I’ve been on radio silence for a couple of weeks, taking a little bit of a break from writing / research - but I am back! And this time, I have expanded my research to cover stocks with market capitalization below 3,000 CRORE.

The problem with small caps is the lack of information available + lack of management commentary on the future, which makes it difficult to predict the future. And as investors, we want to see the future as clearly as possible.

As investors, we are in the future predicting business. 😎

With that, let’s talk about G.M. Breweries — a player in the alcobev space, with a major foothold in the state of Maharashtra.

The company has given decent returns over the past 5 years, but hasn’t been an extraordinary performer. At a market capitalization of INR 1,900 CRORE, at a P/E of 12 times — the stock looks cheap.

Is there more room to grow from here? Why is the stock trading at a P/E of 12 times when the alcobev industry as a whole commands a P/E of 43? Could this be a value opportunity in the future? What does the market know that we don’t know?

Let’s find some answers by looking deeper in to the business of G M Breweries.

The Business

Incorporated in 1981, owned by the Almeida family — G M Breweries in engaged in the manufacturing and marketing of alcoholic beverages such as Country Liquor (CL) and Indian made Foreign Liquor (IMFL).

Majority of it’s revenues come from Country Liquor — also known as Indian made Indian Liquor (IMIL) or in layman terms as ‘desi daru’ 😂

Country liquor is made from raw materials like rice, sugarcane, molasses, palm or coconut. In the case of GMB, the main raw material is ethanol — which is derived from molasses (a derivative of the sugar manufacturing process).

The typical consumer of GMB is your manual laborer / worker. Auto rickshaw drivers. Construction workers. These are recurring customers, with a daily drinking habit.

The company operates the following brands of country liquors — G.M. Santra, G.M. Doctor, G.M. Limbu Punch, G.M. Dilbahar Saunf. A couple of years back, the company launched a new product called G.M. Black.

Although the company says it makes IMFL, I don’t see any brands on their website.

The company has a fully automatic bottling plant in Virar with a capacity to manufacture 50,000 cases a day. However, the company is operating at just 53% capacity — which means that even if demand grows significantly, no major capex will be required in the foreseeable future.

The Tailwinds

One of the biggest tailwinds of the alcobev industry is a simple fact — people will continue consuming alcohol till the end of time. If anything, alcohol consumption is only increasing with time.

The market for Indian made Indian Liquor (a.k.a desi daru) — is expected to grow from 290 million cases in 2021 to 350 million cases by 2025. This will be fueled by rising disposable income in low income groups, with a lot of people moving out of ‘poverty line’ status.

Some of the other tailwinds for the company are:

Market leader in Country Liquor (CL) in Maharashtra — the company claims that it is the market leader in the districts of Mumbai, Thane & Palghar. It is the largest manufacturer of CL in Maharashtra with a capacity to process 13.76 bulk liters of liquor.

The management is taking all possible steps to extend it’s business to the interior districts of Maharashtra taking advantage of it’s brand image.

But is it? I don’t see any increase in sales YoY.

Extremely low / nil debtor days — G M Breweries offers no credit period to it’s distributors, because that’s the nature of this business. The customers pay upfront in cash. Distributors pay upfront in cash. Therefore, working capital requirement is minimal.

This means, that you don’t need a lot of money to run the business. If anything, this is the kind of business that generates positive cash flows.

Significant CAPEX not required to expand — the company operates at a 53% manufacturing capacity, which means that even if demand grows significantly — GMB will not need to invest to increase capacity. It can expand into newer geographies of Maharashtra / other states whenever it wants to.

Causes of Concerns

There are no fundamental issues with the business model of the company. It has a stable business. Sticky customers. Operating margins in the range of 18-22%. Requires almost no working capital to run the show. Has been paying dividends consistently for more than a decade.

The biggest concern, is that the owners of the company do NOT seem ambitious. They are operating at 53% of manufacturing capacity [which has slightly improved from 43% utilization in 2014]. Sales has hardly grown. There is no commentary on future plans + growth drivers of the business for the next 5 years. No new products in the pipeline. Excess cash generated from the business is NOT being invested back in the business.

Further, the shareholding % hasn’t changed over the years. The Almeida family owns close to 75% of the company with minimal holdings from FIIs / DIIs. So any chance of an activist investor shaking things up goes out of the window. It doesn’t seem that Jimmy Almeida will be stepping down any time soon.

So, unless the owners suddenly wake up one day and decide to aggressively expand into more parts of Maharashtra / other states — I don’t see the business growing at a faster clip. Maybe they’ll be able to grow the top-line / bottom-line by 10-12% YoY, but that’s not enough to generate multi-bagger returns.

Some of the other concern points are:

Concentration of sales in one state — 100% of revenues are derived from sale of liquor in the state of Maharashtra. Although the regulators haven’t indicated that they’re thinking of banning sale of liquor in Maharashtra — it is still a possibility. If sale of liquor gets banned in Maharashtra, G M Breweries will be out of business.

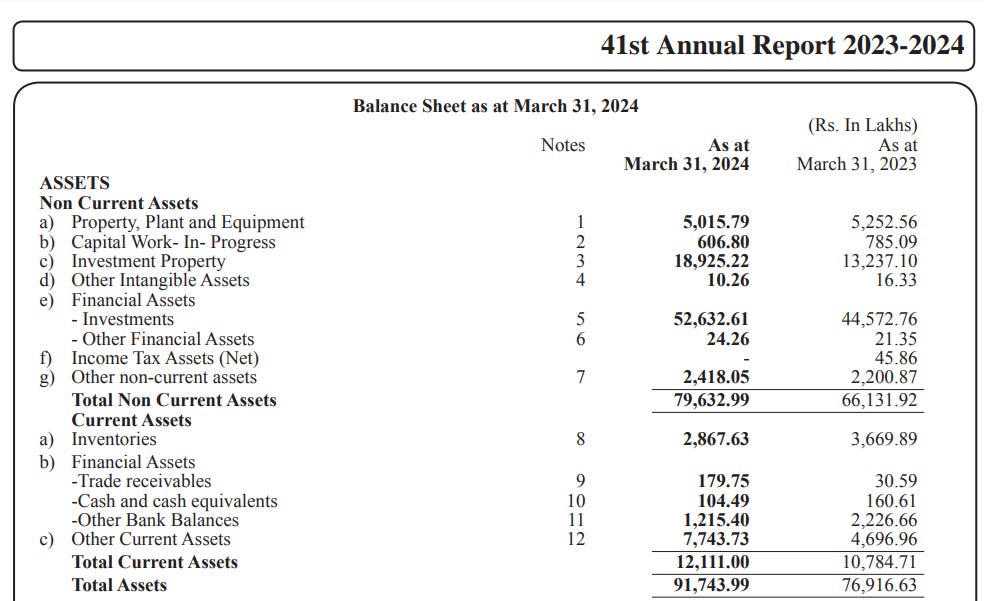

Capital is not being invested back in the business — the company has been returning capital back to investors via dividends, but a major part of cash generated from the business is being invested in non-current assets like mutual funds, tax free bonds, debentures, land & buildings.

Why is the management not investing in PPE? Why is the management not keen to invest in the business? We might not find out because the management doesn’t give out much information either.

Low pricing power — the average customer of GMB is a low income worker / labourer with not a lot of purchasing power. So, even though GMB has been able to increase prices over the years, it might not be able to significantly increase prices in the future and pass on any raw material price increases to the final consumer.

Rising disposable incomes a bane? — per capita income in India is increasing and as more people move from the low income group to the middle class, their alcohol preferences could change from country liquor to IMFL.

Are employees motivated? — the company has no performance incentives for it’s workforce. I couldn’t find any employees listed on LinkedIn which seems weird. So, it doesn’t look like the company is equipped to scale significantly from here.

Rent payment to Director — there was a rent payment of INR 2.57 CRORE to one of the directors — why is this required if so much investment is being already made in investment properties? Is this a way to funnel more money to the directors?

Conclusion

G M Breweries has a 5Y RoCE of 21%. Zero debt. Dividend yield of 0.6%. Mind you, these are great numbers. Especially for a company operating at 53% manufacturing capacity. If the owners wanted, they could really ramp up the business in no time!

From a valuation point of view — at a P/E of 12 times, it looks cheap on paper compared to peers. [see below]

However, the owners of the company have no ambitions to grow the business. They seem happy with a market leader position in country liquor in Mumbai, Thane & Palghar. Without an aggressive push, I don’t see the company delivering super-natural returns. It is still a decent business, which could give moderate returns over the long term.

This is why, it is so important to have good leadership in a company. It is their vision which decides whether a company can go on to become a multi-bagger in the future.

Plot twist — there is a gamble that can be taken on the business getting acquired in the future, with the new owners shaking things up significantly. Only then do I see the business growing exponentially from here. But will this ever happen, is anybody’s guess.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

You can contribute by donating a small token to fund my research on my UPI ID at siddharthbothra64-1@okicici

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

The question to ask is - is this worth the risk? Basically the information here is very limited. Company is not signaling any intent to grow...whereas other players are moving towards premiumization and trying to increase their market.

IMO, Concentration in one state is a major risk. Although I doubt Maharashtra will be banning alcohol, the low-value desi alcohol can face some regulatory challenges !!

If it's not a multibagger, then why invest for measly returns for a risk of investing in a small cap