I’ve always been fascinated by the pharmaceutical space. There’s so much innovation. New drugs being developed. New treatments. Finding ways to extend human life and treat diseases — that’s been the driving force behind all Pharma developments I believe.

And now you have fields like nanotechnology. Synthetic biology. The idea of having chips inside the human body to track diseases. Mind bending stuff.

For all my fascination, I never quite understood how the Pharma industry works. I know there’s a LOT of money in medicines, treatments, hospitals, diagnostics, drug development — but how does this industry function? Which player takes home the majority of the profits? What regulations do you need to keep in mind? Which geographies are the best places to sell your drug? What is a generic drug? What goes into making a new drug? Who owns it? How long is a drug patent valid for?

I had a lot of questions, and so I started reading about the industry dynamics. After spending the past week in research — I would say I have some inkling of how to analyse Pharma companies and I am excited to deep dive into Indian pharmacy companies!

#1 Divi’s Laboratories

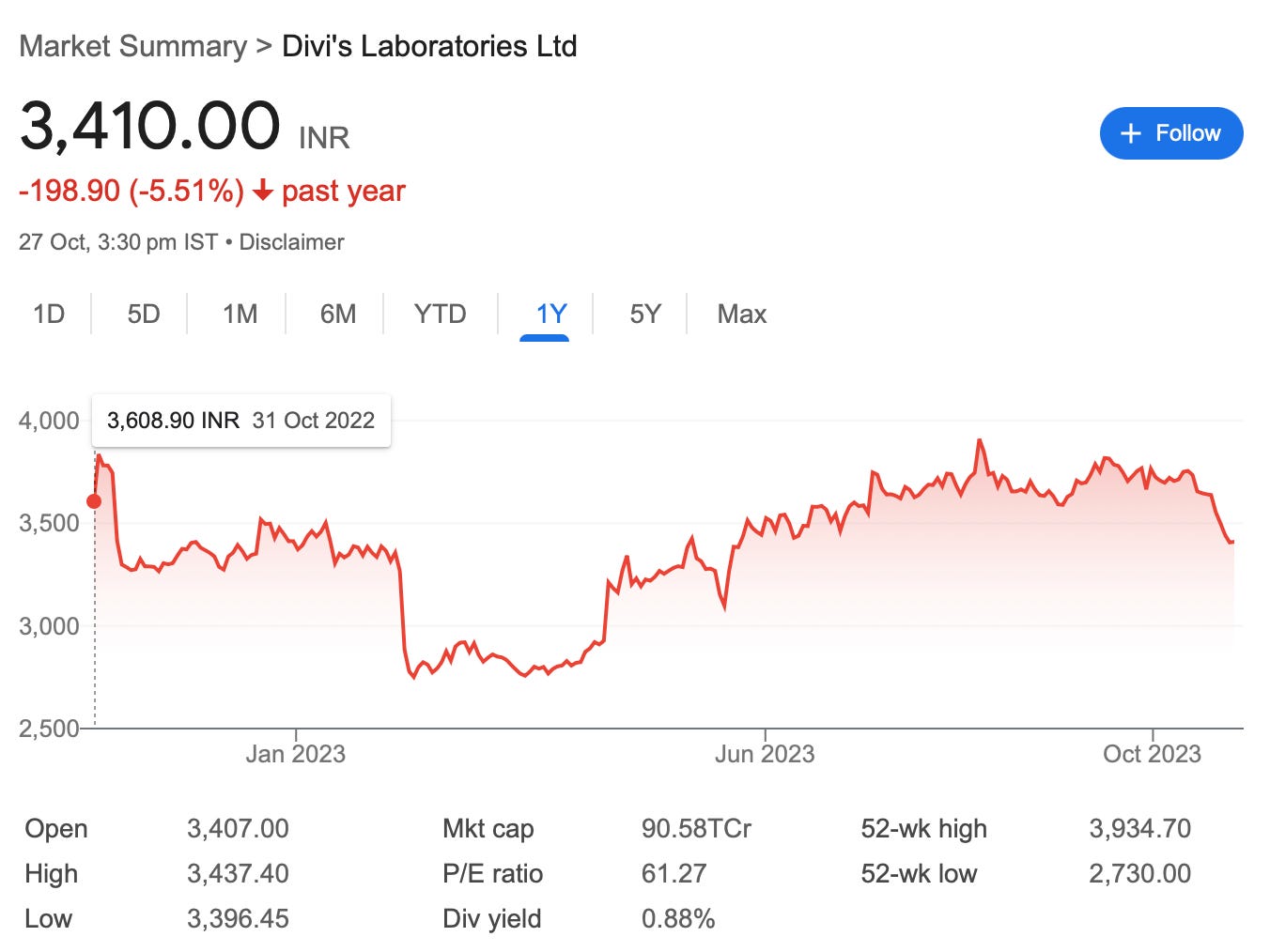

Disclaimer: Well, one of the reasons I want to start this series on Pharma stocks with Divi’s Labs — is because I used to own some shares in the company. Sold it recently because I thought it was TOO expensive. But, wanted to understand if I made the right decision, so here we go.

Before we understand the business of Divi’s Labs, it is extremely critical to understand the various sections of the Pharma space and their respective functions:

Active pharmaceutical ingredient (API) manufactures: These players make — what is called the bulk drugs which essentially are the basic molecules that go into the creation of a new drug / medicine, which are supplied to formulations manufacturing companies.

Formulations manufacturing companies: These company buy the basic molecules from the API manufacturers and convert them into tablets, injections, syrups. These companies convert the chemicals into the final drug, which can be sold for human consumption. There are two types of formulations manufacturers:

Innovator companies — these companies do the R&D + discover new drugs themselves and file patents so that ONLY they can sell these drugs in the market until the patent expires.

Generic companies — these are companies that wait for patent protection of the Innovator companies to expire, so that they can copy their formulations and manufacture what are called ‘generic drugs’. These are substantially cheaper than the patented drugs.

Contract Research and Manufacturing Services (CRAMS): These companies provide R&D and contract manufacturing services to the Innovator companies. The investors must note — players operating in the CRAMS space DO NOT own the patented drug and manufacture the drugs putting the labels of the innovator companies.

Drug distributors: Once you’ve made a drug, the most essential part is to distribute it so that it can reach the masses. Players in this section include C&F agents, super stockists, stockists and retailers / pharmacy shops.

In India, most companies are either API manufacturers, generic formulation companies, CRAMS or distributors. Very few are innovator companies, given the amount of R&D and deep pockets required to create new drugs.

The Business

So now that we have a brief understanding of the different sections of the Pharma industry — let’s understand Divi’s business.

Divi’s Laboratories has 3 revenue streams:

Generic APIs [47% of total sales]— Divi’s manufactures APIs for generic formulations companies. It is one of the largest API manufacturers in the world, with two world class multi-purpose manufacturing facilities. It has a product portfolio of 30 APIs, with additional 10 APIs in various stages of R&D.

Custom Synthesis [45% of total sales] — Divi’s undertakes contract manufacturing of APIs for global innovator companies. It has a robust product portfolio spread over diverse therapeutic areas. It counts some of the biggest Pharma companies like Novartis, Sanofi, GSK, Merck as its clients.

Nutraceuticals [8% of total sales] — Divi’s is one of the leading producers of carotenoids — which are natural pigments extracted from plants. Carotenoids, are antioxidants which protect against chronic diseases, increase immunity and increase the shelf life of food articles. Divi’s Labs supplies carotenoids to food, dietary supplement and feed manufacturers around the world.

*% composition of sales of the above revenue streams is taken as at the end of FY23.

The Positives

Let’s talk about some of the positives that are working in favour of the company:

Divi’s Labs has one of the best operating profit margins in the industry. The API business is a commodity business, and essentially doesn’t enjoy high margins. The fact that Divi’s Labs has enjoyed operating margins in the range of 27-35% suggests that:

It manufactures complex APIs which have few competitors and involves complex chemistry.

It enjoys good relationship with its customers — which are large global pharmaceutical players. One of the reasons for sticky customers, is that Divi’s is an API-exclusive manufacturer and it doesn’t compete with it’s customers.

Custom Synthesis contributes significantly to total revenues, which is a high margins business.

Divi’s generates 90% of it’s revenues from the export market which are price insensitive markets. It derives 29% of revenues from exports to the US market, which in general doesn’t have stringent price control on drug prices.

Operates two manufacturing facilities with combined capacity of > 14,600 m3 and is in the process of setting up another manufacturing facility at Kakinada which is expected to be commercialised by the end of CY24 (i.e. December 2024).

The Company plans to use this new facility to manufacture KSMs (Key Starting Materials), nutraceuticals and intermediates. Nutraceuticals as a segment is growing rapidly which is dominated by key players like BASF, DSM and Divi’s.

Since the new unit will be used to manufacture nutraceuticals — this will free up capacity in the existing two units for more custom synthesis (high margins biz) and generic API business.

Divi’s has ventured into development of contrast media APIs (which is a part of the custom synthesis business). Contrast media are substances which are injected orally to highlight internal organs during X-rays, CT-scans, MRI scans etc.

It already has an existing Iodine based contrast media API — which has only 4 global players and is a $5 BILLION opportunity.

It is developing MRI based contrast media APIs — which has only 2-3 players and is a $2 BILLION opportunity, which should be ready for commercialization in a couple of years.

It has started registrations for a CT contrast media in various countries which is under review and pending qualifications by customers.

Divi’s plays in well as a China +1 strategy for major pharmacy companies as they look to de-leverage from dependence on Chinese API manufacturers. It is a perfect alternative to Chinese API giants thanks to its cost leadership, existing capacity, excellent regulatory track record, operational efficiency and laser-sharp focus on IP compliance.

Lastly, the Company has negligible debt [despite significant Capex], strong cash flows from operations, and an optimal utilisation of it’s fixed assets.

Causes of concern

Now that we’ve spoken about the positives — let’s talk about some of the points of concerns:

The Company generates 46% of revenues from the top 5 products and 41% of revenues from the top 5 customers. Any decline in the demand of these top 5 products / customers could significantly affect revenue & profitability. However, one positive is that the company has been able to significantly reduce product / customer concentration YoY. (see chart below)

Q1FY24 witnessed a slowdown in revenue & EBITDA growth. Operating profit margins — although already high, have been steadily declining over the years which could be due to increase in raw material prices, better pricing negotiated by customers etc. I’d like to see if the margins keep declining further — which could signal a loss in the company’s competitive advantage.

The Company has a working capital intense business. It runs its facilities at full capacity and builds inventory of high volume products freeing capacity for its multi-purpose manufacturing units to produce other products. It also extends a healthy credit period to its customers to build long lasting relationships — which has a positive impact on margins. However — all of this means that more money is required to run the business.

The Company faces forex fluctuation risks — since it earns almost 90% of it’s revenues from exports. However, since the Company imports around 45% of its raw material, that provides a natural hedge to the Company. Apart from that, Divi’s enters into fixed exchange rate contracts with its customers wherever required.

The entire pharmaceutical industry is subject to regulatory risks and Divi’s is no exception. The Company has several new products in the pipeline which are subject to regulatory approvals — and in case of a rejection, it could significantly impact future revenues. A few years back, the two existing manufacturing units were inspected by the USFDA and no observations were issued, which instills confidence in it’s investors.

Conclusion?

Trading at a market capitalisation of INR 90,000 CRORE at a P/E of 61 times — I think the stock is quite expensive.

It has the highest operating margin compared to its peers. Two world class multi-purpose manufacturing facilities — which means it can manufacture various APIs and operate at full capacity.

Zero debt. A third plant coming up soon to ramp up on nutraceuticals + key starting materials. Key starting materials are like raw materials that are used in the production of an API. So — essentially a backward integration, that should logically increase their margins even more.

Venturing into the lucrative contrast media API market — which has very limited global players. Marquee customers. It is one of the largest API manufacturers in the world. Got 10 more APIs in the R&D stage.

It is an API-exclusive manufacturer and doesn’t compete with its customers and that enables Divi’s to gain more confidence and build more trust with its clientele that can keep giving it more business.

Revenue concentration from top 5 products + customers is going down and I’d like to see this trend continue. It has a high working capital (builds up high volume inventory) and is subject to regulatory risks — like all pharmaceutical companies — but overall it’s a company with a good track record. Good R&D capabilities.

The only reason I sold the stock was because I wasn't very comfortable holding onto it at the current levels, but if it significantly corrects — hard to see that happening unless some adverse regulatory news comes out — I’d buy it again.

I think it definitely deserves a place in your watchlist!

What are your thoughts? Have you invested in any other Pharma company that you’d like me to cover in the next few articles?

Let me know your thoughts in the comment section!

I put a lot of effort into research (^ article took me almost 4 days of research) — and these articles are absolutely free. If you liked this article, you can help me out by spreading the word — share it with your friends and investment buddies — and by subscribing to my blog or you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]