In Mahabharat, Dronacharya was a legendary teacher of the royal family divided into Pandavas and Kauravas. He was considered as one of the greatest Gurus in India and trained his students to become great warriors — which ultimately decided the fate of Mahabharata.

The Company that we will explore in this article — has drawn inspiration from his name and is also in the business of training people. But in this case, training people to become drone warriors!

I am talking about DroneAcharya Aerial Innovations Limited — a company recently listed on the BSE SME Platform. It’s IPO was oversubscribed by 243 times and the stock listed at a premium of 95% on the listing day. Goes to show you the appetite and the liquidity available in the markets.

The drone sector is a sunrise industry in India with use cases in defense, surveillance, internal security, disaster management, agriculture, healthcare, mining, aerial photography etc.

The question is — can DroneAcharya capture a sizable market share in the drone sector and make a mark? Can it grow its profits 10X from here?

Let’s find out!

The Business

DroneAcharya is India’s first listed drone company engaged in the business of drone pilot training, drone based services such as surveys, processing of drone data and GIS training.

It is one of the 58 private companies approved by the Directorate General of Civil Aviation (DGCA) out of the total 66 such Remote Pilot Training Organizations (RPTOs) in India. According to a release by the Company, it has become the first private company in India to generate >500 Remote Pilot Certificates in India.

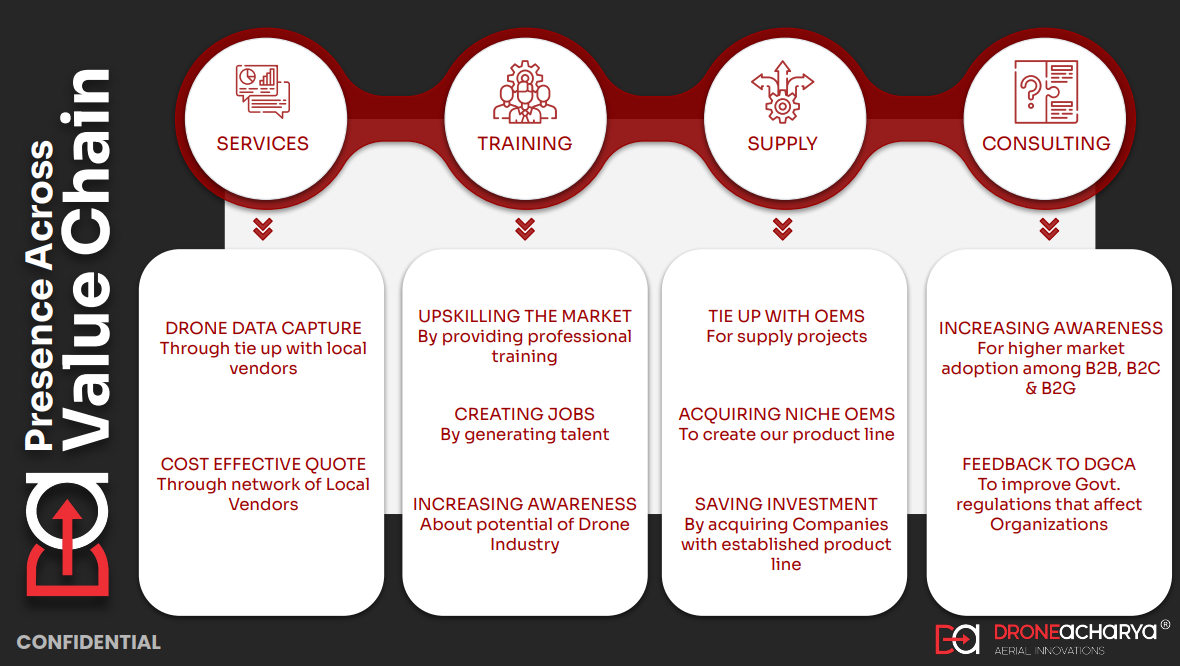

The business is divided into the following segments:

Drone Pilot Training:

DroneAcharya provides DGCA approved drone pilot courses + other courses such as drone building, drone in agriculture, drone based disaster management, drone racing, aerial cinematography, python coding for GIS etc.

At the moment, their flagship 5-day DGCA drone pilot training course costs around INR 64,900 (inc. 18% GST) which has a validity of 10 years.

Drone related services:

The Company provides services like aerial cinematography, processing drone & satellite data, anti-drone solutions for rogue UAVs, air traffic management, drone delivery etc.

The Company boasts having dedicated surveyors, UAV pilots, GIS analysts and LiDAR experts to carry out the above services for various clients.

Surveillance & Inspection:

Offers land surveying, urban planning, base map creation and other data driven solutions for various sectors like power & utilities, oil & gas, roads & highways, mining, energy, infrastructure, agriculture etc.

Drone Product Sales: Going through the latest investor PPT published by the Company on BSE, it has 5 niche drone products in it’s portfolio:

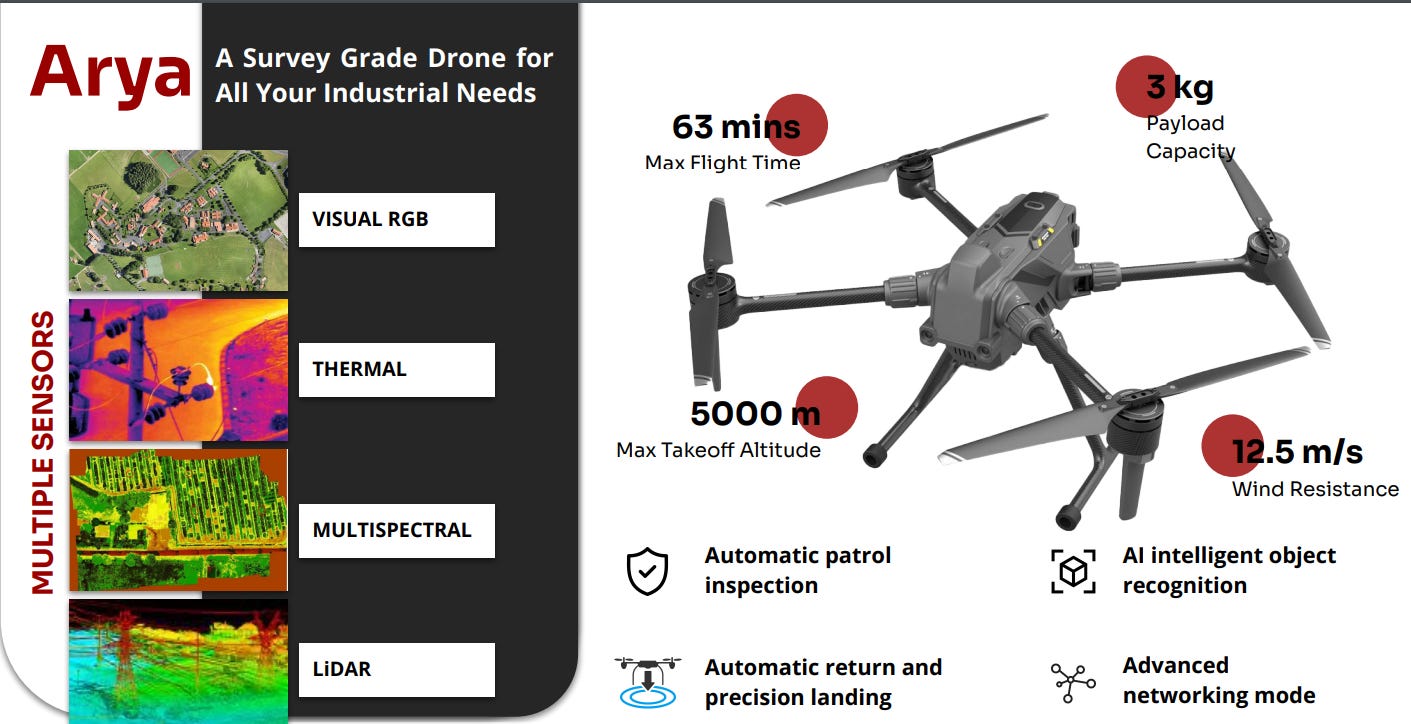

Arya — a drone with multipurpose sensors for various industrial applications.

Agriveer — agricultural spraying drone for insecticides and pesticides to prevent crop damage.

Bhujang — a drone made for the armed forces for high altitude missions, delivery of critical supplies, military surveillance. The drone is equipped with an integrated gun for offensive capabilities.

Recently launched drone for the military and armed forces. Turang — heavy liftoff RPAS system for combat, transport & surveillance for critical deliveries with a payload capacity of 12KG and a flight time of 25 minutes.

Rudrayan — for carrying out challenging missions with applications in defense, medical emergencies and disaster management.

Investors would like to note, that as at 31 March 2023 — the Company reported drone sales of ONLY INR 5,000 and for the period ended 30 September 2023, information is not available to understand if any drone sales has happened.

The Positives

Now that we’ve got a firm grip on the business, let’s take a look at some of the things that are working for the Company.

Industry Tailwinds — the drone industry is a sector which is bound to grow at CAGR of >10% over the next 5 years. DroneAcharya could be a good proxy to gain from the growth in the drone sector.

As per new drone rules by DGCA, the process of obtaining a license to operate drones has been simplified — with a goal to make India a drone hub by 2030.

Various PLI schemes have been announced by the Government to promote domestic manufacturing of drones + drone components.

Promotion of Kisan Drones for crop assessment and PMKVY 4.0 scheme introduced with a plan to train the youth in AI, Drones and coding to bridge the skill gap in the industry.

It is estimated that > 1 LAKH drone pilots are required to be trained in the coming years out of which only approx. 7,000 pilots have been currently trained — leaving a LOT of room for growth in drone training.

Setting up more training centers — The Company claims to have a 8.4% share in DGCA drone pilot certification and aims to achieve a 20% market share by FY24.

To achieve that target, it is expanding and setting up new training centers through the Franchise model.

A franchise agreement has been signed between DroneAcharya and Switzerland’s Wollstone Capital SA to open 30 remote pilot training organizations (RPTOs) across India — the company claims the deal could be worth $2.7M (INR 23 Cr)

Venturing into drone manufacturing — DroneAcharya has partnered with Gujarat based robotics company Gridbots Technologies, which specializes in robotics, AI and machine vision.

In a company filing, DroneAcharya said that they would be setting up a manufacturing plant in Pune and this partnership would help the Company build new products and drone technologies.

The Company recently undertook the commercial launch of it’s drone product line and it would be interesting how much drone sales would contribute to the topline going forward. Investors should watch this space.

Building Space and Defence capabilities — DroneAcharya have been trying to venture into new revenue streams and recently added space + defence sectors to it’s kitty.

Ventured into CubeSats and NanoSats with the aim of creating it’s own constellation for civilian, aircraft and defence purposes.

Successfully launched a reusable rocket launch vehicle & launched a weaponized drone called BHUJANG to cater to the defence sector.

Collaborations and winning new orders — DroneAcharya has partnered with several institutions like IIT Ropar, Asian Institute of Technology for drone training and technology development which could translate into something meaningful in the future. It has not published it’s Total Order Book as of date, but I was able to extract recent contract wins from the BSE website:

Tender from DRIISHYA Haryana to supply high end surveying drones [1.4 Cr]

Contract from TCS for providing 5G enabled drone based solution [15 lacs]

Contract from Ministry of Defence for supply of Drone Lab Equipments [NA]

Contract from Karnataka Forest Department for training 240 officers [96 lacs] (potential to become a bigger contract to train 13K government personnel in Karnataka)

Tender from Indian Defence System to train 20 officers in J&K [12 lacs]

Secured a $1.26M order for supply of survey + surveillance drones, IT hardware, drone data acquisition and processing services and supply of decision support system + project management software to Triconix Industrials Solution QFZ LLC — a company in the Oil & Gas sector in Qatar.

Signed a $2.7Mn franchise deal with Wollstone Capital SA to boost drone sales, services and certified training in India — specifics of the deal are unknown.

Financial Performance — The company posted decent H1FY24 numbers, with a topline of INR 20.8 crore (approx. 10X growth in revenue due to lower base). EBITDA of 28% reflects that the operating margins are robust. The management has projected FY24 topline of INR 45-50 crore. I would like to see if the company can keep the margins intact even after getting into drone manufacturing.

Points of Concern

Things seem to be moving in the right direction for the Company, but if you read the Investor PPT — it looks like the Company is overselling itself. So, let’s look at some of the concern points with respect to DroneAcharya.

What’s the MOAT?

DroneAcharya’s main business is drone pilot training, drone related services etc. The current market share of the company in DGCA certified pilot training is 8.4% and the management expects to achieve 20% market share by the end of FY24.

However, there are 65 other organizations doing exactly what the Company is doing — so how is DroneAcharya going to increase market share? What’s the barrier of entry for other players from becoming drone pilot trainers?

I knoweth not.

New drone rules have simplified the process of obtaining a drone pilot license. Also, the requirement of a license has been abolished for Nano + Micro categories for commercial use.

If the rules were not relaxed, trainers probably would have to obtain specific knowledge and expertise to issue training licenses. But with relaxed rules, the barrier to entry in this market could be VERY LOW.

No commentary from the management on this aspect.

The validity of Drone Pilot Certificates were extended to 10 years. Again, this means that the chances of repeat sales will arise only after 10 years, which signifies low recurring revenue for the company. DroneAcharya would have to continuously cater to new customers to grow it’s topline.

Do we need so many DGCA certified drone pilots?

As per industry estimates > 1 lakh drone pilots will be required in the coming years to cater to various use cases out of which currently only 7,000 people are trained, so there’s going to be a LOT of demand for drone training. However, what if companies were able to automate drones to reduce manual operation?

Companies like IdeaForge are constantly improving drone software to build autopilot and fail safe mechanisms which could bring down the need for drone pilots. You’d still need pilots, but the quantum of pilots needed could reduce.

Negative cashflows + increasing receivables = recipe for disaster

The movement of cash is the single source of truth about a company. It tells you how good a business is. If you sell something for INR 100, but if you’re unable to get paid, what’s the point?

For FY23, Cash Flow from Operating activities (main business) was NEGATIVE 25 CRORE. For H1FY24, Cash Flow from Operating activities improved to positive 4 CRORE.

What I don’t understand, is the increase in receivables. I was expecting, that this was a D2C business to some extent where the Company gets paid from the individual people coming for drone training. But, maybe this is how it works like.

Let say that Elvish Bhai wants to learn how to fly drones & wants to make a career out of it. He contacts the nearby institution that can help him acquire this skill. That institution in turn outsources the training to DroneAcharya’s certified expert drone trainers.

Elvish pays to > Institute. Institute pays to > DroneAcharya.

The only problem is, the institute is not paying DroneAcharya on time. And this kind of ballooning in receivables is NOT a good sign. I would like to see the receivables go down.

Other concern points

The company has not fully utilized it’s IPO proceeds — which could be interpreted either ways. Did the company not know what to do with the funds raised? Why raise excess money? Or are they waiting for the perfect opportunity to acquire other companies?

The company has not complied with various secretarial standards in the past. For e.g. it didn’t conduct Board Meetings at regular intervals. Or it failed to update it’s CIN from unlisted to listed at the time of it’s IPO. These mistakes probably are taken care of now, but shows you that there have been lapses in governance before.

It is listed on the SME platform, which means that you cannot purchase single shares of the company but would have to purchase the stock in lots. The lot size for DroneAcharya is 2000 shares, which means at the current price if you want to buy this stock — the minimum amount you would need to shell out is INR 3.74 lacs! Plus, SME stocks are generally illiquid and quite volatile.

Conclusion

At the current price of INR 187, the stock is trading at a P/E of 64 times with a market capitalization of INR 450 CRORE. The stock is not cheap by any means compared to it’s peers.

My thoughts?

DroneAcharya is a fairly new business. Founded in 2017. Operating in drone pilot training and allied services. A sector which is rapidly growing in India and sees a lot of uses cases across defence, agriculture, energy, infrastructure, videography, space-tech etc.

The Company has plans to enter into drone manufacturing, which is not an easy business and requires specialization, for which it has partnered with Gridbots Technologies. It recently ventured into spacetech with CubeSats and reusable rockets. Launched a weaponized drone (BHUJANG) for the defence sector.

It is also setting up franchisees across India + globally to train more drone pilots. It has won several contracts from various institutions.

No debt on the books. EBITDA margins look good. The guidance for FY24 is around INR 45-50 crore in topline, out of which the Company has already achieved INR 22 crore in the first 6 months.

From a competitive standpoint, I don’t know what the company’s MOAT is. With rules relaxed in the drone sector to obtain licenses, the barrier to entry in this sector looks low — which is not good for the company. Plus, with software developments and autopilot, the need for pilots might come down.

The receivables situation looks scary. Cash flows for the last year were negative. I’d like to see receivables come down significantly without any bad debts being written off to build confidence in the robustness of the business.

At this point, it’s really difficult to say anything about the company. There’s too little information to draw conclusions, but it is operating in a sunrise industry and is one of the ways through which retail investor can grab a bite of the growing drone sector in India.

Definitely worth a place in your watchlist!

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could donate a small token to contribute to my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

360 degrees view of a business. Very insightful article, i would say this is the perfect example of how to study a company. Thanks a lot Sid. Eagerly waiting for next one.

Nice write up. I had read about company some time back my post is https://girishnotes.substack.com/p/droneacharya-aerial-innovations-ltd

I did not study recently - My understanding this company purely on drone piloting space they don't have expertise in other part of the business. I see that you have listed some of the tender company won but my question is is company built any application specific IP example they have provided drone Karnataka forest department but do they have any IP in any part of that solution?