Back in the 1990s, air-travel was considered as a luxury in India. Only the elite could afford to board a flight. It was a status symbol.

Fast forward to today, the entire landscape has changed. Air travel has exploded. Passenger traffic of 327 million at airports across India. 136 operational airports. With Jet Airways going bust a few years back, and Go First recently filing for voluntary bankruptcy — air-fares have gone up, with the Indian skies being ruled by Indigo and the Tata Group. But, people are willing to pay more to save time. And they’re willing to pay more for luxury.

Increase in air traffic = more people at airports = increased spending on airport services

And because flights are not always on schedule, you have people spending more time at the airport which opens up opportunities for lounge operators, F&B players, duty free shops, transit hotels etc.

Now, I’ve never used a lounge before but it looks quite appealing to be honest. Especially if I don’t have to pay for it. I’ve had instances where my flight was significantly delayed and I had to wait at the airport for hours. If I had lounge access, it would’ve been more comfortable. Heck, I’ve heard they also offer free spa services. I would LOVE that! You can order food / beverage. It’s a unique experience. And, a lot of people are opting for it by selecting a card provider that covers these services.

This turns out to be great news for DreamFolks Services — which has built it’s business around airport & lounge services.

The stock price of DreamFolks has significantly corrected in August 2023 — on the back of weak Q1FY24 results, which got me thinking — ‘does this stock offer a good buying opportunity at this level?’

Let’s look deeper into the business to find our answers!

The Business

DreamFolks is India’s leading airport services aggregator — more like the Zomato of the airport services business. It enables services like lounge access, spa services, airport transfer, meet and assist, duty free benefits, F&B offerings and more.

Let’s try to understand how the business of DreamFolks would have come into being. Below is an illustration cooked up by my brain.

Imagine a business which owns a lounge at Mumbai Airport. It wants more people to use its lounge — so what does it do? It reaches out to banks, card networks, telecom players. Banks are businesses that want to sell more credit cards / debit cards to their customers. To sweeten the deal, they often include free airport lounge access as one of the perks of owning these cards.

So the lounge operator goes to the bank and says:

Lounge Operator: you enlist my lounge on your card network. In turn, I offer your customers free access to my lounge. Free spa too. You pay me money for lounge access and the spa. You’ve got a happy customer. I’ve got money for operating lounges and I don’t have to spend money to acquire customers. It’s a win-win. What do you think?

Bank: OK, it’s a good deal. But, how will I know how many customers have availed services at your lounge? Do you have a platform that can capture all these details? What stops you from overcharging us?

Lounge Operator: You’ve got to trust us. We’re running a business here, but it’s not viable for us to build a platform just to cater to your bank. Let us know what you think.

Bank: I understand — but honestly, we’d be more comfortable if we could track these things. Otherwise, we’d like to pass for now.

*Board Room of DreamFolks*

Director 1: Look, I’ve spoken to a few airport lounge operators and banks and there’s a unique problem existing in the market. No one has created a platform where all airport lounge operators can list their properties. You can rope in the banks & card networks on the platform. Maybe even telecom players. And you can act like an aggregator. I think we can do something here.

Director 2: And how do you make money?

Director 1: We take money from the bank every time their customers use the lounges. And we pay the lounge operators. The differential amount, is our gross margin. You don’t have to spend any money on customer acquisition too. To be honest, I don’t see why existing players like Priority Pass are not building something like this.

Director 2: Probably because India isn’t a BIG market for them yet. Currently, not a lot of people avail lounge access at airports. It’s still a niche market. Maybe they don’t see a lot of benefit in building an aggregator platform right now. But domestic traffic is steadily growing, as well as the desire of people to spend time in lounges. So — I think it’s an opportunity that we should capitalise on.

And so, DreamFolks did just that. They built an aggregator platform to cater to this unique gap in the market. (see image below)

The Positives

DreamFolks has a 95% market share of the card-based lounge access in India. It has a 68% market share of the overall lounge access volume in India. It recently collaborated with Plaza Premium Group to include > 340 Plaza Premium lounges in 70+ international airports into the DreamFolks international lounge network. DreamFolks — has NO competition at the moment in the domestic card based lounge market and is virtually operating a monopoly.

It derives almost 95% of it’s total revenue from the lounge access segment. To diversify it’s revenue streams — DreamFolks is entering into new business segments like:

Visa Services: The Company recently partnered with VFS Global to offer visa services. Through this strategic partnership, the Company will provide premium lounges at visa centres and doorstep visa services to customers.

Travel SIM: The Company has collaborated with service providers like Matrix to provide Travel SIMs to people travelling abroad. Travel SIMs includes E-SIMs and Physical SIM cards. This service would provide global connectivity to customers without the need of purchasing new SIM cards wherever they go.

Golf Services: The Company recently acquired Vidsur Golf to offer exclusive access to golf courses, clubs and other ancillary services like golf booking, golf lessons by certified professionals etc.

DreamFolks — is a proxy for air passenger growth in India. Only 8% of existing air passenger traffic avails lounge access. Air travel is steadily growing. Lounge access penetration is going up. This bodes well for the company.

Apart from airport lounges, the Company also caters to railway lounges. This segment doesn’t contribute much right now, but has the potential to significantly move the needle as Indian Railways get modernized and more lounges are built in the future.

Talking about numbers, revenue grew by 3X in FY23 due to a lower base in the previous year. Since the Company operates an asset light business, it reported a ROCE of 62% in FY23. However, the QoQ revenue growth isn’t that great.

Causes of Concern

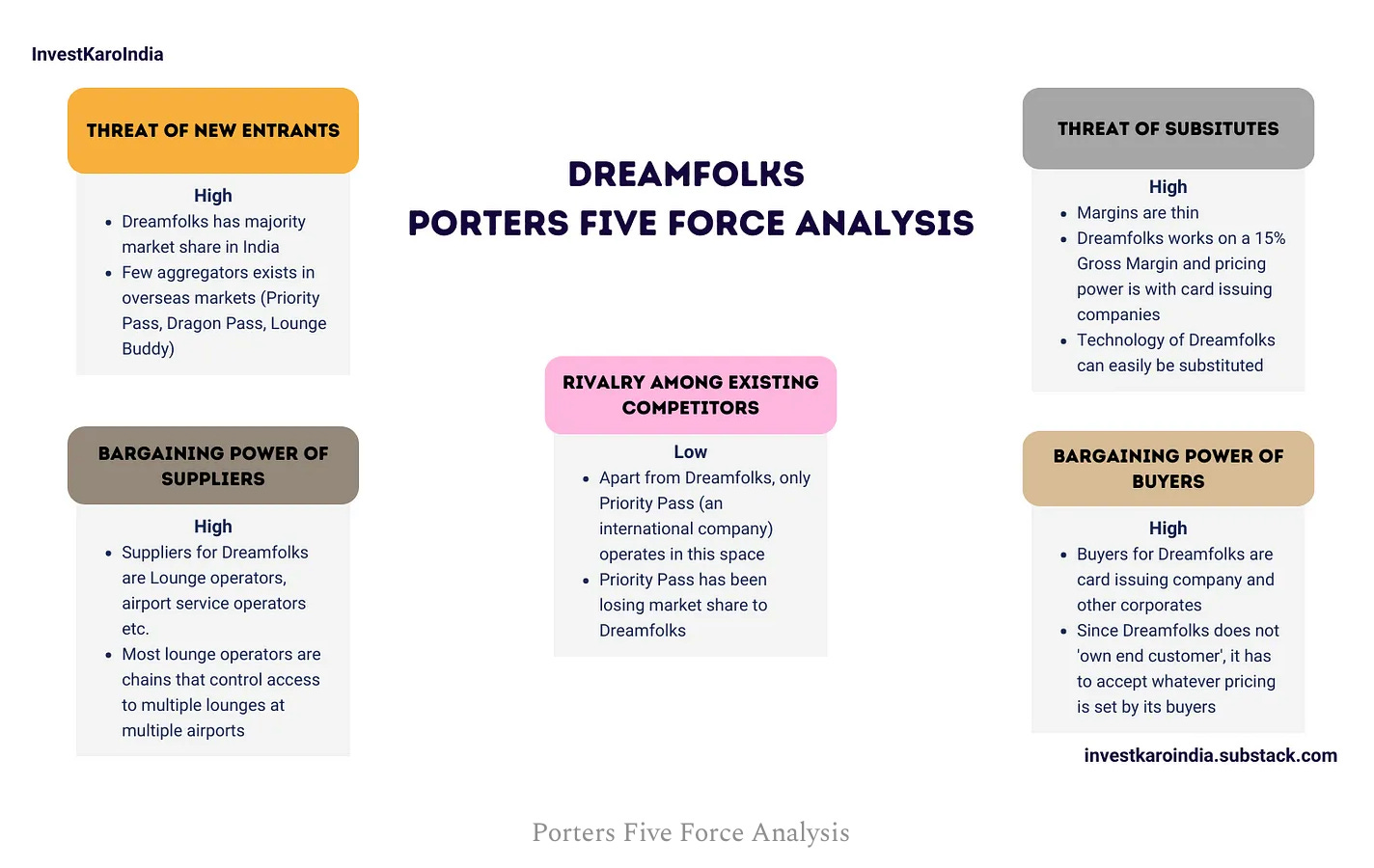

The biggest risk — is that the Company doesn’t have any bargaining power with it’s suppliers and buyers. The Company has indicated in various interviews that margin gap between the price it has to pay to lounge operators vs the price it charges to card companies cannot exceed 15%.

This was evident in the Q1FY24 results where the EBITDA margins dropped to 7% from 12% a year ago — due to one-off abnormal increase in common area maintenance charges (CAM) by lounge operators, which had to be absorbed by DreamFolks, since it could not pass on this cost to it’s customers (banks / card issuers)

DreamFolks claims that it has built a proprietary technology platform — but there’s nothing that stops new players from replicating such a platform. International players like Priority Pass, Lounge Buddy and Dragon Pass have overlooked the Indian lounge market, because of low penetration + low volumes. When air traffic increases, and the market becomes attractive for these established players — nothing stops them from building a similar platform to bite into DreamFolks’ market share and gross margins.

While DreamFolks is adding more international lounges to it’s kitty, in reality it will significantly contribute to the topline ONLY when it also partners with banks / card issuers of such international countries.

This looks difficult — because existing players like Priority Pass already have strong relationships with international banks and any attempt to gain international market share will be faced with stiff competition.

The Company didn’t have a Chief Financial Officer until 2021 — when it was gearing up for the IPO. There have been instances in the past where the company failed to file it’s financial statements with the MCA, indicating a lack of financial controls. For Q2FY24, the Company’s receivables were higher than the revenue for the quarter — signifying that the company has major issues in recovering receivables from its customers — resulting in higher working capital requirement.

Verdict

At a P/E ratio of 37 times, with a market capitalisation of INR 2,700 CRORE — I’d say the Company is reasonably priced. The massive sell-off in August 2023, has significantly corrected the stock price, which is how the Company got on my radar.

I like what DreamFolks has built. Operating as a monopoly in the airport services market in India. A proxy play to the growing domestic air traffic. Venturing into new revenue streams like Visa services, Travel SIMs, Golf services. Adding more international lounges. Catering to railway lounges which could become a lucrative opportunity in the future.

Good ROCE. Minimal debt. Asset light business.

However, I think the business model is susceptible to a LOT of risks. No power over suppliers & buyers limiting the gross margin to 15%. No real barrier to entry for competitors, who can replicate the tech platform built and take away market share from DreamFolks and put pressure on margins.

As at FY23, the Company had only 68 employees, which further corroborates the point that significant effort is NOT required to maintain the technology platform.

Derives 95% of its revenues from lounge access — which means that any decrease in domestic air travel or decrease in use of lounges by customers would adversely impact the top-line. Also, it is already operating a monopoly in India, which leaves little room to grow market share in the domestic market.

Investing in the company to derive short term-profits could be a good strategy. For the company to be a long term bet, I’d like to see these new revenue streams to start contributing to revenues IN A BIG WAY.

Only then, the stock would look attractive at the current levels.

If you liked this article, share it in your investing network. Comment, like, show some love! I spend a lot of time in research & it would mean the world to me if you could recommend this blog to your friends as well OR you could contribute by donating a small token to fund my research!

[Note: The author is not a SEBI registered investment advisor and the contents of this article do NOT constitute investment advice. Always do your own research before you invest in a company]

Do airport lounges pay a fixed annual charge to DFS, or do they pay per passenger or nothing?