Q. Is it the name of a new crypto token? Or a new sunscreen being launched? Or, is it a sexually transmitted disease?

A. None of the above.

Sam Bankman-Fried (aka SBF), is the founder of FTX - a cryptocurrency exchange famous for buying & selling crypto derivatives.

A few weeks back, Sam was considered as one of the untouchables in crypto circles. He was the guy with gravitas. One tweet & he could move the crypto markets. He was also considered as a ‘savior’ since FTX promised to bail out a few failed crypto startups in the past.

The crypto world felt a little safer when Sam was around. He was a silent guardian, a watchful protector. A Dark Knight.

His objective was simple. To create the largest possible positive impact on the world.

And then, in one fell swoop - everything literally came crashing down. Sam resigned as CEO of FTX. Billions of dollars got chipped away from SBF’s networth. FTX froze withdrawals & filed for bankruptcy.

All of that, in a matter of 8 days. 8 FREAKING DAYS.

The Beginning of the End

At it’s very core, the collapse of FTX is a business strategy. One that would be taught in B-schools across the world for decades.

Who was the architect, the mastermind pulling the strings?

Changpeng Zhao (also known as CZ).

CZ is the founder & CEO of Binance, the largest cryptocurrency exchange in the world. One of the most prominent names in the crypto world, like our friend SBF. In my opinion, after what he did to FTX - one of the most ruthless & shrewd business operators out there.

So what did CZ do that triggered events of such magnitude that would shake the very core of the crypto industry?

A Big Hole in Alameda Research

Before we talk about what CZ did, let’s build some ground work to understand how FTX got into this mess.

In 2017, SBF co-founded Alameda Research - a trading firm that he used to trade in cryptocurrencies. He made a fortune trading cryptos, so much so that he started a cryptocurrency exchange in 2019 - FTX.

With time SBF’s popularity (and networth) increased. FTX became the 4th largest cryptocurrency exchange in the world & it’s valuation reached a staggering $32 BILLION.

However, hidden in the background - SBF was making some reckless moves:

Rumoured to have lent out $10 BILLION in customer deposits to Alameda Research to fund risky bets taken by the trading firm. [if this is proved, SBF would be going to jail]

Bailing out bankrupt crypto companies like BlockFi & Voyager Digital, which put a lot of strain on Alameda Research.

Launched FTX Ventures which managed > $2B in assets.

Contributed $40 million as political donations & was one of the biggest individual donors to Joe Biden.

I want to talk more about #1.

In traditional banking, when you lend money - the borrower gets cash in his bank account. However, something like this must have happened at FTX:

a. Customer deposits USD $/Other fiat currency in FTX.

b. FTX issues FTT (a token printed & issued by FTX out of thin air) or some stablecoin to the customers. Where did the fiat currency go? I have no idea.

c. FTX gives a loan in the form of FTT tokens/stablecoins to Alameda to bloat up it’s balance sheet.

d. Alameda Research, based on it’s BIG balance sheet - takes more loans from other lenders & uses it to make risky bets in the crypto markets.

e. Some of the risky bets don’t work out. FTX lends more customer deposits. Alameda’s assets & liabilities continue to grow.

f. The cycle continues without any problem since the customers are not withdrawing ALL their funds immediately.

How do you break the cycle? You devise a plan that creates panic among the customers so that they withdraw all their deposits at one go.

CZ’s Masterstroke

I don’t know if CZ knew about what FTX was doing in the shadows. But what he pulled off, can be termed as one of the shrewdest business maneuvers I have ever seen.

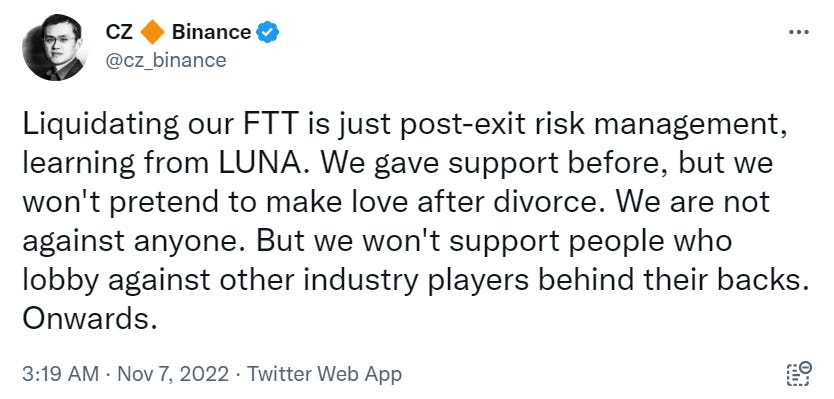

This was the tweet that sent shivers across the crypto markets. People panicked. They started selling FTT & it’s value plunged > 80% in one day. Rumors started circulating that this could cause FTX to collapse - which seemed a little crazy to believe at that time.

But as the fear spread, customers rushed to withdraw their deposits from FTX. Guess what? SBF knew that FTX didn’t have the money to pay back ALL of their customers.

SBF scrambled to get funds before the customers found out the truth. He approached CZ for a potential acquisition. CZ agreed to invest. SBF was relieved.

And then, CZ declined to invest, based on the results of it’s due diligence of FTX. That was the last straw. Every FTX customer panicked. Users rushed to withdraw > $6 BILLION from FTX.

FTX didn’t have the money [obviously] & froze withdrawals, swiftly followed by the resignation of SBF as the CEO of FTX & FTX filed for bankruptcy.

In a few tweets, CZ got rid of one of his biggest competitor.

You either die a hero, or you live long enough to see yourself become the villain ~ Harvey Dent, The Dark Knight.

Sam Bankman-Fried, wasn’t the hero people thought he was. If anything, he is probably one of the biggest conman of this decade.

Meanwhile, can the customers get their money back? We’ll find that out in the coming months.

Until then, hang tight. Make sure you keep your cryptos in your own personal custody.