Q2FY26: Skipper Limited

in the pursuit of becoming the largest transmission tower maker in the world

Skipper Limited is India’s largest manufacturer of transmission towers & poles and aims to become the WORLD’s largest manufacturer of transmission towers by FY28.

I had written a detailed article talking about Skipper’s business model & revenue segments, barriers to entry, growth opportunities and risks involved in the business. You can read the full piece here.

Disclaimer: I’ve been invested in Skipper since 2020, and the company forms around 5% of my total portfolio.

When I am researching a company, I try to find answers around 3 broad themes —

Strategy to increase revenues

Strategy to increase operating profits / PAT

Risks that could derail growth

And that’s what we will do in this article. So, let’s begin!

Revenue growth drivers

As an investor, I am interested in finding how quickly a company can grow its topline? Is it adding new revenue streams? Does it need to incur significant capex to grow sales? Is the management exploring new opportunities to unlock growth? Is it expanding to new geographies?

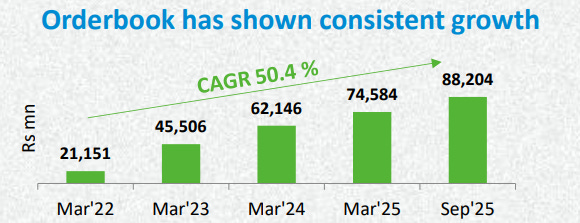

#1 Robust order book & growing export business — Skipper has an order book of INR 8,820 Cr as at 30th September. 89% of the order book comprises of domestic orders and 11% comprises of export orders. Expecting to close FY26 with an order book in the range of INR 9,000 - INR 10,000 Cr.

Growth of the order book. Projects won — during Q2, it won 2 prestigious 765 kV transmission line project orders from PGCIL in Rajasthan + Madhya Pradesh valued at INR 1,243 crores — strengthening the company’s position in the high voltage segment. Execution timelines were not shared by the management.

Bidding pipeline — Skipper’s bidding pipeline remains at INR 30,000 Cr — this is potential business that could flow into the order book. Out of this, INR 10,000 Cr is the export bidding pipeline.

The historical win rate is 25%, which means 25% of bidding pipeline gets converted into the order book.

Export biz — the management’s aspiration is to achieve an order mix of 50/50 between domestic and export orders in the next 2-3 years, with 25% of overall order book coming from developed economies (North America, Europe, Australia) and 25% from developing countries (Middle East, LatAM, Africa).

To put this plan in motion, the company has set up 3 foreign marketing subsidiaries in the U.S., U.A.E & Brazil. Export business would help the company in increasing profitability, since exports typically enjoy 1-2% higher margins.

#2 Increasing manufacturing capacity — The company’s current capacity is 3,75,000 MTPA (for engineering products) and it is planning to add another 75,000 MTPA by the end of FY26 — involving a capex of INR 200-250 Cr. Skipper is currently operating at 85% capacity utilization.

By FY28, the company wants to build a capacity of 6,00,000 MTPA — which would effectively make it the largest transmission tower maker in the world.

#3 Building test bed facilities — Skipper launched two transmission tower test beds for full scale testing of Lattice towers & Monopoles. This will ensure faster project turnaround and unmatched reliability. This helps in improved brand positioning in the export market.

#4 Substation opportunity — the company is executing 2 small sized projects, building 2 substations of 132 kV and 220 kV. These projects will be commissioned in the next financial year, post which Skipper would be qualified to bid for larger substation projects. THIS IS A BIG OPPORTUNITY.

The Government plans to spend INR 9.1 trillion between FY25 to FY32 on the transmission and distribution sector. What I have understood is that this will be split 50/50 between transmission towers and substations.

Therefore, if Skipper can enter the substation market in a meaningful way over the next few years — it is sitting on a huge additional revenue stream. This is a development that needs to be tracked closely by investors.

EBITDA growth drivers

Higher operational profits drive shareholder wealth creation, which in turn should [theoretically] result in a higher market capitalization. What are the levers that the management can pull to increase profits? That is the name of the game.

The management is doing several things to enhance operating profits:

Striving to increase export share in the business — which commands higher margins. Skipper’s engineering facilities were audited by potential clients from Middle East & North America. Growth in exports need to tracked.

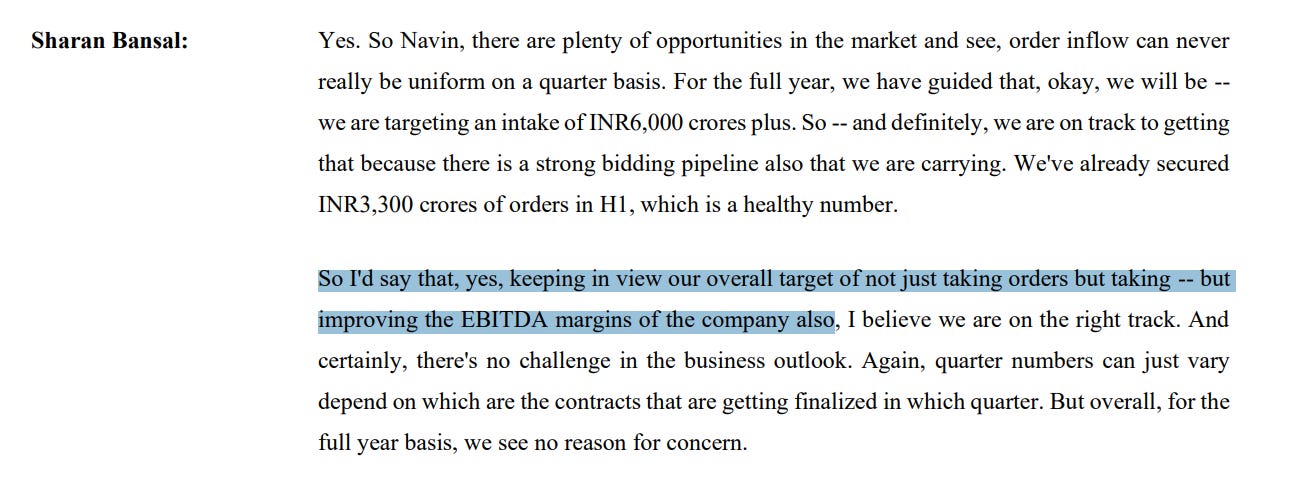

Management is prioritising high value / high margin orders — since it is not desperate to grow it’s order book.

Extract from Q2FY26 earnings call transcript. Targeting to achieve double digit EBITDA margin in the polymer business in the next couple of years. Current EBITDA margin in the polymer business is around 4%. Needs to be tracked, since this is a very aggressive target.

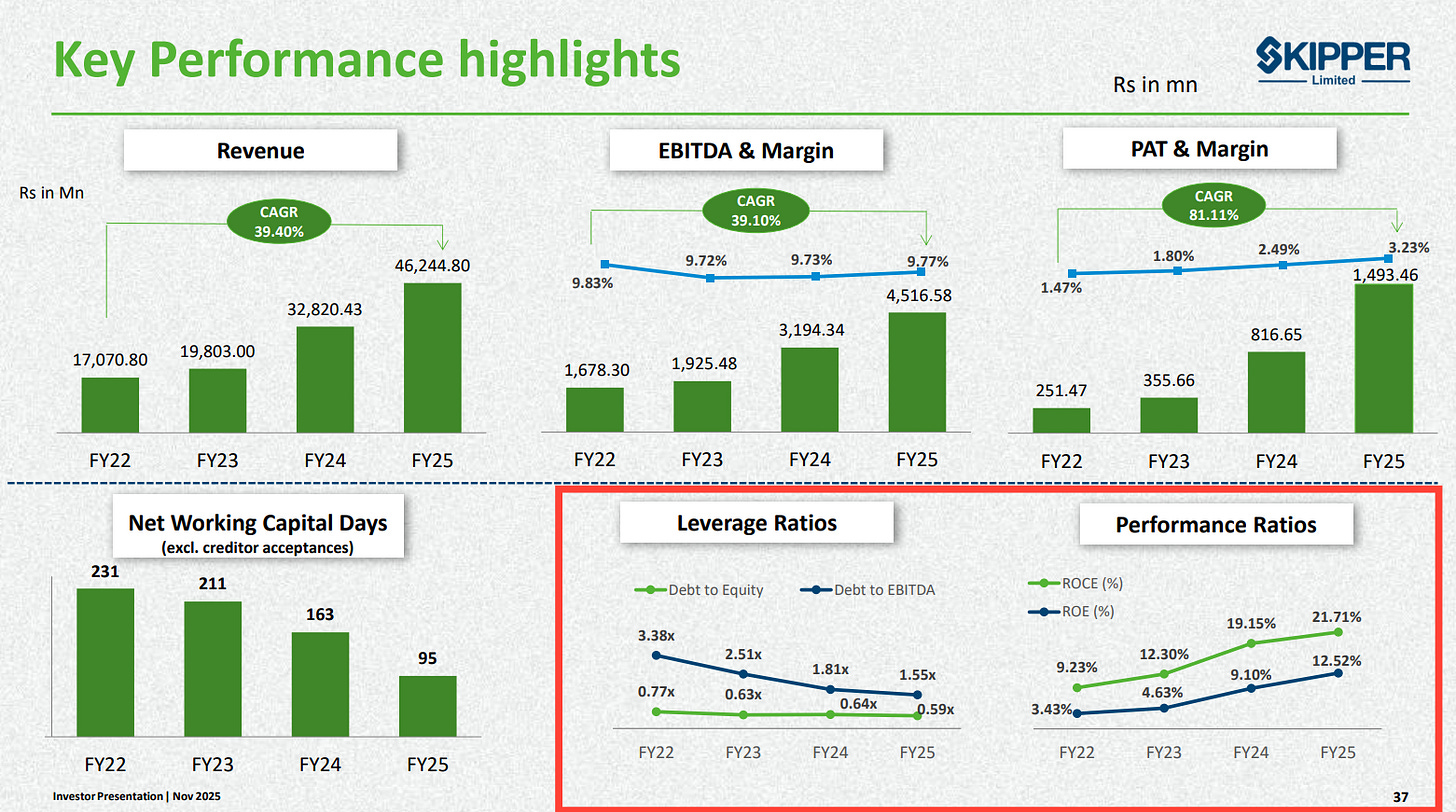

Finance costs are growing since the company needs to incur significant capex to grow, however finance cost as a % of sales has been declining over the years. For Q2FY26, the finance cost as a % of sales was 4.2% (as compared to 5% in Q2FY25) - a significant drop.

The company is implementing SAP S/4 HANA RISE to achieve operational efficiencies.

Performance highlights of Skipper.

Management is expecting long term EBITDA to be in the range of 12%. Currently EBITDA is hovering around 10-10.5%.

Potential Risks

#1 CAPEX led growth

The #1 risk that I see in this business is the requirement of CAPEX to fund growth. What happens post FY28 once they’ve become the largest transmission tower maker in the world? What is the playbook after FY28? There’s no commentary on that yet.

The company needs to continuously build capacity, for which they need to undertake debt. What happens when orders dry up? The fixed finance cost would eat up into margins. I’m still not very clear whether the company can grow sustainably without incurring CAPEX.

#2 Customer concentration

PGCIL is Skipper’s largest customer. We don’t know the exact % of revenue that comes from PGCIL, but I am guessing it is >50%. Any disruption in the business of PGCIL, would have catastrophic impact on Skipper.

#3 Sectoral Risks

India’s T&D sector is hurdled with multiple challenges like land acquisition delays, manpower issues, delay in payments from Discoms — which could delay execution timelines for EPC players like Skipper.

Conclusion

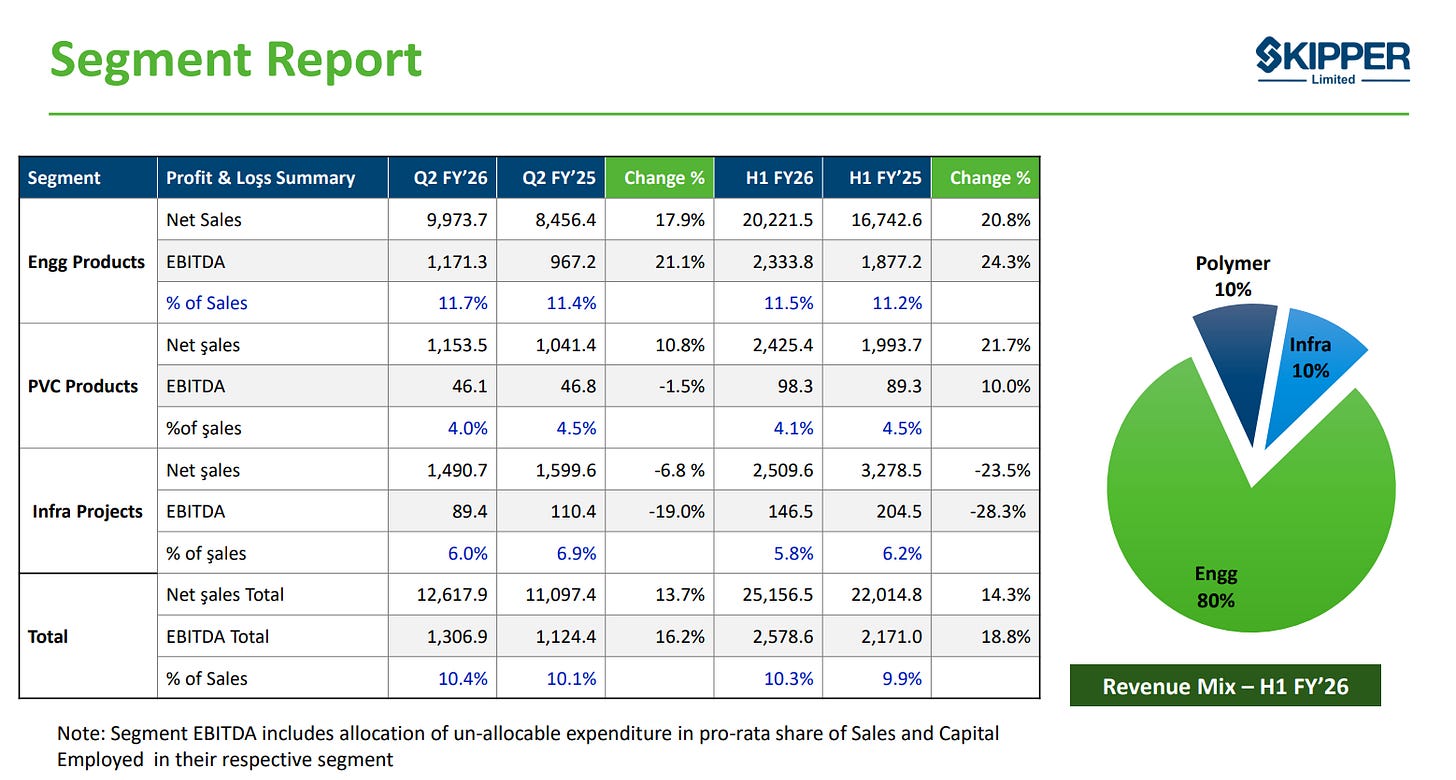

Q2FY26 was a decent quarter for Skipper — with revenues up 13.7%, EBITDA up 16.2% and overall EBITDA margins inching up to 10.4%. There was a sharp decline in EBITDA margins in the Polymer + Infra business, which was compensated by margin accretion in the Engineering Products business. [see chart below]

Management has not changed it’s guidance for FY26 i.e. they are forecasting revenue growth of 25% with EBITDA margin in the range of 10-10.5%.

At the market capitalization of INR 4,900 Cr operating at a P/E of 29 times — I would say that the stock is fairly valued. I believe there is further upside and value to be unlocked — given the capital outlay planned by the Government and themes like AI data centres + renewable energy playing out in the next few decades in India.

What I will be tracking over the next few quarters:

The Substation Opportunity — whether Skipper can start bidding for substation projects and gain market share in this segment.

Export business — whether they can inch towards the 50/50 goal — to have 50% of the order book coming from export markets.

Capacity expansion — whether additional 75,000 MTPA capacity will go live in Q4FY26 as forecasted to take total capacity to 4,50,000 MTPA.

Finance cost reduction — whether management can further reduce finance cost as a % of sales to below 4%.

Guidance — whether the management can achieve revenue growth of 25% YoY for FY26 + maintenance of EBITDA at 10-10.5%.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]