There is no debate, that electric vehicles are the future of mobility. Its a high growth industry, with volumes increasing exponentially YoY.

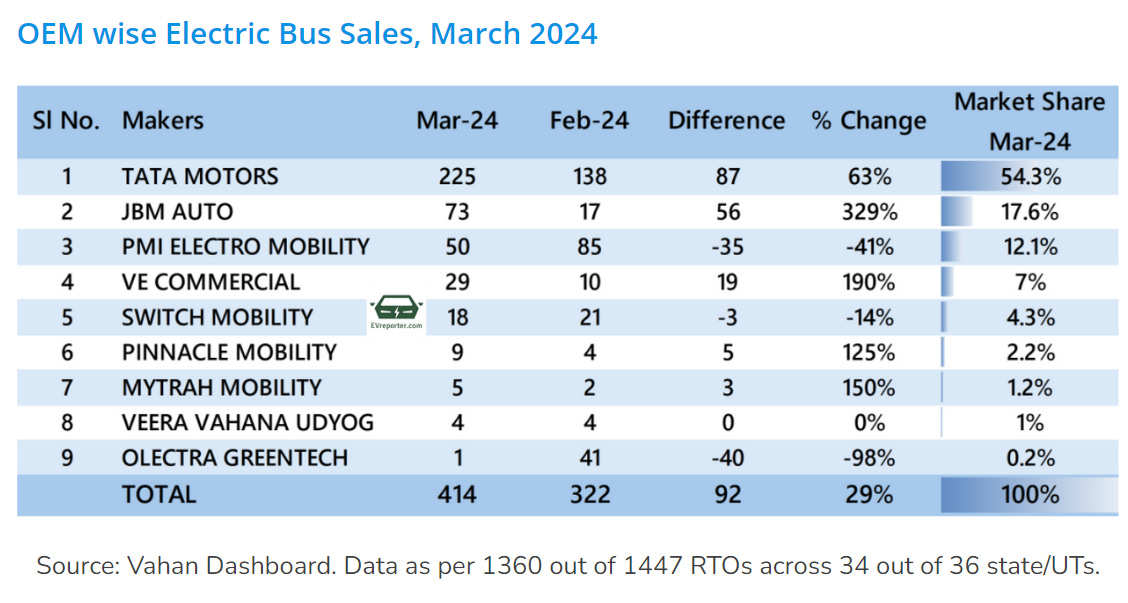

It’s evident from the chart above, that e-buses are still significantly under-penetrated. Players in this space are slowly ramping up capacity, because the Government has a plan to convert 8 lakh diesel buses into electric buses in the next 6 years.

Olectra Greentech — is in the business of manufacture of electric buses & polymer insulators, however the majority of the revenue (>85%) comes from sales of electric buses.

Olectra’s stock has run up significantly, despite a weak FY24 performance — because the future looks quite rosy for players in this segment and investors continue to be willing to pay a premium for EV stocks.

Can Olectra capture a significant market share of the e-bus market in India? Can it scale up fast enough to deliver on it’s order book? Can it get into other segments like e-trucks / e-LCVs?

These are the questions that investors should concern themselves with. These are the questions that I will try to answer in every quarterly update. So, let’s jump right into the Q4 performance.

ALSO READ: My article on Olectra’s business model and an analysis of the Q3FY24 results to build more context before you jump into the Q4 results.

Q4 Performance

It was a subdued performance with a decline in both the topline + bottom-line. The management gave two reasons for the average performance in Q4:

Supply chain constraints — A few quarters back, the Government of India had introduced battery safety norms which required additional testing / certifications. As per the management this testing was completed by Olectra in Q2 itself — but since the battery cells + battery technology is imported from vendors outside India (including BYD), those vendors faced various constraints in ramping up production, hence impacting the production of e-buses by Olectra.

Shifting to a new manufacturing plant — Olectra started pilot production from it’s new greenfield plant in Feb’24. Around 30 e-buses were manufactured and sold from the new plant. Because of this transitionary phase, there was a reduction in production volumes. The management estimates the transition to be completed by Q1FY25.

Which means that Q1FY25 is going to be subdued as well.

Key highlights

Order book of 10,969 e-buses as on 31 March 2024 — became the first OEM to achieve 10K+ e-bus orders.

Management expects sales of 2,000 e-buses in FY25. 5,000 e-buses in FY26. 10,000 e-buses in FY27.

I’d take these estimates with a pinch of salt, given how Olectra has consistently missed sales estimates.

Delivered 1,695 electric buses and 51 e-tippers till 31 March 2024 since the inception of the company.

Delivery of 165 e-buses in Q4 and 541 e-buses in FY24.

Sale of e-buses YoY 41 orders of e-tippers in hand, with delivery of 34 e-tippers in FY24. No sales of e-tippers in Q4. Ramp up in e-tippers is yet to happen, the management has been conducting a lot of demos / trials. Olectra is trying to reduce the cost of the e-tipper since it is a premium offering.

All the e-tippers till date have been sold to MEIL — Olectra’s holding company.

Homologated and completed AIS 038 certification for the batteries for all bus models.

Extended cooperation agreement with BYD till 31 December 2030. Olectra is currently dependent on BYD for sourcing of battery cells / battery technology.

Ramp up of manufacturing capabilities — construction of greenfield project in Hyderabad in full swing, with commencement of partial production.

Total capex planned for the plant is INR 700 CRORE out of which the company received Board approval to take a term loan of INR 500 CRORE and the balance (INR 200 Cr) will be taken from internal accruals / net profits.

The plant will have a capacity to produce 5,000 e-buses in an year which can be scaled to 10,000 e-buses.

Lowlights

Management missed estimates — yet again. In the last quarter, the management guided to sell 650-750 e-buses for the full FY24, but they managed to sell only 541 e-buses — which is a BIG miss if you ask me.

For FY25, the management has estimated that they will sell 2,000 e-buses [this # has been reduced from 2,500 as per the earlier FY25 forecast]— but Q1FY25 is going to be subdued with estimated sales of 150-200 e-buses.

Can Olectra sell 2,000 e-buses in FY25? Given the historical track record of the management, I’d say the probability is quite low.

Olectra participated in the PME tender but it was awarded to competitors. There was no management commentary on why Olectra couldn’t win any orders from PME.

There was a slight reduction in e-bus pricing on the Mumbai BEST Order. If price erosion continues, margin expansion could be difficult going forward.

Olectra operates on a cost plus model — so any reduction in battery costs (which is expected in the next few years) — would be passed through to the final customer. Again, margin expansion would be difficult to achieve with the cost plus model.

Conclusion

I’d like to see Olectra deliver on it’s estimates for Q1FY25 to start with along with the complete transition of its production from the current plant (lease) to the new greenfield plant (owned).

Would like to see Olectra grabbing more market share compared to its peers (see chart below).

My thoughts?

At a P/E of 187, I think it is quite expensive and margin expansion would come primarily through sale of more e-buses and NOT through increase in product pricing / reduction in costs.

Probably not the best time to make an entry into the stock.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]