Q3FY25 Update : Arkade Developers

and why you should keep a close watch on this small cap real estate player

Buying a house in a city like Mumbai isn’t a piece of cake. Real estate prices have skyrocketed [even further] in the last few years. Rentals are red hot. To buy a 2BHK anywhere in the Western suburbs — you’d have to shell out anywhere between INR 1-2 Cr.

To save money, you can buy a property that’s under construction that can save you anywhere between 10-30% of the retail price per sqft. But that’s risky. Projects can get stalled due to multiple reasons. And some real estate developers are known for not returning back investor money in such cases.

But what if — there was a builder that was known for delivering projects on time [in some cases, before time!]. A builder with a strong balance sheet, a high return on capital employed. Zero net debt.

Enter Arkade Developers. A company which is among the top 10 luxury developers in the Mumbai Metropolitan Region (MMR) — one of India’s most lucrative real estate markets.

I wrote a piece on this company a few months back doing a deep dive covering the fundamentals which you can read here.

Q3FY25 Updates

I’m not going to talk about the business model in this article. The idea is to look at the latest quarterly development and get a grip of where the business is moving.

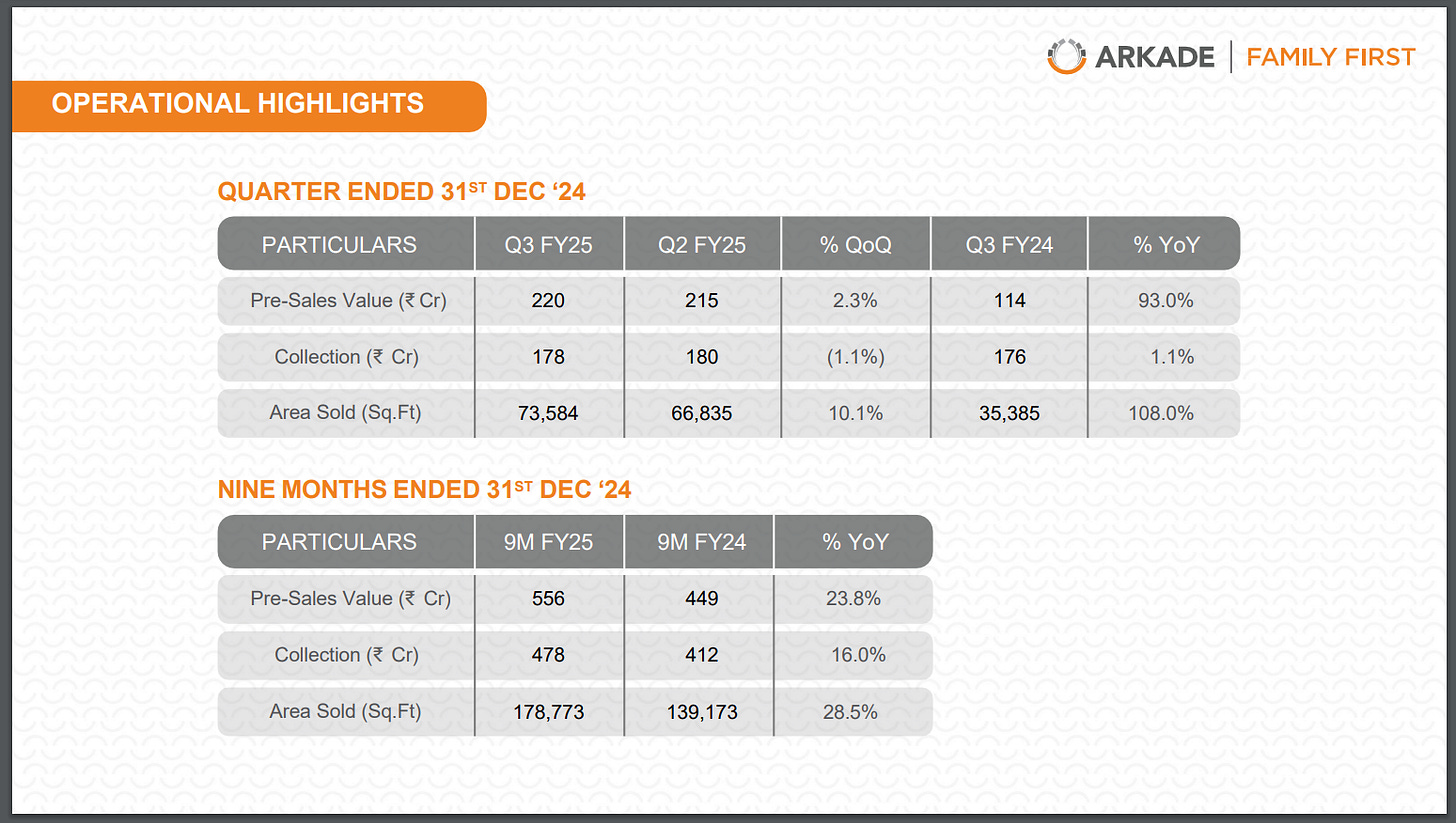

In terms of the financial results, Q3 was decent. Revenue + net profit were flat YoY. Net profit margin increased slightly to 21.7%. Pre-sales was up 93%. Area sold was up 100+%

Pre-sales is money that a developer has secured from selling properties before construction is completed. Its an indication of future revenue. A metric which shows that investors are happy to buy under construction properties from Arkade.

Update on projects

The company’s strategy is to expand their footprint across the suburbs in the MMR with focus on luxury housing.

Order Pipeline — 8 upcoming projects have a revenue potential of INR 5,000 Cr and other projects are in the final stages of acquisition which could generate another INR 5,000 Cr in revenues.

Potential revenues of INR 10,000 Cr is expected to be realized over the next 4-5 years as per management estimates. Out of this, INR 6,500 Cr is expected to be realized from redevelopment projects & the balance from greenfield projects.

Redevelopment projects — added 3 redevelopment projects in Andheri (E), Malad (W) & Borivali (W), these are projects which will be launched in the future. Two redevelopment projects (Laxmi Ramana + Maheshwar) are expected to be launched in Q1FY26.

Arkade secured another redevelopment project of 6.5 acres of land for the cluster redevelopment of Anand Nagar Society in Dahisar (E) with a GDV of INR 1,700 Cr.

Greenfield Project / Arkade’s own developments — received the Occupancy Certificate (OC) for Arkade Aura in Santa Cruz (W) one year prior to the targeted RERA date. Also received OC for Arkade Aspire (Goregaon E) and Arkade Crown (Borivali W) in the last 2 quarters.

Recently launched two towers at Arkade Nest (Mulund) & Arkade Pearl (Vile Parle).

Other updates

Guidance — No revenue guidance was given for FY26. Management expects net profit margins to be in the range of 20% for the foreseeable future (which is VERY impressive for a real estate player). Not focusing on commercial real estate for now. Strategy is to explore more eastern suburbs of Mumbai.

Margin Mix — due to high competition in the redevelopment space, net profit margins from redevelopment projects might get squeezed to 15%, which will be compensated by 25% profit margins from greenfield projects.

Debt position — Arkade is a net debt free company [very rare for a developer]. Management might take some debt to finance expansion in the future, but that will be less than 20% of equity.

Execution — Arkade has a reputation for timely delivery of property to it’s customers, due to which they are able to sell 90% of inventory by the time they receive OC. Bankers also vouch for Arkade when dispersing home loans. Timely delivery saves on rentals that need to be paid to tenants in case of redevelopment.

IPO Proceeds — unused IPO money will be used to buy land parcel in Thane and for construction of ongoing projects.

Conclusion

At a market capitalization of INR 2,700 Cr, with 5Y ROCE of 36% and a net profit margin of 20+% — the company looks undervalued on paper. The markets could be undervaluing it because it has recently listed on the bourses + its a real estate player — a space where a lot can go wrong during execution.

If the company can execute ruthlessly without any hiccups in the next 5Y - the management expects to generate INR 2,000 Cr in net profits (20% of INR 10,000 Cr). Should that happen, the company’s valuation has a lot of room to ZOOM UPWARDS from current levels.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Disclaimer: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]