I’ve been writing about micro-caps and doing a deep dive into their business models to find potential multi-baggers — which has been a really fun activity so far.

However, a few subscribers have requested me to explain basic investing terminologies which would make it easier to understand some of the stuff I write about — and so I thought, why not start a series on investing basics.

If you’re someone who already knows the basics — you can skip this.

Let’s start with one of the most misunderstood concepts when it comes to investing — market capitalization.

I have been fascinated by the stock markets ever since I was a kid. Every morning, I would watch that floating line at the bottom with stock prices on CNBC Awaaz. All I could see was the ‘price’ of the stock and based on that I would make the assumption that a higher price meant a more expensive OR a more valuable stock.

However, it was only about 10 years later that I understood that looking at the stock price meant nothing — what I needed to focus on was ‘market capitalization’

Let’s understand this with an example.

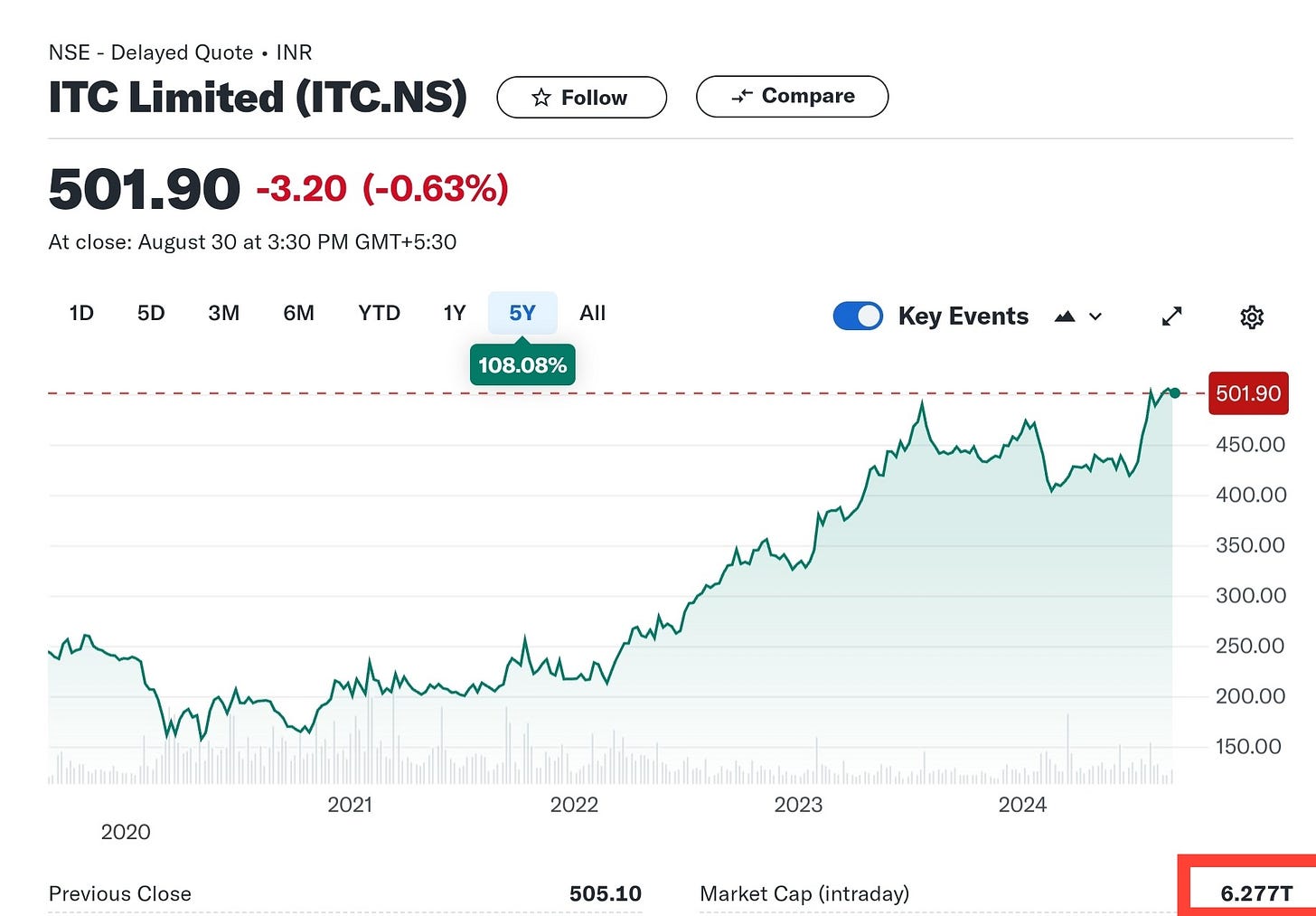

If you look at the two stock charts above, you’ll see that MRF is trading at a price of 134,833 per share & ITC is trading at a price of 501.90 per share. Surely, MRF is a more valuable stock because you’d have to pay more to buy ONE SHARE of MRF?

Not really.

What is market capitalization?

In simple terms, it is the market value of a company. Market value is defined by market participants (like mutual funds, pension funds, insurance funds, institutional investors, retails investors etc) based on the profits that a company generates.

In our example above, the market-cap of MRF is INR 57,196 Cr and of ITC is INR 627,700 Cr. So the market believes that ITC is 10 times bigger than MRF - because the profits of ITC > profits of MRF.

FY24 net profit of ITC = INR 20,751 Cr

FY24 net profit of MRF = INR 2,081 Cr

The mathematical formula for market capitalization = Share price x total number of shares of a company.

A more advanced definition of market capitalization — is that it is the present value of ALL future [net] profits that a company is going to earn in the future. It is a value that is derived by looking at the future.

And every investor has a different way of looking at the future, based on the data that is available in the present. That’s how opportunities exist in the market.

This is the reason why the market capitalization of a company changes everyday — because the perceived value of the company changes everyday in the minds of market participants.

It is possible that next week MRF — a company in the tyre manufacturing business — wins a deal from Tata Motors to manufacture tyres for it’s new electric car.

Let’s say that from this deal alone, MRF could make 1,000 Cr in additional net profit every year. When investors read this news, they think — this deal would make MRF a hell lot more valuable than 57,000+ Cr. This drives the share price UP.

In another news, imagine that ITC — a big conglomerate with presence in FMCG, Hotels, Agriculture, IT, Paper & Packaging — declares that it will shut down the production of a certain brand of cigarettes due to government regulation.

This will impact profitability in a BIG way because ITC derives a lot of it’s revenue from the sale of cigarettes. Investors think that net profits will take a hit. And therefore the stock price takes a tumble.

Classification of Stocks

Stocks are also classified into different buckets based on their market capitalization. You must have heard terms like large cap, mid-cap, small cap before. Here’s what it means:

Large Cap — are companies with market-cap of > INR 20,000 Cr

Mid Cap — are companies with market-cap between INR 5,000 Cr to INR 20,000 Cr

Small Cap — are companies with market-cap of <INR 5,000 Cr

There’s also micro-caps which are companies with a market cap between INR 50 Cr to INR 1,000 Cr. These are extremely small companies and investing in them can be quite risky — but the returns that micro-caps can generate is tremendous.

From an investing point of view — if you want to generate high returns, it makes sense to catch companies when they are small i.e. small caps OR micro-caps that have the potential to become large-caps.

So the next time you think about investing in a company, don’t look at the stock price — look at the market capitalization.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Wow... Loved your blog... I'm beginner and want to clean bacis for investment.. Your article very helpful and easy to understand.. By reading this now I completely understand what market cap is... Before this I was totally wrong about it...

Thankyou so much

Keep adding more on your #investing Basic blog about more basic information