6 months back, I had written how Apollo Micro Systems was undergoing a transition in its business model - with an ambitious target to become a Tier-1 Defence OEM.

It had acquired IDL Explosives — a company which makes industrial explosives & detonators — for INR 107 Cr, enabling Apollo to backward integrate and evolve from a sub-systems manufacturer to a full fledged weapons manufacturer.

India is going BIG on defence spending, with a 15% surge in defence budget to INR 7.85 lakh crore ($93 billion) with a focus on modernization, indigenous manufacturing & military readiness.

Apollo Micro Systems has a presence in every indigenous missile program of DRDO and is poised to be a MAJOR beneficiary in the future with the management shifting gears to capitalize on future opportunities.

Unit III Manufacturing Facility

The company is investing INR 250Cr+ in building a new manufacturing facility which will lead to an 8X increase in capacity.

This will allow Apollo to scale + take larger production orders + build its export portfolio.

Phase 1 of Unit 3 is completed and partial production in Phase 1 has begun. Phase 2 civil structure is in process. Expecting Unit 3 to be fully operational by June 2026.

Currently, the company relies on DRDO for testing of weapons systems. Going forward, once Unit 3 is set-up, testing will be done in-house. This will save time & increase project execution speed. Capex of INR 60 Cr planned for procuring testing equipment.

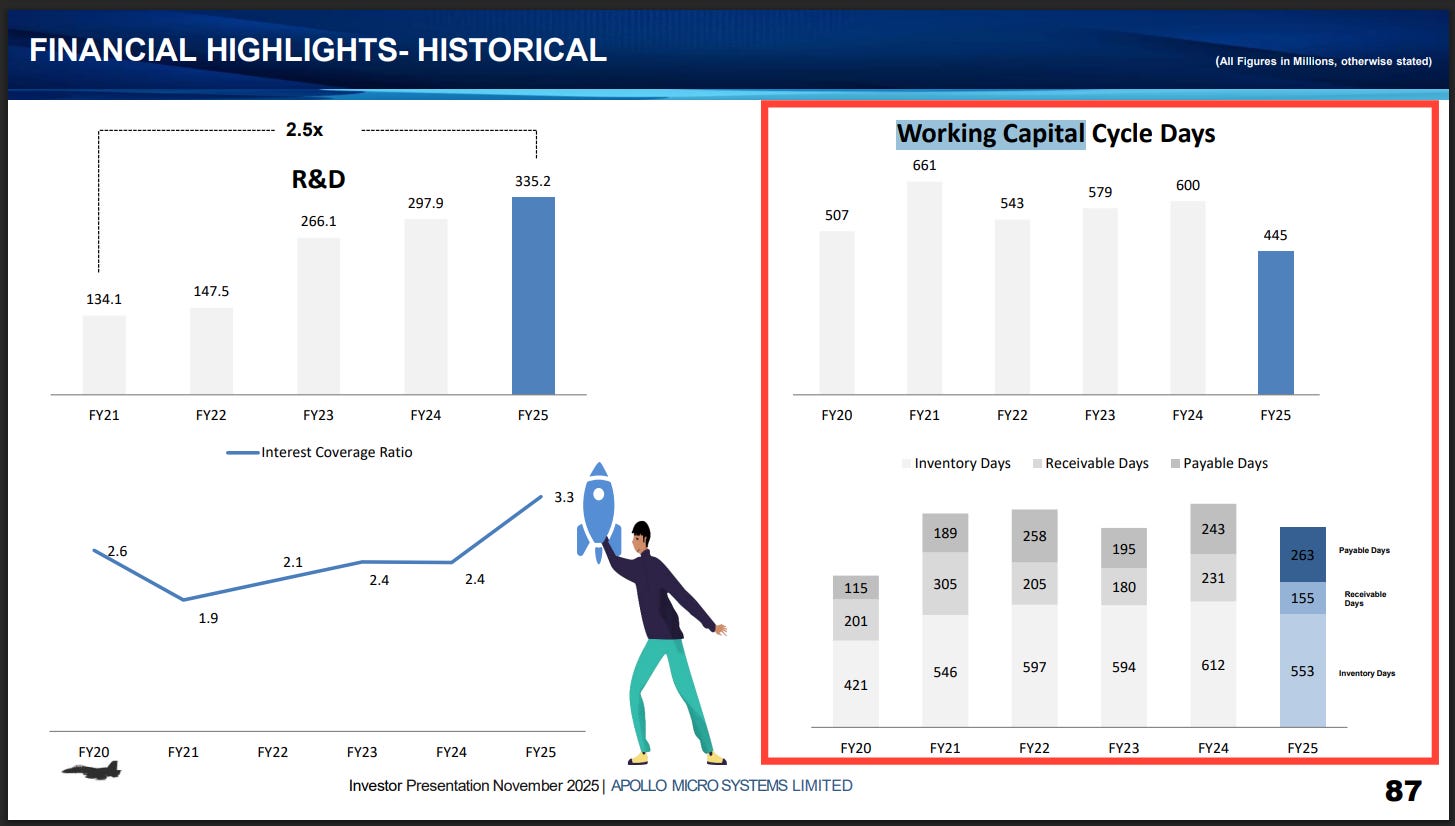

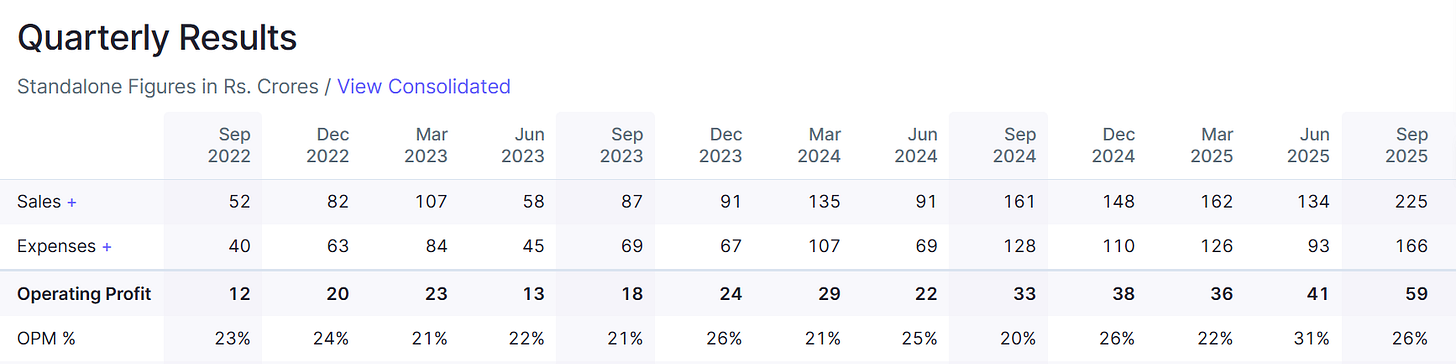

Financial Performance & Future Guidance

Several products are in transition from development / prototype to production. This is important, since a lot of working capital gets blocked in prototype development (NWC = approx. 450 days)

Currently, 30% of the order book pertains to production orders and the rest (~70%) pertains to prototype development. Management expects large production orders in the next few quarters — taking production orders to 45-50% of the order book.

Production orders = less working capital requirement + higher margins = better ROCE %

The company posted a robust H1FY26 with revenues UP 43% (INR 359 Cr) and EBITDA up 82% (INR 100 Cr). EBITDA margins expanded to 28% and PAT margins to 13.3%.

The management has forecasted 45% revenue growth for FY26 AND FY27 (excluding revenues from IDL Explosives) and is expecting EBITDA margin to be in the range of 26-28%, however margins would fluctuate quarter on quarter.

This means that revenue would double in the next 2 years. PAT might not expand at the same rate, since the company is incurring significant CAPEX to scale operations.

Revenues from IDL Explosives will be consolidated with Apollo from Q3 onwards. It is loss making currently and the management is taking various initiatives to ensure IDL achieves break-even by Q2FY27.

The idea behind acquiring IDL Explosives was to integrate explosives within current weapon systems + manufacturing critical high energy explosives for different calibers of artillery.

Existing Order Book

As at 30 September 2025, the company had an Order Book of INR 785 Cr [~1.4 times FY25 revenue]. However, going through the recent press releases [upto 08 February 2026] — Apollo added another INR 695 Cr in orders.

INR 420 Cr order from Coal India to IDL Explosives for supply of bulk explosives. Execution timeline not defined.

INR 150 Cr from a private company, execution timeline not defined.

INR 100 Cr from a private company for supply of UAVs [drones], to be executed within 4 months.

INR 25 Cr from a defence PSU, execution within 18 months.

Apollo received transfer of technology from DRDO for Laser based Directed Energy Weapon (DEW) which uses high powered laser beams to destroy targets. Could be a big opportunity for the company.

Programs & Development Projects

Apollo is working on a LOT of projects at various stages of development. Highlighting some of the key projects below:

Multi-Influence Ground Mine (MIGM) — is an underwater mine developed by DRDO & Indian Navy, designed to detect and destroy stealth ships & submarines. Order potential of INR 4,000 CRORE to be split between BDL & Apollo. BDL would bid for this order and then sub-contract part of the order to Apollo. Exact value of order inflow to Apollo not revealed.

Torpedos — received approval from Ministry of Defence for advanced light weight torpedos (ALWT). Expecting order flow of electronic heavy weight torpedos (EHWT) to BDL. BDL would sub-contract part of the order to Apollo.

Naval projects — working on anti-submarine rockets, underwater mines, ground to air guided rockets, torpedo decoy systems, torpedo homing systems.

GRAD rocket — entered in a partnership with an American company for developing a rocket motor, where the GRAD rocket is being developed by Apollo.

BrahMos — working on one sub-system + participated in 5-6 projects of which technical evaluation is ongoing. Expecting orders in this segment in the next few months.

Various technologies being developed by Apollo Micro Systems

Management is expecting 12-13 full fledged weapon systems to move to production in the next 2-3 years on a LARGE SCALE basis.

Some concerns

Shareholding pledge — Promoters have pledged part of their shareholding (35%), to raise money to invest back into the business — which is quite a risky strategy. They are planning to reduce pledge % to ZERO in the next 6 months.

Working capital — Receivables have significantly increased to INR 360 Cr (equal to H1FY26 revenue). Management believes this should reduce in Q4. Going forward, as more production orders flow (which have payment terms of 30 days), receivables should go down. This is a very important metric to track, as an investor.

FDI — Government of India has allowed foreign companies to setup Indian wholly owned subsidiaries (WoS) to qualify as vendors for defence projects. There are certain criterias like Indigenous content (IG) that needs to be adhered to. This could increase competition in general for defence players in India.

Conclusion

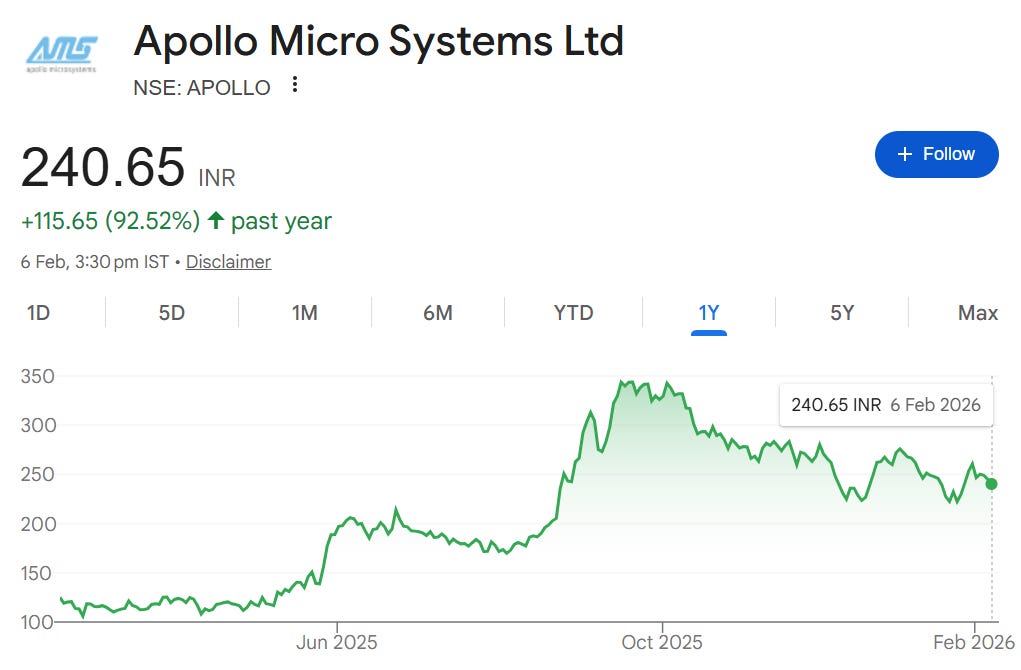

At a market capitalization of INR 8,500 Cr, the company is trading at a P/E of 100 times. Not cheap by any stretch and the market seems to have priced in the growth upto FY27.

What would be important to track in the next 3-5 years:

How much can revenue grow beyond FY27? Can Apollo tap into the export market? Can it truly transform into a Tier-1 OEM? Can it bag large orders? (>1,000 Cr)

How many projects convert from prototype > production? Can margins expand further?

The Government is serious about the defence sector and they’re serious about Make in India and indigenous technologies.

Apollo is making the right moves.

Expanding capacity. Working on various technologies that could go into production in the next 2-3 years. Expecting more production orders in the future. Promoters have increased their stake in the company, which is a positive sign.

As investors, this is a company [and a sector] that deserves to be tracked.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Plz tell ur opinion about sci stock

I have heard that govt planning to invest in water transportation 80 lakh crore next 5 year . So what is d future of shipping corporatio ?