May 25th.

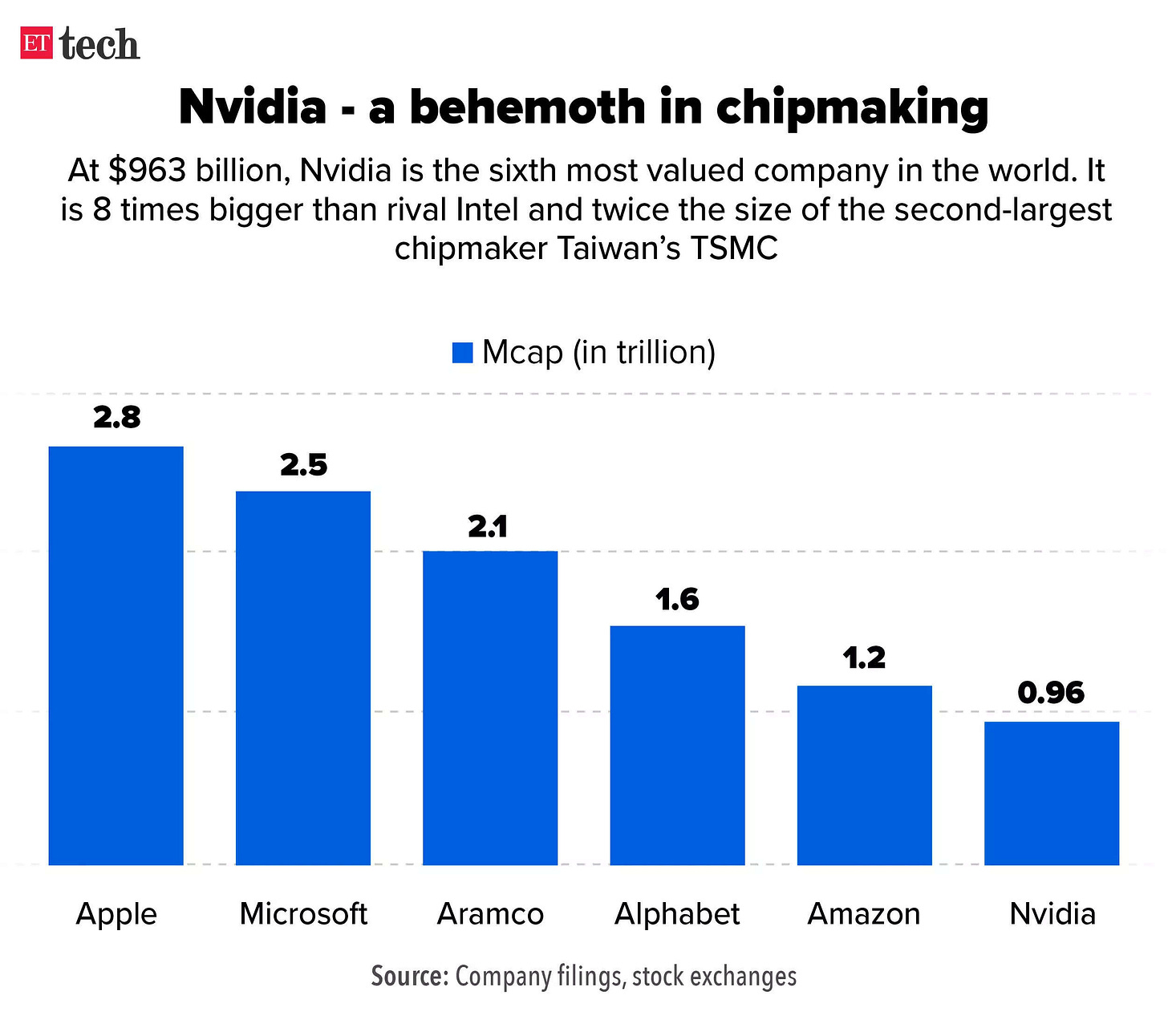

Shares of NVIDIA are on a tear. UP 25% IN A SINGLE DAY. Adding > $200 billion in market capitalization in one shot taking it’s valuation very close to $1 trillion.

I am a shareholder in the company & I was very happy to see a sudden surge of green in my portfolio. But it got me scratching my head. You don’t normally see companies the size of NVIDIA pop by 25% in a single day.

What caused this sudden surge in the share price?

NVIDIA announced it’s Q1FY24 results and they were pretty darn good. But it wasn’t the Q1 results that excited investors. It was the guidance/forecast for Q2FY24. Analysts were expecting revenues of $7.1 billion for Q2FY24 — however NVIDIA forecasted revenues to be $11 billion for the second quarter on the back of higher demand.

And that was it.

A moment of euphoria took over. Everyone was stunned. You DO NOT see such a stark difference in analyst estimates vs company forecasts. Investors went batshit crazy. The share price went berserk. And just like that NVIDIA became one of the most valuable companies in the world [for the moment].

What does NVIDIA do?

It is in the business of making Graphics Processing Units (a.k.a GPUs). GPUs are widely used in gaming, deep learning, artificial intelligence and high performance computing.

Jensen Huang — CEO of NVIDIA, very early on understood where the markets would be heading in the future. The need for high processing speed. The ability to solve complex computing problems. Jensen knew these problems would arise in the future & invested billions of dollars to develop capabilities to cater to that demand.

NVIDIA’s H-100 GPU is what allowed ChatGPT to make it’s blockbuster debut last year. Training AI models requires chips with high amounts of memory and crunching massive amounts of data. A set of eight of the most advanced chips can cost $300,000 and companies are buying thousands of these chips from NVIDIA.

AI is not slowing down by any means. The demand for GPUs is going to exponentially increase in the future. The biggest beneficiary? NVIDIA. It dominates the market for GPUs and even with companies investing a LOT of money to develop GPUs in-house, analysts expect NVIDIA to sustain a dominant market share of >90% for the foreseeable future.

Plus, the demand for GPUs is not only limited to AI. Gaming, Data centers, Autonomous vehicles and a host of other technologies are going to need GPUs to function efficiently.

Conclusion: NVIDIA is perfectly poised to capitalize on the growth in AI. It has a virtual monopoly in the GPU market. Demand is outstripping supply. It is becoming a one stop shop for what companies need to drive their AI ambitions and controls the entire ecosystem —hardware + software both.

If you want to bet on the growth of AI, NVIDIA is one of the best stocks to put your money in.

However, there’s ONE BIG BLOCKER. And that is..

Crazy Rich Valuations

I’ve painted a very rosy picture in the section above. NVIDIA is going to absolutely crush it. The analyst community have a simple verdict — BUY NVIDIA.

But here’s the problem. It is too [goddamn] expensive at the current valuations. At the time of writing this article, NVIDIA is already worth > $1 TRILLION.

That’s why I have a simple theory. When in doubt, look at the numbers — because the numbers never lie. Here’s a breakdown:

When we say that NVIDIA is worth $1 trillion, what the market is indirectly telling you is that at this point in time, all the future net profits of NVIDIA discounted should be = $1 trillion.

To justify such a valuation, a company is expected to generate net profits after taxes of around $60-80 billion in a year. [see Apple’s results]

HOW MUCH PROFITS IS NVIDIA CHURNING OUT? Last quarter it generated a net income of $2 billion. Maybe for FY24 it would be able to generate net profits of $12-15 billion given the increase in its forecasted revenues.

To go from net profits of $15 billion to $80 billion is a looooooooooong journey. Significant ramp up in production capabilities. Unparalleled revenue growth. Continuous increase in demand for GPUs. The ability to maintain a dominant position in the market and fending off new players/big tech. The execution has to be flawless.

It is a tall order. Even if you disregard the current P/E ratio of 210 times — I don’t see a lot of upside. Let’s say you invest $10K in the company today. For your investments to double, NVIDIA would need to be worth atleast $2 trillion. That’s a lot of zeroes.

A prudent strategy could be to wait for a correction. One bad quarter, and the market could punish the stock. And maybe then, the stock would become attractive.

Until then, keep your eyes on other high potential (under the radar) AI stocks.