I’ve been following Arkade Developers for quite some time and full disclosure, I have taken a small position in the company. After going through the recent results, I further increased my position in the stock. I believe, it has the potential to create significant shareholder wealth.

Why do I say so? Let’s take a look at the recent results.

Business Updates

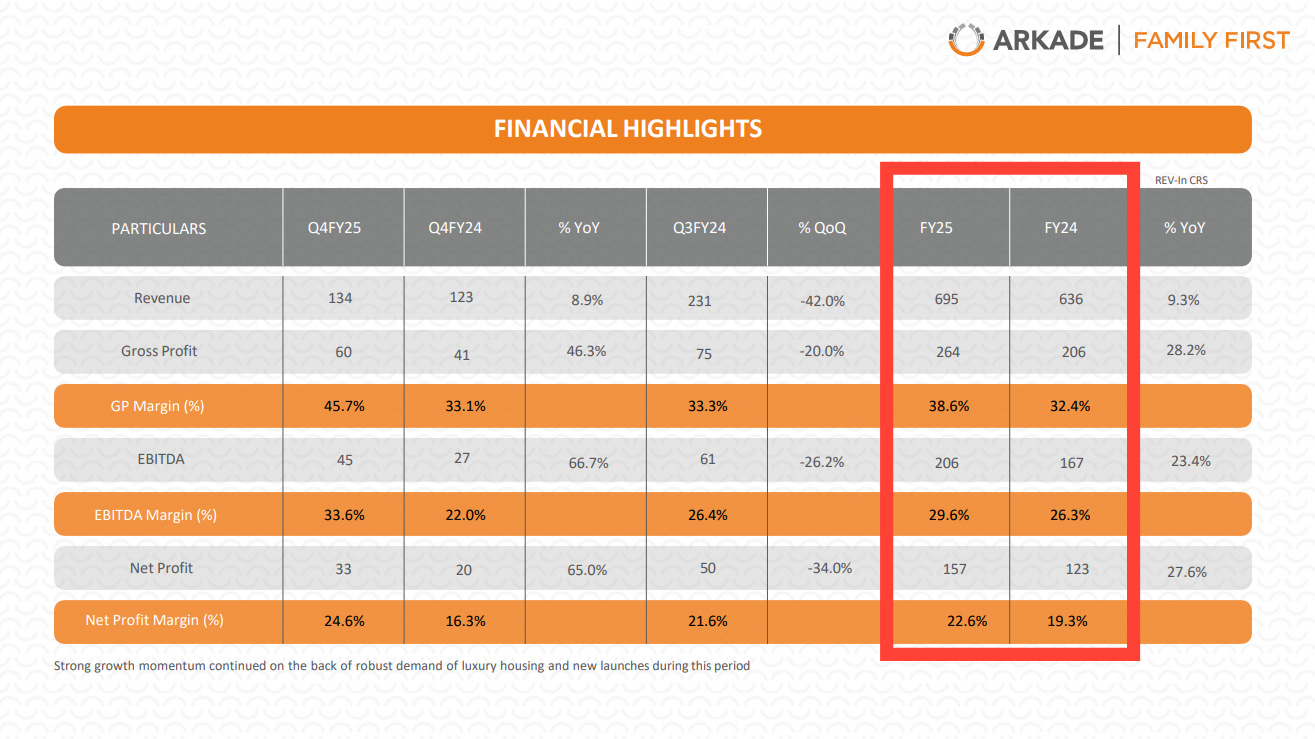

Performance — The company recorded it’s highest ever pre-sales of INR 773 Cr for FY25 (20% YoY increase) and sold 2.5 lakh sqft. Revenue was flat for FY25, however there was a major improvement in margins. (see chart)

Financial metrics of Arkade (Source: Q4 Investor PPT) Guidance — management abstained from giving a specific revenue # for FY26. However, several major updates were given. The company plans to launch 4 projects in FY26, out of which 3 are redevelopment projects.

Expecting a 20% CAGR in Pre-sales and GDV (Gross Development Value) going forward.

GDV under execution is INR 2000. GDV under pipeline is INR 6,790. Resulting in a total order book of INR 8,790 (approx.). The order book is expected to be realized over the next 4-5 years.

EBITDA margins are expected to be in the range of 27-33%.

Redevelopment opportunity — as per MCHI-CREDAI, more than 25,000 buildings are eligible for redevelopment in the MMR region, with a project value of INR 30,000 CRORE, which means that property rates and rentals in Mumbai aren’t going down (ever!).

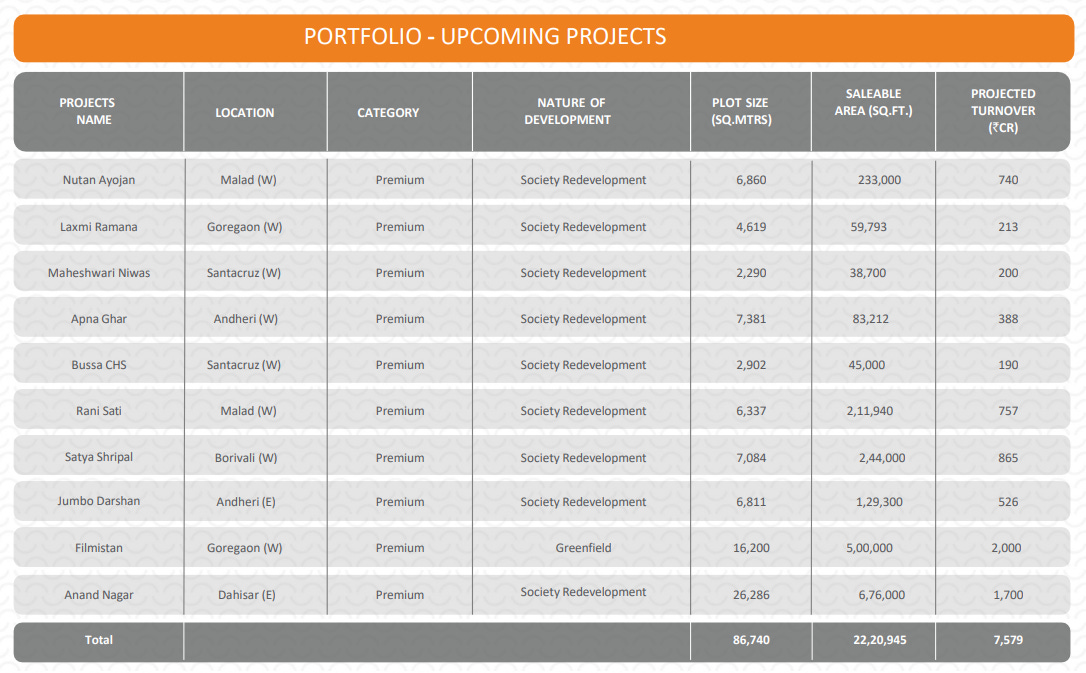

Arkade signed key redevelopment agreements in Borivali (W) + Malad (W) with estimated GDV of INR 850 Cr & INR 750 Cr.

The company secured one of the largest redevelopment projects to date, a 6.5 acre land parcel in Anand Nagar, Dahisar (E) — with an estimated GDV of 1,700 Cr.

Greenfield development — Arkade acquired a prominent 4 acre land parcel in Goregaon (W), currently leased to Filmistan. The company plans to design 3 / 4 / 5 BHK + penthouses in this land parcel, marking its entrance into the uber-luxury segment. [a.k.a high revenue, high margins]

I like the management. They are fiscally prudent (especially for a real estate developer) with net debt below ZERO. Great ROCE. Low unsold inventory. Management generally avoids taking debt as much as possible — they haven’t fully utilized the IPO proceeds either.

The USP of the brand is that they deliver projects before time, in an industry plagued with delays. They have a razor focus on the Mumbai Suburban (MMR) region, which is a BIG enough opportunity. No mindless expansion. Not throwing away cash to generate growth.

The company wants to achieve cumulative revenues of INR 10,000 Cr in the next 5 years. With a baseline PAT margin of 20%, that translates into net profits of INR 2,000 Cr.

Therefore, at a market capitalization of INR 3,600 Cr — I think there is a LOT of room for the company to grow. Management knows the business well. They’re great capital allocators. Good executors when it comes to delivering on time.

All the ingredients required, for a great long term investment.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Yes, even i am tracking this gem and i am impressed by the execution by the management

Thanks for the updated. This is one developer (albeit a small MCap) that is still available at reasonable P/E with zero debt.

One aspect we need to monitor is the FCF, while this QR it is probably negative due to the land parcel purchase.