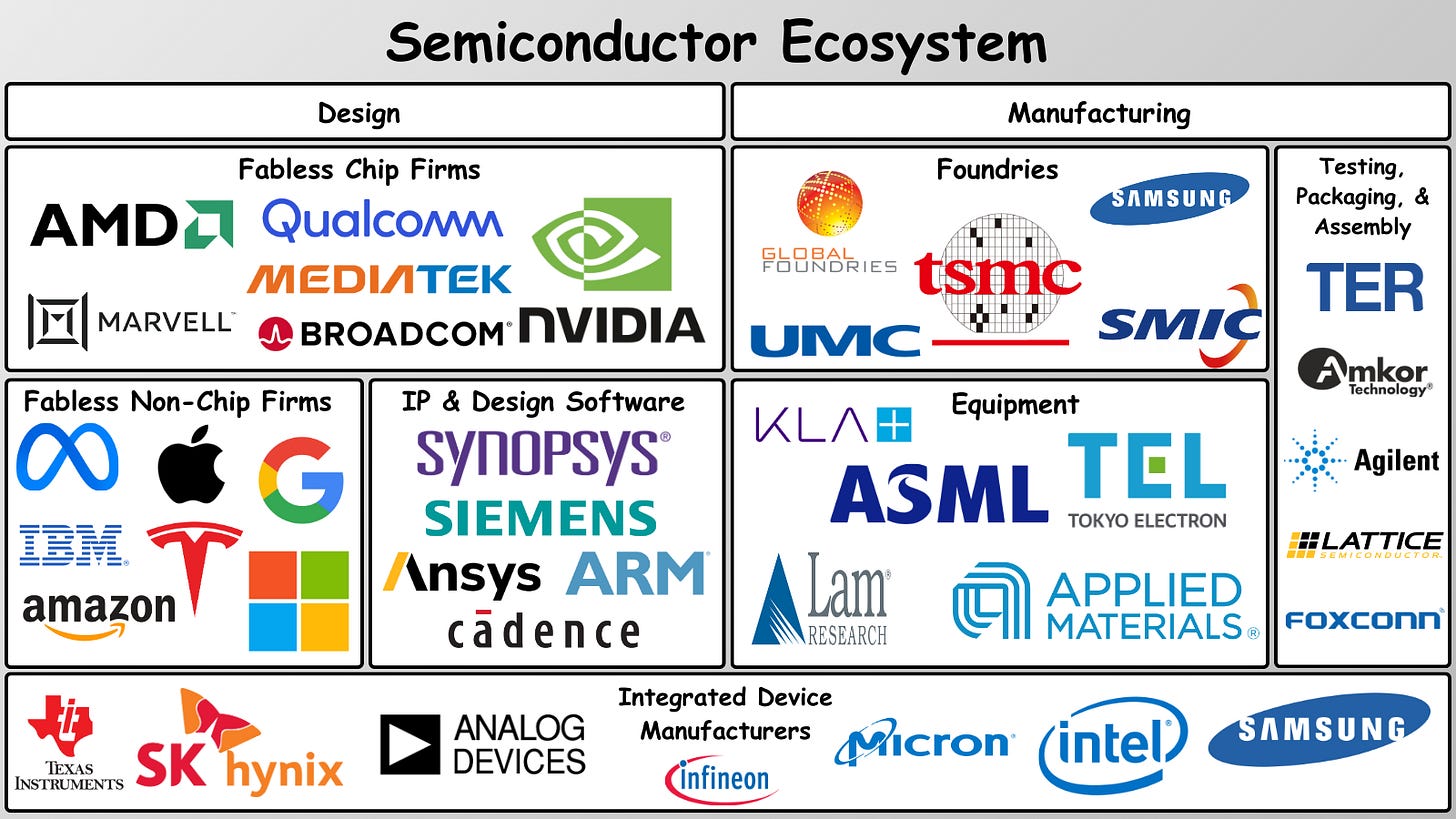

Before we talk about MosChip and it’s recent business updates, I wanted to run through a quick overview of the players in the semiconductor space, which would give us some idea where MosChip fits in the ecosystem and the global competitive landscape.

I came across one of the best articles written on an overview of the semiconductor industry by Eric Flaningam — which for a newbie like me, was key to understand how the industry is structured.

As an investor, if you can spend time studying an industry in which your target company exists, it can enhance your understanding of the business model many folds — which is key in conducting fundamental analysis.

For our purposes, we can categorise chip companies into the following broad categories:

Design companies — companies which design the semiconductor chip, but don’t manufacture the chips themselves, also known as fabless chip companies.

Foundries — firms which manufacture the chips based on the designs provided by fabless companies.

Integrated device manufacturers — companies which design + manufacture their own chips.

Equipment manufacturers — companies that manufacture the equipment that is used in the design and manufacturing of semiconductors.

MosChip is in the business of design — of semiconductors, software & systems. The design of semiconductors is a complex process, which involves various steps like:

Identification of the design requirements of the chip + intended function

Laying out the logic design

Simulating semiconductor performance (hardware / software)

Testing for errors, bugs etc.

The software used for design is called Electronic Design Automation (EDA), and once the design is complete — it is sent to foundries like TSMC, Samsung etc — to convert that design into a physical chip.

For designing chips, there are 3 architectures — Arm (licensed by the company ARM), x86 (developed by Intel) and RISC-V (an open source alternative).

Business Updates

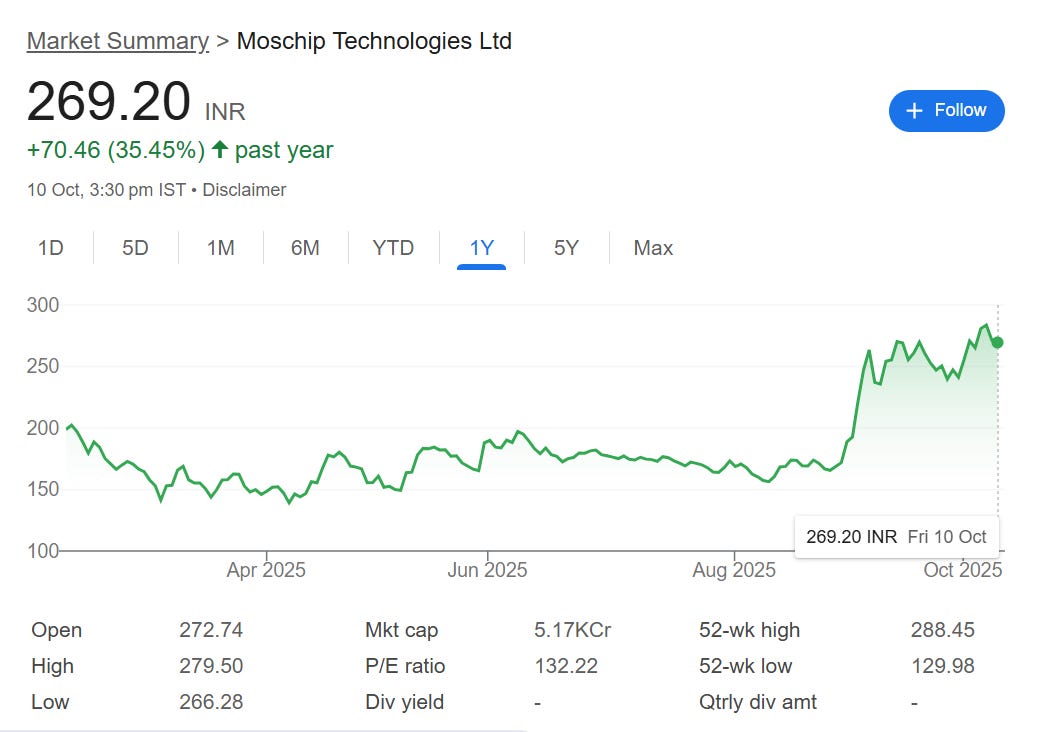

FY25 was a good year for the company, with increase in topline by 59% YoY. Operating profit margins remained stable at 12%. Q1FY26 was also a decent quarter.

Due to lack of management guidance, we don’t know the revenue target for FY26. But, if you extrapolate the Q1FY26 revenue, a 20% YoY growth for FY26 looks probable. Now, this isn’t explosive growth - which is what you’d expect with a company operating in the semiconductor design space commanding a PE of 130+.

Summary of the business model

MosChip operates two business units viz. — (1) Semiconductor design (2) Software & System Design.

Semiconductor design contributes 80% of total revenues, and the company offers design services like ASIC design, SoC design, FPGA design, IP services etc.

MosChip has been involved in more than 600 SoC tape-outs. A tape out is the final step in the design process, where the design files are sent to a foundry (like TSMC) for manufacturing.

Operating margins from semiconductor design is around 23% [a slight decrease from FY24 margins of 25%]

Software & system design contributes 20% to the topline. MosChip helps businesses with their hardware and software design needs.

Operating margins from this segment is around 6% [a sharp decrease from FY24 margins of 10%]. Why have margins decreased? Is it change in sales mix? Or increase in project costs? Management doesn’t provide any commentary.

Costs — the major costs incurred for running this business are:

Manpower costs — MosChip hires 1400+ engineers, which are essential in delivering design services to clients. The quality of skilled engineers, is what differentiates a design company.

Electronic Design Automation — the software used for semiconductor design, this is probably the licensing cost of the EDA tool.

Outsourcing services — despite having 1400+ engineers, the company still outsources various activities to external consultants / agencies. This cost has increased from INR 16 Cr in FY24 to INR 129 Cr in FY25 — is it because of increase in revenues? Or development of a new design? We don’t know.

What’s next for MosChip?

If you look at the companies operating in the semiconductor space, most of them are valued at >$50B — and sadly none of them are Indian companies. India is playing catch-up with the rest of the world, when it comes to investing in semiconductor manufacturing.

With programmes like the ‘India Semiconductor Mission’ the government plans to create a full supply chain from design to fabrication, testing and packaging in India.

For this the government has approved 10 semiconductor projects, with a total investment of $18.2B — which includes two semiconductor fabrication plants and multiple testing and packaging factories.

Coming back to MosChip — what we are interested to understand, is whether it can become a chip design behemoth in the next 10 years? Can it generate exponential returns for it’s shareholders?

Although the P/E ratio of the company has halved from 250+ to 130+, it still looks quite expensive at current growth rates.

What are the initiatives that should fuel growth in the coming years?

CDAC HPC Processor ‘AUM’ — MosChip has obtained an INR 509 CRORE contract with CDAC for development of a high performance computing SoC [System on Chips]. The SoC will be based on ARM’s architecture, co-developed with Socionext on TSMC’s 5 nano-meter technology node. The contract will last for 4 years.

Smart energy meter integrated circuit (IC) — MosChip is involved in the design of a smart energy meter IC which will be used by Electricity Energy Meter OEMs. MosChip will supply the design of the ICs to CDAC.

Aims to grow emulation expertise — the management wants to build emulation expertise in MosChip. Emulation is the process of using hardware to imitate the behaviour of a chip or a system before it is physically fabricated. It is much faster than software simulations, and helps engineers fix design errors quickly, reducing cost of physical prototypes.

Digital Sky GenAIoT — MosChip is also working on a solution suite, that helps clients design, integrate, and deploy smart AI powered products faster and with reduced complexity. It brings together AI, IoT, Automation and Cloud technologies — enabling accelerated product development.

Conclusion

In the absence of any clear guidance from the management, it is difficult to predict the growth trajectory of the company going forward. I have no idea, how much the above initiatives are going to contribute to the top-line. Will these new initiatives expand margins? We don’t know.

Can it compete with global design players like Qualcomm, AMD, MediaTek, Broadcom or even Indian players like Tata Elxsi, HCL Technologies, Sasken? Only time will tell.

MosChip has partnerships with leading foundries (TSMC) providing it early access to cutting edge chip technologies. It has strengthened relationships with EDA & IP vendors. It is training its employee base via MosChip Academy of Silicon Systems, a way to build and retain talent.

However, there are risks in the form of customer & geographical concentration. Promoter shareholding has slightly decreased YoY.

The management hasn’t given any forecast on future revenues. No commentary on Order book. We don’t know who the biggest clients of the company are [most probably AMD / Microchip among others]. No quarterly calls. Investor PPTs are very basic.

Without clear guidance, all you can do is shoot arrows in the dark and wait for more information to emerge. And that’s what we’re going to do. Keep close tabs on the company.

Because it is among the very few small cap stocks operating in the semiconductor space, and that alone warrants a close watch on the business!

For my subscribers, I have partnered with Finology to get you a one month free subscription to Finology Ticker. Follow the steps listed in the Google Form [Form Link].

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]