MCap < 3,000 CRORE : Monarch Networth

can this financial services company continue to deliver multi-bagger returns?

I was talking to my brother-in-law the other day and he told me that he is very BULLISH on companies operating in the financial services space.

When I say ‘financial services’ it includes broking, equity research, investment banking, fund management etc — but doesn’t include the banking sector. Although the banking sector is poised for decent growth as well and is an indication of the broader economy.

His thesis was simple:

Risk appetite of a normal retail investor + market penetration into stocks / mutual funds is growing in India.

India’s GDP is expected to grow by 6-7% (at the minimum) every year.

This means increase in assets under management (AUM) for financial services companies. Increase in trading activity. More IPOs. More AIF launches to invest in startups.

As per his estimate, if a financial services company can execute well — a 20% YoY growth in top-line & PAT over the next 10 years doesn’t look very surprising. And this would mean a lot of wealth creation for shareholders in such companies.

Enter Monarch Networth.

A company operating in the financial services space with very (very) attractive operating margins. The company has TRIPLED their profits (PAT) YoY. Introduced new revenue streams in the past few years. And delivered a 35X return in the past 5 years!

The question is, can it continue winning? Can its market capitalization catapult to INR 20,000 Cr in the next 8-10 years? That’s what we want to find out!

The Business

Established in 1992, the primary business of Monarch Networth is of stock broking. However, there has been a shift in strategy post FY20 — with the management venturing into new business lines with the vision of turning Monarch into a fully integrated financial services company.

Business units

Retail Broking [64% of revenue] — this is a simple business where Monarch offers it’s clients a platform where they can buy and sell securities and Monarch extracts a brokerage for facilitating such transactions.

It offers trading in equities, F&Os, Commodities, Currency futures, ETFs, FPOs and e-IPO services.

Users can trade via its native application called RESACH. The application has a 4.1* rating on Google Play with most users quite satisfied with the performance.

Revenue sources in the broking business are several:

Broking revenue — this is the commission charged by brokers on buy / sell transactions undertaken by Users on the platform.

Interest on Margin funding — brokers typically lend money to Users to enable them to buy securities using leverage. Interest is charged on such ‘margin funding’.

Interest on delayed payments — brokers charge an interest in case there are delays in payment by Users. Delayed payment charges can be levied in case of negative Demat balance, margin shortfall etc.

Investment Banking [17% of revenue]— this is a high growth business division of the company under which it helps businesses with raising capital via IPOs, Debt financing and provides advisory on Mergers & Acquisitions (M&As), Corporate restructuring etc. Some key milestones in this segment:

Successfully led the IPOs of IRM Energy [Issue size: 545 Cr] and Exicom [Issue size: 500 Cr]

Successfully led the QIP of HFCL [Issue size: 350 Cr]

Revenue from this segment recorded robust growth of 93% YoY growing to INR 44 Cr (approx) for FY24. The management is expecting more deals in the pipeline with India’s red hot IPO market.

Asset Management [3% of revenue] — Monarch has diversified into the asset management biz by launching alternative investment funds (AIFs). The target market for AIFs are generally institutions / HNIs since the minimum investment amount is 1Cr.

It is currently managing 2 AIF (MNCL CCF-1 & MNCL CCF-2) schemes with combined AUM of > INR 1000 Cr.

Pre-closed 1 AIF scheme (MNCL CCF) which was raised in October 2020 ahead of schedule generating returns of 23% CAGR to investors.

Planning to launch a PMS scheme to compliment the AIF business and venture into the mutual funds biz to cater to retail investors.

Revenue from Asset management for FY24 was INR 9 Cr (up from INR 2.17 Cr in FY23). MNCL CCF-2 AIF raised INR 729 Cr in April 2024, so if you do the math — the management fee % for FY24 comes to around 3.3%. Taking a conservative approach, if we assume a 3% management fee going forward that would translate to INR 30 Cr in revenue on an AUM of INR 1,000 Cr.

Other revenue streams — Monarch makes money through various other revenue streams like:

Interest on FDs kept under lien with stock exchanges [13% of revenue]

Income from insurance distribution

Interest income from NBFC business

The Tailwinds

Now that we have a firm grip on the business model of Monarch and how it has evolved into a fully integrated financial services company, what we want to understand is — can MNCL become an INR 20,000 Cr company in the next 8-10 years? What are the growth levers that it can pull to grow its top-line / bottom-line?

Shift in management strategy and growth drivers — Monarch has been a broking company since inception primarily appealing to HNIs / Corporations / Institutional clients. That narrative is slowly changing.

Since FY20, the company began diversifying into other businesses and in the last 3-4 years is seeing good growth in the investment banking and asset management business.

In July 2024 — Monarch raised INR 300 crore via private placement which will be used:

to launch it’s PMS offering

to scale it’s margin trading book

for launching a pre-IPO fund

for applying for a mutual fund license

strengthening the debt capital market division

Underwriting IPOs among other things

The above initiatives might take anywhere from 2-5 years to scale and make a meaningful impact on revenues.

Growth in margins — Monarch operates an asset light business (like most financial services companies). It has minimal debt on it’s balance sheet. And its operating margins are VERY sexy indeed — which means that the company is bearing the fruits of operating leverage.

Operating leverage is when revenues increase faster than expenses because of certain expenses being of a fixed nature.

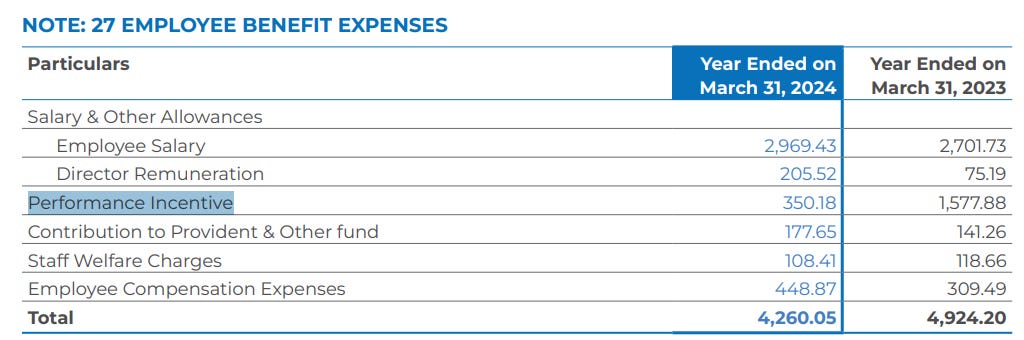

In this case, for e.g. total income for Monarch increased by 72% in FY24. But employee benefit expenses actually decreased by 13% [which is weird?]

Sub-broker & commission expenses which it pays to it’s sub-brokers increased by only 25% YoY.

Other expenses increased by 16% YoY.

Other developments — some other noteworthy developments in the last few months that investors should be aware of:

IFSC License — One of Monarch’s subsidiary companies has received a ‘Registered Fund Management Entity (Retail)’ license from the IFSC authorities at GIFT City. Using this license, Monarch will be able to manage public offerings of REITs / InvITs enabling it to target foreign investors.

MF License — the company has applied to SEBI for a mutual fund license to cater to grow it’s target audience and offer mutual fund schemes through it’s platform. India currently has 47 fund houses with INR 68 TRILLION in AUM. This is an ultra competitive space & Monarch might have a hard time gaining market share, but this opens up a BIG market for them in the future.

Causes of concerns

I couldn’t find a lot of red-flags against the company and there’s not a lot of research material by other analysts out there which makes it difficult to find out if there are any skeletons in the closet. In the absence of information, we draw as much as we can from the numbers that are present in front of us.

Reduction in employee benefit expenses — in an ideal world, if a company reports increase in revenues [and profits], you’d imagine that the employees would get paid higher. Well, that’s not what has happened here.

In a year, where total income is up by 72% — why have performance incentives dropped significantly? That doesn’t make a lot of sense to me. The sales team is probably not very motivated.

The company has a Glassdoor rating of 3.9*, which isn’t too bad. However, if you read some of the employee comments it seems that there are not too many growth opportunities for low / mid level employees — which means decision making is concentrated with a select group of individuals.

Increase in receivables — there was a significant increase in trade receivables, putting pressure on Operating cash flows. The company also recognized a provision for doubtful debts of INR 1.16 Cr. Not a big cause of concern, but a metric which should be closely monitored.

Violation of stock broker’s rule — the company paid INR 11.37 lacs towards settlement amount to SEBI for violation of stock broker’s rules. Monarch was alleged to be the stock broker for certain entities who carried out fraudulent trades in the securities of Atlantaa Limited.

Other points

Director remuneration has increased from INR 75 lacs to INR 2 Cr, despite decrease in overall employee costs. Not something that employees would be thrilled about.

Approx. 3% of shares are pledged by the promoters of the company.

What is the requirement of such pledge when the company is making healthy profits which can be distributed as dividends to promoters? We do not know.

Auditor remuneration stands at just INR 6.6 lacs — which looks absurdly low for a company the size of Monarch [w/revenues of 260+ Cr in FY24]. One could question the quality of the audit being conducted, given such low audit fees.

Conclusion

At a market capitalization of INR 2,400+ CRORE, trading at a P/E of 16 — I think the company is fairly valued. The metrics look solid. Operating margin of >60%. 5Y ROCE of >40%. Revenue growth of 72% in FY24.

However, the FY25 #s were recently released and revenue growth has taken a hit.

Revenue for FY25 was INR 327 Cr [a 18% increase YoY]

ROCE dropped to 33% in FY25 from 52% in FY24 [this was due to the 300 Cr private placement in July 2024, which increased the capital base]

I believe there is a lot of growth that can be unlocked with new initiatives that the company is undertaking like expanding it’s margin book, launching a PMS offering, getting into the mutual fund business etc.

Some unanswered questions that I would like to get answers to:

What is the revenue guidance for the next 3 years?

What is the baseline EBITDA and PAT? Has it stabilized or is there more room to grow?

What will be the revenue contribution from new segments like PMS / Mutual Funds? Will these segment dilute margins to some extent?

What is Monarch’s competitive advantage? What is management’s strategy to win deals? How will it claw market share in an ultra competitive market?

Is there a plan to launch more AIFs? Can it sustainably grow AUM?

What are the IB deals in the pipeline? How much commission does Monarch make on investment banking deals?

To conclude, Monarch can scale it’s business without significant capex requirements and I believe if the company can grow its net profits by 15% every year — this could be a compelling value investment for the next 5-10 years, creating [a lot of] wealth for it’s shareholders.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends.

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]