Semiconductors are used everywhere you look. Smartphones. Laptops. Big ass servers. Companies who bet on this small piece of electronic, have made a fortune [read: NVIDIA, Qualcomm, ARM, TSMC etc.]

Very soon, we’ll have semiconductor chips implanted in humans. So, clearly this is a very big market.

But — if you are an Indian investor, how do you get a bite into this sector? There are several stocks that you can invest in, one of which is MosChip Technologies.

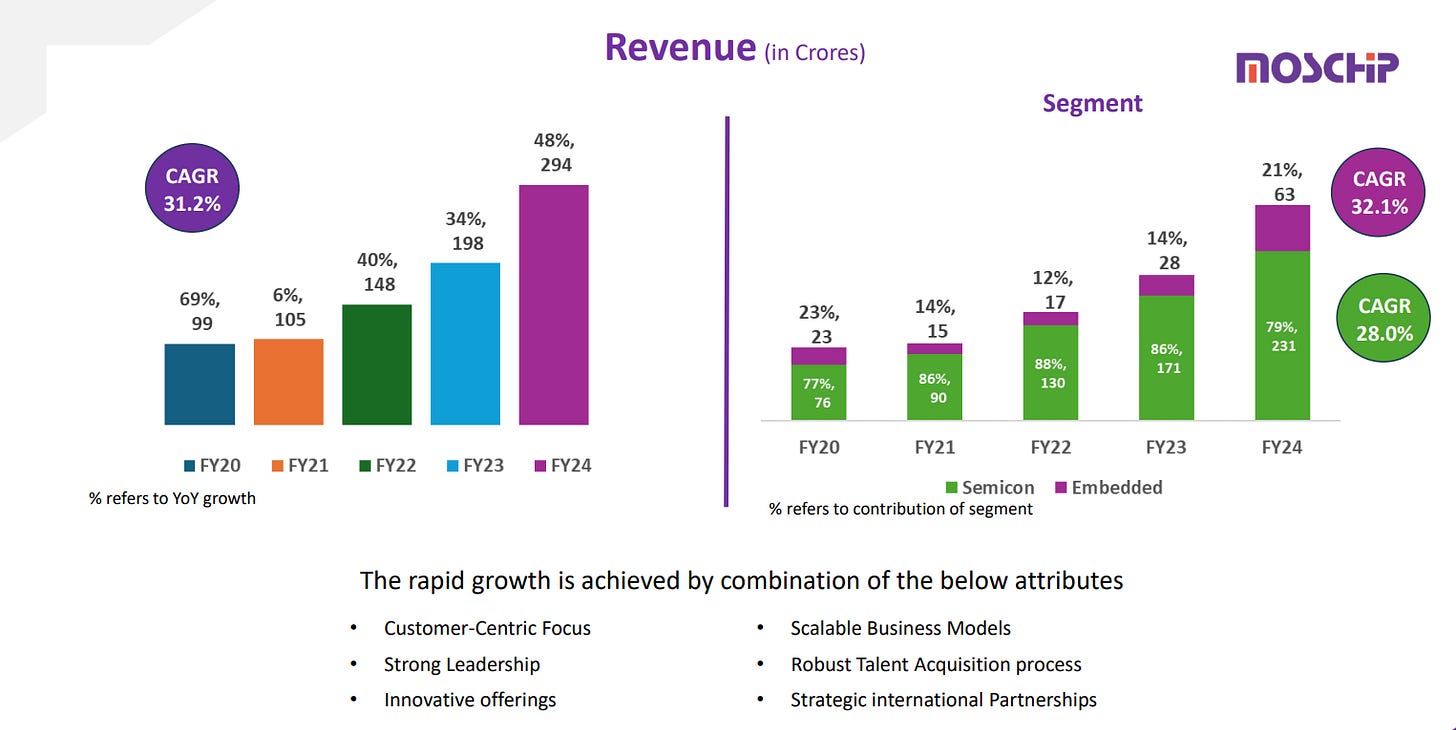

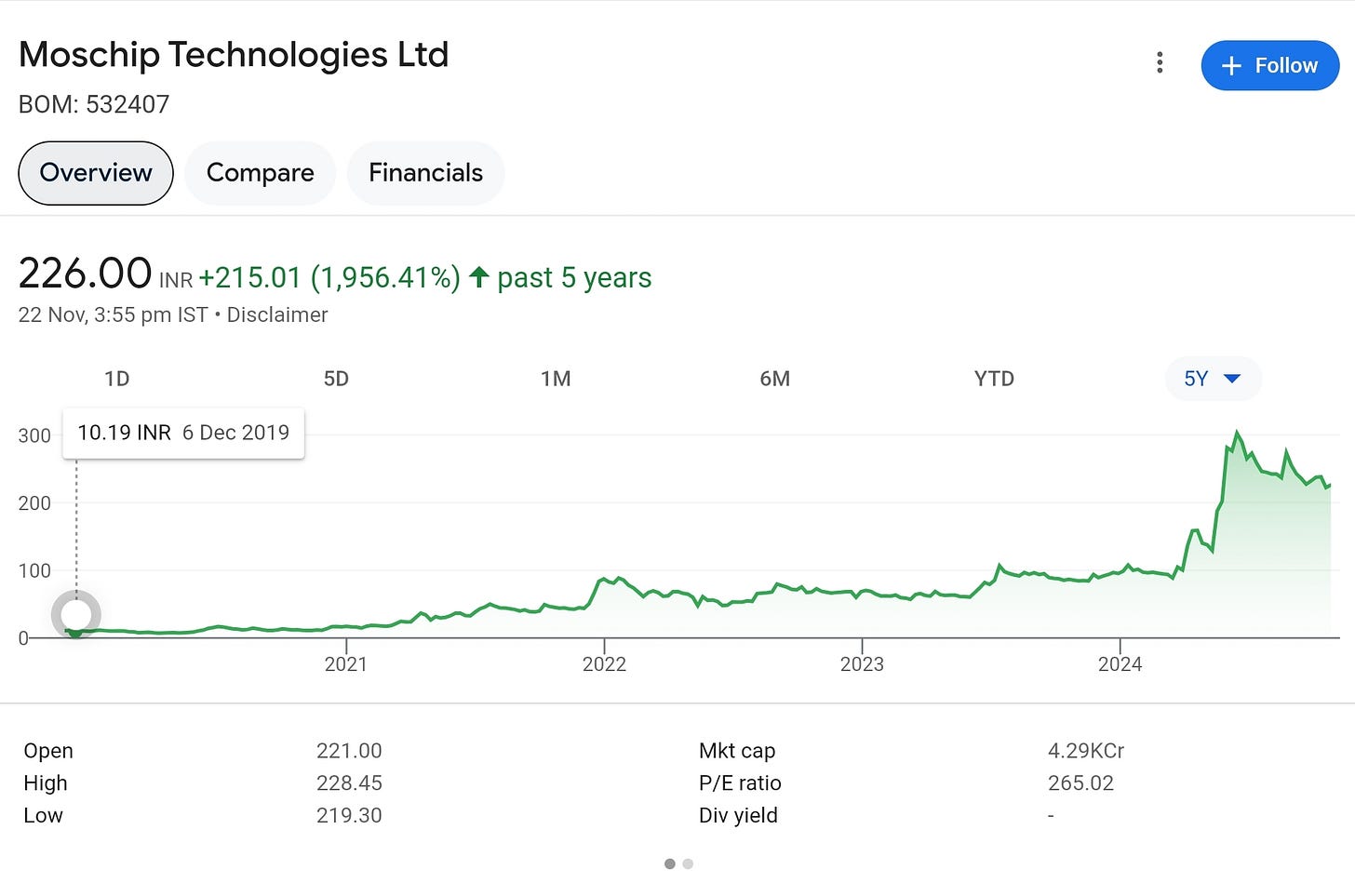

In the past 5 years, the stock has delivered multi-bagger returns, with majority of the rise happening in the last 2 years.

Even with this insane rise, the market capitalization of the company is only INR 4,250 CRORE — which means there could be more room to grow if the company can scale the business. However, at a P/E of 250+, the stock is trading at a VERY expensive valuation.

Can MosChip grow earnings? Can it capture more market share in the semi-conductor space? Let’s find out!

The Business

At the very core, MosChip is a semiconductor and system design company which is engaged in the development & manufacturing of integrated circuits (ICs) and various IoT solutions.

It works with globally acclaimed chip design companies in areas of aerospace, defence, consumer & industrial applications.

It has 2 business segments — (i) Semiconductors (ii) Software, System Design & Product Engineering.

I. Semiconductor business

This business can be split into 3 categories:

Semiconductor Intellectual Property (SIP) — in which it offers a range of semiconductor IP blocks for design and verification to customers.

Semiconductor design services — offering end to end design solutions which includes chip design, verification, PCB Board design etc. It masters the science behind ASIC, SoC, RTL Design.

Turn-key ASIC — it offers ASIC platforms and design solutions from RTL to volume production to meet the needs of various industrial domains.

Bursting the jargons:

Semiconductor IP — this refers to the design specifications, source code or other information necessary for manufacturing semiconductor chips & integrated circuits (ICs). MosChip probably licenses it’s Semiconductor IPs to other companies to produce semiconductors.

ASIC [Application Specific Integrated Circuit] — is a custom designed semiconductor chip made for a specific function. An ASIC combines various circuits in one chip, allowing it to perform a specific task faster than a less focused circuit. MosChip probably designs & sells ASICs to their clients.

SoC [System on Chip] — is a technology which integrates all the components of a system into a SINGLE CHIP. SoCs reduce the space taken up by semiconductors, allowing for smaller products. Both ASIC + SoC are integrated circuits with different functionalities.

RTL Design — RTL is a way to describe the behaviour of a circuit. RTL design is essential for designing + verifying complex digital systems like micro-processors.

I use the word ‘probably’ above — because reading the annual report, I wasn’t very sure what the business model is exactly. If anyone reading this blog has a more accurate understanding of the b-model, please correct me!

II. Software & Systems Design Business

MosChip offers solutions at every stage of the product lifecycle including hardware design, software design, embedded systems and various software engineering solutions.

MosChip’s FY24 annual report also mentions that it provides various AI/ML solutions — however I am not sure how much it is contributing to overall revenue at this point.

The Tailwinds

One of the most critical aspects for a technology company — especially in the semiconductor domain which requires precise engineering and technical knowledge — is hiring the right people and the ability to retain them.

The management highlighted that there has been no leadership attrition in recent years. MosChip employs > 1,300+ employees with a median age of 28 years — which means they have a good mix of youth / experience in their workforce to drive innovation.

MosChip has a dedicated training centre [Institute of Silicon Systems] to enhance skill-sets of employees related to silicon, semiconductors and software.

Some of the other tailwinds are:

Customer relationships / partnerships — 10 out of top 20 semiconductor companies are MosChip’s customers. Major customers being CDAC [Centre for Development of Advanced Computing], Samsung & TSMC.

The Company has entered into partnerships with leading semiconductor companies like AMD-Xilinx, Altera, Intel, Lattice Semiconductor & Microchip — which enables it to gain early access and expertise on their latest platforms.

It entered into a partnership with Tenstorrent to work on cutting edge RISC-V solutions, leveraging MosChip’s expertise in design services.

Order book — the company has not published any information about it’s order book, but let’s take a look at some of the recent deals it has secured.

CDAC HPC Processor ‘AUM’ — MosChip has obtained a INR 509 CRORE contract with CDAC for development of a high performance computing SoC [System on Chips]. The SoC will be based on ARM’s architecture and TSMC’s 5 nano-meter technology node. The contract will last for 4 years.

Smart Energy meter IC — MeitY approved MosChip’s application under the Semiconductor DLI scheme [Design Linked Incentive] for the development of a smart energy meter integrated circuit (ICs). MosChip will supply the ICs to CDAC. This market is expected to grow to 60 million units in India and 2 billion units globally by 2028. [Order size not disclosed]

Won a contract from an ASIC company headquartered in Japan for design services. [Order size not disclosed]

Acquisitions + Growth drivers

Investments — MosChip’s strategy is to continue to grow in design services. The management wants to invest in building emulation expertise and developing expertise in emerging areas (AI/ML/IoT/Automotive applications).

Acquisitions — MosChip has acquired various companies between 2016 to 2019 to expand their semiconductor capabilities. Last year it acquired Softnautics which brought new customers, enhanced it’s technical expertise and expanded it’s service offerings.

This shows that the management is not shy to make acquisitions to grow the business. However, the company has a goodwill of INR 195 CRORE in it’s books — which signals that it is overpaying for it’s acquisitions, which is a little concerning for an investor.

Points of Concern

There is very little information about MosChip on investing forums, so I couldn’t find a lot of perspectives from industry insiders on this stock. However, the biggest cause of concern is the PE at which the company is trading [250+] which means that earnings do NOT support the current price levels.

So, either the stock should correct significantly OR there has to be major expansion in profits. Some of the other concerns are:

Employee turnover — if MosChip is unable to retain talent, it could adversely impact the business. If you look at the average employee rating on Naukri.com or Glassdoor — the average rating is 4.0 out of 5 stars, which is decent. However, investors should keep an eye out for that attrition ratio.

Difficulty in scaling up — Semiconductor business is highly competitive and capital intensive in nature. MosChip is quite small in scale and might face challenges in maintaining it’s competitive edge + growing margins.

Execution challenges — developing advanced SoCs using 5nm technology [for CDAC] is technically challenging. Delays is executing such projects could impact MosChip’s reputation and financials.

Declining promoter holding — the shareholding % of promoters has been declining over the years [as the stock has been skyrocketing]. This could mean several things.

Maybe the promoters wanted some liquidity and so they’re selling stock.

Or the promoters think that the stock price is overvalued, and hence they want to book some profits at these levels.

Conclusion

Semiconductors are an essential part of our lives now, and India is realizing that it cannot depend on countries like China / Taiwan for it’s semiconductor capabilities.

Various programs like India Semiconductor Mission and Design Linked Incentive (DLI) scheme have been launched to boost advanced chips to be ‘Made in India’ and provide financial support to companies investing in semiconductors.

Worldwide semiconductor sales is expected to reach $1 TRILLION by 2030. In India, the semiconductor industry is forecasted to surge to $100 billion by 2032. MosChip could benefit from this growth.

Some unanswered questions still remain:

Business: What is MosChip’s share in the semiconductor design market? Who are it’s major competitors? Can it compete with the likes of TSMC in the future? Does it have plans to get into chip manufacturing in the future? Which product / service contributes the most to revenues?

Forecast: What is the size of the order book? What is the revenue / profit guidance for the next few years? What is the baseline profit margin to be considered?

Employees: Does it really need 1,300+ employees?

At the current price point, I just don’t see any upside unless there is a multi-billion dollar order win. However, because it operates in the semiconductor space, it is a company that should be in your watchlist. Would be interesting to keep a watch on the business updates and see how the company shapes up in the future.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

You can contribute by donating a small token to fund my research on my UPI ID at siddharthbothra64-1@okicici

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

MosChip has designed an advance lighting automation solution – (Greenlight) any idea why this is now under reduced focus? and GeoHEMS Indigenous asset monitoring platform any idea who use it?