Original Post | Q1FY25 Update | Q4FY24 Update | Q3FY24 Update

I’ve written several articles covering the business model + quarterly results of Olectra Greentech — a major player in the electric bus market in India. It also sells insulators, however investors aren’t interested in that business.

The reason is simple, the future of transport is electric and the GoI is making a big push towards electrification of public transport with a plan to convert 8 LAKH diesel buses to e-buses by 2030.

The average sale value of an electric bus in India is approx. 1 Cr. So, using simple math, we can find out that this is a 8 LAKH CRORE opportunity for incumbents in this space (Olectra Greentech, Tata Motors, Volvo, Eicher Motors, JBM Auto, PMI Electro Mobility among others).

And we want to find the answer to a simple question — who will be the winners?

The Union Cabinet recently approved the PM e-Bus Sewa scheme with a total outlay of INR 3,400+ Cr aimed at supporting procurement of e-buses by STUs. More than 38,000 e-buses are expected to deployed in the next 5 years under the scheme.

The Union Cabinet also approved the PM E-Drive scheme [which succeeds the FAME program] with total allocation of INR 10,900 Cr over 2 years. The scheme is designed to promote adoption of e-2Ws, e-3Ws, e-ambulances, e-trucks & e-buses. Electric cars + hybrids are NOT covered under this scheme. Out of the total outlay of INR 10,900 Cr, INR 4,391 Cr will be for electric buses.

Can Olectra win? Can it dominate the e-bus market in India? Let’s take a look at the most recent quarter to get a glimpse of where things stand.

Q3FY25 Biz Update

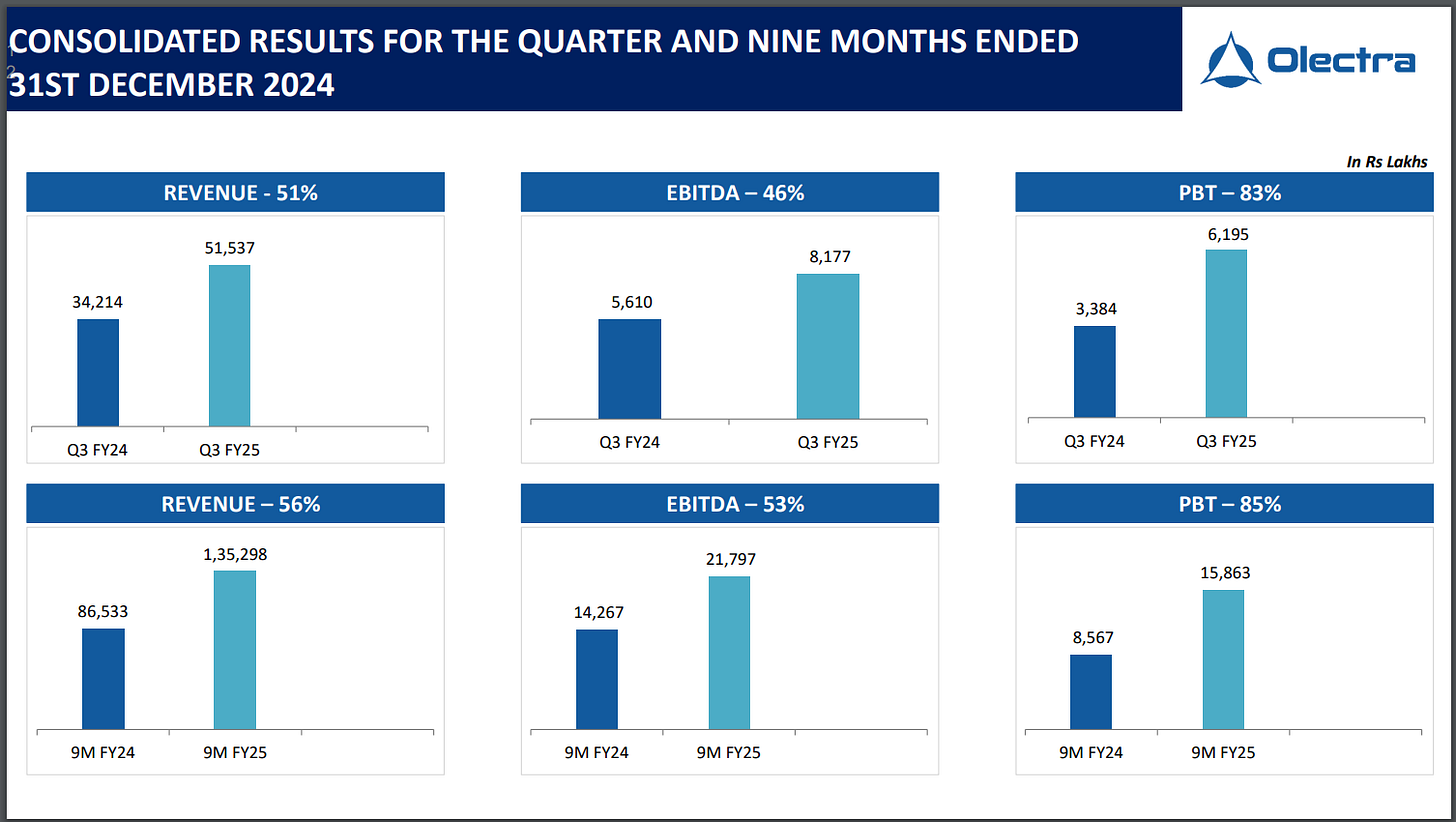

Financial metrics were up YoY across the counter. However on a sequential basis, revenue and bottom-line were flat.

Bus deliveries & Order book

Delivered 753 e-buses for 9MFY25, with 282 buses delivered in Q3FY25. Expecting to close FY25 with 1,200 e-bus deliveries — meaning that management expects Q4 e-bus deliveries between 400-450.

Order book stands at 10,224 e-buses as at 31 December 2024, the value of this order book stands between INR 15,000 to INR 16,000 Cr — which the management expects to fulfill in the next 2 years.

Participated in tenders for HRTC (Himachal Road Transport) for 330 e-buses and Northwest Karnataka for 350 e-buses, which are under negotiations. These orders are not yet won by the company.

For FY26, 2,500 e-buses are planned to be delivered.

The management has consistently over-promised on deliveries and under-delivered. For FY25, the initial # was between 1,500 to 2,000 e-buses. This # was lowered to 1,200 and frankly I don’t think they will be able to achieve this.

For FY26, the management had guided for 5,000 e-bus deliveries, which has been reduced to 2,500. As an investor, you got to ask — how can the management estimate be so wrong?

New technology

Olectra launched new e-bus models equipped with blade battery technology (developed by it’s technical partner BYD). This battery technology is 30% lighter than LFP batteries, provides 30% more energy storage enabling an e-bus to travel >500KMs in a single charge.

No competitor has this technology in India, yet — which gives Olectra an edge.

Manufacturing ramp up

Current capacity is to produce 200 e-buses per month which is going to be increased to 400 e-buses per month in the next 6 months. The company is in the process of installing an automated robotics unit in the next 6 months.

For ^ purpose, the company is planning to take INR 500 Cr in debt.

Capacity expansion to 5,000 e-buses per annum was expected to be completed by the end of FY25 — but looking at how things stand currently, there is a minimum 3 months delay before they can start producing 400 e-buses per month.

Another crucial question as an investor is — if the company can produce 200 e-buses per month currently [600 e-buses per quarter] — why was it able to sell only 282 e-buses in Q3?

Other points

No e-trucks (also known as tippers) were sold during the quarter. The management has no clear guidance on sale of electric trucks, however this is an exciting area to watch since not many players have the capability to produce and deliver e-trucks.

The management is expecting operating margins to moderate from 15% (currently) to 12% (in the future) due to increase in volume of low margin e-buses in the revenue mix.

Revenue from the AMC / Bus maintenance business is currently around 5% of the topline. This should increase as more e-buses hit the road. Olectra enters into a servicing contract with customers for 12 years, over which AMC revenue is earned.

Based on the # of electric buses registered in 2024, Olectra has a market share of 17.7% (#2). Tata Motors has a market share of 40% (#1).

Conclusion

Olectra’s stock has almost halved in the last 1Y — partly due to not meeting it’s delivery targets and partly due to the recent bear market.

Despite management missing estimates consistently, at a PE of 67 times at a market capitalization of INR 8,800 Cr — this looks like a compelling investment at this price point.

Especially with an order book size of INR 15,000 Cr which could materialize into net profits [assuming net profits of 8-9%] of INR 1,000 Cr to INR 1,300 Cr generated over the next 3-4 years.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]