Making money in the stock markets — is not a linear equation. You need patience. You need to read a lot. Understand market trends. Buy companies at fair valuations, when there is more room to grow. Make some contrarian bets. Take disproportionate risks at times. Understand your own self.

It’s one of those fields where you need to keep learning. Where there are no ‘experts’. And even seasoned investors cannot guarantee profits. Because — at the end of the day, no one knows what is going to happen in the future. Everyone’s trying to make a best estimate of what the future could be like.

There are > 5000 companies listed on the Bombay Stock Exchange (BSE). How many of them do you hear about on a daily basis? Once a company catches the limelight — everyone wants a piece of it. Analysts. Traders. Long term investors. Once everyone knows about an opportunity, there’s little money to be made.

The art, is to buy into companies that are working in the shadows and maybe get into the limelight sometime in the future.

That’s one of the ways to make multi-bagger returns. Again, the possibility of such returns also comes with a HUGE risk that you could lose a significant portion of your capital in the process.

It is a risk, to not take a risk ~ Warren Buffett

I want to talk about one such company, which is not on the mainstream media’s radar right now — but has been building in the shadows. It’s called Permanent Magnets. I heard about the stock from a friend.

The company has already delivered a return of 250X over the last 10 years — but if you see the chart below you'd see that the stock started moving up only recently from 2021.

Did something fundamentally change in the company’s operations? Did the management change? Was there a positive shift in the industry? And, is there more money to be made here? Let’s find out!

The Business

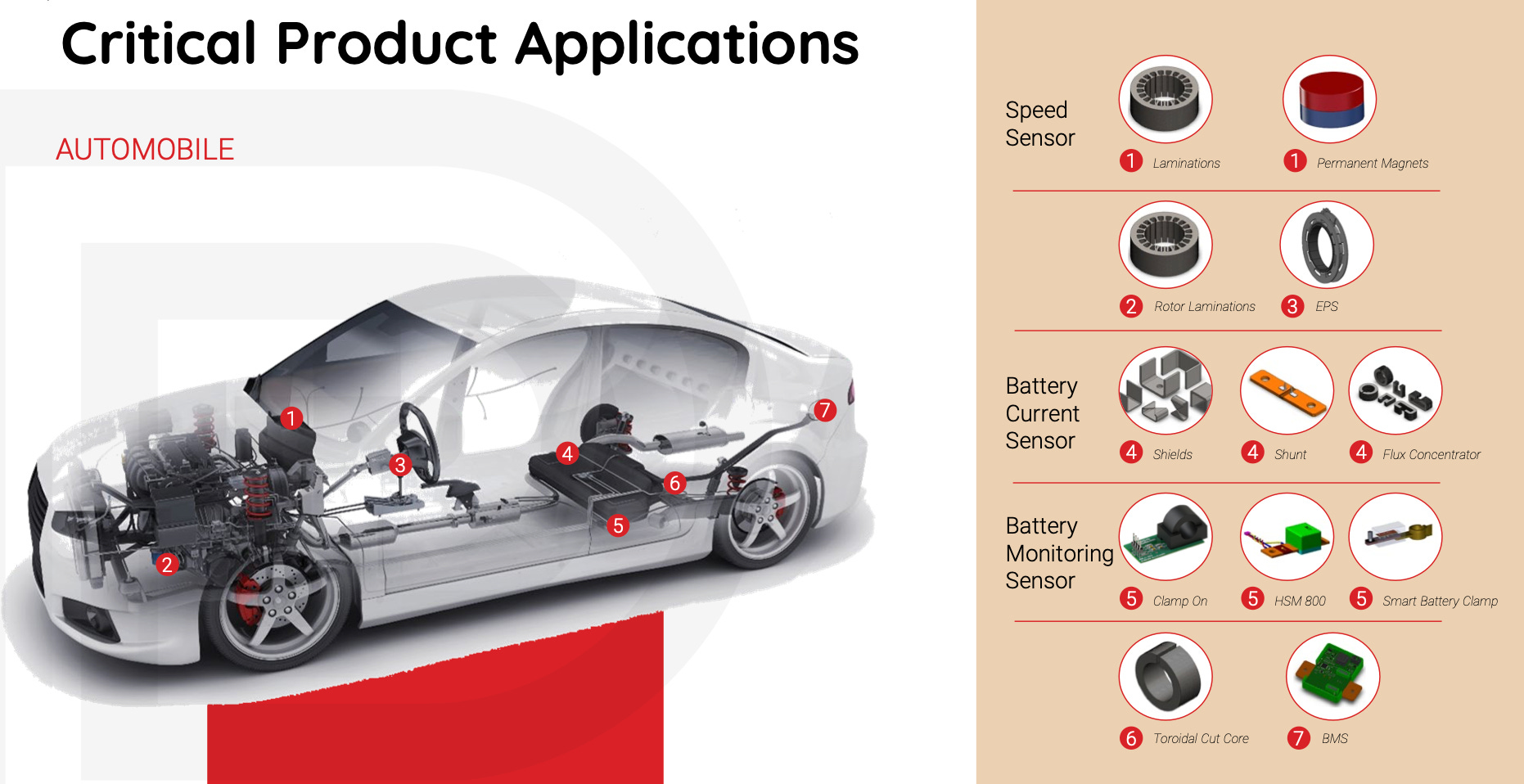

Permanent Magnets (PML) is in the business of making electrical components and assemblies that go into automobiles, energy & gas meters and find applications in many others industries.

PML has exceptional expertise in the fields of metallurgy, mechanical engineering,

electrical engineering and electronics, enabling it to offer comprehensive solutions to its clients.

The Company is involved in each stage of the product lifecycle i.e. design > prototype > production and has 350+ SKUs that go into the following applications (see images below)

A few things to note about the business:

For FY23, the Company derived 77% of total revenues from the electricity meters and automobile segment. It added new segments like — medical, aerospace, engineering and computers. Also supplied components for the Chandrayaan and Aditya L1 mission.

In terms of product portfolio — it derived 50% of total revenues from Hi-Perm products (i.e. Soft magnetic parts), 30% from shunts and 20% from magnetic assemblies.

Gas meters as a segment is slowly approaching the end of it’s product life cycle and it’s contribution to total revenues was only 4% in FY23 (from 18% in FY20)

The Company derives majority of its income from the export market (US, Europe, Asia) and ventured into new markets like China and France in FY23.

It is the preferred supplier of electrical components and assemblies to 50% of Tier-1 companies globally like Pegatron, Delta, Valeo, Siemens, Mahle etc. These Tier-1 companies in turn supply products to OEMs.

In electricity meters — PML is a supplier to the top 3 electricity meter companies globally — Itron, Landis and Jabil.

The Positives

The global smart meter segment is expected to be worth $55 billion by 2028. PML’s customers in this segment have a significant market share of the global electricity metering market and long standing relationships with these clients would provide PML a steady flow of revenue in the future. The penetration of smart meters in India stands at just 1.5% and as the penetration of smart meters increases domestically — that could benefit PML.

The Company has shown that it has the ability to add new technologies and build new capabilities. Established in 1960, the company was into manufacturing of magnets and magnetic assemblies.

However in 2005, the energy meter technology changed significantly impacting the magnets business. The global financial recession had a significant adverse impact on the business between 2007 - 2009.

However, since 2015 — the company reinvented itself under the leadership of its next gen. promoter Mr. Sharad Taparia. PML has been able to shift from traditional magnets to shunts and Hi-Perm (soft magnetic parts).

PML was able to transition from mechanical meters to smart meters by developing relevant products to cater to this transition in technology.

PML added a new segment — automotive — in the last 5 years, which has steadily grown and now commands 32% of total revenues.

PML is extensively focusing of creating larger pipeline of projects to counter product life cycles that come to an end (i.e. Gas Meters). They are increasing the funnel of projects which are at various stages of development (RFQ, design, prototype, commercial).

This ensures that while product life cycle for some of the existing products come to an end, other projects from the pipeline can kick in and the revenue loss is more than compensated by the scale up in new projects.

It works closely with customer’s design/product development team to develop new components/modules for the products, thus once components are accepted and incorporated in product design, the switching cost for the customer is quite high.

The company is focusing on increasing it’s capabilities from current sensing and casting to plastic moulding, wire harnessing, alloy making, heat treatment etc. thus preparing it to move from being just a component supplier to a module supplier (getting into complex assemblies).

The company has been able to increase it’s operating profit margins (OPM %) from 9% in March 2018 to 23% in March 2023. This means that the company has been able to add products that command high margins and tap into customers / markets that are willing to pay a premium for its products.

The company recently signed an MoU with Quadrant International for manufacturing Neodymium magnets and assemblies in India through a JV.

Neodymium magnets are a category of rare earth (RE) permanent magnets – specifically, neodymium-iron-boron (NdFeB). It is one of the strongest magnets commercially available, and has versatile applications.

Global demand for these magnets are forecasted to reach 750K tonnes by 2050 and these magnets are used in EVs, HEVs, wind turbines etc.

The supply chain for Neodymium magnets is concentrated in China & since OEMs are adopting a China +1 strategy — this JV, if it materializes could open up a new source of income for the company.

Points of Concern

Technology Obsolescence is one of the biggest concern points for the business. The company has been in existence from the 1960s, but saw a significant impact on its revenues in 2005 when the energy meter technology changed. More recently, the gas meter business is scaling down and the management expects this sector to completely go away in the next few years.

Given the risk above — it becomes important to track the pipeline of new projects that the company is undertaking i.e. THE ORDER BOOK. However, I wasn’t able to find a concrete number that could give me visibility into the order book from customers.

There’s no way to predict when the existing products could go obsolete and there’s no management commentary on this, apart from the fact that they acknowledge that technology obsolescence is a BIG RISK and they’re trying to move away from components to modules and building technological capabilities instead.

For a retail investor then, you’d have to put some level of trust that the management knows what it is doing and will be able to capture new projects before the existing ones come to the end of their product life cycle. The move into the automotive sector and the increase in gross margins since FY19 does give me that confidence, but you never know how the future will pan out.

The Company derives 52% of it’s total revenues from the top 10 customers and as per some analysts the largest customer contributes > 15% of total revenues. Apart from this 77% of total revenues are derived from the electricity meters + automotive segment. Any slowdown in the business of the top 10 customers OR slowdown in demand in automotive / electricity meters could hurt the topline and profitability.

The company has been successful in building it’s automotive business and supplies to Tier-1 companies that in turn supply to OEMs. It is a feature of the auto-ancillary industry to pass on the margin benefits of scale to OEMs — therefore as PML adds more customers + increases it’s revenues from the automotive segment, the gross margins might not necessarily go up and could see a marginal decline in the future if volumes significantly increase.

Working capital days have increased in the past few years due to increase in trade receivables and inventory levels — putting strain on the cash flows of the company. The company has also been investing into Machinery & Equipments, further putting pressure on the free cash flows. However, bad debts written off have been negligible signalling that the company is able to recover money from it’s customer — albeit after a long credit period.

As at FY23, the Company has contingent liabilities to the tune of INR 27 crores (approx.) which if it materializes would have a direct impact on the bottomline.

Conclusion

As of today [15 November 2023] — the company is trading at a P/E of 36 times with a market capitalisation of INR 1,100 CRORE. Compared to it’s peers, the stock looks reasonably priced.

My thoughts — I think the management knows what it is doing. They have added new capabilities in the past few years. Been able to grow a new segment — automotive — which forms a significant part of revenues and have added more segments like Aerospace, Medical Equipments, Computers etc.

It would be interesting to see if they’re able to significantly grow these new segments to compensate for the loss of revenues from the gas meter segment.

The management has been vocal that they want to shift from being just a component manufacturer to a module manufacturer. They’re incurring capex for this purpose and such a shift will take time & should have a positive impact on margins too. They have been able to add capabilities like die-casting, alloy making, heat treatment, plastic moulding etc.

In the absence of an ORDER BOOK — it is difficult to ascertain how much topline growth the company will be able to achieve in the next few years, however the management has guided a 20-25% revenue growth YoY, which looks positive.

They’ve been able to get into a MoU (non-binding) with Quadrant International — which is a world leader in magnetics. The potential JV with QI for manufacturing Neodymium magnets could turn out to be a BIG opportunity for PML. Tesla, entering the Indian market could potentially benefit the company as well.

The company has negligible debt. Good return ratios. Decent gross margins. 3 manufacturing facilities - with more capacity addition in the pipeline over the next 2-3 years. 200+ products in the R&D stage.

Most importantly — the stock is not talked about often in the mainstream media, which makes the company a tad bit more attractive.

Keep tracking the quarterly results, and keep the company in your watchlist. It looks like a good play on the growth in smart electricity meters and EVs.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]