Sona Comstar - an auto ancillary player has had a pretty decent run in the markets since it’s listing [up by 50% from it’s IPO price].

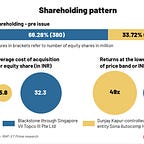

It’s IPO provided a great exit for Blackstone which diluted 50% of its total holdings in Sona Comstar - earning a RoI of 8.8x.

As is the case with most of the IPOs - the VCs & PEs of the world are the ones that really get to eat the cake & the retail investors are left with a cherry on top.

But, let’s not go down that rabbit hole.

Let’s try to answer the question - ‘Is Sona Comstar a good long term investment?’

History

The company was incorporated in 1995 as a JV with Mitsubishi - originally named as ‘Sona Okegawa Precisions Forgings Limited’ - led by it’s promoter Surinder Kapur who has been instrumental in the development of the Indian auto components industry.

In 2008, they acquired Thyssenkrupp’s forging business ‘BLW’ - because the company was criticized of being too conservative. The irony is, that this acquisition put a lot of strain on the cash flows of the company and at one point in 2008 - they were on the brink of bankruptcy. But, they managed to weather the storm.

2016 - was a BIG year in the company’s history because they bagged the priced jewel - Tesla as a customer. (this isn’t confirmed in the prospectus - but industry sources believe that they indeed have Tesla as a client)

Tesla was facing issues with it’s ‘differential assembly’ & came to Sona Comstar for a solution. Sona invested in this line of business specifically to cater to Tesla & the investment paid off really well - a masterstroke, from the company’s management.

Parameter #1: Growth of the Industry [Score 9/10]

One of the reasons why a lot of investors are excited in Sona Comstar - is it’s link with the EV space. The company derives 40% of it’s revenue from the EV category.

As per the company’s prospectus - 2 Wheeler EV sales in India is projected to grow at a CAGR of 74%. [which is absolutely massive!]

To put things into perspective, in FY21 only 1.5 lac ‘2 Wheeler EVs’ were sold in India. This, is projected to rise to 2 MILLION units in FY26 & if the company can capitalize on this growth - sky is the limit.

EV, is one of the fastest growing industries right now & the world is moving towards E-mobility.

Parameter #2: Competition & Risks [Score 7/10]

a. Competition

The company operates in the auto ancillary industry - which is dominated by players like MotherSon Sumi, Bosch & Bharat Forge to name a few.

On the global front, it faces competition from players like Valeo, BorgWarner - which are 10x the size of Sona Comstar & would be in a better position to grab opportunities in this space.

Competition is bound to heat up in the EV market & established players will also look to grab a piece of this growing pie. It’ll be interesting to see if the company can maintain it’s competitive edge in the future.

b. Risks

One of the risks for the company - is customer concentration. It derives 80% of it’s revenues from the top 10 customers.

However, this is a feature of the auto components industry, where a few customers contribute heavily to the topline.

Another risk - is that the industry itself is cyclical in nature & demand keeps fluctuating - which makes it difficult to forecast production & could lead to money being blocked in excess inventory.

Parameter #3: Advantages of the Company [Score 8/10]

One of the biggest advantage I believe - is management’s ability to grab opportunities at the right time.

Case in point - ‘differential assembly’ - which wasn’t a business segment before 2016 & currently contributes 17% to the topline.

The company also has long standing relationships with it’s clients & auto components manufacturing is a sticky business. Once you get a customer - they tend to stay. They have clients like Maruti Suzuki, Mahindra, Escorts etc, with more than a decade of relationship.

Plus, having Tesla as a customer is a BIG DEAL and as Tesla grows so does Sona Comstar. It’s association with the EV space - is a definite green light.

They have a good product mix in the ‘starters & bevel gears’ market and the company has been able to grow their market share consistently.

Parameter #4: Financials [Score 7/10]

For an auto components maker - the financials look pretty decent.

The company has been able to maintain an EBITDA margin of 28% - consistently for the previous 4 years - which is almost double compared to it’s peers and it also indicates that it’s products fetch high margins.

They have a healthy RoCE (‘return on capital employed’) - which shows that the management has been smart in rotating it’s capital. Revenue & net profits however, have not grown exponentially & have witnessed relatively stable growth YoY.

One of the things to look out for - is the high amount of Inventory & Receivables on the books - which is classic for a components manufacturer. But, because they have long standing partnerships - I am quite confident that high inventory wouldn’t be a BIG risk.

Parameter #5: Valuations [Score 5/10]

The pre-IPO P/E of the company was 74 - which is nothing short of exorbitant. And, the P/E has only gone up, since the company’s stock has increased by more than 50% from it’s IPO price of INR 291.

Take any valuation parameter - P/E ratio, P/BV ratio or the EV/EBITDA ratio, the company’s valuation is higher across all the ratios - compared to it’s established peers in this space.

The markets have discounted all the future growth it seems - and the company needs to grow it’s topline & bottomline exponentially to justify these valuations.

Verdict: Keep the company on your watchlist - since the company is a play on the EV story. It’s a stable business with sticky customers, a good product mix & a healthy EBIDTA margin - but at the current valuations, look a tad bit expensive.