The per capita energy requirement in India is rapidly increasing. India’s installed power generation capacity stood at 476 GW as of June 2025 which is projected to rise to 777 GW by 2030.

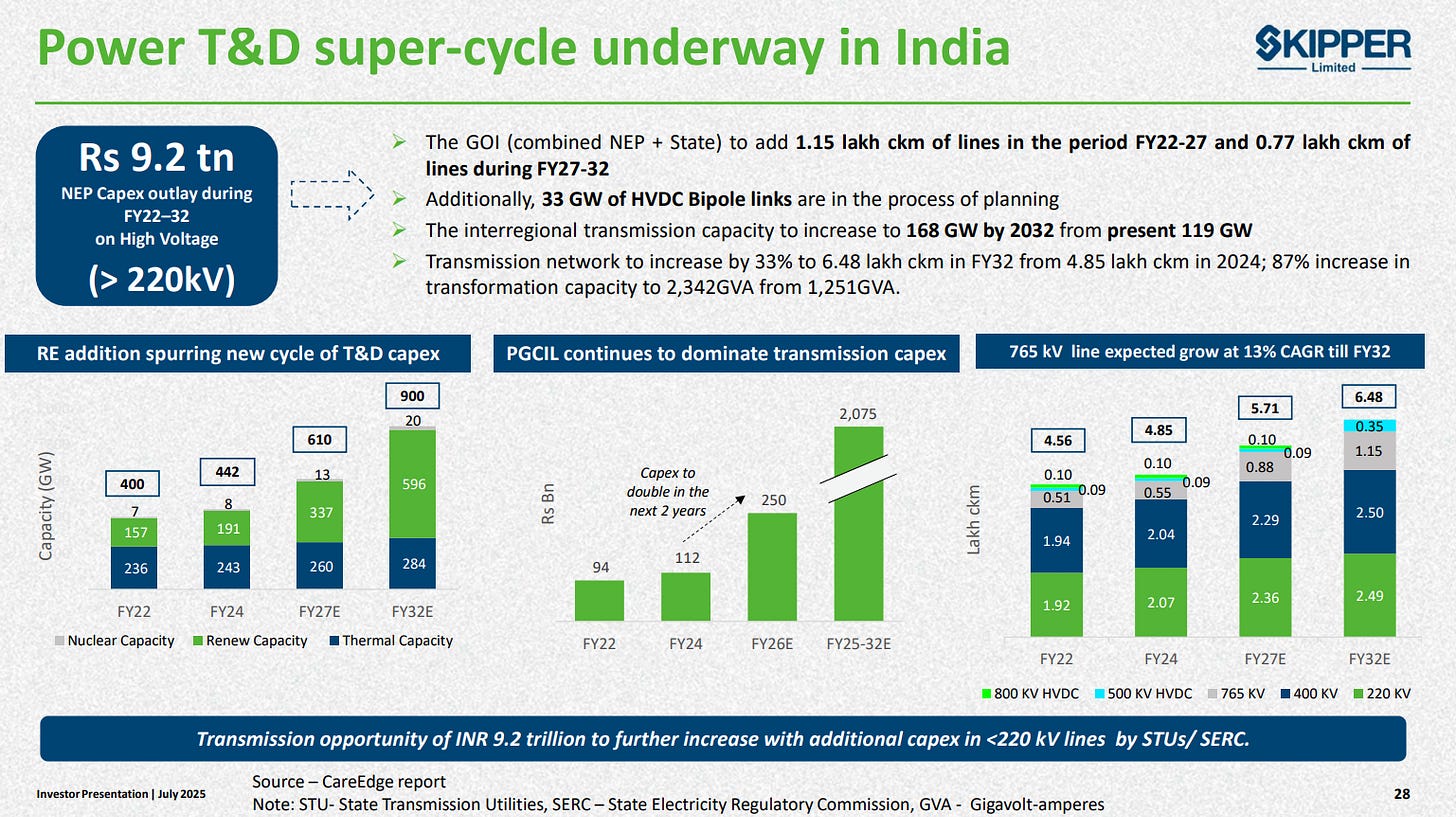

It is not enough to build power generation capacity, you need to transmit that electricity, which requires more transmission lines + substations. The Government has planned to invest INR 9.1 TRILLION over the next 7 years in the power transmission sector unlocking opportunities for companies operating in this space.

Business is boomin’ if you’re in the power & transmission business with strong demand for atleast the next 2 decades — which brings us to Skipper Limited, a company which makes towers which form a vital part of the transmission grid.

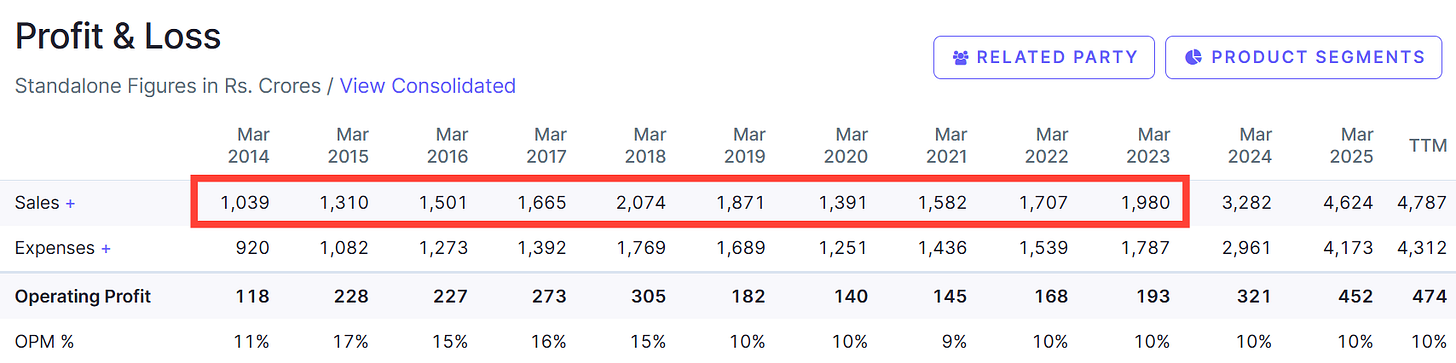

If you’ve been an investor in Skipper Limited for the past 10 years, you’ve been on a rollercoaster ride (see chart below). It is a turnaround story. And shareholders’ who stuck with the company, have been handsomely rewarded.

The question remains — can the company keep winning from here? Let’s find out!

Business Model

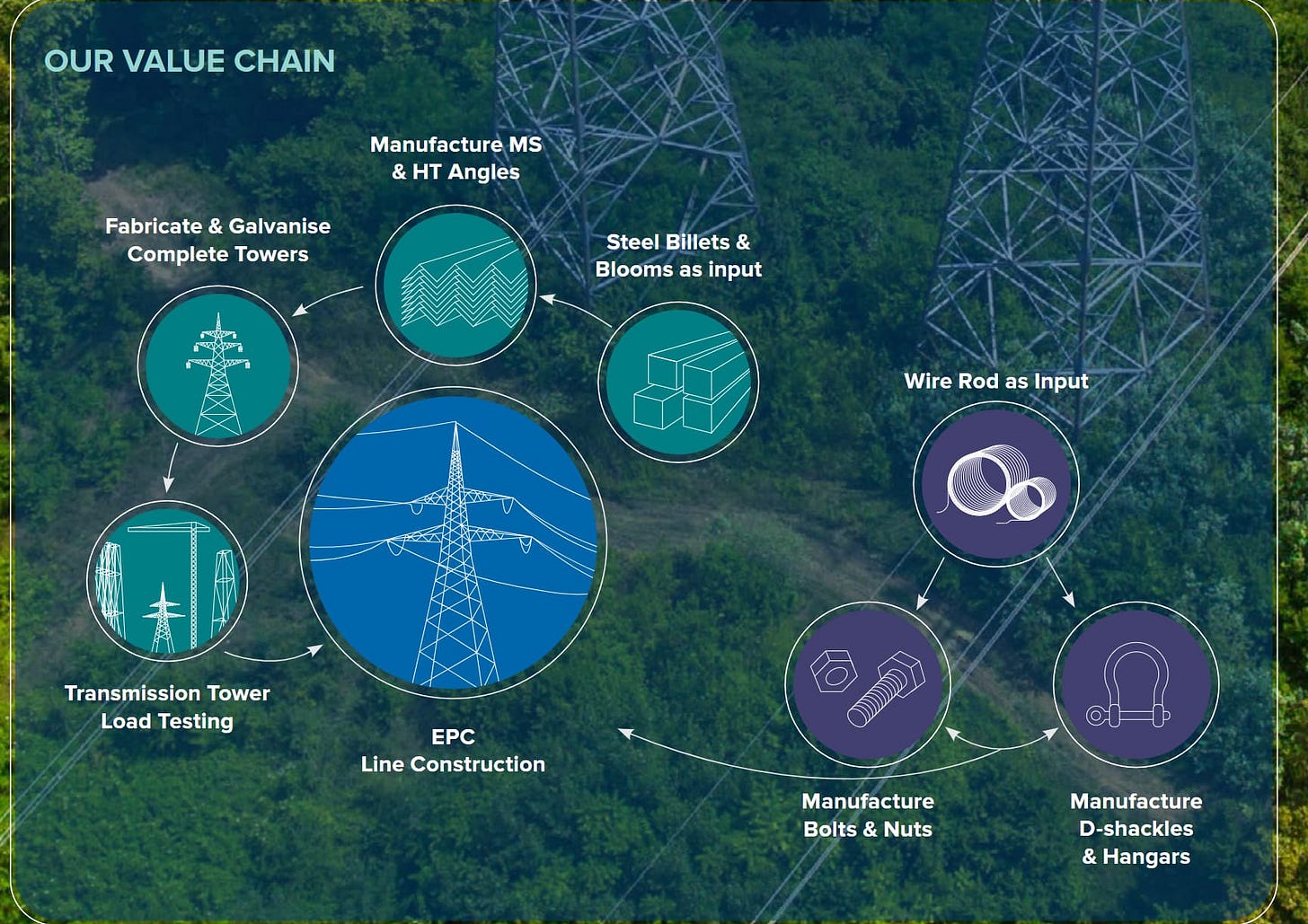

Skipper Limited is in the business of manufacturing transmission towers. They design the blueprint of the tower, manufacture various parts required and assemble the parts on site into a tower — the entire process taking anywhere from 2-3 years.

The company was incorporated in 1981, headquartered in Kolkata and has a long standing partnership w/Power Grid Corporation which is India’s largest power transmission company. This relationship with PGCIL, is crucial for it’s growth + survival.

Segments

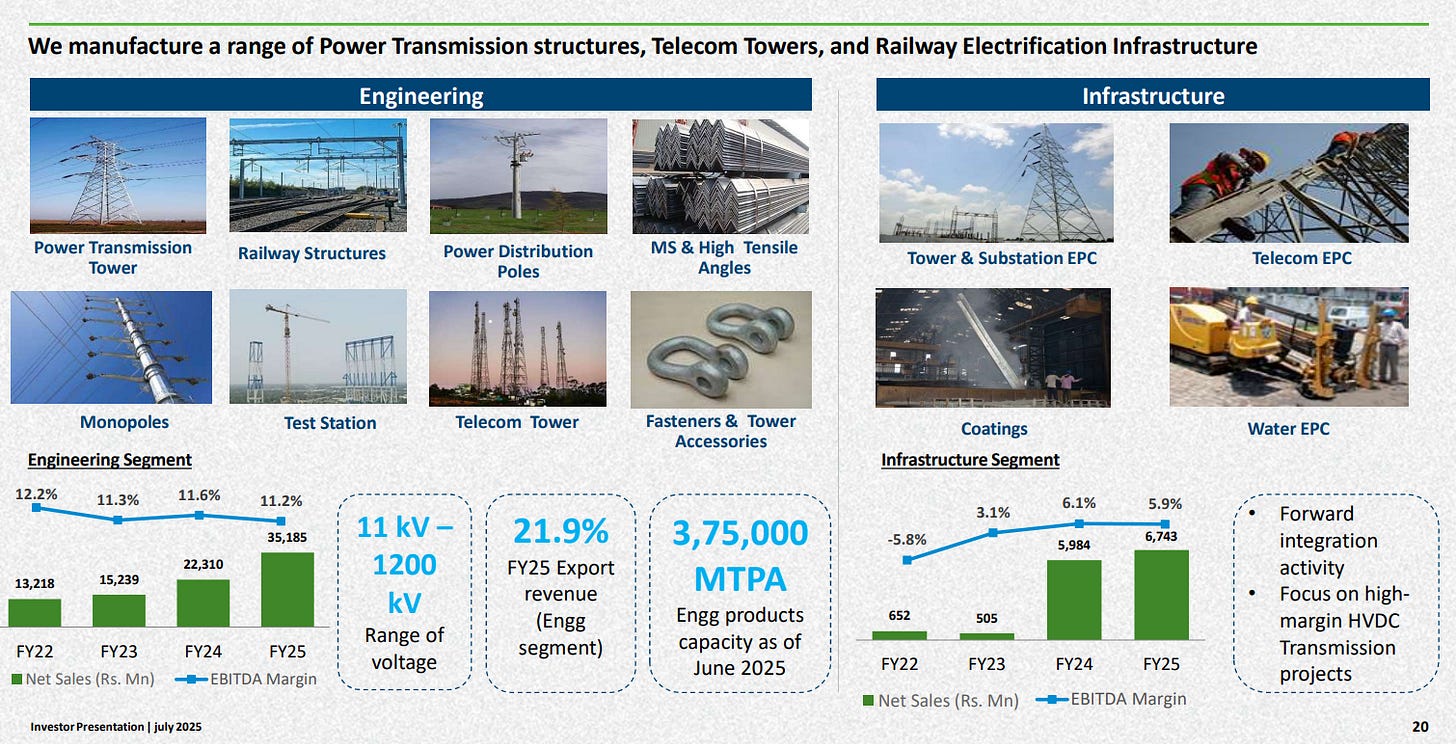

The company operates across 3 revenue segments — Engineering, Infrastructure & Polymer business.

Engineering business [82% of topline] — this segment covers manufacturing of power transmission towers, railway structures, monopoles, test stations, telecom towers and other tower accessories.

As of June 2025, the company has a capacity of 3,75,000 MTPA for Engineering products.

20-22% of engineering revenue comes from exports and the company has a strong international presence in Middle East, Latin America & Africa.

The company makes the entire spectrum of transmission towers from 66KV to 800KV and has the capabilities to manufacture 1200KV towers.

EBITDA margin in the range of 11-12% — margins are low and the company most probably operates on a cost plus model. Money is therefore made, by saving costs since selling price cannot increase much.

Let’s break down some verbiage.

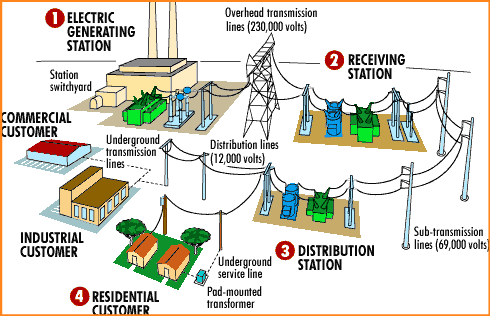

Transmission towers — tall steel structures that act as electricity highways, carrying bulk electricity from generating plants to substations.

Substations — these are facilities that convert voltage for efficient distribution. They contain specialized equipment like transformers to step voltage up or down, circuit breakers to protect the system from faults, and busbars to distribute electricity.

Infrastructure business [8% of topline] — caters to the EPC business, which stands for Engineering, Procurement & Construction, where the company is responsible for the entire lifecycle of a project.

the company undertakes EPC for towers, substations, telecom and water projects.

EPC projects demand higher working capital — involving procurement of materials, manufacturing, assembling, getting approval certificates for the project and final release of payment.

EBITDA margins in this segment bounce between 3-6%. Naturally, the company is not very keen on increasing it’s EPC pipeline, unless it is margin accretive.

Polymer business [10% of topline] — unrelated to engineering, the company is a leading manufacturer of polymer pipes & fitting products in West Bengal. They’ve also roped in Dhoni as a brand ambassador.

These pipes are used in plumbing, sewage management, borewell & agriculture. The company has 30,000+ retail units across India.

There’s been a decline in Governmental orders and increase in business from the pump plumbing segment which has higher margins, which makes the management optimistic about achieving double digit margins by end of FY27

EBITDA margins (current) bounce between 3-5%. You can think of this as a commodity business, with little pricing power.

One could raise a question whether the company should be in the polymer business to begin with? Wouldn’t it be better to divert capital & human resources into the tower making business?

Capex heavy business?

Growth is fueled by increasing capacity, which is dependent on capex. This means, the company cannot grow without undertaking more debt, since it doesn’t generate enough profit to cover capex requirements.

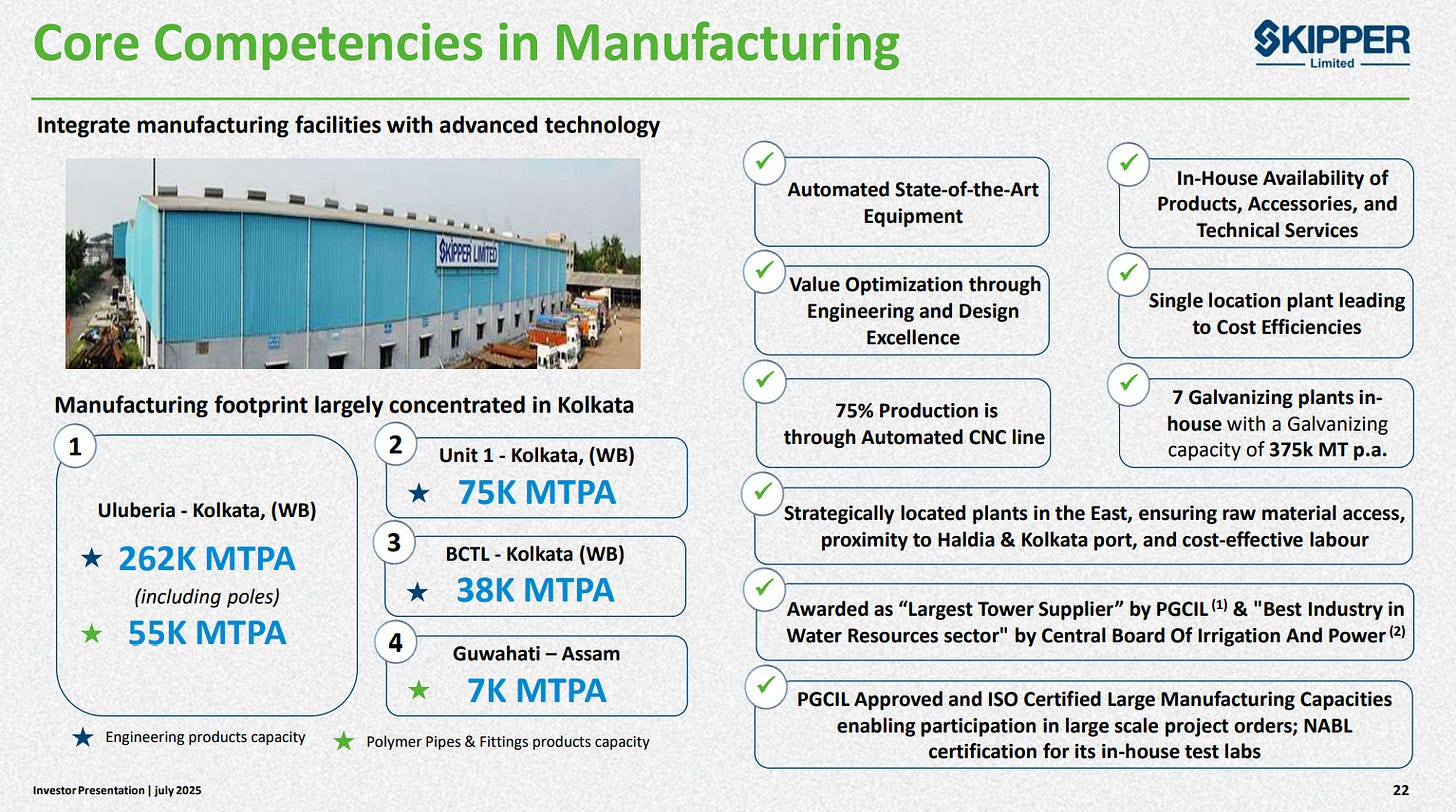

The company added 75,000 MTPA capacity in Q1FY26 for Engineering products — taking total capacity to 3,75,000 MTPA. Targeting a capex of INR 200-250 Cr [financed by 60% debt / 40% equity] to add another 75,000 MTPA capacity which should be added by Q4FY26.

Capex of INR 200-250 Cr is required for each block of 75,000 MTPA capacity addition. For each addition of 75,000 MTPA, the company is able to generate INR 1,000 Cr in revenues approximately.

An average EBITDA of 10%, means an EBITDA payback period of 2-3 years for each capex cycle. And a PAT of 3.6% translates into a PAT payback period of 6-7 years.

The company is planning to invest INR 600 Cr in the next 3 years taking total capacity to 6 LAKH MTPA by FY28 — with the vision to become the WORLD’s largest transmission tower manufacturer.

Raw materials

The management claims that the company is completely backward integrated and 90% of the raw materials used to make towers are sourced internally.

Steel is converted into MS & HT angles and wire rods are converted into bolts, nuts, hangars & D-shackles — which are used in fabricating a tower.

The company’s location in Eastern India allows it access to raw materials at a competitive price leading to cost savings by 4-5% as a result of lower freight costs & bulk purchases. The primary supplier of steel billets is SAIL, with whom the company enjoys a good relationship.

Management Guidance

One of the things that I liked about the earnings call, was that the management was quite open in answering questions. They didn’t hide details and these little things make a BIG difference.

However, the management has skipped earnings call in the past when the company was going through a tough phase and it would be interesting to see if they skip future calls in case of a bad quarter, that would speak volumes about their character.

Revenue guidance — management expects revenue to grow by 25% in FY26 & FY27. Targeting order inflows of INR 6,500 Cr in FY26, out of which 25% will be export orders.

Margin guidance — expecting operating margins to improve by atleast 50bps. Expecting to reduce interest cost to 4% of revenues by end of FY26.

Cost benefits = higher profits = higher shareholder wealth creation

What sets the company apart?

On the outset, given the moderate level of EBITDA — you might believe that arranging steel components into a tower might not be very hard. Anyone with money (capital is definitely an entry barrier) can do what Skipper can do?

Wrong.

Building a transmission tower requires high engineering expertise, because each transmission line has a specific design requirement and it needs to be customized. Skipper focuses on making towers for high voltage lines (400 KV+) which has far more stringent criteria’s to meet — and price is not the only deciding factor. You need credibility, capability & capacity.

It takes time to build repute in execution of high voltage offerings, for obtaining orders of sizable scale — and since the time required to build a tower takes anywhere from 2-3 years — Skipper doesn’t foresee any major competition from Chinese players in this segment, since the Chinese lack commitment for long term assignments.

Also, tower being a very critical part of the transmission line — needs to be empaneled with PGCIL / private T&D players, which is a tedious process. Not many players can build a tower that will meet the requirements.

So, barriers to entry exist. And the above points set Skipper apart to safeguard it’s business from any major disruption.

Order Book

In Q1FY26, the company won orders worth INR 1,977 Cr taking the total order book of the company to INR 8,520 Cr, which is 1.8 times FY25 revenue — which gives good visibility of future business.

secured 3 contracts of 765 KV (high voltage) transmission line projects from PGCIL in Rajasthan & Andhra Pradesh.

secured an INR 2,570 Cr order from BSNL in 2022 to supply and erect telecom towers to advance connectivity in rural areas. [to be executed over 5 years]

Secured major tower testing & design order from Saudi Electric Company [of INR 25 Cr] — Middle East’s largest utility.

Secured 1st substation EPC contract [INR 45 Cr] making a strategic expansion into the substation segment (which is a massive opportunity)

Involved in Railway Kavach project which is a 50,000 Cr opportunity — how much Skipper will benefit out of this opportunity is not known.

Skipper has a bidding pipeline of INR 30,000 Cr participating in high value tenders across domestic, EMEA, LATAM, Africa. With a bid convert rate of 20-25%, the company is confident to win orders worth INR 6,500 - INR 7,000 Cr during FY26 (this includes 1,977 Cr of orders won in Q1)

Industry tailwinds

Like I mentioned at the start of this article, the GOI intends to spend INR 9.1 TRILLION till FY32 in the transmission sector, which will be split 50-50 between transmission lines & building substations.

There is an INR 2.5 trillion budget for new renewable energy grid to generate power and for every rupee spent on generation an equal rupee needs to be spent on transmission.

So — the long term outlook for the transmission sector is very strong. There’s also demand for more telecom towers as India is the 2nd largest telecom market in the world and 5G rollout is in full swing.

The company confirmed that US constitutes less than 1% of it’s current order book, so there wouldn’t be any adverse impact from Trump’s recent tariffs on Skipper.

Global Expansion

The company wants to increase the export share in total revenues, and estimates export revenue to double from INR 700-800 Cr (current) to INR 1,500 Cr in FY26.

Increase in exports should drive margin expansion, since export orders have 1-2% better margins compared to domestic orders. The current addition in capacity of 75,000 MTPA also frees up the company to target export orders and short term demand — a segment where the company faced constraints last year.

Investors should keep a track of this, since more export orders = better margins = more wealth created for shareholders.

Skipper has established a R&D Centre + tower testing station — which improves brand positioning in the export markets.

It plans to set up 3 subsidiaries across 3 key international regions to accelerate export growth.

The company has strong relationship with global EPC players and has been working with other utilities in the Middle East.

Obtained LCA + EPD certificates for towers & pole products which is required for exports to Europe / USA.

Other tailwinds

Skipper has reduced it’s finance costs to 4.22% of sales (from 4.69% last year). PAT margins have increased to 3.56% from 2.89% (PY). Similar trends need to continue into FY26.

It is slowly scaling the sub-station segment, which is a HUGE opportunity. It might take some time to ramp up in this segment, but this is one to watch for future growth.

What’s the bear case?

One of the biggest challenges for the company, would be to scale its business. We’ve understood from an analysis of the business model that it probably operates on a cost plus model. It is heavily dependent on PGCIL for majority of its business. And, it is operating at near full capacity.

You will not see a wild swing in EBITDA margins in this line of business. On the contrary, EBITDA margins in the Engineering business has reduced by 1% since FY22.

So, it cannot increase prices. It doesn’t have a lot of pricing power. It doesn’t have unutilized capacity to leverage. So, how does the business scale from here?

The company needs to spend anywhere between INR 200-250 Cr to add 75,000 MTPA capacity, which leads to additional revenues of INR 1,000 Cr and a PAT of INR 30-50 Cr. By FY28, Skipper aims to become the largest transmission tower maker in the world, and there are serious questions on how the company will unlock the next leg of growth post FY28. Can it increase service revenues? Can hiring more people help scale the biz? We’ll have to wait for the management to comment on this.

Other headwinds that could impact the business:

Dependence on PGCIL — Power Grid is the largest transmission player in India, and Skipper’s largest customer. Any decrease in demand from PGCIL, would adversely impact the business.

Although the management actively works with private players like Sterlite, Adani Energy, GR Infra, DRAIPL to mitigate some of that risk.

Increase in commodity prices — steel & zinc are key raw materials and higher raw material prices could impact profitability — however I believe the company operates on a cost plus model, and should be passing on raw material price increase to the customer, since operating margins have been relatively stable throughout the years.

India T&D sector faces challenges like manpower issues, land acquisition delays, delayed discom payments, high AT&C losses which increases working capital cycle for players like Skipper.

Conclusion

At a market capitalization of INR 5,919 CRORE at a P/E of 37 times — I think the company is a tad bit expensive. Management has guided for a 25% revenue growth for the next 2 years and a margin expansion of 50bps in FY26.

It has better operating margins (10%) compared to peers [KEC - 7%, Kalptaru - 8%].

If you see the company’s performance since 2018, it witnessed periods of degrowth in FY19 / FY20 and there was no growth between FY18 - FY23. However, in FY24 the company delivered significant growth, carrying it forward into FY25. And that is a significant turnaround for investors in the business.

My main concern is the scalability of the business. It needs to incur capex to fund growth and I’d like to see if margins can expand without significant capex.

The management has a solid plan in place to become the biggest transmission tower maker by FY28. The order book is expanding. The share of exports should grow, which has better margins. And the industry tailwinds are very strong.

I believe the stock price could still appreciate significantly from current levels, however if you’re expecting Skipper to be a 10 bagger or a 20 bagger, it might not fit the bill.

Disclosure: I’ve been invested in the company since 2020, and will continue to hold it until it reaches a market capitalization of INR 15,000 Cr.

BIG shoutout to the ValuePickr community. The analysis in that forum has greatly helped in writing this piece.

For my subscribers, I have partnered with Finology to get you a one month free subscription to Finology Ticker. Follow the steps listed in the Google Form [Form Link].

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]