Everywhere you look, you see electronics. We’re surrounded by it. In-fact, we’re drowning in electronic devices. And every device is getting smarter, because humans have found ways to embed increasing amounts of semiconductors into incredibly small spaces — following the famous Moore’s law.

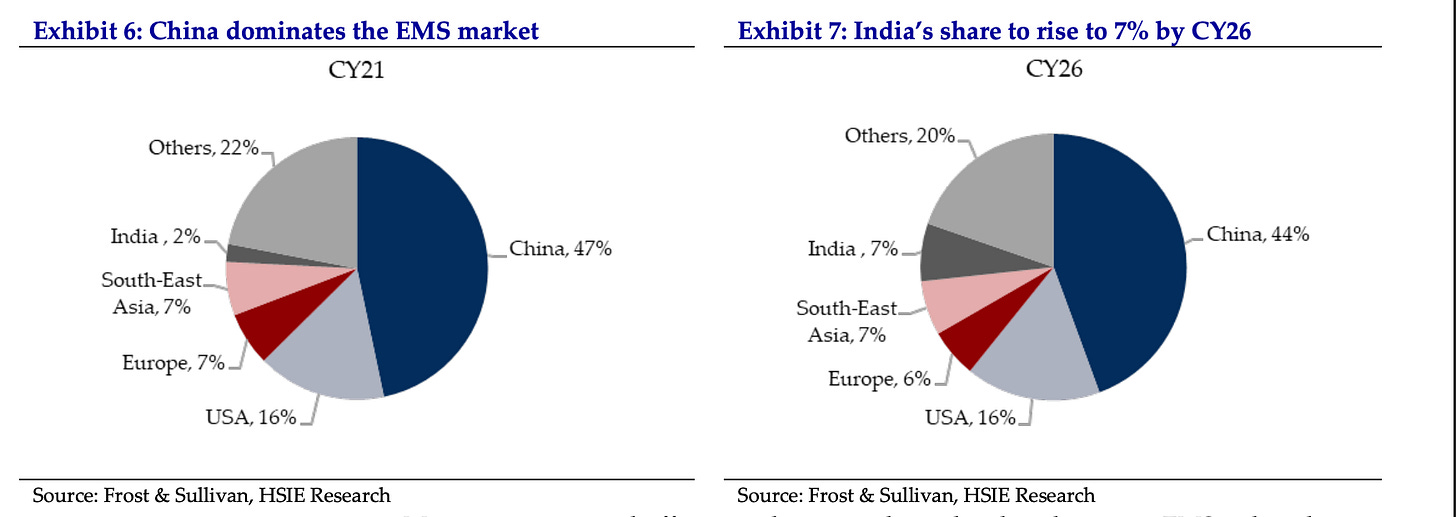

China leads the pack in EMS manufacturing — with a staggering 47% market share. No surprises here. No other country comes close to it, however as the world moves away from China to diversify their supply chains — they’re looking at countries like Vietnam, India and other South East Asian nations.

If you see the chart above, you can see that India’s share in electronics manufacturing is projected to increase to 7% — which is a far outcry from where China is, but it still offers a high growth opportunity for all Indian players in this space.

Dixon Technologies, Kaynes Technology, Amber Enterprises, Syrma SGS are some of the established players in the Indian EMS industry. And there are upcoming players like Avalon Technologies, Elin Electronics etc.

As an investor, this is a sector which warrants your attention — given that the EMS industry in India is projected to grow by a STAGGERING 30% CAGR upto FY28.

Over the next few months, I will cover 3-4 companies operating in this space, which I believe can significantly ride the industry tailwinds. The first one to make the cut, is Avalon Technologies.

Avalon listed on the bourses back in April 2023 and has delivered stellar returns in the last couple of years. The P/E ratio [101 times] is quite elevated and this is by no means a cheap stock to own at these levels.

However, given the high growth expected in this sector — it makes sense to learn about the business of Avalon (and other EMS companies) — which is what we will embark on in the next few months!

Business Model

Avalon is a fully integrated EMS company with a focus on high value precision engineered products. The company has manufacturing facilities in India & the US — making it quite unique compared to other EMS players.

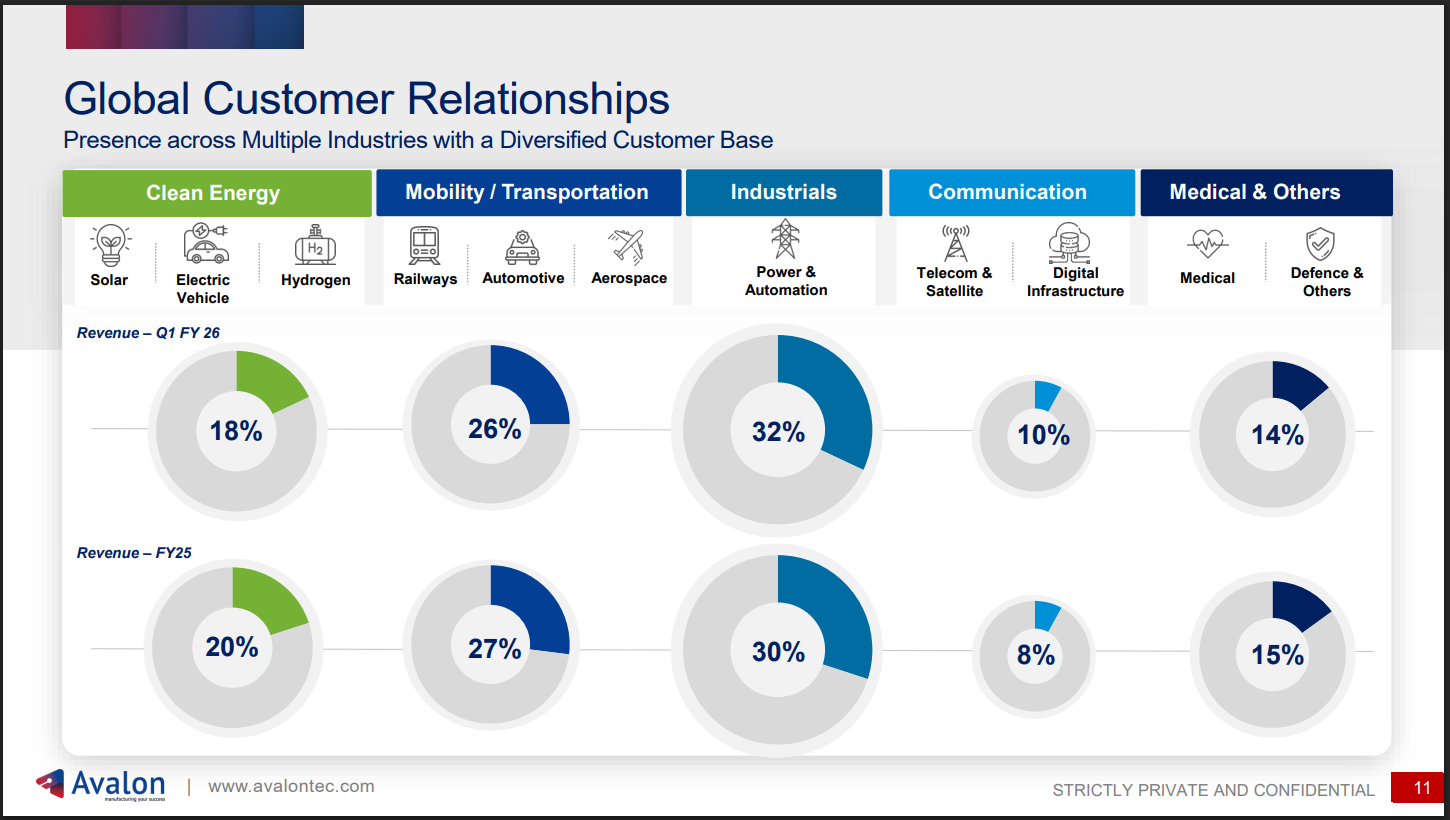

It serves a diversified set of industries such as industrials, clean energy, mobility, aerospace & communication.

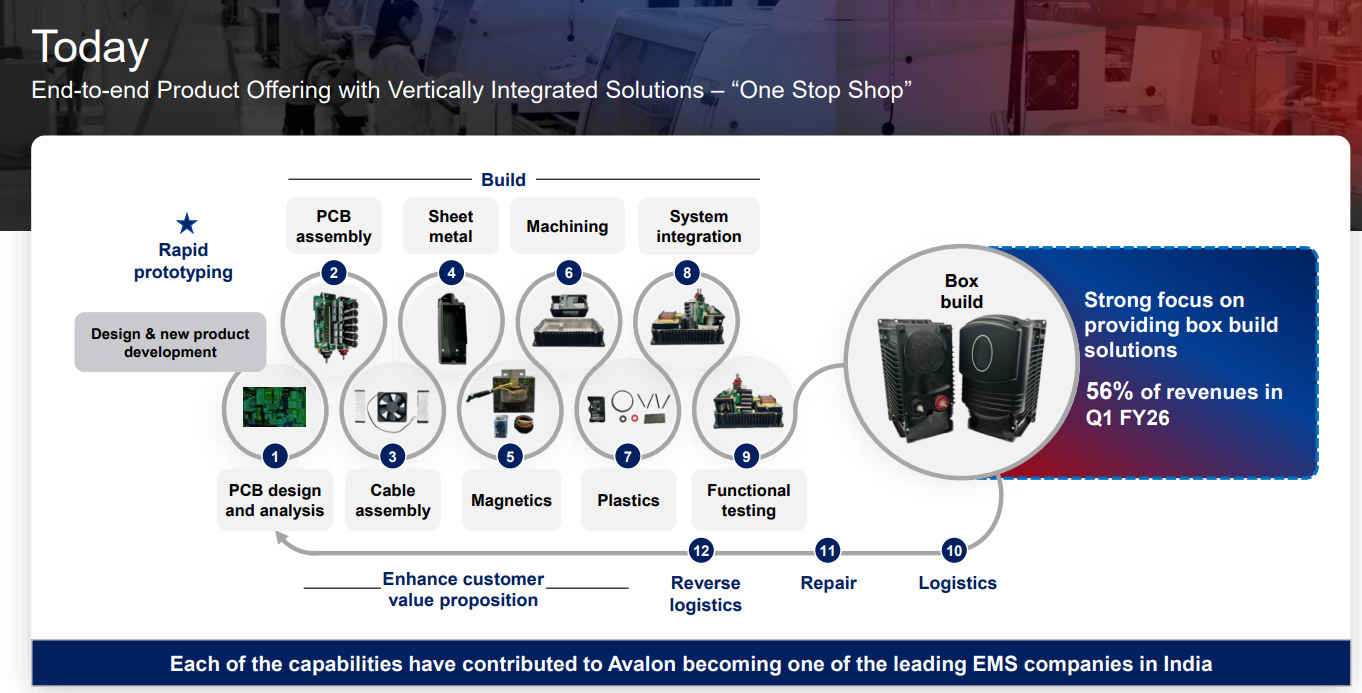

The company was incorporated in 1999, with limited capabilities of PCB assembly. Over the years the company ventured into various other functions like magnetics, plastics and ultimately today is delivering box build solutions. This shows the ability of the management to anticipate and build capabilities as per the evolving EMS landscape.

I have worked in a startup which was in the business of selling battery management systems [which is the brains of a Li-ion battery] and we used to sub-contract our electronics manufacturing.

We would share our product design with the EMS player [obviously after signing NDAs + Supply agreement], and send them raw materials (PCBs, electronic components, microchips etc.)

They would assemble all the components on the PCB, conduct quality tests and deliver the final product back to us.

The EMS player would charge a certain % over and above the costs of raw materials for their EMS services.

This ensured two things.

#1 — we didn’t have to invest capital in setting up electronics manufacturing facilities, which takes time & capital. You have to buy the right machines, hire the right talent, get the required ISO certifications. It can take years to build EMS capabilities — which is a barrier to entry in this industry.

#2 — it ensured speed. Since the EMS players have multiple manufacturing facilities, they can rotate machinery more efficiently, ensuring that the customer gets the finished product on time. This is essential, if you’re a startup. Speed of execution is EVERYTHING.

The risk here was — in case demand for the final product took a hit, we were left with components and raw materials that we would then have to sell in the market at discounted prices. Most of the EMS players do not take the risk of unused inventory, in case of a demand slowdown, to safeguard their working capital.

Products

Avalon makes a variety of products like Printed Circuit Boards (PCBs), Injection Molded Plastics, wire harnesses, cable assemblies, sheet metal fabrication, magnetics and complete box build solutions.

Box build is the process of integrating the PCBs with other components like wiring, cables, power supplies, enclosures in a single functional unit — it is the final stage in Electronics Manufacturing that turn individual components into a ready to use product.

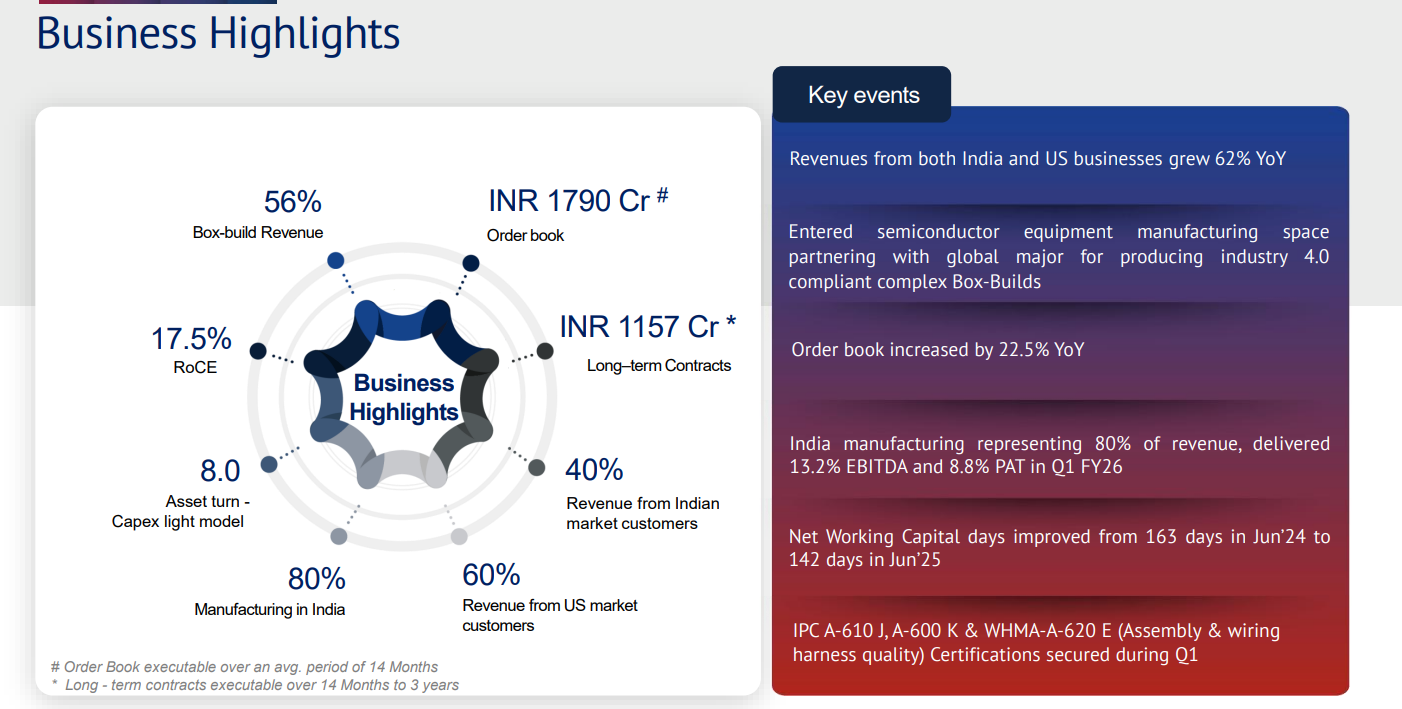

Box build solutions contribute 56% of the top-line (from 44% in Q1FY25) — which indicates the company’s success in moving up the value chain towards more complex and profitable products.

Manufacturing Facilities

Avalon has 12 manufacturing facilities — 10 of which are in India while the other two are in the US, giving it a rare edge over other EMS players. This strategic manufacturing footprint in the US, makes Avalon better positioned to deal with Trump’s erratic tariff policies + the ability to manufacture in US if a client requires.

The company operates on a cost plus structure, meaning it is able to pass on the increase in costs to customers, safeguarding margins / profitability in the long run.

Sticky Customer Base

Key customers include Kyosan India, Zonar Systems Inc., Collins Aerospace, Meggitt among others. The company has an approach of engaging in component level design from the product’s conception — effectively embedding it into a customer’s ecosystem early on.

This technical dependency creates a barrier to exit for existing customers, since it would lead to high costs + time + effort to transition to an alternative EMS player. In effect, once Avalon (or any other EMS player for that matter) wins a customer — they stick with the company for long periods of time.

Significant Tailwinds?

Now that we have a firm understanding of the business model of Avalon — let’s take a look at some of the growth factors which are contributing to the current bull run in the company’s stock price.

Entry into Semiconductor Equipment biz

Avalon has won orders from a global semiconductor company [name undisclosed] to provide highly complex industry 4.0 compliant box builds — the customer is a semiconductor equipment manufacturer. The company has been working for the past 3 - 4 quarters to achieve the level of complexity and technology required to win this client.

As per the management, it is the most complex level of box build an EMS player can do and takes Avalon to the next level in box building solutions — which means higher margins?

The management believes it is very scalable with the company making many products in this segment and manufacturing capacity should not be a constraint.

Avalon will look for Government incentives once they get into production. Currently they are in the pilot stage and it will take several quarters before they enter the production stage.

Revenues from this segment should start flowing in from the next quarter — and will gradually grow over the next 1-2 years. Something investors should watch out for!

Order book

The company boasts an order book of approx. INR 2,950 Cr — which is close to 3x of FY25 sales. This gives investors good revenue visibility with INR 1,800 Cr worth of contracts executable over the next 14 months.

Management has revised it’s revenue guidance projecting revenue growth between 23-25% for FY26 - an upward revision from the earlier projection of 18-20%. With such a robust order book, 25% YoY growth looks achievable.

Order book has grown by 23% YoY and the company is working on several new programs at various stages of development [design / prototype / nearing production].

Some of the products under development are backup power systems, power transmission systems, aerospace cabin sub-assemblies, locomotive engine sub-systems, energy storage systems, power electronics etc.

Steady progress is being made on the Railway Kavach project — which is currently under prototyping and final stages of approval. Expected to enter commercial production next year.

The company has witnessed high growth [albeit on a low base] in the communication segment — where the company’s focus is on 5G and 5G radios.

Guidance

Revenue — The management has guided for 25% growth in revenues for FY26, with objective to double FY24 revenues of INR 870 Cr by FY27 — in short, they want to achieve revenues of close to INR 1,750 Cr by FY27.

Gross Margins — are expected to be in the range of 33-35% over the next few quarters. The management doesn’t expect a lot of volatility here, since the company operates on a cost plus model. Raw material price increases, are passed on to the customer.

EBITDA — expected to be in the historical range of 10-12% (although the management didn’t specify the exact #). In Q1, EBITDA dropped to 9% — which was due to front-loading of manpower and other costs incurred, the benefit of which will start showing from Q3.

Capex — company plans to invest INR 45 - 55 Cr in infrastructure build up and is planning to complete Phase 2 of brownfield expansion of Chennai plant by Q3FY26. Management has a goal to achieve asset turnover of 10X in the long term.

Other points

Manufacturing facility — as per the management the company’s facility in the US puts it in a better position to deal with U.S. tariffs and respond to evolving trade dynamics. 20% of revenues are serviced from the US plant.

EBITDA of the US facility is NEGATIVE 6.9% with a PAT of negative 9 Cr. In short, the facility is making losses due to high costs of production. Management expects to achieve break-even in the next few Qs.

Export mix — 40% of revenues comes from Indian based customers and 60% of revenues comes from US market customers. The company is gradually increasing the share of domestic revenues.

Zepco partnership — Avalon will be investing in Zepco Technologies to acquire a 4% stake and will partner with the company. The company will be servicing various customers in the industrial / clean energy space — where design will be by Zepco and manufacturing by Avalon. It will also cater to drone motors and power electronics manufacturing through this partnership.

Concerns

I couldn’t find many things to be concerned about Avalon. It has reduced it’s borrowings over the years. There was a period of revenue de-growth in FY24, from which the company has bounced back (and so has the stock price).

EMS is a sector poised for growth, with India’s global share increasing exponentially.

Operating margins have remained in the range of 10-12% over the years. The business is not VERY capital intensive. Return on capital employed has sharply decreased since FY22 — due to increase in share capital (Avalon IPOed in April 2023)

However there are a few factors that warrants investor attention:

#1 Impact of tariffs — if you read the Q1 earnings transcript, you’d see most analysts concerned with ONE question — ‘what will be the impact of US tariffs on the company?’. The management responded saying that the effects are still playing out and currently, all price increases are being passed on to the customer.

However, it is possible that such pass on might not continue and Avalon might have to bear some part of the tariffs to reduce it’s EMS service fee %. This is an evolving situation that needs to be closely tracked.

Despite having a facility in the US, even with tariffs included — producing in US is more expensive than producing in India, so having a U.S. based facility doesn’t help the company too much if the consumer is not ready to pay more.

#2 Reduced promoter shareholding — the company’s stock is increasing and simultaneously the promoters’ stake is decreasing. Now, it could be that they want some liquidity, but it doesn’t instill a lot of confidence when people who are running the company sell stock. In all probability, they believe the stock is over-valued and want to make some money.

However, FIIs / DIIs have a combined holding of 32% of the company — and this means that fund managers sense an opportunity with Avalon. And they’re willing to bet on this stock long term.

Conclusion

At a P/E of 100+, the stock looks very expensive at current levels. It has already doubled in the past 1 year and the fundamentals need to grow to justify a further increase.

Order book looks robust. Entry into semiconductor equipment manufacturing should be lucrative and margin accretive. Many projects are in pipeline, which should convert into orders in the next few quarters. More share of revenues is coming from box build solutions, which is a good sign.

Tariffs remain a worry, which will need to be monitored closely. Regardless of that, the EMS sector remains a multi-decadal opportunity and Avalon could be one of the beneficiaries of such growth.

Investors should definitely track this company and a basket of other EMS stocks. Stay tuned, I will be publishing more pieces on EMS companies in the next few months.

Disclosure: I am invested in the company, and will add more to my position in case of a significant correction.

For my subscribers, I have partnered with Finology to get you a one month free subscription to Finology Ticker. Follow the steps listed in the Google Form [Form Link]

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]