The consumption of coffee is blowing up in India. Everywhere you look, you can see cafes springing up. Blue Tokai, Third Wave Coffee, Barista, abCoffee, SUBKO and countless other home grown brands are brewing good quality coffee.

A decade back, you wouldn’t have imagined that Indians (who are generally considered price conscious consumers) would be paying INR 250-300 for a single cup of coffee. But that narrative is changing. Indians are ready to pay for premium coffee. They’re ready to pay for convenience. And a major transition is underway.

I had the opportunity to read up on a little known company which operates in the coffee space, which could scale up exponentially in the future.

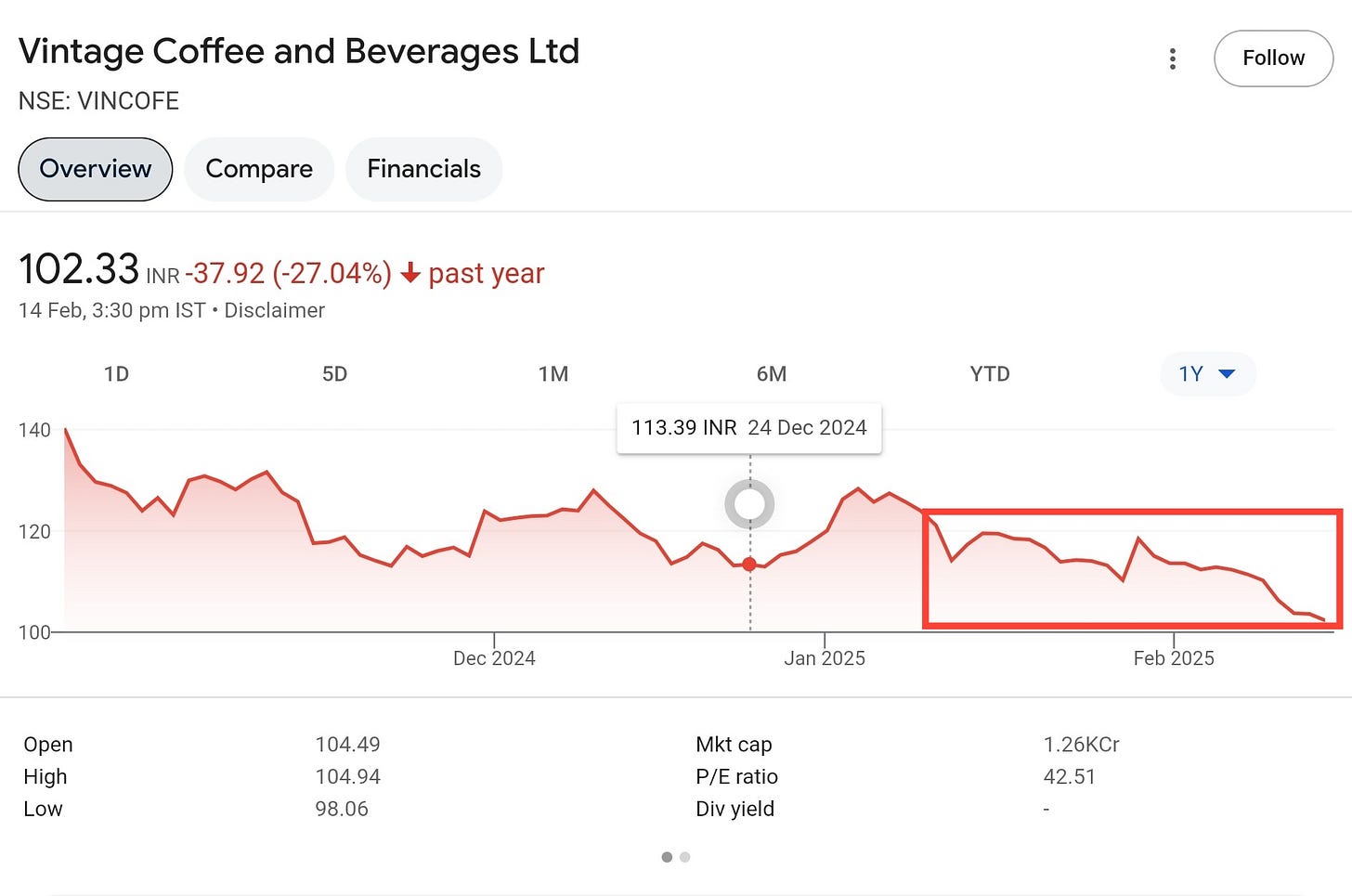

The stock is down 27% in the last 1Y, primarily due to the recent bear run in the markets. The recent results of the company however, have been impressive.

Revenues have doubled in FY24. Profitability has increased. Capacity expansion is under way, which could lead to more revenue growth. Can the company grow exponentially from here? Can it sustain this growth? Let’s find out!

The Business

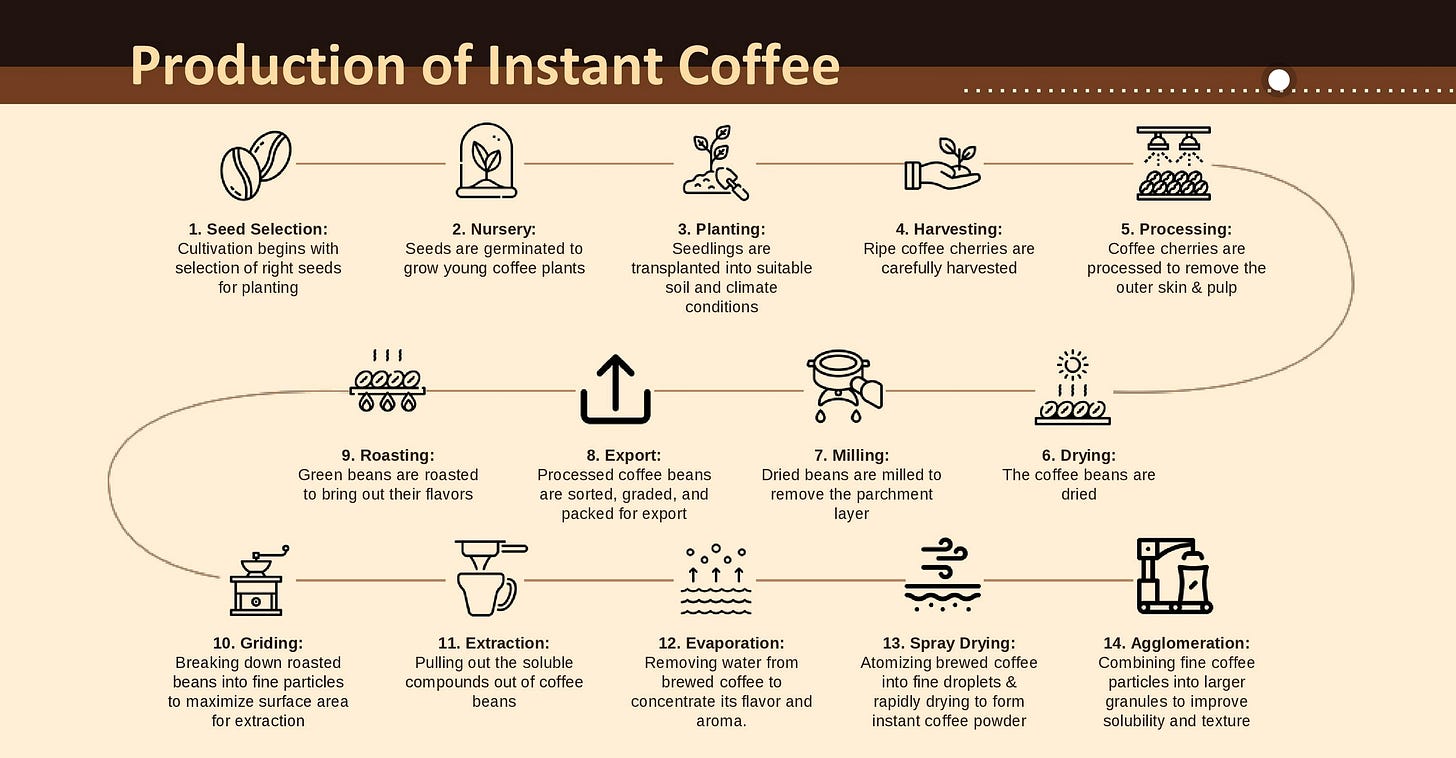

Vintage Coffee is in the business of manufacture of instant coffee & instant chicory — with a strong focus on private labelling and providing customized solutions to global clients.

Private labelling is when a retailer buys coffee from a 3rd party manufacturer and sells it under their own brand. Vintage Coffee acts as a 3rd party manufacturer for it’s global clients, who then sell the coffee under their own brand.

The business comprises of B2B sales with 92% of revenues coming from exports to key markets like Russia, Middle East, Europe & Africa.

Product range — Spray dried instant coffee, agglomerated instant coffee & instant chicory.

Chicory is a herb which is blended with coffee to give it an earthy / nutty taste and it doesn’t contain any caffeine. It’s quite popular in South India and some parts of the US (New Orleans).

The company has two subsidiaries:

Vintage Coffee Private Limited — which manufactures instant coffee and is a 100% Export Oriented Unit.

Delecto Foods Private Limited — which manufactures instant chicory & other chicory based products.

The Tailwinds

One of the biggest tailwinds for the company, is the general increase in coffee consumption in the world. Let’s face it, coffee is a magical bean. It’s a fuel, which powers the people who run the world.

Who doesn’t love a good cup of coffee? ☕

By 2028, global instant coffee market is projected to be worth $139B, growing at a CAGR of 7%.

Some of the other tailwinds are:

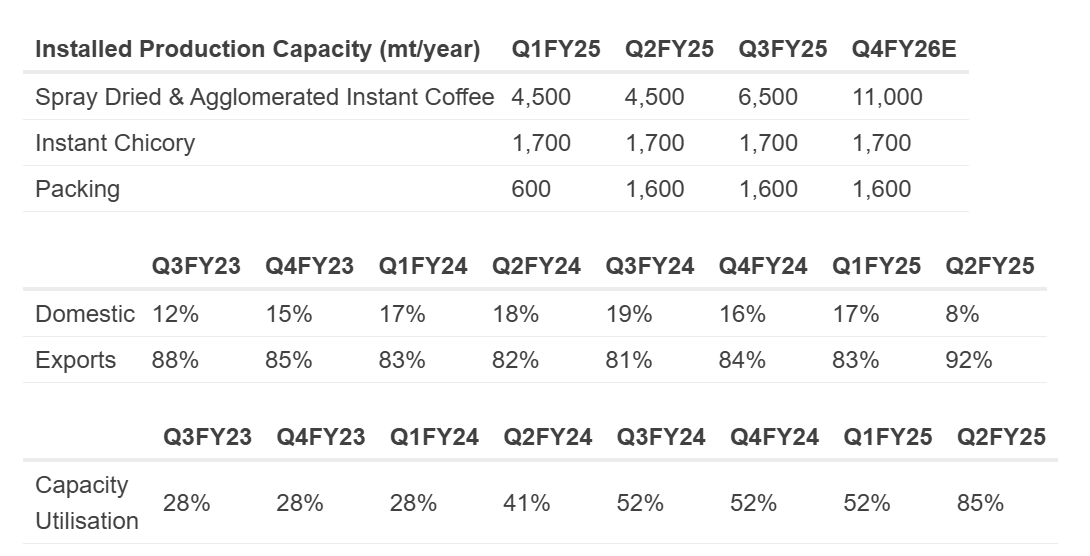

Expansion of manufacturing capacity — the company added 2,000 MT of capacity in Q3FY25 bringing total manufacturing capacity of instant coffee to 6,500 MT/year. The company raised INR 66 Cr from a preferential issue of equity shares for this purpose.

Management announced addition of another 4,500 MT for instant coffee by Q4FY26, which will bring total capacity to 11,000 MT/year — to meet growing global coffee demand. The company plans to incur a capex of INR 150 million likely to be funded through the proceeds from a rights issue + internal accruals.

For comparison, CCL Products — the world’s largest private label coffee manufacturer, has a manufacturing capacity of 55,000 MT / year.

The company was operating at 100% capacity in Q3FY25. As you can see from the chart above, capacity utilization has increased YoY which is a sign that the management is sweating their assets optimally.

Such increase in capacity means that the management is foreseeing exponential growth in the next few years.

Venturing into B2C segment — the company recently unveiled it’s first premium cafe lounge in Navi Mumbai. I did a little bit of digging on Zomato and the initial reviews of the Cafe have been great!

It plans to launch 2 more cafes in Mumbai and one each in Gurugram and Pune, with a potential outlet in Hyderabad on the horizon [the cafes will be operated on a master franchise model].

The company launched it’s e-commerce platform to sell instant coffee directly to consumers. [however, the website isn’t working properly]

This marks a shift in strategy of the company, with an entrance in the B2C segment, which is a high margins business with more pricing power.

Contracts covering input cost increase — increase in the prices of coffee beans (which is a raw material for the company) is passed onto the final consumer by including escalation clauses in customer agreements. This ensures that margins do not fluctuate wildly in case of raw material price volatility.

Others:

Geographical Diversification: It is exporting instant coffee products in bulk and private labels to Europe, Southeast Asia, Russia and West Africa. The company is planning to explore the US, Australian & New Zealand markets in the future.

Strategic Growth in Consumer Packs: The company started the operation of a fully automatic packaging line in it’s Hyderabad plant which will help raise consumer pack exports by 25%, tapping into premium revenue streams due to higher realization compared to bulk instant coffee.

Management remuneration looks quite reasonable. The MD [Balakrishna Tati] is getting paid around INR 50L which is extremely low compared to industry standards. The maximum limit of his remuneration will be increased to INR 1.2 Cr.

Revenue guidance of INR 300 Cr for FY25, which is approximately 2.5 times the FY24 revenue — which I must say, is quite impressive.

No guidance on EBITDA was given, however credit rating agencies expect EBITDA margins in the range of 15-20% for the foreseeable future.

Points of Concern

The thing with small cap companies is that they do not disclose a lot of information, hence it is difficult to draw out concerns with the business model. However investors should keep tabs on the following:

Raw Material Volatility – The company depends on coffee beans and chicory as key raw materials. Any fluctuations in commodity prices, supply chain disruptions, or adverse weather conditions affecting crop yields could impact profitability.

Management claims that input price increases are passed on to the final consumer, hence there should not be a major hit to gross margins.

High Export Mix – With 92% of sales coming from exports, the company is highly exposed to currency fluctuations, geopolitical risks, and regulatory changes in key markets like Russia, Africa, and Europe. Any trade restrictions or demand slowdowns could affect revenue.

Management is focusing on domestic sales through e-commerce sales + launch of more premium cafes which should increase the share of domestic sales mix.

Competition from the BIGGIES – The instant coffee market is highly competitive, with major global players like Nestlé and Tata Coffee holding significant market share. The company’s reliance on private labeling means it competes on price and customization, which could pressure margins.

What is Vintage Coffee’s market share in the global instant coffee market? We don’t know, but it is probably less than 0.1% — almost negligible.

Capex required to scale – The company has aggressive capacity expansion plans, aiming to scale up to 11,000 MT/year by FY26. Any delays, cost overruns, or financing challenges could strain financials and impact growth projections. To continuously grow, the company has to keep investing in building capacity.

Customer Concentration: During FY24, top 5 customers contributed 56% to the top-line with major customers based out of Singapore, Russia, the UAE, and China. Any disruption in demand from these customers would adversely impact the company.

27% of the shareholding is pledged with banks / financial institutions — which can trigger a larger sell-off in the stock in case it falls dramatically.

Conclusion

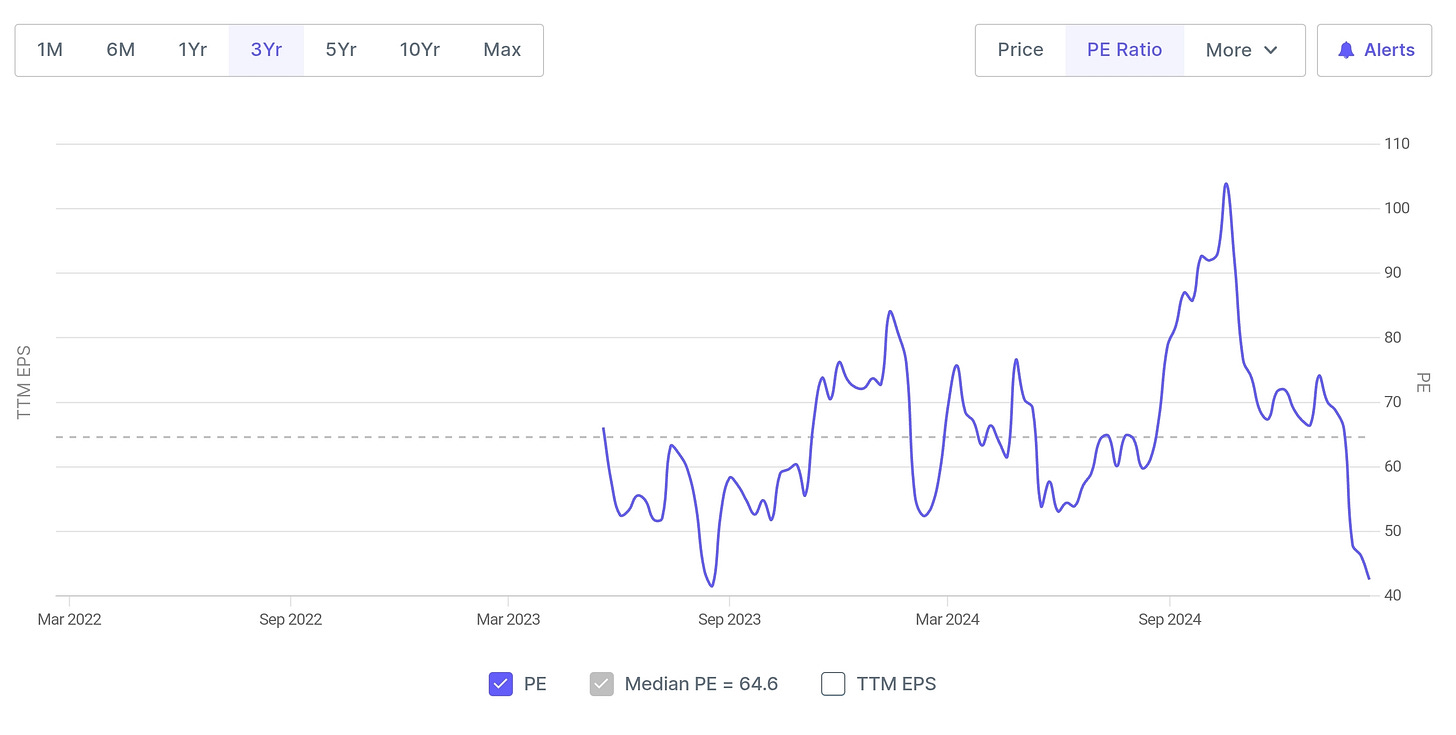

From a valuations perspective, I think the company is fairly valued — however it is operating at a premium to the industry P/E [of 29 times].

The stock is trading below it’s median P/E partly due to the recent market correction & partly due to increase in the top-line & bottom-line.

Analytics

What does the company need to do to scale over the next 5 years [and generate shareholder wealth?]:

Invest in capacity expansion. Current manufacturing capacity is 6,500 MT / year which translates into INR 300 - 350 Cr in revenues.

At a capacity of 11,000 MT / year planned to be added by the end of FY26, the company might be able to generate INR 700 - 750 Cr in revenues at 100% utilization. Assuming EBITDA margins of 20% — that would translate to 160 Cr in operating margins (significant jump from current levels)

Post FY26, the company might need to raise more money to build more capacity which could lead to further equity dilution / increase in debt.

The company needs to strengthen e-commerce presence + build more premium cafes — where the margins are higher. This will also create more brand awareness.

Invest in the right talent that can devise strategies for the future — no disrespect to the current management, but if you’re paying 29L to your CFO, you probably aren’t paying much at lower levels, which means you don’t have a LOT of quality talent available to fuel future growth.

Unanswered questions

Management has not guided for revenues post FY25. What is going to be the revenue from FY26 onwards? What is the baseline EBITDA margin?

What is the company’s order book? On what basis is it planning to increase it’s capacity from 6,500 MT / year to 11,000 MT / year?

What is the break up of revenue by product category or by geography? What is the margin profile of each geography?

Why has it not entered the US markets in the past, even though it is the highest coffee consuming country in the world?

Why is the remuneration of employees so low? What is the strategy to attract top talent to grow the company?

What is the broad vision of the management? How much market share are they looking to capture in the next 5Y?

I believe the company has potential to scale from here. It’s market share is negligible compared to peers. Domestic coffee consumption is booming. However competition is intense. Every day a new coffee player springs up in this ecosystem. Can Vintage Coffee, act quickly and capture a larger share of this growing pie?

We’ll keep tabs on the company to find out!

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Great work man

Very well put, bro! A lot of research has gone into this. Do you think a buyout could possibly be on the cards in the future? Given that banks/financial institutions are holding 27% of the shares, in case during a bad market the supply chain gets disrupted and the shares tumble further?