More than 5,300 companies are listed on BSE. Every week, more companies are added to this list as they come out with their IPOs and get listed on the bourses.

If I could research 50 stocks in a year, it would take me more than a CENTURY to study all the stocks listed on the BSE. Its not practically possible to monitor all stocks and that’s where a screener comes into play.

A screener helps you to sort out stocks based on certain criteria + narrow down your search. I use a screener with the following parameters to find micro-caps worth reading about:

Parameter 1: Market capitalization < 1,000 Crore

Parameter 2: ROCE > 20%

Parameter 3: P/E ratio <40 times

The micro-cap that I’ll be covering today — is Kronox Lab Sciences Limited [ticker symbol KRONOX].

The company recently came out with its IPO and listed on the stock exchanges on 10th June 2024 with a decent listing gain of 21%. Since listing, the stock has been relatively flat and has been range bound.

Can it go further up? Can it become a future multibagger? Is there a margin of safety at the current valuation?

With a market cap of INR 650+ Cr, at a P/E of 30 times — there could be a lot of room for the stock to grow from here. So, without wasting any time, let’s deep dive into the business of Kronox.

The Business

Incorporated in 2008, Kronox is in the business of manufacturing high purity specialty fine chemicals which finds applications across various industries.

The products they make are used as:

Reacting agents / raw materials in the manufacturing of APIs 💊

Excipients in pharmaceutical formulations

Reagents for scientific research and lab testing 🧪

Ingredients in nutraceutical formulations

Process intermediaries + fermenting agents in biotech applications

Ingredients in agrochemical formulations, animal health products, personal care products.

Some context:

APIs (also known as active pharmaceutical ingredient) are the active chemical compounds in drugs that produce the desired effects on the body. APIs cannot be directly consumed, which is why they are packaged into capsules, soft-gel capsules, tablets, injections etc. [known as delivery mechanisms].

Many chemicals (raw materials) are used in making the APIs. Excipients (like binders, fillers, bulking agents) are then used to enhance stability, bio-availability, integrity of the drug.

Kronox has a portfolio of 185 products, available in different grades and particle sizes ranging from 10 mesh to 100 mesh. It has 350+ customers and supplies to 20+ countries, however majority income is derived domestically.

The major segments contributing to revenue are:

Pharmaceutical formulations + API — 45% of topline

Scientific research + Lab testing — 26% of topline

Nutraceutical supplements — 23% of topline

The primary raw materials used in the manufacture of high specialty chemicals are citric acid, phosphoric acid, potassium hydroxide, sodium hydroxide, soda ash, acetic acid among others. Material costs are in the range of 50-58% for the company.

At the face of it, this seems like a commodity business with not a lot of pricing power. And I could not find any management commentary which proved how their products were superior compared to competition.

The Tailwinds

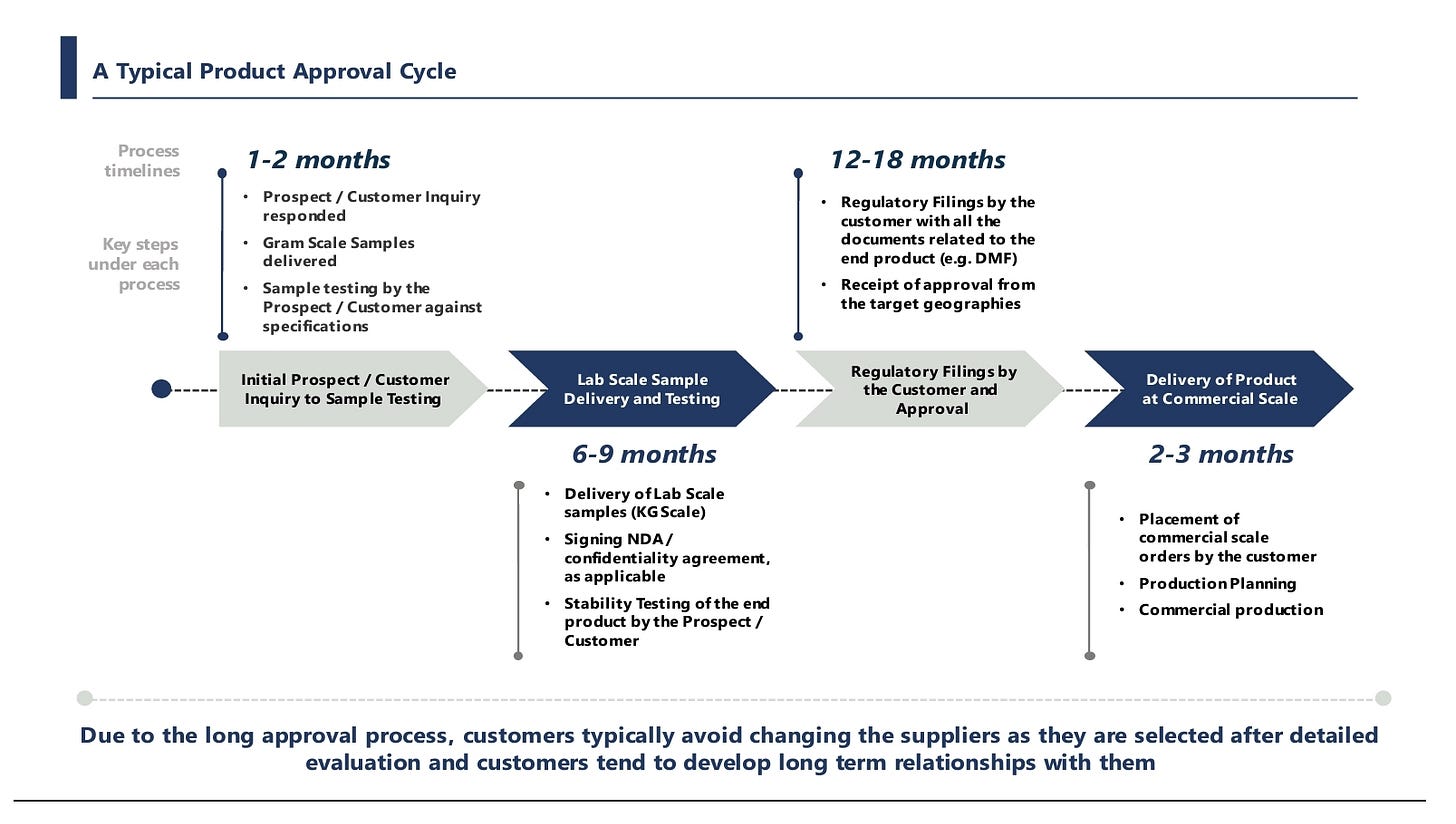

One of the biggest advantages of the company — even though it is a commodity business — is the high entry barrier of the sector. The business is characterized by long customer approval cycles + strict product standards.

The manufacturing process involves multi-step production and purification processes to manufacture fine chemicals. Customer acquisition is a long process & product approvals take time.

Some of the other tailwinds are:

Customer relationships — the company has 350+ customers, with the top 10 customers contributing > 45% of the topline. Average relationship with the top 20 customers is 7 years.

The company doesn’t enter into long term agreements with customers, but operates on individual purchase orders — released as and when there is demand.

23% of customers placed repeat orders with the company.

Exports constitute around 25% of the topline. 83% of the exports are to the US, which is the largest market for pharmaceuticals.

The company would want to increase the repeat order % + share of exports in the future. This is a metric to look out for. This is probably a reason why the company hasn’t been able to grow revenue YoY.

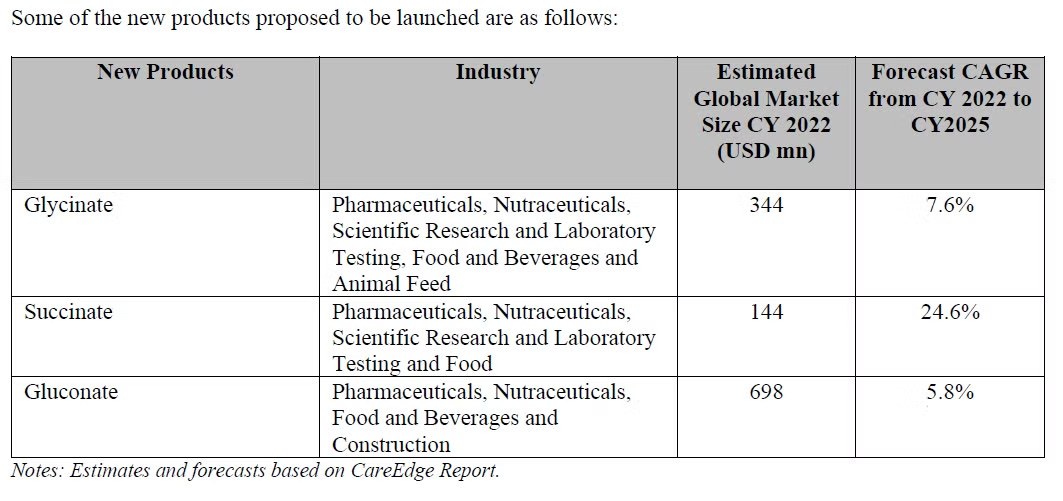

Growth drivers — the company has 122 products under various phases of R&D. The management wants to target applications in industries such as F&B, electronics, precision industrial products. New products are expected to increase penetration in existing applications + provide entry points into newer industries.

Investors should note, that the company employs ONLY 16 people for R&D purposes. And the R&D expenditure was <1% of topline — which makes me question — is that sufficient to develop new products?

The Indian pharmaceutical market was valued at $50B in 2023 and is expected to grow to $57B by 2025.

The Indian API market is expected to grow at a CAGR of 13.7% over the next 4 years. India is the 3rd largest API producer manufacturing 500+ different APIs.

Can Kronox capture market share of this growing pie? We’ve very little info available, to answer that question at this point in time.

China + 1 strategy — supply chains are trying to de-risk themselves from an over reliance on China, which could benefit Indian chemical manufacturers including Kronox.

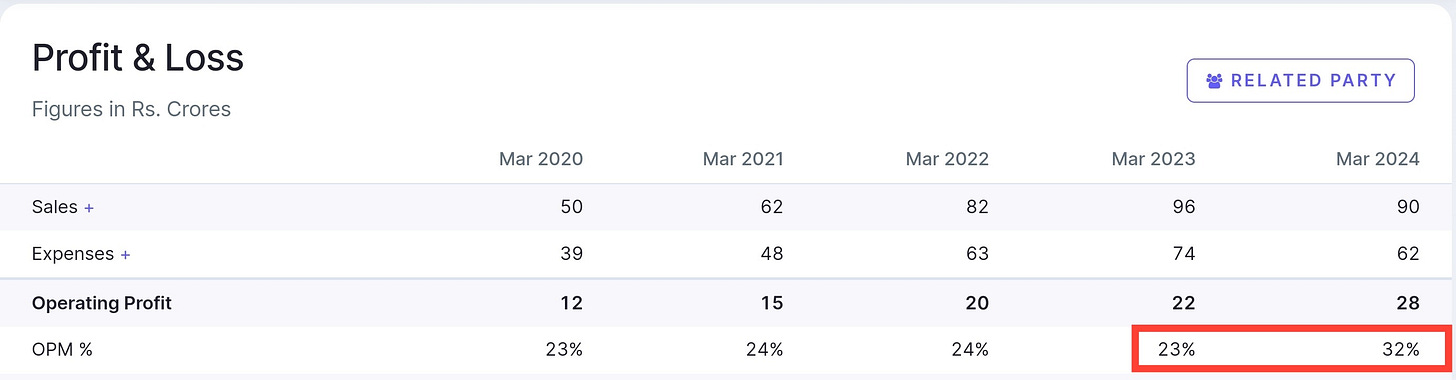

One other thing to note, is that although there has been a sales degrowth in FY24, operating profit margins have increased YoY. However, the management has not given out too much information regarding what the sustainable level of OPM % is going forward.

Also, companies in general reduce their fixed costs before coming out with an IPO — to show a favourable financial position to investors, for better listing gains. Investors should track the next few quarters to see what is a sustainable OPM % for Kronox.

Points of concern

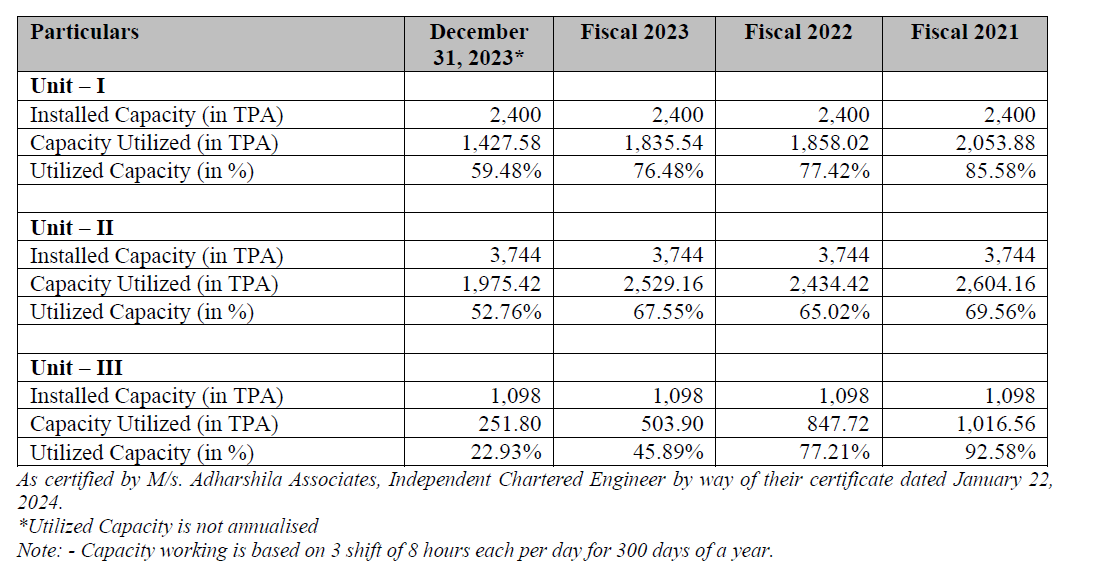

In a manufacturing business, capacity utilization is very important. It defines the success of your business. Signals operational efficiency. And can be one of the things that give you an edge over competition.

Under-utilization of capacity > less production > less sales > less profits > greater payback period to recover the cost of setting up the factories > slower creation of shareholder’s wealth.

Kronox has 3 strategically located manufacturing units with an installed capacity of 7,242 MTPA. The company is establishing a new plant at Dahej, Bharuch which will increase their manufacturing capacity — financed through a mix of equity / debt / internal profits.

From the chart above, it is clearly evident that the company isn’t fully utilizing it’s capacity. So, why is it adding more capacity?

Well, because it received a notice from the Gujarat Pollution Control Board (GPCB) restricting expansion in the Padra region where the company’s Unit III is located. Due to this reason, it is not able to fully utilize the Unit III facility and hence is investing to set up a plant in Dahej, Bharuch.

Are they going to close Unit III? Or operate it at sub-par capacity? There’s no management commentary on this matter.

Other risks:

Concentration risk

Product concentration — top 20 products contribute >60% of revenue. Any decrease in demand for such products would reduce sales.

Sector concentration — pharmaceutical / scientific testing contribute >70% of topline. Decline in demand in these sectors would adversely affect Kronox.

Customer concentration — top 10 customers contribute >45% of the topline. The company is tapping into new market / adding new customers to reduce this concentration.

Competition risk — Kronox is significantly small in comparison to competitors and has a negligible market share in the chemical industry. It might face a hard time clawing market share away from existing competition & growing revenue.

Other risks

Revenue growth has been flat for the past two years. This means that despite adding new products & customers — the company has not been able to significantly move the revenue needle.

Repeat customer sales is only 23% — which is a BIG cause of concern, because this means that they would have to continuously add new customers to grow revenue. Customer acquisition, is a lengthy process, which means the fastest way to grow revenue is to increase repeat sales.

The company employs only 60+ employees. If it wants to significantly expand operations and grow market share, I believe it will need more people in key positions. Also, managerial remuneration > employee costs.

Conclusion

Kronox is trading at a P/E of 30 times, at a market capitalization of approx. INR 650 Cr. It has a healthy operating margin of 31%. ROCE of >40% despite not operating at full capacity. At this valuation, the stock doesn’t look very expensive IF it can grow profits in the future.

Also, there is operating leverage at play — whereby the company has unutilized capacity to tap into to increase revenue and in turn profits.

The most important question is — what sort of strategies can the company employ to increase it’s topline?

There are also certain unanswered questions that make it difficult for an investor to understand Kronox’s growth potential in the future:

Which product group generates the most revenue? The company has mentioned top 20 products contribute to > 60% of revenue, but which product group has the highest share? There are different growth rates for different product groups like phosphates, sulphates, chloride, acetate etc. Without the knowledge of the highest contributing product group, we don’t know how to predict future growth.

What is the revenue guidance? I couldn’t find any estimates for revenue for FY25, FY26 and beyond. Further, can it grow export revenues — since these are high margin revenues.

What is the base level operating margin? You can see that operating margins have shot up in FY24, but can the company sustain those levels of margins?

How are R&D expenses so low? Can new products be developed / tested with R&D expenses of as low as 45L?

What is it’s strategy to claw market share from competitors? Is the product of Kronox superior in any way?

The company has just listed on the bourses in June 2024 and is relatively new in the public markets. I’d give it some time and see how the next few quarters play out. If it can grow the business in a meaningful way.

It is operating in an industry which will grow at a brisk rate. Can it create wealth for it’s shareholders over the next 10 years?

We will keep tabs on the company to find out.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Previous article 👇

Interesting Substack - From listening to podcasts, those 5000+ stocks (depending on how strict one's investing criteria is) can be screened down to less than 100 or a few 100 stocks worth taking a closer look at... I'm trying to compile an index of ones worth a closer look here: https://emergingmarketskeptic.substack.com/p/south-asia-india-and-central-asia-stock-index