door for the majority of the journey.

Soaking in the nature’s beauty. Wind blowing against your face. Watching the train tracks twist & turn and merge into each other. You can feel the energy, the constant thump of the train. Tea vendors going past you, asking if you want to buy something. All the while, you’re listening to your favorite music — forgetting about all the problems in your life.

Apart from the experience, train travel is one of the most efficient ways to travel in India. 5.8 BILLION passengers in FY23. Significantly cheaper than air travel, which is why a lot of cargo moves through trains to save on logistics cost.

India has one of the most sophisticated rail networks in the world, and is the largest rail network in Asia. This opens up a LOT of business opportunities around railways and ancillary services — with IRCTC being one of the biggest beneficiaries.

Disclaimer — I own some shares of IRCTC, so I had extra incentive to cover this stock. The stock price has been range bound for a year, witnessing several lows and highs. However, the stock popped up by 7-8% last week!

The company reported a net profit of INR 2.9 BILLION in Q2FY24 which was the highest ever net profit reported by the company in the entirety of its existence.

IRCTC has a market capitalization of INR 69,000 CRORE and I wanted to find out if the company had the potential to be a long term bet at the current price point.

So — the deep dive began!

The Business

IRCTC has built its business around railways. What’s interesting, is that it is a monopoly business.

It is the only entity authorized by Indian Railways to offer online tickets and manage catering services on trains / railway stations. It is also the only entity authorized by the Ministry of Railways to manufacture and distribute packaged drinking water under the brand ‘Rail Neer’.It is owned by the Government of India and was awarded the status of a Miniratna in 2008. With that, let’s take a deeper look at each business segment.

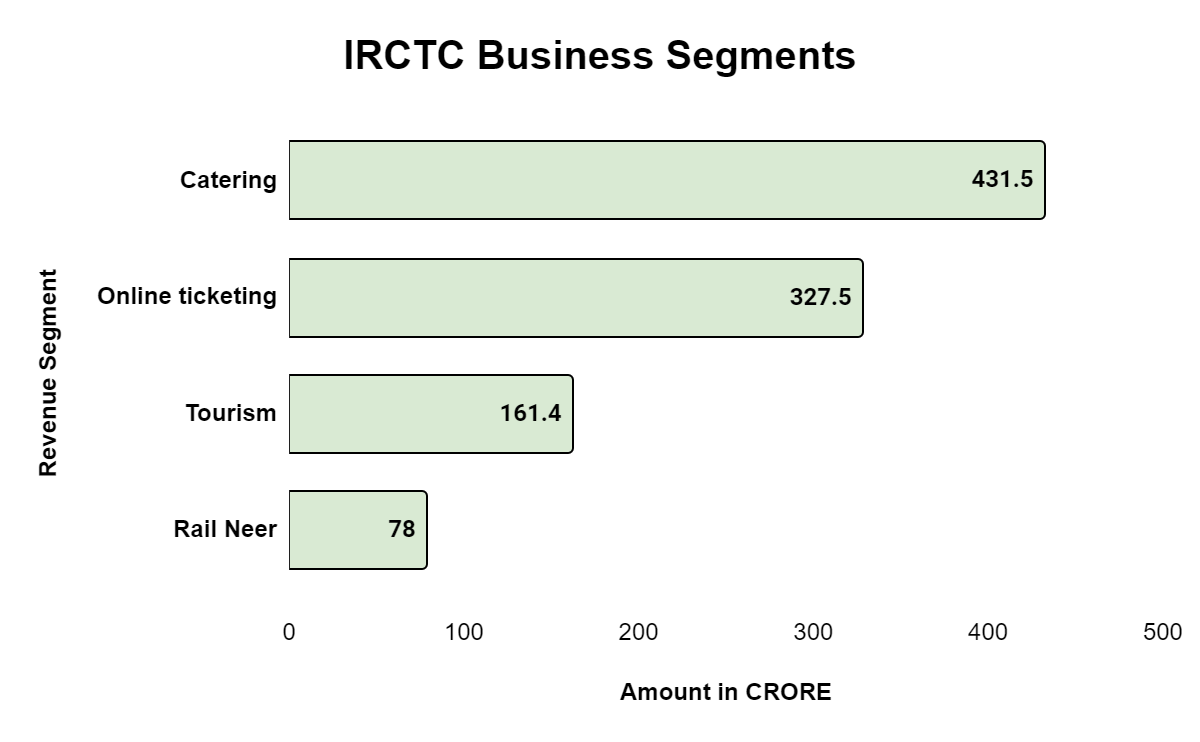

I. Online ticketing services [33% of total revenues]

Let’s say you want to travel from Mumbai to Jaipur through a train. You have two options. Either you can go to a nearest railway station and book a ticket. Or you can visit IRCTC’s website and book a ticket online. For this, IRCTC charges a ‘convenience fees’.

This is the bread and butter of IRCTC’s business. Key statistics of this segment:

This segment enjoys EBITDA margins of >80%. Once the website / mobile application infrastructure is set up, there is no incremental cost per passenger ticket booked.

Revenues from this segment is directly linked to number of passengers booking tickets through the website / app. Passengers can book tickets 120 days in advance. Currently 80% of all train tickets are sold online and the balance 20% are sold through physical train counters at stations.

Apart from convenience fees, IRCTC also makes money through:

Agents — For e.g. you can also book a train ticket through PayTM which integrates IRCTC’s API into it’s app. For this, IRCTC charges these 3rd party apps some $$.

Payments gateway business — transaction fees is levied by IRCTC to facilitate online payments. IRCTC has also set up it’s own payments platform called ‘iPay’ which will reduce the need of 3rd party payments platforms going forward.

Loyalty programs — it has partnered with several banks to issue co-branded credit cards for frequent travelers.

Marketing + Advertisement — it also earns by selling advertisement space on the website / app.

II. Catering Services [43% of revenues]

The Company is the only authorized entity by the Ministry of Railways to provide catering services across Indian Railways on a revenue sharing model.

Key point to note — 40% of all profits generated from the catering segment is to be shared with Indian Railways. However, in case of departmentally managed units, 15% of profits generated are to be shared with Indian Railways.

There are 3 groups within this segment:

Static Catering — which refers to catering offered at railway stations through Food plazas, Cell kitchens, Jan Ahars etc. As at 31 March 2023, IRCTC was managing 565 static catering units.

Mobile Catering — which refers to catering offered through pantry cars which are built into the trains. The Company also offers catering through a concept called 'train side vending’ where-in base kitchens are built at major locations and vendors on-board the train collect meals from the base kitchens to serve the passengers. This enables meals to be provided to passengers even if a train doesn’t have a pantry car. As at 31 March 2023, IRCTC was managing 1,187 mobile catering units.

e-Catering — this is a relatively new concept introduced by the Company wherein passengers can order food from partner restaurants. The partner restaurants in-turn deliver food at railway stations which can be collected by passengers. Currently, e-Catering is available at 338 railway stations. IRCTC charges a 15% commission on the order value from these restaurant partners.

III. Travel & Tourism [16% of total revenues]

Offers various domestic & international tour packages, hotel bookings, air ticketing etc. Operates special tourist trains like Buddhist Circuit, Bharat Darshan and luxury trains like Maharaja Express and Golden Chariot. Margins from this segments are in the low single digits due to stiff competition from private players like MMT, Easy Trip etc.

IV. Packaged Water [8% of total revenues]

The Company operates 17 state of the art — fully automated — manufacturing facilities to produce packaged drinking water under the brand ‘Rail Neer’. This is again a monopoly business since no other company is authorized to sell water in trains / railway stations apart from IRCTC.

Key point to note — 15% of all profits generated by Rail Neer are to be shared with Indian Railways.

It added a new plant in Kota in Q2 and plans to add two new plants in Q3FY24.

Now that we have some understanding of the revenue levers of the Company, let’s take a look at the PROS & CONS associated with the business.

The Positives

A Government Monopoly: Most businesses strive to become monopolies in their respective fields. They have to constantly innovate, stay ahead of their competition to survive and thrive. With IRCTC, the mechanics are quite simple. The Ministry of Railways didn’t want any private players in online ticketing, catering & packaged drinking water. And hence, IRCTC was born.

Without any competition in online ticketing for instance — IRCTC doesn’t have to reduce it’s convenience fees [unless the Government directs it to do so]

Proxy for growth in railway passengers: The number of people travelling via trains is expected to increase especially with how expensive air travel is at the moment.

Increase in railway passengers would directly lead to > more tickets booked online > more convenience fees charged > more catering revenues > more packaged water sold.

The Government of India has allocated a capex of INR 1.37 TRILLION in the Union Budget 2023 to be spent on building railway tracks, wagons, trains, electrification & developing facilities at stations. While this will directly benefit players like Titagarh Wagons, Texmaco Rail — IRCTC is poised to benefit in the long run, since more trains would lead to more ticket inventory available for IRCTC to sell online.

Recently added 11 pairs of Vande Bharat trains and 18 static catering units which helped drive it’s catering margins upwards. Vande Bharat is a premium train with higher catering income as explained by the Company’s MD in the recent earnings call.

Non-railway ambitions: The Company recently announced its plans to become a premier brand in hospitality + catering in India.

IRCTC is looking to broaden its catering operations across India and is in discussion with various government organizations / industrial houses to set up catering units.

The Company has signed MoUs with establishments like the Border Security Force [BSF], Indian Maritime University (Kolkata), Cotton University (Guwahati) and is actively commissioning 15 more catering units across the country.

New initiatives: The Company has taken several initiatives to diversify it’s income streams away from the core ticketing business.

Pilot Program with Zomato / Devyani International for e-Catering — to expand it’s e-Catering offerings, the Company has tied up with Zomato + Devyani International (which operates brands like KFC, Pizza Hut, Costa Coffee). This pilot program with Zomato is launched for 5 stations for 6 months, where the fee per order for IRCTC is expected to be INR 40/order.

Online Helicopter bookings — the Company has signed an MoU with UCADA for development of online ticket booking system to book Helicopter services from 3 locations (Sirsi, Phata, Guptkashi) to Shri Kedarnath and back. This was launched in April 2023. This could be expanded to other routes.

Fare details for Helicopter trip to Kedarnath. Monetization of Chatbots — If you login into IRCTC’s website, you’re greeted by it’s Chatbot for enquiries. Having gained experience in this, the Company will extend AI based Chatbot services to other government and private organizations.

Setting up its own payments platform — IRCTC is probably one of the most transacted websites in the world, which means a lot of payments’ volumes flow through the website / app. The Company has launched iPay which is IRCTC’s own payments platform and the Company has plans to become a payments aggregator for which it is seeking authorization of the RBI.

Bill Payments / e-Marketplace — in partnership with third party service providers, IRCTC wants to provide various services like bill payments, e-Marketplace, mobile recharge, online insurance on its website / app.

Financial Performance: The Company had a sensational Q2FY24 reporting revenues of INR 9.9 BILLION [23% YoY growth] and profit after tax of INR 2.9 BILLION [30.4% YoY growth].

Points of Concern

Government created monopolies can collapse if the government wants to privatize the sector. We have examples like MTNL, BSNL, VSNL which were profitable companies and as soon as their respective sectors were opened up to private players — these companies couldn’t compete.

Developments to privatize this sector were underway in July 2020 with a broad target offering 500 trains to private operators over the next 5 years.

Out of this, Indian railways opened a tender process for running 151 private trains along 109 routes with an estimated investment of INR 30,000 crore. Private entities would be responsible for financing, procuring, operating and maintaining the trains.

However, only two bidders (IRCTC & Megha Engineering) showed interest in the financial bidding stage with IRCTC touted to win the contract after quoting a higher revenue share to Indian Railways. Since IRCTC is a government owned company, questions were raised on the entire exercise to get private players to run trains and the Ministry of Railways decided to put this tender on hold.

However, this doesn’t mean that IRCTC is out of the woods. Similar tenders could open up in the future, with a more incentivized push to make this sector private — which could significantly impact IRCTC’s business.

75-80% of profits is contributed by the internet ticketing segment, since it enjoys exceptionally high margins. However, the following possibilities could adversely impact margins / revenues from this segment:

Scenario 1: Post demonetization — the government had issued a directive to IRCTC to remove service charges which were re-introduced before IRCTC’s IPO to assist in propping up its valuation. The Government could issue such directive again in the future, to remove convenience fees on online tickets.

Scenario 2: the Government could issue a directive to reduce the value of convenience fees charged on each ticket.

Scenario 3: the Government could come out and open up the internet ticketing space to private players which would bite into IRCTC’s market share. Currently, all online ticketing has to be routed through IRCTC.

Scenario 4: the Government could ask IRCTC to share some % of convenience fees with Indian Railways.

And we all know what happened when the Government made the decision to share 50% of convenience fees earned by IRCTC back in October 2021 — the stock tanked by 25% IN A SINGLE DAY. Seeing this, the Government rolled back it’s decision — but, it could happen again!

Underutilization of packaged water manufacturing plants — currently IRCTC operates 17 manufacturing plants for producing packaged bottles of water under the brand name ‘Rail Neer’. However, these facilities are operating at 73% capacity which means that demand < supply.

Which raises the question — why are two more facilities being set up? Why can the existing facilities not operate at 90-95% capacity and the excess inventory be sold later? Also, should there be a monopoly on water production for railways?

In the past, certain audit observations were raised against the Company which are not something you want to see as an investor. Below are few examples of observations raised:

Non declaration of quarterly numbers due to process of quarterly closing not being followed.

Non-deferment of integration charges — basically recognizing revenue in advance.

Proper reconciliations not carried out for receivables, payables, advances. Absence of transaction by transaction reconciliation of bank accounts.

As at 31 March 2023, the Company has a Contingent Liability of INR 234 crore. Certain litigations are ongoing against the company, and any adverse ruling could impact the Company’s profitability.

Conclusion

As of today [25 December 2023] — IRCTC is trading at a P/E of 65 times at a market capitalization of approx. INR 69,000 CRORE. At this price point, I don’t see a lot of upside and the stock looks quite expensive at the current valuation.

My thoughts?

IRCTC is a monopoly business created by the Government. Exclusive authorization to provide online ticketing services, catering services in trains / railway stations and selling packaged water.

Online ticketing — although contributing 33% of total revenues, is still the money making machine for IRCTC. Enjoys margins of >80%. Around 80% of all train tickets are booked online, which means there is not a MASSIVE room left for this segment to grow. Growth will come in the form of more trains added by Indian Railways prompting more people to travel via trains.

The management probably understands this, which is why they want to pursue catering + hospitality and de-risk themselves from railways. The company wants to become a catering giant and is actively commissioning catering units across India.

As the sales mix changes, with more revenue contributed by catering & tourism segments, it will not be easy to rapidly grow net profits.

Would be interesting to see how new initiatives like the pilot with Zomato, online helicopter bookings, setting up it’s own payments platform (iPay) will contribute to revenues and profits going forward.

The Company is debt free. Operating margins and net profit margins are robust. Return ratios look good.

The biggest risk however — remains government regulation. Any moment the Government feels that they want to open up catering / online ticketing / sales of packaged water to the private sector — IRCTC would be in an uncomfortable position.

However, until that happens — IRCTC is in the front seat to benefit from the capex plans of the Government for development of railway infrastructure and is a proxy for railway passenger growth in India.

And for that reason, it deserves a place in your watchlist. Any major correction, would make the stock attractive for short to medium term investment.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR could contribute to my work by donating a small token!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]