One year back, I had written a detailed article on SKM Egg Products - a company which makes egg powders + egg liquids. The stock had corrected by >30%, which made me take a deeper look into the business.

Since then, in the last one year the stock has delivered a decent return of 30%. I had set a GTT on Zerodha to buy the stock at INR 170, and those who were able to time the entry into this stock, are sitting on gains of >100% in the last 1Y.

Which begs the question, is there more room to grow? Or is SKM one of those range bound companies, taking investors for a rollercoaster ride? Let’s dig deeper to find out.

The business of SKM is easy to understand. They convert eggs into egg powder & egg liquids. They spend money on setting up a poultry farm. They incur costs on buying feed for chickens who lay eggs. The company has an installed capacity to break 1.8 million eggs per day to produce 6,900 MT of egg powder annually.

The costs of feed like corn & soya can fluctuate & as I have observed in my previous article — it doesn’t look like SKM has the pricing power to pass on the increase in raw material costs to it’s customers.

In the image above, you can see that operating profit margin is closely related to the movement in material cost %. Material costs have taken wild swings, making it very difficult to predict how much money SKM is going to make any given quarter.

FY25 results

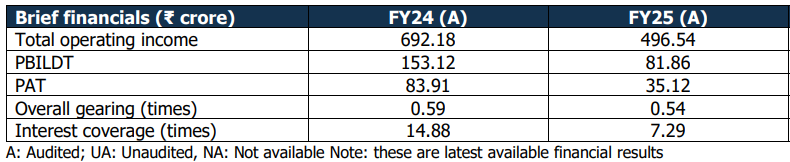

FY25 was not a great year for the company, with a period of sales degrowth. There’s no management commentary on why there was a drop in sales [a major issue with microcaps] but a CARE Ratings report (released on 04 August 2025) comes to our rescue.

As per the report, revenue took a hit in FY25 mainly due to decrease in export sales caused by lower selling prices for it’s egg products. Classic case of a commodity business with low pricing power. And as an investor, you do NOT like to see a drop in selling price!

Why is the stock price going UP then?

Decent Q1 — One reason is that the Q1FY26 results were good. Revenue inched up 50% YoY (on a lower base) to INR 176 Cr. Operating profit margin was stable at 14%.

Still a far outcry from 2 years back when revenue was INR 210 Cr with a operating margin of 24%. Can SKM achieve such margins again? The markets certainly feel that way.

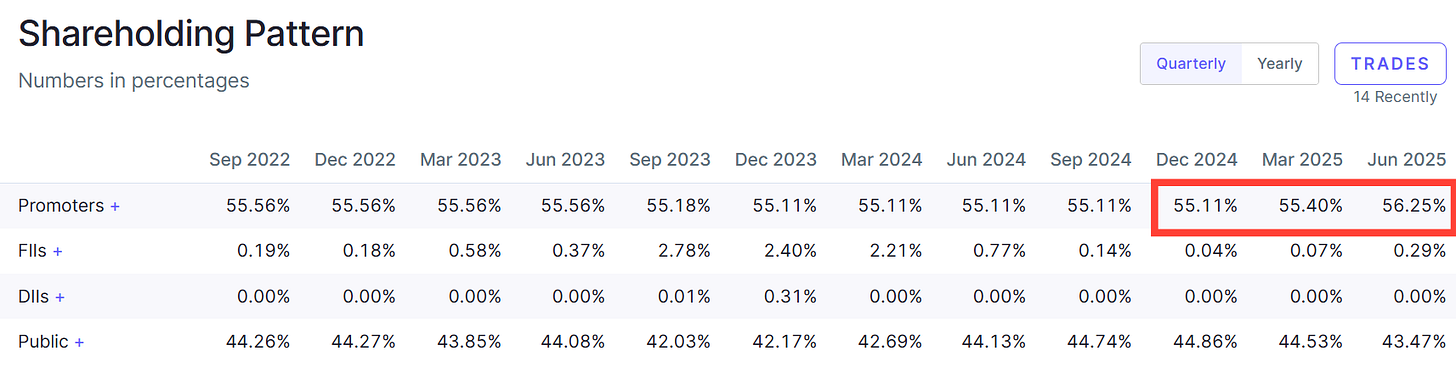

Promoter buying — Another reason for the stock going up was an increase in promoter shareholding. The stock took a massive beating in the month of March 2025 and promoters kept buying more shares in the company — which is an indirect signal that the promoters believe there might be significant upside in the stock.

Shareholding pattern of SKM

The founder of the company (Mr. Shivkumar) has indicated that he wants to achieve INR 1,000 Cr in topline in the next 3-4 years. Once that target is achieved, he would retire from the company — which begs the question — who will replace him? And what does the future of SKM look like post it reaches the target of INR 1,000 Cr? Can it scale beyond that?

CARE Ratings Report

Some other takeaways from the CARE Ratings report which stood out to me were:

Slight reduction in revenue concentration — In FY24, 46% of export revenue came from Japan & Russia. This was slightly reduced to 45% in FY25. Not a huge reduction, and the company still relies heavily on these markets.

Revenue from top 10 customers contributed to 52% of total sales in FY24. This decreased to 32% of total sales in FY25. Major improvement and reduction in customer concentration.

Increase in domestic sales — Export sales was 76% of total income in FY24, which has dropped to 58% in FY25, which means that domestic sales has increased from 24% (FY24) to 42% (FY25).

Although this reduces foreign currency risk and dependency on foreign markets, this has resulted in lower price realizations shrinking operating margins from 22% (FY24) to 16% (FY25)

SKM is the largest exporter of egg powder from India, accounting for 65-70% of overall export of egg powders used in the food + health industry. So, this means to grow it needs to expand in existing & newer geographies.

Integrated and strategically located manufacturing facility

SKM’s operations are integrated with the company having its own and leased poultry farm to meet ~90% of egg requirements and also its own feed manufacturing unit to cater to its poultry farm.

All the poultry farms are strategically located in proximity to the company’s manufacturing unit (30-40 km radius), providing easier access to the raw material and ensuring lesser breakage of eggs in transit.

The company’s entire operations from the egg-breaking process up to production and packing of the final egg powder is automated to maintain high level of quality standards.

I spoke about this point in my previous article, as a key lever which SKM uses to differentiate it from other egg powder producers.

Conclusion

SKM Egg Products has doubled it’s market capitalization in the last 6 months due to a decent Q1 + promoter buying, and the market has reacted to that with a 100% return in the last 6 months.

FY25 was a period of degrowth and on that lower base, Q1FY26 looks impressive. However compared to FY24, revenue is still far off. Input costs have increased in FY25 and have not shown signs of softening.

The company has invested approx. INR 63 Cr on building / plant & machinery in FY25 — however, we’re unclear what this capex leads to. Is that capacity addition? Is that maintenance capex? Is that purchase of a poultry farm? It’s hard to know in the absence of information.

The recent run-up in the stock price means that the company is trading at a P/E of 23 times, at a market capitalization of INR 900 Cr. Not cheap by any means. And the upside looks limited, even if the company reaches the INR 1,000 Cr mark in the next few years.

Bull Case

SKM cracks the USA market. Egg yolk powder demand from key markets (Russia / Japan) increases substantially. Enters and scales the Saudi Arabia and African markets. Maintains price realizations in the export market. Increases capacity to meet increase in demand. Domestic sales continue to rise. Input costs stabilize, leading to better operating margins. If this happens, I see some upside in the stock from here.

Bear Case

Price realizations continue to drop in key markets. Input costs rise compressing margins further. Considerable time taken to expand and scale new geographies (Africa, Europe, Saudi Arabia). Founder retires, with no clear execution strategy. Domestic sales get stagnant.

It’s difficult to predict what’s going to happen, but the absence of management guidance doesn’t help. It doesn’t give ANY visibility into the future and investors are in the dark. Will track the next few Qs to see how the business shapes from here.

(I’d also like to give the ValuePickr Community a BIG shoutout — discussions on that forum gave me a lot of insights into the company.)

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]