One of the ways to identify value opportunities is to screen stocks that are trading at a P/E of < 10 + 5Y ROE of > 20% + market capitalization of < 1,000 CRORE.

What this signifies is that the stock isn’t very expensive and is able to generate above average returns and also has a lot of room to grow. FD gives an ROI of 6-7%. Mutual funds over a long term have known to generate average returns of close to 10-15%.

So, a company with a ROI of 20% over a period of 5 years, is pretty darn impressive. And if you can buy into that stock at a cheap valuation, you’ve got yourself one hell of a good deal.

I am starting a series on stocks with market capitalization of < 1,000 CRORE. Very honestly, at this juncture with the markets in a overstretched bull run — it is difficult to find GAPS in the market, but that will not deter us. Our search for money making opportunities shall continue endlessly.

I want to start with a company that is in the commodity business — Goa Carbon Limited.

The reason I started with this company is that not many people know about it. I would never have found about it unless it appeared on my screener.

At a market capitalization of INR 750+ CRORE, is there a lot of room for this stock to grow from here? Let’s find out!

The Business

Goa Carbon Limited is in the business of manufacture and marketing of Calcined Petroleum Coke (CPC) — an essential ingredient in the smelting of aluminum.

Before we dive deeper into the tailwinds and future prospects of the company, let’s first understand a little bit about CPC.

What is Calcined Petroleum Coke?

Calcined Petroleum Coke (CPC) — is very important in the manufacturing process of aluminum, steel & other carbon based products.

CPC is an essential raw material for making the anodes which are required for aluminum smelting. About 400 KG of CPC is required to produce 1 ton (1,000 KG) of aluminum.

Raw Petroleum Coke (RPC) or Green Petroleum Coke (GPC) (which is a by product of oil refining) is the raw material used to produce CPC. The process of calcining removes moisture and volatile matter from RPC at high temperatures (around 1,350 degrees) to produce CPC.

There are no commercially viable substitutes for CPC in aluminum smelting due to it’s low impurity levels, relatively low cost & ready availability. Additionally, CPC plays a significant role in production of titanium dioxide — which is used as a base pigment for construction, automotive paints, plastics, coatings, cosmetics, toothpaste & sunscreen. CPC is also utilized in the production of high strength steel for building bridges / skyscrapers etc.

China + North America are the dominant producers of CPC, accounting for >75% of global CPC production. Demand for CPC is directly linked to the demand for aluminum and steel.

History + Tailwinds

Established in 1967, Goa Carbon is one of the leading CPC manufacturers in India and was the first Indian manufacturer and exporter of CPC. With more than 5 decades of experience in this industry, GCL has an established market position in the CPC market.

GCL is part of the Dempo Group — which has presence in iron ore mining, construction, publishing, ship building, travel and trade among others. So, there’s a very strong holding company backing Goa Carbon.

Tailwinds

Long term relationships with customers / suppliers — Since Goa Carbon has been in business for >50+ years, it has developed excellent relationships with it’s customers & suppliers [which is ABSOLUTELY NECESSARY in a commodity business].

In a commodity business, customers buy from the player that sells a product (of the same quality) at a lower cost. The only reason they might pay higher is if you offer a better credit period OR if they have a great business relationship with you.

Domestic customers include Hindalco, NALCO, Vedanta Aluminum, Kerala Minerals, SAIL and several steel plants in the South western region and Odisha.

International customers include Aluminium Pechiney (France), Aluminium of Greece, SABIC (Saudi Arabia), Dubai Aluminium, Sohar Aluminium (Oman), ALUCAM (Cameroon).

GCL has developed healthy relationships with various global raw material suppliers such as Kuwait Petroleum, Oxbow Carbon & Minerals, Mitsubishi Corporation etc.

Growth in Aluminium demand to spur growth in CPC demand — India’s aluminum market was valued at $11.28B in 2023 predicted to reach $19.76B by 2030 growing at CAGR of 7.6%.

Aluminum’s lightweight nature contributes to fuel efficiency, making it an efficient choice for automotive, defence & aviation industries.

The Government’s massive infrastructure development plans, growing urbanization, investment in railways / metro lines, transition to clean energy and EVs are likely to increase aluminum demand in India. As per ICRA, the automotive sector plays a pivotal role in overall consumption of aluminum in India.

Rising costs of aluminum production in the West could shift production towards the East, which could result in additional business opportunities for the Company.

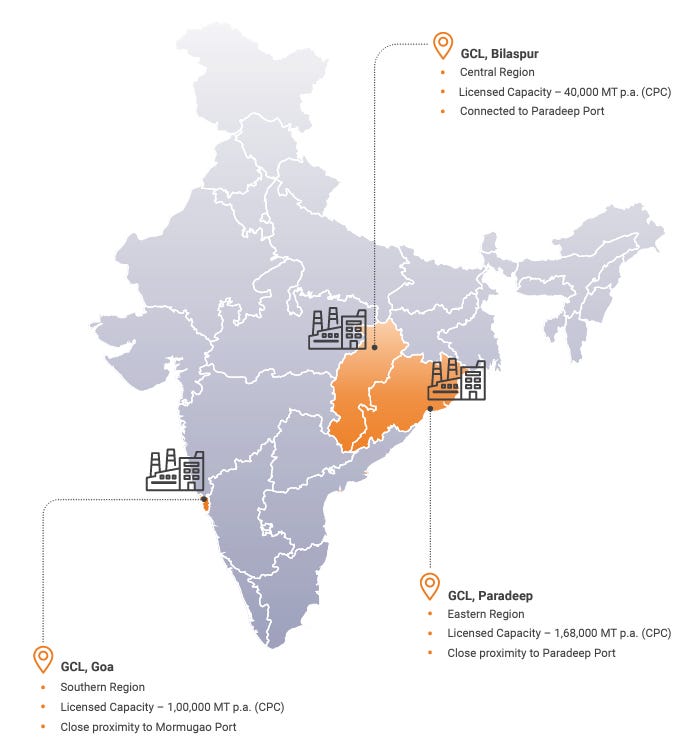

Manufacturing facilities — Goa Carbon has 3 manufacturing facilities strategically located near major ports in Goa, Paradeep and Bilaspur with a combined capacity of 3,08,000 MTPA (metric ton per annum).

Manufacturing facilities of Goa Carbon All the plants are ISO 9001 and ISO 14001 certified by Bureau Veritas, reflecting the company’s commitment to quality and environmental standards.

Others

The Supreme Court of India has put a cap on import of CPC by aluminum smelters at 0.50 million tonnes per annum which means that additional supply of CPC has to be met from domestic supplies — thereby benefitting GCL.

The company recently launched it’s first branded product called ‘Gcarb+’ to revolutionize the recarburizer and carbon additive sector. Targeted primarily at steel / foundry industries — the introduction of Gcarb+ signifies the company’s dedication to innovation and its vision to offer holistic carbon solutions beyond CPC supply.

Promoter holding has remained at approx. 60% with no considerable change in the last 5 years — which means that the promoters are not really looking to cash out even though the stock price has increased. Also, no shares held by promoters have been pledged, which is a good sign.

Shareholding pattern of GCL The company has a dividend yield of 2.11% and has been continously paying dividends for the past 10 years.

Points of Concern

Apart from the fact that Goa Carbon is a micro-cap with low liquidity, there are several concern points that an investor should note before investing in the company.

Commodity business — Calcined Petroleum Coke is a commodity, which is used in the production of aluminum — which is another commodity. There is not going to be much difference between CPC that Goa Carbon makes and CPC that a competitor makes.

Commodity businesses in general do not have a lot of pricing power. Low pricing power > low operating margins. Low margins > Low profits. Low profits > Low growth in shareholder wealth.

In the commodity business — it comes down to operational leverage to reduce prices continously, running your factories at optimum capacity and maintaining a healthy relationship with the customer.

Raw Petroleum Coke (RPC) is the raw material used to make CPC. RPC is derived from crude oil. Increase in prices of crude oil, could increase the cost of procuring RPC and have a direct impact on margins of Goa Carbon.

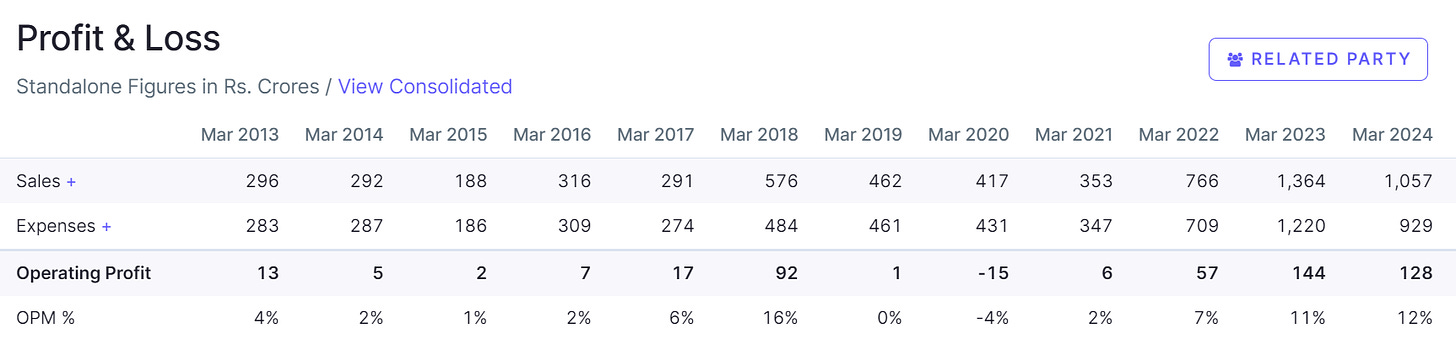

You can see from the table below, just how much the operating profit margins (OPM %) have fluctuated over the years. It probably means that Goa Carbon is unable to pass on the increase in input costs to the final customer.

Extract of P&L of Goa Carbon As per the management, customers are very specific about the quality parameters of CPC which puts a lot of pressure to procure high quality RPC. A slight change in quality parameters has a significant impact on the pricing of RPC + the quality of RPC in the domestic market has been deteriorating causing dependence on imported RPC — which would lead to increase in the cost of RPC. Not great, if you’re Goa Carbon.

Demand for CPC is dependent on demand for aluminum / steel which is dependent on the pace of growth of the domestic / global economy. Any slowdown in economic activity — would adversely impact Goa Carbon.

Idle manufacturing capacity — GCL has 3 manufacturing facilities, but they’re not operating at 100% capacity. As per an analyst report, the capacity utilization was 64% in FY21, 59% in FY22 & 55% in 9MFY23.

It takes a lot of money to build factories. Once they’re built — you want them operating at near 100% capacity to recover your money back ASAP. Capacity utilization levels going down means that your machines / factory is lying idle for a significant time and that’s not something you want to see as an investor.

The question is — is the capacity utilization level low because of low demand? Or is there some issue with the machines? And if it’s a demand issue, can GCL increase capacity to cater to more demand?

Others

Environmental Regulations could hinder business — Aluminium / steel production releases a lot of harmful emissions which has an adverse impact on the environment. Any potential regulation that impacts either the import or production of aluminum could have an adverse impact on the production + demand for CPC.

High customer concentration — Majority of GCL’s revenues come from Hindalco Industries (HIL) and Vedanta Aluminium & Power Limited (VAPL). Any slowdown in the businesses of these two companies would directly impact GCL.

High Debt to Equity ratio — GCL’s D/E ratio is quite high given the requirement to raise short term loans (including overdraft limits) due to fluctuations in raw material prices.

However it has reduced it’s borrowings from INR 422 Cr in FY23 to INR 334 Cr in FY24, which is a good sign.

Revenue decline in FY24 — there was a 23% decline in topline YoY for Goa Carbon. Why has revenue declined so much? Because of low demand? Or because production facilities were closed for some time? I couldn’t find much on the internet as well, so I guess we will have to wait for the FY24 Annual Report to understand the exact reason for the revenue decline.

It could be a reason for worry if this trend continues because if you look at the sales trendline for the past 10 years, there is no real consistency in the topline.

Conclusion

Demand for aluminium / steel is going to be on an upward trend given the massive infrastructure spending that India is embarking on — which means more requirement of CPC, which bodes well for companies like GCL.

Compared to it’s peers, GCL is trading at a discount. It has a decent dividend yield. Good return ratios. Operating profits have increased YoY despite decrease in revenues. With a market capitalization of just INR 750+ Cr, there could be a LOT of room for GCL to grow, despite being a commodity business.

The problem with a lot of microcaps — is the lack of information available for investors to act upon.

For Goa Carbon, I couldn’t find any quarterly earnings transcripts. No earnings call. No PPTs. Limited information in the annual report. Not much available on the internet either. Not a lot of coverage by brokerage houses on the stock.

As an investor, answers to the below questions from the management could help in gaining a deeper understanding of the business:

What is Goa Carbon’s market share in India / globally? As per some sources on the internet it is the second largest producer of CPC in India, but how much is the market share exactly?

How much growth is Goa Carbon expecting for FY25? What is the revenue / EBITDA guidance? Who are the competitors? What is the strategy to expand margins? Any more capex planned? What is the plan to reduce debt?

Can the company branch out into production of any other commodity? Can the manufacturing plants be used for multi-purpose manufacturing to utilize the idle capacity? What is the capacity utilization of the plants for FY24?

What are the new customers in the pipeline? What is the order book? Where is the market headed? Any headwinds that the management foresees?

What is the baseline EBITDA margin for investors to consider over the long term?

We will keep a close watch on the company to see how things play out eventually.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

In last quarterly result employee cost is increasing from 2% to 4%