Warren Buffett and Charlie Munger — one of the most successful investors in the world, often talk in parables and quotes. Quotes are easy to remember. They build depth in our understanding about complex topics.

One of their most famous quotes — that I personally live by — is:

‘Rule #1: Never lose money. Rule #2: Never forget Rule #1’

When I first came across this quote, I thought it was absolutely absurd. The markets are extremely unpredictable. You don’t know what’s going to happen. The tech meltdown of 2001. The 2008 financial crisis. The COVID pandemic. Trump’s tariff tantrums. War in several parts of the world. Trade disruptions.

There’s no way you can accurately predict the movement of the markets on any given day. It’s a game of probabilities - that’s what the stock market is.

In such a market — it would be very improbable that you would never lose money. Heck, even Buffett lost money in some of his investments throughout his illustrious career.

Losing money is part of the process of making money. ~ Baba Siddhartha

What is this rule all about then? What does Buffett mean when he says ‘Never lose money?’

How to decrease the probability of losing money?

This is my interpretation of the quote. When Buffett says to ‘Never lose money’ — what he’s trying to say is to decrease the probability of losing money. What NOT to do in the markets.

#1 Don’t trade in F&Os

One of the easiest ways to lose money — is to trade in Futures & Options. In fact, as per a SEBI study — 91% of individual traders made a loss in the equity derivatives segment in FY25. A similar trend was observed in FY24.

Why? Because firstly unlike investing in equities, F&O trading is a zero sum game — meaning a trader’s profit comes from another trader’s loss. You’re dealing with high frequency traders [like Jane Street]. Complex algorithms. Traders with access to Bloomberg terminals.

A lot of traders are drawn into F&O trading with ‘get rich quick’ schemes. And trust me, most of the times they turn out into a ‘lose money quickly’ scheme.

Unless you’re a genius, or you’ve made your own algorithm or you have a perfect F&O strategy — long term, your portfolio will be in RED. My advice — avoid F&Os. Stick to equities.

#2 Don’t buy into expensive valuations

Another way to lose money — is to buy a stock when it’s trading at crazy valuations — in another words, at a VERY HIGH P/E ratio. In those cases, the upside is limited.

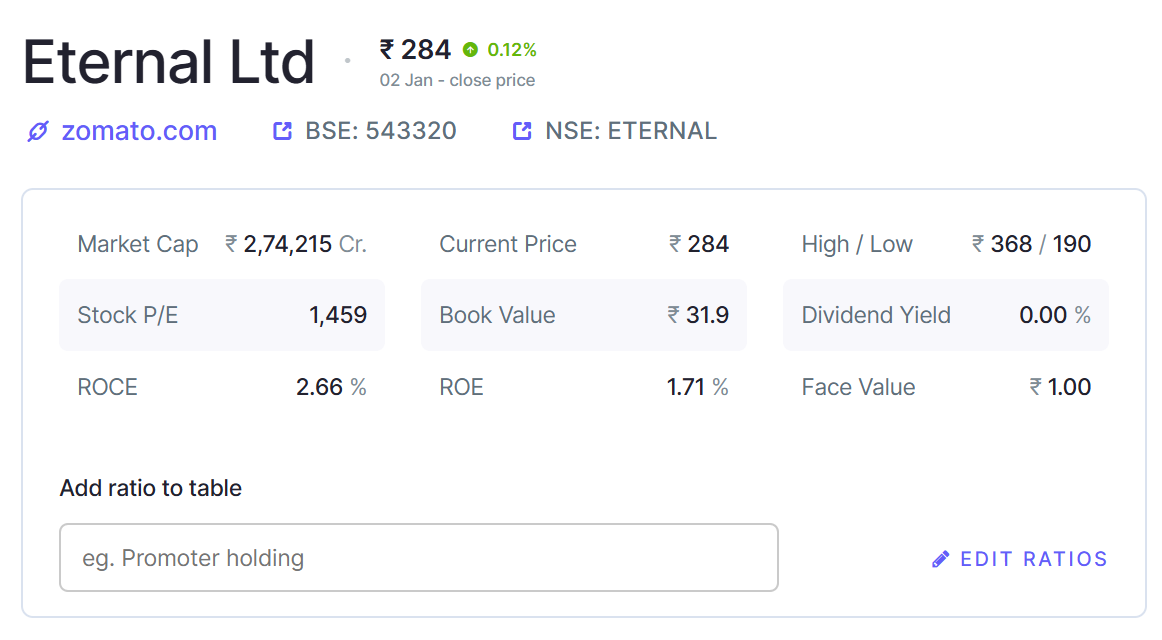

Eternal is a market darling. It is valued at a market capitalization of INR 2.74 trillion and is trading at a P/E of >1,450. Now, this is a crazy valuation.

Simple analysis

Eternal’s Q2FY26 revenue was 13,590 Cr, on which it earned a PAT of 65 Cr. That’s a PAT margin of 0.5%. The company is investing heavily in build out of dark stores and scaling Blinkit, which means profitability will be compressed in the near term.

As as investor, if you invest at this price point — for your investment to double — the company’s market capitalization must double to INR 5.4 trillion — which means profits must increase 40x / 50x from here to justify such valuations. This has a very low probability, even after Blinkit scales.

What is the probability of you losing money investing at current valuations in Eternal? Very high. You would be wise to look for other companies trading at fair valuations, with a higher upside potential.

#3 Avoid low ROCE stocks

Return on capital employed [ROCE] is my favourite metric while evaluating companies. Any company which is not able to generate a ROCE of >5% over the long term, shouldn’t be in the business of doing business.

Because, the company is not even beating inflation (in India). It would be a better decision to shut down the business and invest in FDs / Liquid funds and earn a risk free return of 5-6% instead.

What this also means is that the management of the company are probably not good allocators of capital. You can use the ‘5Y ROCE %’ to filter out deadwood from your analysis.

Obviously, this is not applicable to companies undergoing a transformation. It is possible that a company is reporting low ROCE, because it is heavily investing in a new vertical, or a new business — and for a period of time, ROCE + profitability would be compressed.

#4 Don’t buy penny stocks

Penny stocks are companies with low market capitalization — less than INR 500 Cr — known as micro-caps. These stocks have low liquidity. Are prone to market manipulation [in some cases]. Most of these companies don’t publish any information about their business — so you don’t really know what the management is doing.

Unless you find a micro-cap, which is transparent about it’s business, publishing promising earnings report and communicating with investors — general rule for early stage investors — stay away from micro-caps.

When you don’t know what a company is doing, an investment turns from a calculated bet to a full blown gamble.

#5 Don’t act on tips

Your money is your responsibility. And therefore, you must do your own research before you take ANY investment decision. You can join investment groups. It’s good to listen to ideas. But, you should never act on tips — even if you think it is an expert who is giving the tip.

Pro tip — there are no experts in investing. Only lifelong students. Curiosity to learn, is what differentiates great investors from average investors.

There are many other factors to look at — (i) decrease in promoter shareholding (ii) high contingent liability (iii) management consistently missing estimates (iv) businesses with low purchasing power etc. — that you can look at before investing.

But these 5 broad items, should in general, lower the probability of you losing money in the markets.

Keep learning about new businesses and sectors. Increase your investing acumen. Inculcate patience within. And embark on a journey of wealth creation. 🚀

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]