Once you know where to look [wrote an article on information sources], you need to know ‘what’ to look at. One of the first things I do, when researching stocks — is to understand the business model of the company.

I use several slicers to gain a deeper understanding about a company + understanding how strong the business model is.

Slicer #1: Understanding the Business + Industry

First thing that you want to do as an investor, is to understand the product / service that the company sells + the industry that it operates in.

Here are some basic questions that you should ask:

BUSINESS — What product / service does the company sell? What does the company have to do to create the product / provide the service? Is the product / service superior in any way — what are it’s unique characteristics? Where is the product / service used?

CUSTOMERS — Who are the customers? Is the distribution model B2B or B2C? Does it have to spend a lot of money to acquire customers? Are the customers sticky / loyal to the company? Is the sales concentrated to a few customers? Are the customers happy?

SUPPLIERS — Who are the major suppliers? If it is making a product — what are the raw materials? Which raw material is the most important? How would margins be impacted if the key raw material increased in price?

GEOGRAPHIES — What are the geographies where most of its sales happen? What are the most profitable geographies? How much does it export? Has it been able to expand into newer geographies historically? Is it planning to enter new territories?

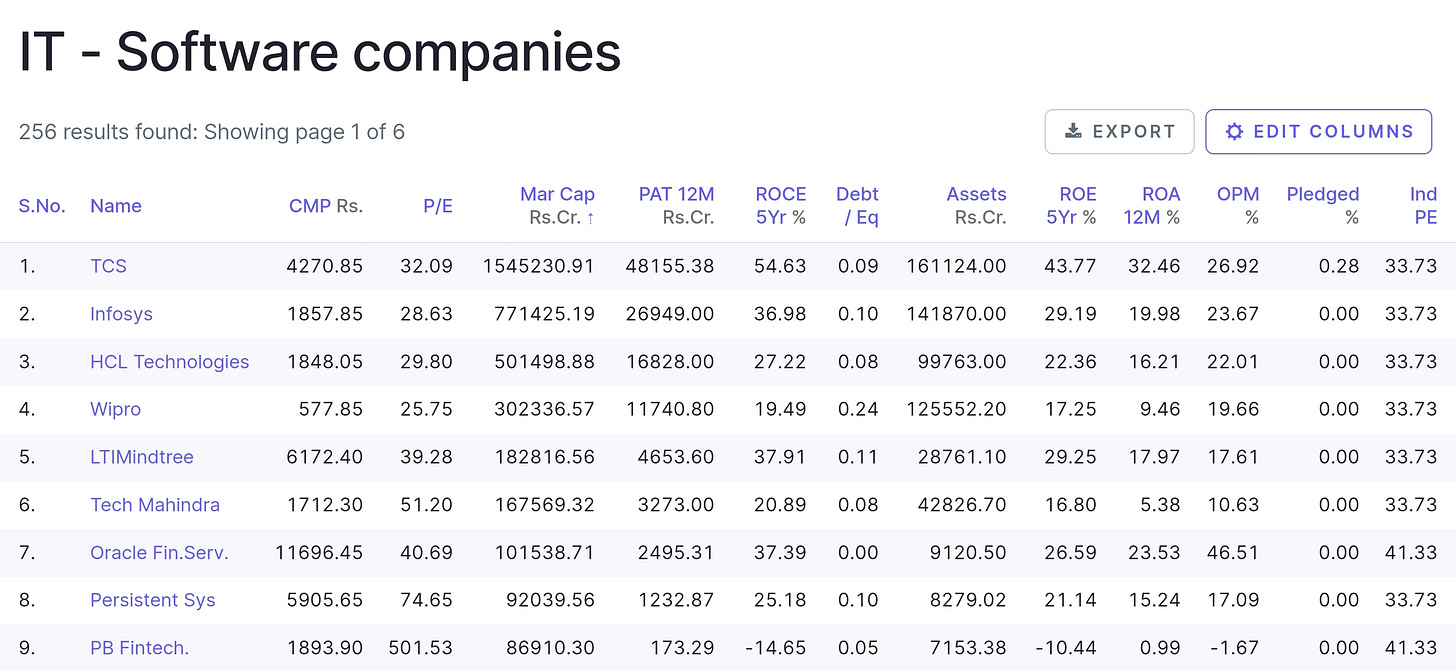

COMPETITION — Who are the main competitors domestically / internationally? Does it engage in pricing wars with competitors? Does it have better operating margins compared to peers? What is the strategy to stay ahead of peers?

INDUSTRY — Is it in an industry which is dying OR in a high growth industry (for e.g. AI / EVs)? How quickly is the industry growing domestically / internationally? What are some regulations specific to the industry? What are the government initiatives to boost the growth of the industry?

Slicer #2: Capital Requirement

Next thing you should understand about the company, is the capital requirement to run the business.

Money makes money, and the faster you can rotate capital the more money you make.

For e.g. a company operating in the construction business would be capital intensive. It needs more capital to buy land, construct buildings, and it takes time to sell properties [meaning more working capital required].

On the flipside, a company operating in the IT sector would be asset light. You don’t need to invest a lot of money to build software. With AI being able to code, this cost would further come down in the future.

For this reason, you’ll see asset light businesses command higher premiums than capital intensive businesses.

Some questions you can ask while researching the company:

Is it operating in an industry which is capital intensive or asset light?

How quickly does it churn capital? [Look at ROA, ROCE, 5Y ROCE to get an idea]

Does it need to incur significant CAPEX every year? Or is it non-recurring, maybe once every 3-5 years to build capacity?

Can it scale the business without significant CAPEX?

What is the working capital requirement? Is significant money blocked in inventory / debtors?

For e.g. Olectra Greentech — an electric bus company cannot scale without investing in building up it’s capacity. It can currently produce 2,500 e-buses in a year and to make more e-buses it has to invest to increase it’s manufacturing capacity. It has an order book of 10,000 e-buses.

When you read this, you understand that the company can only grow revenues [and profits] by using more capital. And you cannot expect 3X growth in revenues / profits in 1Y. So, I wouldn’t pay a premium valuation for this stock.

Slicer #3: Cyclicality

Some business are cyclical in nature, while others are immune to economic cycles.

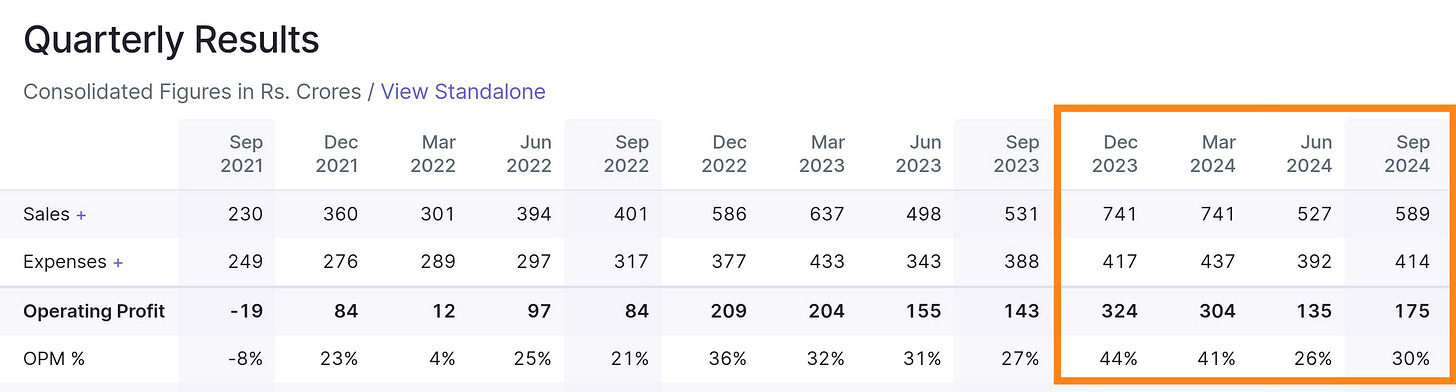

For e.g. the hospitality industry is highly cyclical. You’ll see significant revenue growth in festive seasons and muted sales in off-season months. In this case, if a business is able to generate significant sales in an off cycle — that is a signal that it has a strong business model and the management has got a good execution strategy.

However, if you look at certain sectors like FMCG, Utilities, Pharmaceuticals — they are generally non-cyclical in nature. You will continue to buy bread no matter what happens in the world. Medicines will get sold every day. Hospital will be filled with patients. You will need electricity / gas to run your house.

So, when you’re researching a company — you should figure out whether it is cyclical in nature. If it is, is it doing something to boost sales in an off-cycle?

Slicer #4: Commodity vs Monopoly

This is probably the most important slicer that you should look at.

If you look at Apple — it operates in a commodity business. A lot of companies are making smartphones. But why is everyone drawn to the iPhone? Is it because it is a superior product? Or is it a result of superior marketing?

As an investor, you want to find companies, that can create a differentiated product in a commodity business.

And then you have pure innovators. For e.g. pharmaceutical companies spend a lot of money on R&D to develop new molecules to treat diseases. If they’re successful in developing a molecule, they file for a patent — which gives them exclusive rights to sell a medicine for a specific period of time. It has complete monopoly until the patent expires.

Some questions that you should ask:

What is the nature of the industry that the company operates in? Is it making a commodity product? What is it doing to differentiate itself from the competition?

Does the company have pricing power — will customers still buy its product / service if it increases prices?

Apple has been launching iPhones with increased prices every year — without any significant drop in sales. That is a superpower. If you can find companies with pricing power at a low valuation, you’re looking at a multibagger.

How complex is it to make the product / deliver the service? More complex product / service > high barrier to entry > less competition > high margins > strong business model.

How much market share does the company have? What is the strategy of the management to grow market share + revenue + profits?

What is the order book size? How quickly can it execute the order book? What is the order pipeline that will materialize in the future?

What are the new products in pipeline? How quickly does the company respond to change in technology? How many new products has the company launched in the past?

If you use the 4 slicers above, I believe you would be able to gain a comprehensive understanding about the business + it’s future potential.

You might not get the answers to all questions — especially with small cap / micro cap stocks where the information available is limited, but this framework will really help you while researching a company.

If you liked this article, share it in your investing network. Comment, like, show some love!

I spend a lot of time to write these articles and I plan to keep this newsletter free for the foreseeable future. You can contribute by donating a small token to fund my research 😇 [UPI ID — siddharthbothra64-1@okicici]

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Tracing a value chain end-to-end, is what I have found to be incredibly helpful not only in understanding a business, but also mapping the entire landscape it operates in. One gets to see the hidden connections, strategic pressures, and ecosystem dynamics that shape an entire industry