Business Update : Permanent Magnets

can it seize the opportunity to make rare earth magnets in India?

A couple of years back I had written a piece dissecting the business model of Permanent Magnets. Since then, the stock is down around 40% and for good reason.

Revenue has been flat YoY. Margins have compressed significantly. The company’s export business has taken a hit due to Trump’s tariffs.

So why should we be spending our time [and energy] reading about this company? Well, because it might be sitting on a BIG opportunity when it comes to rare earth magnets.

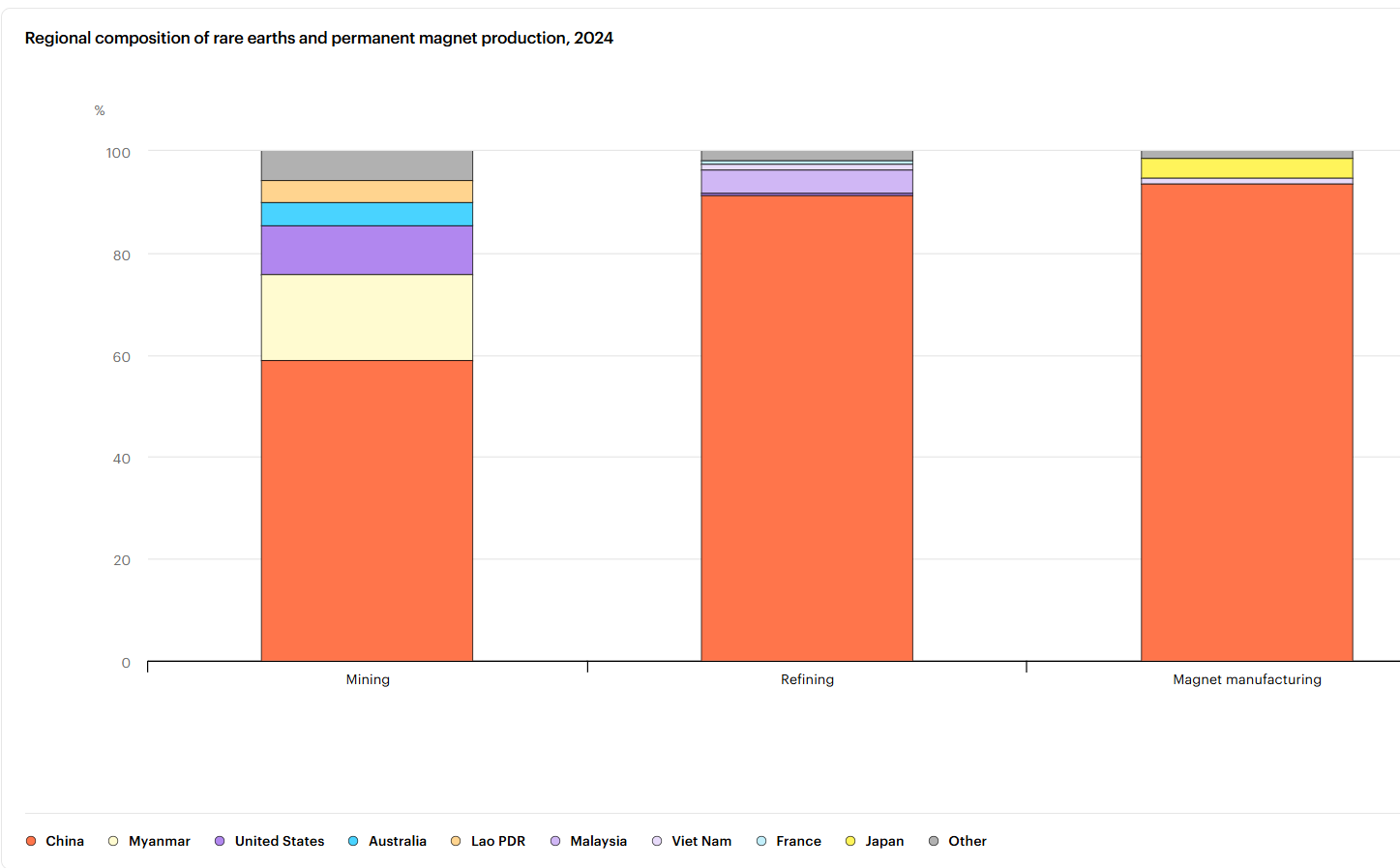

You see, rare earth magnets are essential components in manufacturing everyday objects like phones, electric cars & missiles. And there is one country which has a monopoly on these rare magnets — yep, you guessed it right. China.

This gives them leverage against the entire world. And they’re using it. Last year China placed export restrictions on rare earth magnets as a response to Trump’s tariffs. The world’s supply chains were in disarray, and the tremors were felt in India too.

The Government of India didn’t sit idle — and on 26th November 2025 — launched a PLI scheme with an outlay of INR 7,280 Cr to promote domestic manufacturing of rare earth permanent magnets (REPMs) in India.

This is a tiny drop in the ocean of what’s required to combat China’s dominance in this space — but a step in the right direction.

So, where does Permanent Magnets feature in all of this?

The Rare Earth Magnet Opportunity

On 28th August 2025, Permanent Magnets entered into an agreement with Lorentic Pte Ltd to set up a JV for manufacturing, marketing & distribution of neodymium magnets.

The proposed plan is to set up capacity to manufacture 5,000 tons of these magnets by FY30, with an expected revenue of INR 3,700 Cr upto FY30 with estimated capex of INR 550-750 Cr split between Permanent Magnets & Lorentic. Total EBITDA expected of INR 550 Cr upto FY30.

Even if we assume that the company gets INR 1,850 Cr upto FY30 from this business (since it is a JV and the revenue would be split 50/50) — this is around 2.5x of the company’s current market capitalization. This opportunity, has the potential to change the trajectory of the company.

And the company’s current revenue run rate is around INR 200 Cr. So, we’re talking about exponential revenue growth + we’re looking at a decent EBITDA margin of 15%.

The company plans to source rare earth metals locally + import if required. The idea is to use domestic supply chain in a phased manner. Currently it is in pilot phase where the company is absorbing technology and setting up equipment.

In Phase 1, capex of INR 50-100 Cr will be required to set up capacity of 500 tons. Equipment orders have been placed. The next phase (Phase 2) would be block cutting onwards to magnet production. Expecting Go-Live by 2027 — date unconfirmed as of now, but I am guessing towards the end of 2027.

Applications — these neodymium magnets have multiple applications in automotives, consumer electronics, mobile phones, windmills, motors etc. The management is targeting applications in the premium segment with high quality products, where it could compete with China on pricing.

My take? I think the FY27 target is quite aggressive, given that they are still in Phase 1 setting up equipments. Plus, they would be reliant on Chinese imports for rare earth minerals until India can gradually build up it’s own supply chain.

I am not very clear on how the revenues will be booked. The management is saying they will generate INR 3,700 Cr in revenues upto FY30. That’s cumulative revenue. This will be split 50/50, so for Permanent Magnets that’s 1,850 Cr in cumulative revenues upto FY30? And what is the forecast after FY30? What is the confidence of achieving this number? The management was not very explicit on this topic.

The company doesn’t have enough money on the books, so it will need to raise money (via equity / debt) to fund this. There are many variables at play. But, this is something to track as investors — since, Permanent Magnets, might emerge a winner in the rare earth magnets space in India, and if it does, the stock could rapidly zoom UP from here.

Current Business

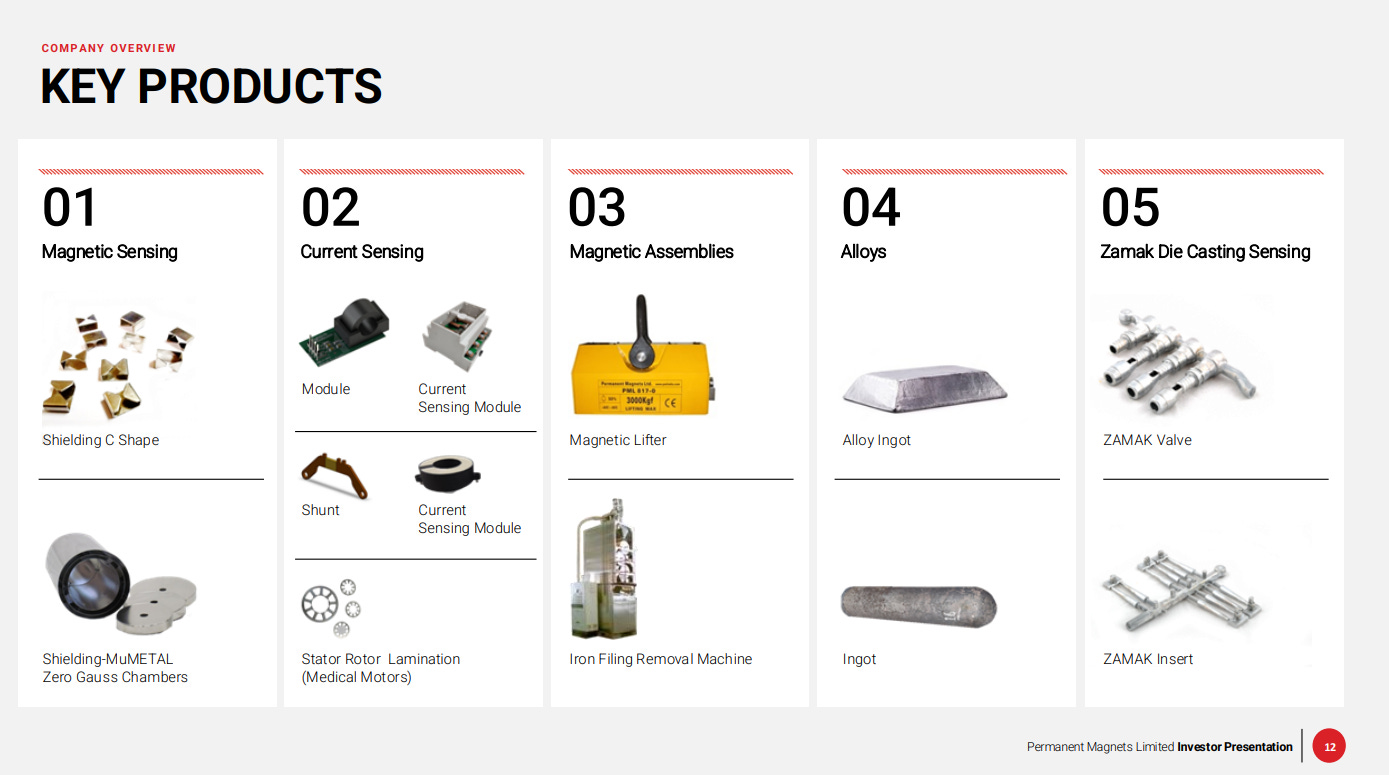

The company makes various products like magnetic sensors, current sensors, current transformers, magnetic assemblies & alloys — which find applications in electricity meters, automobiles etc.

Smart Meters - transition from shunts to relays

One of the things that I like about the management, is that they’re not shy to adapt to the needs of the market. The company began its journey in 1960, with manufacturing magnets.

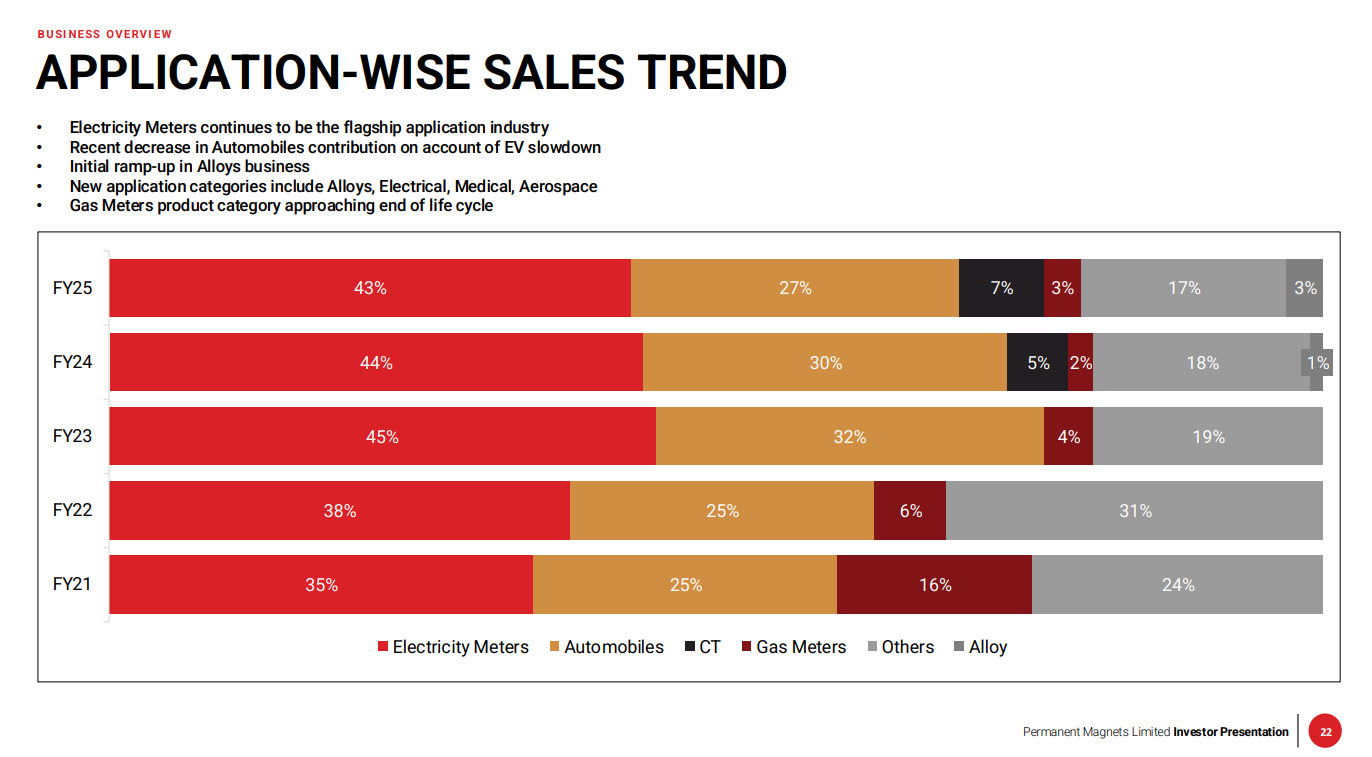

As the world moved from mechanical meters to smart meters, the company pivoted to make products to cater to smart meters. The company shifted from making traditional magnets to shunts. It added a new segment in 2021 (automotives & EVs) which has steadily grown over the last 5Ys and now commands 25-30% of total revenues.

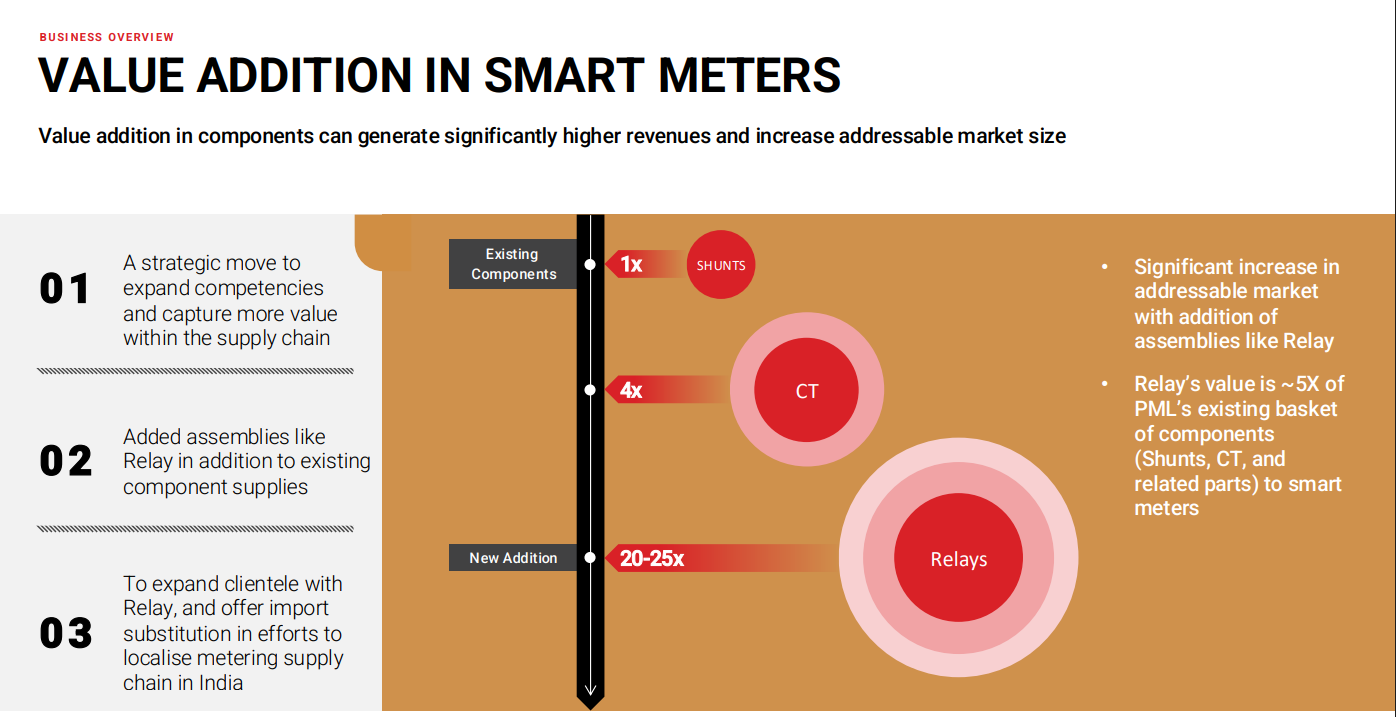

Now again, the company is transitioning from shunts to relays. The management observed that in smart meters, customers were buying assemblies of relays which included shunts and therefore the company decided to get into the relays business — to forward integrate themselves.

The company also manufactures current transformers (CT) which are used in smart electricity meters. These CTs are made from nano-crystalline and amorphous cores. Instead of importing these cores, the company has backward integrated to make these cores in-house. CTs are used along with relays in smart meters.

The company has signed an agreement with REL — a UK based company — using their designs to manufacture relays. A plant is being setup + trials are ongoing with customers. The company will also need to take some certifications.

Capacity buildout — setting up a 5 million relay units facility, which is expected to be operational by March’26. A capacity of 5 million units, will give revenues of INR 50 Cr at peak capacity.

Expecting trial orders for relays in Q4FY26, since customers do a lot of testing before on-boarding a product (endurance testing, EOL testing etc). Ongoing discussions with various customers, and the company will be a second supplier — since the first supplier is a Chinese vendor. However, customers want to de-risk their supply chains, hence they are approaching the company.

EV / Automotives

In this business, the company makes customised products for EU customers + Off the shelf (OTS) standardized products.

The company has launched a range of standard current sensors, which are used in automotive applications — some of which are being supplied to EV 2-wheelers. It has started approaching some bigger automotive players in India as well — however, no names were mentioned in the con-call.

The company is seeing demand of current sensors in applications other than the automotive sector — like UPS, Industrial applications etc. Expecting growth in non-automotive applications in the coming years.

Alloys

This is a relatively new segment that the company has entered. It is working with 4-5 customers, with good visibility + repeat orders. Alloys are used in multiple applications like Oil & Gas, powder metallurgy etc.

New furnace for alloy facility is in progress and is expected to be installed by December’25 [needs to be verified once the Q3 earnings release is published]

New product development

Working on manufacturing of stator rotor for one automotive company. Stator rotor is part of a motor — with application in coolant pumps. The management believes the market is quite big for this business, and currently this product is in pilot stage.

Management Guidance

FY26 — expecting revenue growth of 15% for FY26, closing the year at a topline of INR 220-230 Cr. Revenue for H1FY26 is around INR 102 Cr, so in the second half of the year the company needs to generate INR 110-120 Cr to achieve it’s target.

Expecting additional sales in H2 from alloys — since alloys are running at full capacity and with the new furnace being set-up, additional capacity will be available in Q4.

EBITDA guidance in the range of 16-18% for FY26.

FY27 — expecting revenue growth of 20-30%, which is not a HUGE jump when your revenue base is as low as INR 200 Cr per year. Growth in FY27 depends on the uptake in the alloys & relays business.

Revenue guidance of INR 40-70 Cr from alloys in FY27 + INR 20-50 Cr from the relays business. Balance to come from smart meters, automotives & other segments.

Revenues from rare earth magnets (from the JV with Lorentic) has not been factored in these estimates, which means the management is not expecting any significant revenue in FY27 from this segment.

Conclusion

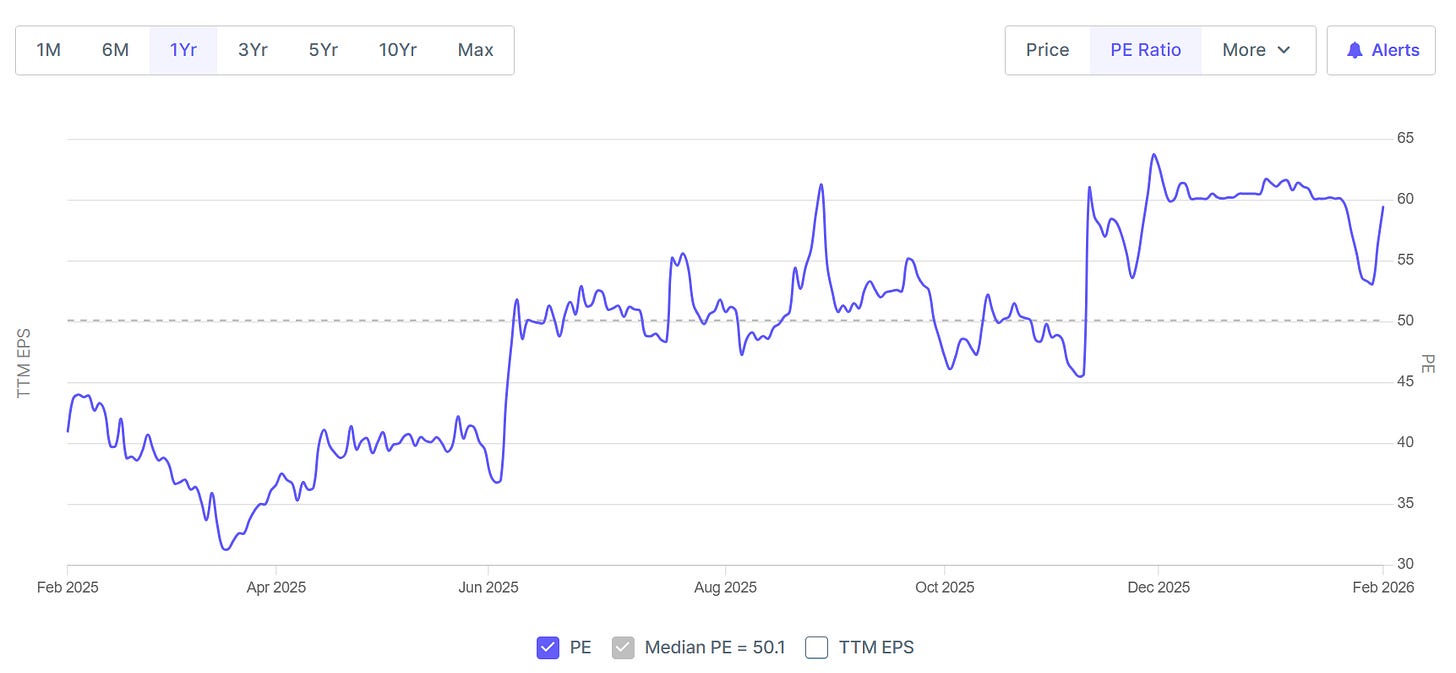

The stock is trading at a P/E of 60 times, which has inched up in the last one year despite a 30% correction in the stock price. This is because margins have compressed. And that is partly due to a decrease in exports in its automotive business - which is a high margins business. Trump tariff’s put a spanner in the works.

However the rare earth magnet opportunity gets me excited about this stock. The world wants to reduce it’s dependency of rare earth magnets on China.

If Permanent Magnets can build the capability to produce these neodymium magnets — which are used in mobile phones, EVs, MRI scanners among other things — I see a lot of potential in the company.

And for this reason, I believe this company should be in your watchlist.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]