One of the things about studying micro-caps, is that there is very little information available for investors to take informed decisions. Without a solid management commentary, it becomes very difficult to understand what direction the company is going in.

So, the best you can really do — is take a calculated gamble.

I asked my subscribers which microcaps they want me to study next & I got a good list which will keep me busy for the next few weeks. The first one I want to start off with— is Gujarat Toolroom Limited.

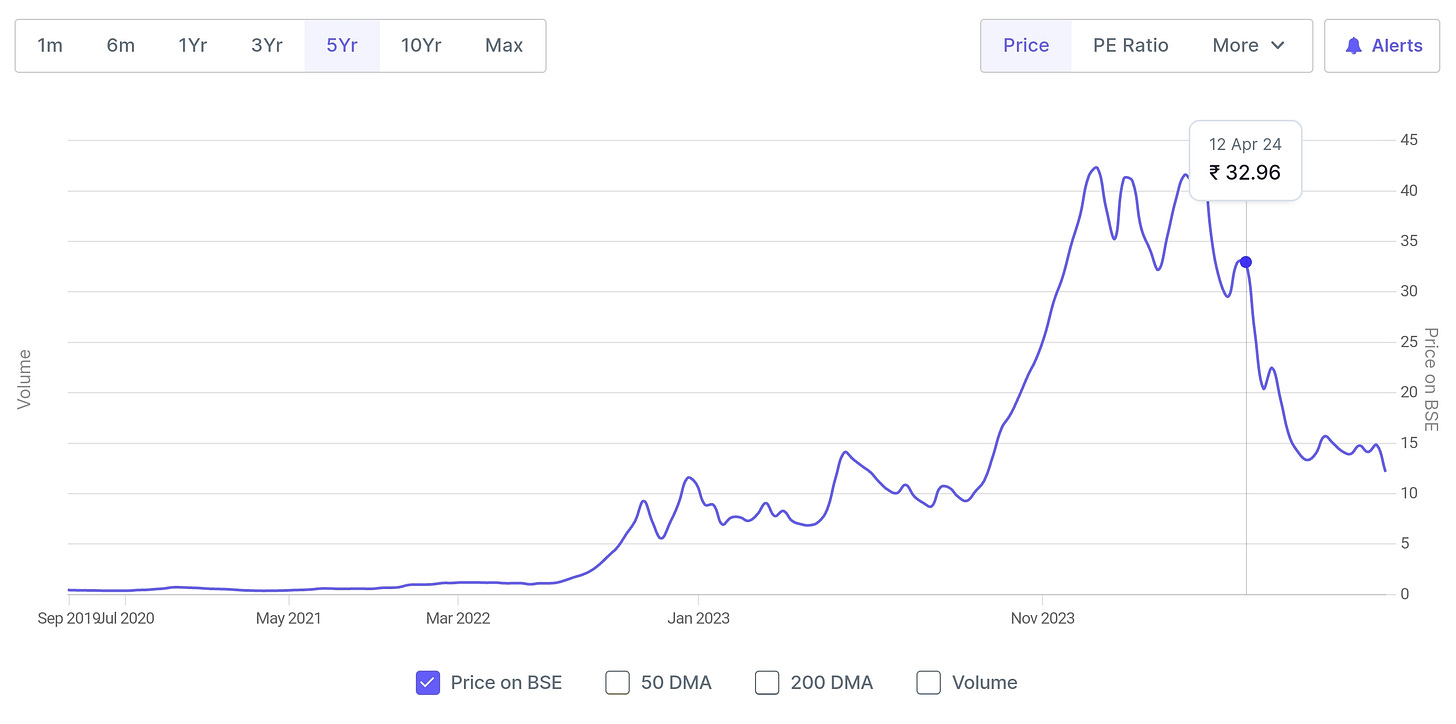

It is evident from the chart above, that the stock has been in a bit of a freefall lately. Trading at a P/E of 2, with a market capitalization of INR 140 CRORE, ROCE of 160%+ and a dividend yield of around 8% — on paper this seems like the perfect value stock.

But, more often than not — there is a strong reason why a stock falls in such drastic fashion. The collective market, is quite intelligent.

So — why is the stock falling? Is this a great opportunity to make a value bet? What are the growth drivers? To understand this, let’s first understand the business.

The Business

If you go through the annual report OR the financial statements of this company — you wouldn’t understand what business they’re in. There is no commentary from the Chairman / MD. No management discussion. No quarterly earnings call. No interviews with any major news outlets. Typical for a penny stock.

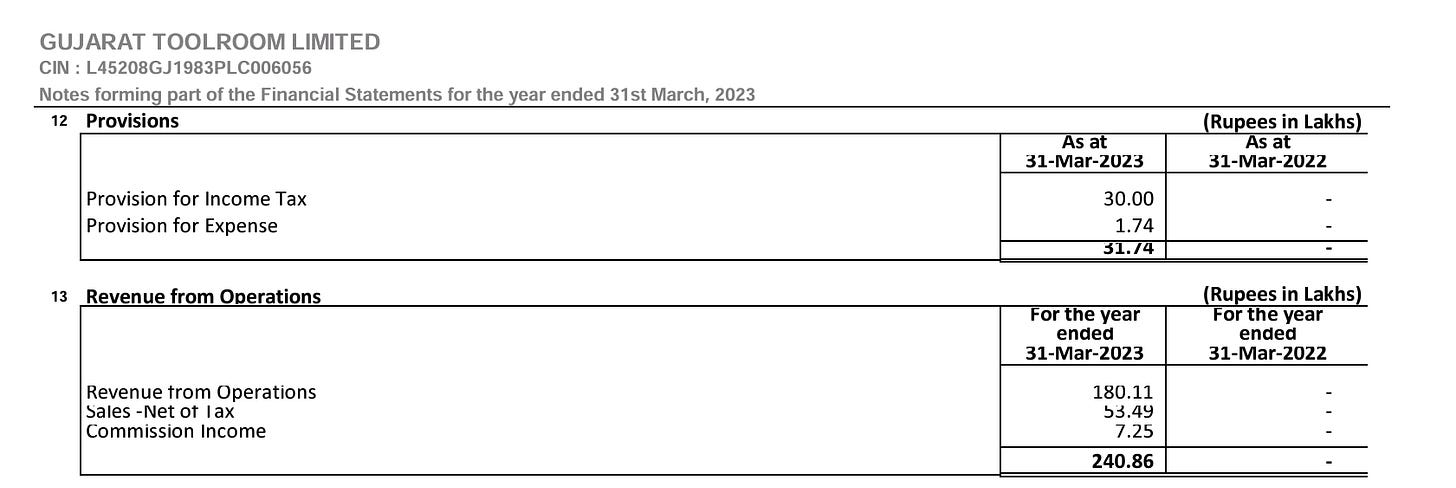

If you try to deduce anything from the notes to financial statements, you’re disappointed. Even in the picture above, all that’s mentioned is ‘Revenue from Operations’ and it is not defined what falls under ‘Operations’

So — I resorted to external sources to understand what exactly is the company doing.

Gujarat Toolroom was incorporated in 1983, involved in the business of mining, metal trading, dealing in precious gems and import / export of industrial supplies including manufacturing of moulds for pharmaceuticals, food and beverages, writing instrument, caps and closures and oral hygiene products.

The company was undergoing a period of dormancy upto 2022 (which means there was ZERO REVENUE) — and recently went through a remarkable resurgence in 2022 under a new management. It has the following lines of business:

Mining Business — the company recently acquired 6 hectares of mines in Zambia, expecting to generate >INR 700 Cr in topline per annum once these mines become operational (mines expected to go live by Q1FY25).

As per the management, the company’s subsidiary (Gujarat Toolroom Zambia Limited) is positioned to be a leading gold refining plant in Zambia — processing pure gold as per international standards.

Diamond Business — The company is planning to invest INR 50 Cr to set up a wholly owned subsidiary in Dubai in the sector of precious stones, diamonds, gold bars & jewellery.

Renewable Energy business — The company recently announced it’s foray into renewable energy through it’s Hybrid Green Energy power plant, claiming such investment would increase annual profitability by INR 145+ Cr.

The project would involve an estimated investment of INR 572.5 Cr to develop a state of the art facility spanning 65 acres. This plant would generate 97.5 MW of energy per hour.

The power plant is expected to provide electricity to approximately 70-73K households — driving positive environmental and social impact.

Order Book — Gujarat Toolroom has an order book of INR 3,000+ Cr, comprising contracts from domestic + international markets.

The company secured contracts to supply construction materials to leading firms like RIL (INR 29 Cr), Adani Gas & Power, Gujarat Gas and Indian Oil.

Other points

Currently the company is listed only on BSE. The company is in the process to list on NSE + NASDAQ which aligns with the company’s vision of expanding it’s shareholder base.

The company announced an interim dividend — which highlights that the company has sufficient cash to payback it’s shareholders.

Reg Flags 🚩

There are several striking red flags against the company that the investors should be aware of.

Lack of information provided by the management — if you were to go through the financials of Gujarat Toolroom, you wouldn’t understand what business they’re into. Apart from the lack of material information for investors, there are several other gaps in the financials of the company:

Formatting + alignment issues in the financials — basic hygiene is missing in the financials which signal that the auditors of the company probably are not really performing basic checks.

Employee benefit expenses of INR 28L? — with hardly any employee costs, you wonder what kind of business is the company doing? Without employees, how are they going to build a sustainable business? Who is going to execute all these new projects?

Slight mismatch in the year end numbers reported in the Q4 report published and the year end audited financials. This is quite embarassing if you ask me.

SME Stock — Gujarat Toolroom besides being a microcap, is also an SME stock. This means that the minimum investment in the company has to be greater than INR 2L, which is quite risky for most investors.

Secretarial Lapses — in the FY23 annual report, around 16 secretarial lapses were noticed by the secretarial auditor, which highlights the lack of basic hygiene. You need to have employees to handle these things and by the look of it, they are heavily understaffed.

ZERO PROMOTER HOLDING — saving the biggest red-flag for the last, there has been a significant decline in promoter holding — with promoter holding going to ZERO in the quarter ending March 2024.

Promoter holding is very important, because they are the stewards of any business. Without promoters, who is running the business? Who is going to take key decisions and guide the CEO on the right path?

More importantly, if the company was going to increase profitability — why did the promoters sell their shares? The growth in business would directly benefit the promoters — so them selling their shares, looks very shady.

Conclusion

This article has been relatively short because there was not enough information out there about this company for me to sift through — a point of grave concern.

If you look at the valuation and the return ratios in isolation — it looks like an extremely good value opportunity. ROCE of 165%. PE of 1.97 times. Dividend yield of 8%+. Management expecting to add INR 145 Cr in annual profitability through it’s renewable energy power plant, which in theory should lead the market capitalization of this company to shoot up significantly.

But — the stock has been falling. Obviously, the market is intelligent and it knows something that we don’t yet? Apart from this, there are many unanswered questions like:

How is the company expecting to build a renewable energy power plant with a capex of INR 500+ Cr without any significant liquidity (cash & cash equivalents of INR 8.29 Cr as at 31 March 2024) on the books ? Did it raise money through private placement post March 2024?

Also, who will execute these projects — there are hardly any employees on the payroll of the company?

Why was the business dormant for such a long period of time? What’s the strategy going forward?

How quickly can the company execute it’s order book?

Which vertical (Diamonds, Mining, Renewable Energy, Construction Materials) will the company focus on?

Why is the stock price falling despite increase in profitability?

Why did the promoters sell ALL their holdings despite knowing that increase in profitability would directly benefit them the most?

I’d keep a close watch on the quarterly results and extract as much information as possible about the ^ questions before taking any investing decision. Without employees you can’t run a company. Without liquidity you can’t undertake any capex. Without promoters, you don’t have a solid direction. Without information, you cannot take informed investing decisions.

Investing, is a gamble. With proper research, you can take an informed gamble. With Gujarat Toolroom, although the downside is very limited — there’s too much ambiguity about it’s operations to take any sort of decision.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Umm yeah maybe they’d have recently gone mainboard..

FII Holding Recently Increased to 27.15%. What's Your Thought on this.